One of the most important components of digital banking transformation is the ability to collect, collate, analyze, share and deploy customer data and insights. The banking industry is one of the most data-rich businesses, yet it is also far behind other industries in moving beyond the collection phase, to the most important differentiator … being able to use insights to build an exceptional personalized experience.

Data helps financial institutions understand customer behavior and how individual consumers prefer to use products or services. It also allows organizations to provide personalized offerings, reflecting contextual needs in real time, versus promoting products to segments or a mass audience.

In order to take advantage of the opportunities presented by these vast amounts of data, financial institutions must invest in competencies around data and analytics, customer experience, content, and digital technologies. They also need the analytical skills – either internally or through external partners – to turn raw data into insights. Most importantly, organizations need a data-driven culture, with top management support, that will commit to the investment in the technology and support of the vision of becoming a data-centric organization.

Read More:

- Digital Banking Transformation Begins With Quality Data

- How to Avoid Digital Transformation Failures in Banking

- Digital Transformation Requires More Than Technology Upgrades

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Data and Customer Insights as a Competitive Weapon

While data is plentiful in the financial services industry, the creation of customer insights from this data is still in the early maturity phase. This is because most data sources at banks and credit unions are housed in silos, which are challenging to integrate, and even more challenging to deploy as an asset. Therefore, those organizations that have embraced the power of insights are possessing a competitive differentiator as they hope to digitally transform their organizations in an increasingly crowded ecosystem.

While virtually all financial institutions profess to place ‘improving the customer experience’ at the top of their priorities for the past five years and for 2021 and beyond, less than 25% say they are adept at using customer insights to build contextual offers that are timely and actionable. This limits the ability to optimize the customer experience or maximize the enterprise value. In a post-pandemic world where the consumer has been exposed to how organizations can make their life easier with data and applied insights, this gap between what’s possible and what’s experienced will negatively impact success.

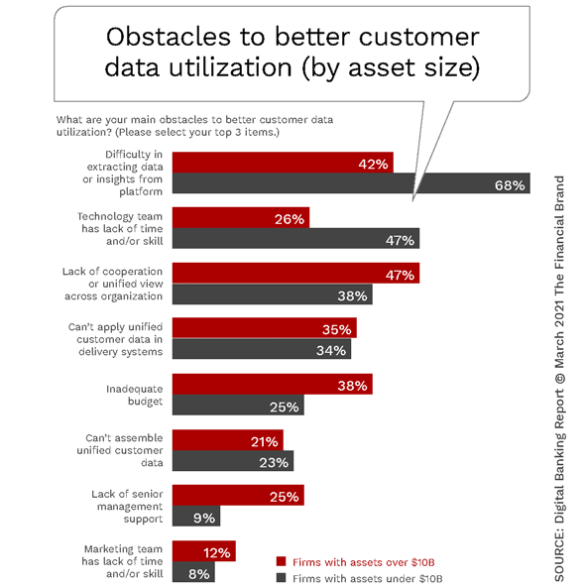

The primary obstacles for the development of a better data management process differ based on asset size according to the research conducted. While difficulty in extracting data and insights from the platform were key challenges for both small and large organizations, the level of difficulty was much greater for smaller institutions (as was the availability of skilled talent). Both large and small organizations also indicated a lack of cooperation or unified view across the organization. It is clear that technical and organizational issues both contribute to the challenges faced by financial institutions.

It was also found that financial institutions in the early stages of deployment (or those not yet deploying a solution) were the most likely to cite organizational, budget, and leadership issues as obstacles. Those banks and credit unions further along in the deployment process tended to cite more technical obstacles.

Data Maturity Begins with a Data-Centric Culture

When we talk about digital banking transformation, financial organizations need to realize that an important component of this shift is the need for leaders and employees to transform themselves as well. Leaders must educate themselves on the importance of data and analytics and ways to increase both data and digital transformation maturity. Successful data and digital banking transformation journeys start from top down – leadership and culture are paramount.

Leaders also need to personally facilitate and inspire their fellow leaders and teams to navigate the importance of continual learning and change. Without the top of the organization illustrating the importance of a data-driven culture and the involvement of every team member in the deployment of insights for the benefit of customers, data maturity will never be achieved.

Key Insight:

Without leadership support and a data-centric culture, most initiatives around the use of data and insights will be fragmented.

Change is not easy and is often avoided. The mission of becoming a data-centric organization must become the centerpiece of the enterprise strategy, focus and investment, with complete transparency and engagement across the organization. Some of the keys to building and reinforcing a data-centric culture include:

- Collect and Democratize data and insights across all areas of the organization. Make all decisions and build all solutions using data and insights that support these decisions. Strive to unlock data silos to support all major initiatives, enabling leadership to encourage all divisions to move in the same direction.

- Engage and Communicate instances where data has been the foundation of decisions and where successes have been realized. Recognize people are teams that have improved the business model using data and analytics and support the deployment of insights for improved customer experiences.

- Quantify and Optimize the value of initiatives undertaken, illustrating the revenue potential and cost savings possible when decisions are supported by data and analytics.

- Train and Collaborate for needed data and analytics competencies that stand as hurdles to success. Invest in helping team members become part of the data and digital banking transformation journey and collaborate with solution providers that can share successes, help to avoid distractions, speed development and deployment and facilitate other partnerships and collaborations.

In order to transform and build data maturity, banks and credit unions must commit to the value of data as a central tenet of the new business model, utilizing the predictive capabilities that data and digital banking transformation provide. This means moving from a culture of data outputs to a culture of data outcomes.

Read More: Digital Transformation Is About New Business Models, Not New Tech

The Role of a Data Platform

In financial services, data is around every corner. From transaction and account level balance data, to behavior and trend data, the quantity of data is usually not the problem. What is far more challenging is collating the data from multiple sources within the organization, development of robust models and use cases, selection of data to be leveraged, the interpretation of analytics, and most important, the deployment of insights across the organization for the use in business.

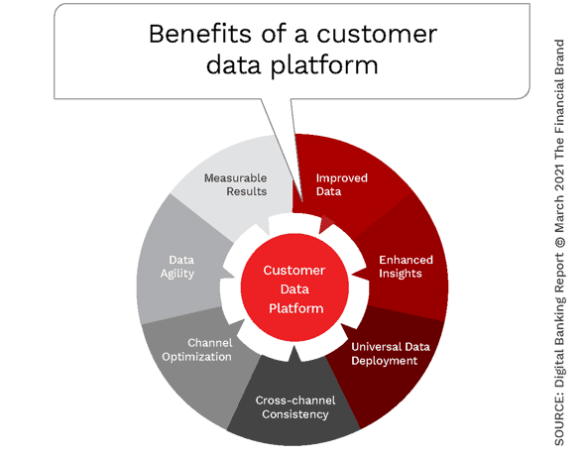

Each of these challenges have their own solution. A well-designed customer data platform (CDP) brings together multiple disparate data points and creates a unified and holistic approach to internal business cases and external customer interactions.

A CDP should serve as a centralized location so other systems can access and act upon customer data. According to Seth Early, “The platform also becomes a broker or orchestration layer that can take the outputs from one customer-facing application, process it, convert the format, and export it or make it available via an API for a personalization engine. The personalization engine might then send data back to the CDP, which can use the results to inform or drive another process.”

Action Item:

Financial institutions need to look beyond customer data platforms to more robust customer information management systems.

In more and more instances, organizations are expanding the development of customer data platforms to include more insights and deployment of information to more areas of the organization than simply marketing. Customer insight platforms and the process of information management can expand to customer service, product development, compliance, privacy governance and other key areas of the organization that need a complete and real-time view of the customer.

This expanded level of customer information management is increasingly essential to organizations of all sizes. Deploying insights across the organization reveals gaps and challenges in serving the customer and providing a positive customer experience. Without a complete view of the customer, it is impossible to serve them optimally.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Integration of Data and Digital Banking Transformation

Having a lot of data is not the goal. The goal is to collect, collate, manage, process and deploy data that provides a unified and accurate view of the customer in a way that all parts of the organization can use. As opposed to multiple data silos being used by different parts of the organization, decisions should be made using a single set of information. A data-driven organization is achieves a higher level of operational efficiency, can adapt to changes quickly, and meet customer demands faster. In other words, any digital banking transformation strategy must be backed up by a robust data strategy.

In the future, a traditional customer data platform that extracts, transforms, cleans, analyzes and stores data and insights is not enough. Strong information management will need to leverage collected, real-time insights to inform a financial institution’s decision making, operations, and customer experience components to enable high-level digital transformation strategies.

Organizations that leverage new-generation of data management tools will be best positioned to build a solid, data-based foundation for all components of digital banking transformation.