If data is the new oil, then why are so many decisions being made with no regard to it? And given how much money banks and credit unions have been spending on data analytics, how can a better return on that investment be found?

Gartner found in its Marketing Data and Analytics Survey that 54% of CMOs and VPs of marketing aren’t impressed by what their data analytics team provides.

As a result, the data teams have much less influence on decisionmaking than might be expected — especially given that the research indicates that senior marketers would prefer to be making data-driven decisions. Mid-level marketing officials report somewhat more influence from data analytics than did the senior group, but still 37% say it hasn’t matched expectations. With one out of five members of both groups not expressing an opinion pro or con, that leaves only 27% of top marketing managers and 45% of mid-level marketers saying that data has had the expected influence on the organization’s actions.

Close to half of the overall study sample says that they can’t measure the ROI of data analytics. And overall 46% say that decisions are not being influenced by data analytics.

In spite of the disappointments, optimism stubbornly persists. 85% of the sample expects that by 2022 “significantly more” of their organization’s marketing decisions will be based on analytics.

Lizzy Foo Kune, Senior Director Analyst and author of the report, says that going into the research her team wondered if part of the faith senior marketers have in data analytics has been what she calls a “sunk cost fallacy.” That is, they feel they have to keep spending on analytics so they can somehow reach the point where the investment will pay off.

Or is the reason cynical disregard for data teams’ analyses? One of the leading findings was that management pursued its original plans in spite of conflicting analytics.

“It would be easy to think that senior leaders are just ignoring data and doing what they wanted to do anyway,” says Gartner’s Foo Kune. “But I don’t think it’s that simple.”

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Five Pounds of Data Analytics Means Less Than One Key Point Made

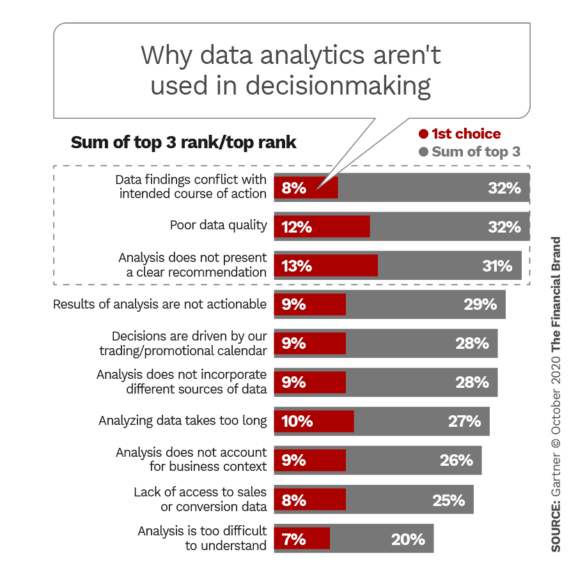

The chart below ranks the reasons organizations aren’t using their data teams’ output to make decisions. One factor many of the reasons have in common is a communication failure — there’s a disconnect between data producer and data user.

Foo Kune tends to regard the top line of the chart (findings that conflict with original plans) to be the result of the second and third lines — poor data quality and unclear recommendations.

The study report found that respondents who said data findings didn’t synch with original plans were also most often those who said that data analysts failed to make clear recommendations. But something more fundamental is also in play.

“Organizations have to get their data house in order,” Foo Kune explains. “You have to develop a strong data foundation before you can try to do the modeling and the analysis that you’d like to do.”

Foo Kune worked for a decade as a data analyst leader for marketing agencies serving multiple types of clients, including financial institutions. Too often, she explains, she found that data analysts try to be everything to everyone. In the end, they may be producing work that doesn’t quite serve anyone.

Here’s where data teams miss the boat: “They wind up with mile-long Excel spreadsheets that are also layers deep that they hand over to stakeholders once a month,” says Foo Kune. “It has all of the data that you could possibly ever need. Everybody feels good about it —I call it a ‘security blanket.’ Everyone files it away, until they need to feel comfortable again.”

Such all-inclusive research doesn’t get used because it doesn’t get sharpened to a point, like a spear.

“Data teams don’t need to design reports that fit everybody’s needs,” says Foo Kune. “They should be designed for a person. They should be designed for a team. They should be designed to answer a question. And they need to have targeted metrics and data that addresses that question.”

Foo Kune recalls an early project in her analyst days for a consumer packaged goods company. “I had a beautiful deck of data, 50 pages long,” she recalls. It had everything except a recommendation for action.

She was immensely proud of the project, but when the CEO reviewed it, after five minutes, “he barked at me that it was too complicated. He told me to make it simple and walked away.”

Data analysts have to know what the senior stakeholders for a project are trying to do and what decisions they need to make. When in doubt, they should be able to ask questions for better guidance. “This helps overcome challenges in connecting analysis and insights with business value,” she explains.

This is something the marketer who will be the user of the analysis can encourage. The conversation should address such questions as:

- Why do you want this analysis?

- What are you hoping to achieve?

- What use do you hope to make of the data?

If they aren’t going by data analytics, what are execs using? “Part of it could be gut feel,” says Foo Kune. “At the end of the day, data isn’t going to tell you everything. You have to marry it with experience and knowledge. And that’s why conversations between marketing stakeholders and analytics teams are so important.”

Read More: Digital Banking Transformation Begins With Quality Data

Why Financial Institutions Are So Far Behind the Curve

As basic as this may seem, lack of communication lies at the root of much of the wasted data analysis. Foo Kune says that many financial institutions have much the same issues as the study respondents on the whole, but they are often a step behind many other kinds of companies. She believes this results in part from being a highly regulated industry and from the sheer volume of data that financial services generate.

A key way this combination comes through is banking’s typical organization into silos that don’t communicate with each other. This structure affects many aspects of financial institutions, but Foo Kune says it exerts a major impact on data analysis and quality.

Many financial institutions lack connective organizational intelligence., the analyst maintains.

“Different teams work with the institution’s data and it can create a lot of blind spots — when your Market Insights function doesn’t know what Customer Insights knows and Customer Insights doesn’t know what Marketing Analytics knows, and so on,” Foo Kune explains. “This highlights the opportunity for more cross-functional collaboration. Data is a great place to start that.”

Collaboration must range beyond just the analytics functions. Picking up on her earlier point about analysts asking more questions about their assignments, senior marketing leaders also need to work harder at communicating. They have to remember that analysts tend to get stuck in minutiae and can lose sight of their goal.

“The onus is on senior stakeholders to communicate effectively with the analytics team so they know what decisions leaders are trying to make on a regular basis and what their business priorities are,” says Foo Kune.

This two-way communication is so important, she believes, that it ought to be considered a key part of the ongoing research and analytics process.

Read More: How Financial Marketers Can Move From Data Analytics Angst to Action

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

More Organizations Plan to Grow Analytics Teams than Shrink Them

In spite of dissatisfaction with the results of data analytics efforts, considerable optimism continues regarding its possibilities. As noted earlier, most respondents expect analytics to play a much larger role by 2022. And in Gartner’s 2020 CMO Spend Survey marketing analytics was a major spending priority and 73% of those respondents expected to invest more in fiscal 2021.

In the data and analytics survey, 44% of respondents plan to increase the size of their marketing analytics team over the next two years. As the chart below shows, the leading reason is the desire to increase the supply of analytics to increase the influence on decisions.

The 2020 data and analytics survey found that the median number of full-time equivalent employees on data teams had risen 37% over the 2018 edition of the research.

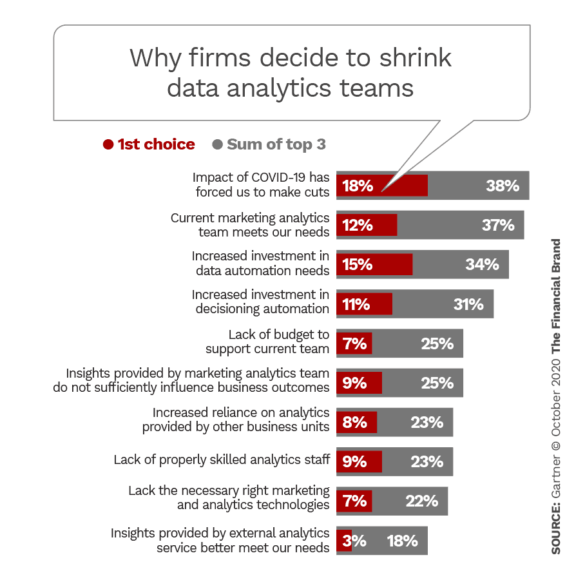

On the other hand, while 38% of the sample report that the size of the analytics team should remain the same, 18% anticipate that it will shrink in the next two years. In the chart below, the leading reason for cuts is the impact of COVID-19. However, the pandemic impact aside, the next three reasons given are more instructive.

Interestingly, respondents who cited either investment in data automation or decisioning automation tended to be those who feel analytics have had the desired influence on decisionmaking.

“This suggests that marketing leaders who are reducing team size due to automation are making the decision based on the benefits of that investment rather than merely being optimistic about its future potential,” the report says.

Dangers of Spending More on Data Tech Than on Data Analysts

The study questions the need to increase the size of data analytics teams — especially given disappointment with current product — suggesting instead that what’s needed is more skills among the existing team members. “Upskilling” those people will take money that right now is being earmarked for hiring.

“Analytics teams are deprioritizing skill development during a time where it may be needed most,” the report states. Spending on skills training should be stepped up, especially in areas that can address shortfalls of the past and present. Three examples are persuasive communication, advanced modeling and consulting skills.

Foo Kune sees the need for skills training to be especially acute in financial institutions because of the silo effect discussed earlier.

“You might have a CRM analyst, a web analyst, a marketing analyst and a business analyst all operating with their different hats and not much overlap,” says Foo Kune. “As a result of some of the changes we’re seeing in data management and automation, financial institutions need to take advantage of existing talent and reskill them so they can be cross-functional within the institution and help manage the shift to automation.”