2012 industry results are out for FDIC-insured depository institutions. By any account, the industry should be taking a bow — full year earnings were up again, and problem loans continued to decline. But now, what does the industry do for an encore? That remains the harder question. Of particular concern is where financial marketers will find growth in loans, spreads, fees and earnings.

First, take that bow. Here are the key 2012 results:

- Net income was up 19% — the third year of large increases, and almost a record.

- Return on assets rose nicely, to around 1.0 % for the year.

- Revenue was rose to $680 billion, a record number and 3% higher than 2011.

- Loan growth, while still modest, was positive at 3%.

- Credit quality improved — non-performing loans down 12%, net charge-offs down 27%

- Non-interest revenue was up almost 10%, led by fees and gains from mortgage refinance

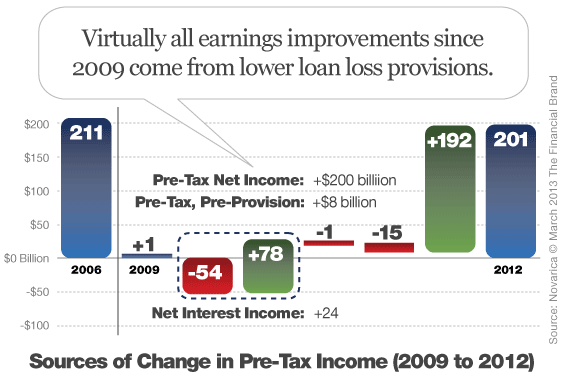

Now, let’s look for that encore. We must realize how much of the earnings recovery has been about credit quality improvement and not about underlying banking growth. Looking at pre-tax net income from 2009 to 2012 (see chart), literally 96% of the earnings growth comes from reduced loan loss provision. The remainder comes from spread revenue, with assets yields falling but cost of funds falling even faster. Non-interest revenue was flat and expense rose.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

What’s difficult for the industry going forward is finding the real pockets of top line or bottom line growth. Absent full economic recovery, banks face some major headwinds:

- Credit quality cannot improve earnings further — loan loss provision is now increasing.

- Net interest margin keeps falling — with loan yields down and cost of funds at bottom.

- Consumers are still de-levering, so consumer loan growth will remain weak.

- Additional fee declines are likely on both the trading and retail banking fronts.

There is light on the horizon for the industry as a whole, but it is a ways off. In the meantime, banks will be competing hard to win lending customers and to differentiate on revenue growth. And at the same time, they must continue reducing expense, or at least lower their efficiency ratios by keeping expense growth below revenue growth.

Lee Kyriacou is Managing Director with Novantas. Lee’s industry research, forecasts and opinions leverage twenty-plus years in consulting and banking to offer industry analysis and insights. His banking experience includes head of bank-wide financial planning and analysis, as well as strategy and M&A roles, at two top ten banks. Lee also has an banking business focus in consumer and wholesale payments and payments-related lending.