Bank lending is improving. Loans on bank balance sheets grew by 3% in 2012, up from 1% the prior year. But for consumer lending, we expect to see at best muted loan growth, at least until consumers have adjusted their individual balance sheets for the burst in the real estate bubble.

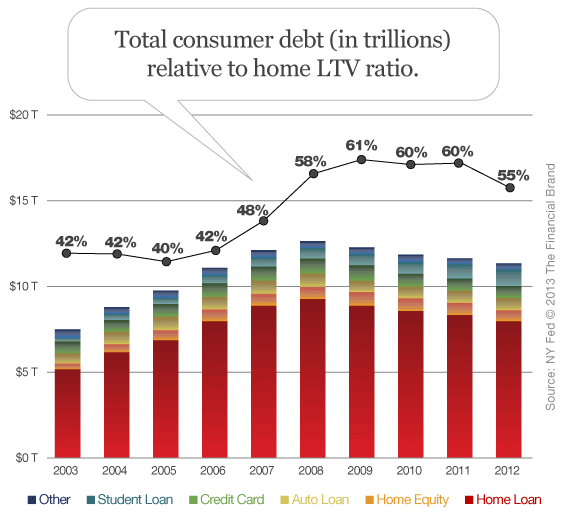

The clearest way to see medium term consumer demand for bank loans is to look at the consumer sector’s collective balance sheet. The chart shows for U.S. households their collective home loan-to-value ratio (in percent), along with their total borrowing by loan type (in trillions of dollars). What can be seen is fairly rational collective behavior by households in both the run-up of real estate prices and the aftermath of the bubble burst. When home prices were rising, consumers maintained relatively stable home LTV at about 40% – through increased borrowing, largely in home mortgages, but also in home equity, credit card and other categories. When real estate prices collapsed, the consumer sector’s home LTV jumped unsustainably to over 60%.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Read More: Congratulations, Banking Industry Earnings Improve… Now For The Encore?

As a result, consumers have been de-leveraging since the real estate bubble burst – by paying down mortgages and loans, and avoiding new debt (and also through default and restructuring of mortgages). Bank consumer lending growth has suffered as a result, with banks posting their second year of overall decline in consumer loan balances. Consumer mortgage debt declined in 2012, though bank balances grew slightly as banks are held a greater portion of new originations. Home equity loans and lines continue to plummet, with bank balances having fallen respectively 19% and 8% in 2012. Credit card turned the corner and grew 2%, while bank auto lending continued to be a bright spot with 7% expansion.

Looking ahead, we believe that consumers will continue to de-lever and be cautious about new debt until home LTVs drop to the mid-forties. As a result, we see only slow recovery of consumer loan demand. Specifically, we believe that consumer housing loans will not grow overall for several more years, and that non-housing consumer loans will not rise past the mid-single digit mark in the near term.

That said, there are some opportunities for banks in consumer lending:

- Taking advantage of the remainder of the mortgage refi boom, as well as serving the slowly recovering home purchase market

- Participating in growth in auto lending, whether by expanding the indirect channel or better direct programs to bank customers

- Repositioning credit card offerings for bank customers

- Developing new offers for unsecured and payments-related consumer borrowing

The trick will be finding ways to differentiate from the herd, as all consumer lenders compete harder for fewer near-term opportunities. Part of that differentiation will come from more precise credit evaluation and pricing; part will come from better and more focused marketing, and innovative offers.

Lee Kyriacou is Managing Director with Novantas. Lee’s industry research, forecasts and opinions leverage twenty-plus years in consulting and banking to offer industry analysis and insights. His banking experience includes head of bank-wide financial planning and analysis, as well as strategy and M&A roles, at two top ten banks. Lee also has an banking business focus in consumer and wholesale payments and payments-related lending.