Across all industries, employees are worried about AI. A whopping 75% of workers are concerned about AI making certain jobs obsolete, and 65% are concerned about AI taking their job, according to a survey from consulting firm EY.

Bank employees, in particular, may have good reason to be concerned. More than half (52%) of entry level positions at banks are set to be impacted by generative AI, according to Gartner research.

But despite the buzz that AI has generated in banking, for most bank workers, not much has changed yet. So why hasn’t AI been that disruptive to community bank jobs? According to Tim Bates, professor of practice at the University of Michigan’s College of innovation and Technology, the use of AI has everything to do with how comfortable people are with using technology. Right now, the customers of community banks and credit unions tend to be older — 57% of community bank customers are over the age of 55 — and still overwhelmingly prefer to interact with a human rather than a robot.

“I don’t think it’s technology, it’s us,” Bates says. “When you have a problem and call a support desk, some people still hit 0 to get a human. They don’t want to talk to the AI.”

“When you have a problem and call a support desk, some people still hit 0 to get a human. They don’t want to talk to the AI.”

— Tim Bates, University of Michigan

Bank leadership, which skews over 40-years-old, also tends to be slow to implement new tech. Executives, of course, do have good reason to be wary of AI. But as younger generations rise through the ranks at community banks — and become customers themselves — AI will become more of a necessity than a nice-to-have.

So exactly when will this transition happen? It’s still a little unclear, Bates says. As Gen Z and millennials begin to make up a larger portion of the workforce and customer base of banks, the more AI and other technologies will be used.

“A small percentage of our world is ready and comfortable with it right now,” he says.

Register for Discovery2024 Conference

Join us August 8th for Discovery2024, your gateway to the strategic insights and human connections you may need to navigate the evolving financial landscape.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs.

Younger Generations Feel Positively about AI

In general, millennials and Gen Z feel good about the use of AI. A survey from market research firm Y-Pulse, found that 40% of millennials felt excited about AI and 41% felt hopeful. By comparison, only 3% of millennials felt sad about AI technology.

Younger generations grew up with technology, Bates says, and naturally are more comfortable with it. As Gen Z and millennials begin to dominate the American workforce, community banks will have to invest in the latest technology tools to stay relevant for customers and employees — who might actually prefer interacting with an AI than a person.

“Today, we’d rather talk to humans than computers,” Bates says. “In the future, as our generations evolve, people are going to be like ‘I don’t want to talk to you, just give me the computer.'”

For Now, AI isn’t Ready to Replace People

Another major factor in the AI equation is that the technology isn’t developed enough to replace the job of a human worker. At least, not yet, Bates says.

“AI doesn’t have the ability to bring human sentiment to the table, and it’s going to be a long time before that happens,” he says. Generative AI tools like ChatGPT are still not smart enough to replace the role of a person, Bates says.

Even when AI does become advanced enough to automate some work, it will likely replace cumbersome tasks, as opposed to employees, said Agustín Rubini, director analyst in the Financial Services and Banking team at Gartner. Companies like Amazon, for example, have been testing AI robots to assist workers with order fulfillment and delivery.

“AI doesn’t replace jobs, AI replaces tasks,” Rubini says. “The jobs that typically a junior person does, they have more tasks. Eighty percent of your tasks can be automated. Even for customer service jobs, which are predicted to see the most impact from technology.”

The more senior your position is, the less likely your role will see an impact from AI. Generative AI technologies are much more likely to impact entry-level roles, according to research from Gartner. About 52% of entry level individual contributor positions will be impacted by generative AI, compared to 16% of first level managers and 17% of mid-level managers, Gartner finds. By the time you reach the executive level, that percentage shrinks even further. Just 3% of senior management (think: CEO, COO) are set to be impacted by AI technology.

More Roles for Tech Workers

Community banks have historically struggled to recruit tech workers — losing out to the high salaries and robust benefits packages offered to workers in Silicon Valley.

“Talent doesn’t see financial institutions as fast movers,” says Anna Kooi, national financial services practice leader at the consulting firm Wipfli. “Historically, the pace of change has not been anywhere near the pace of change on the technology side.”

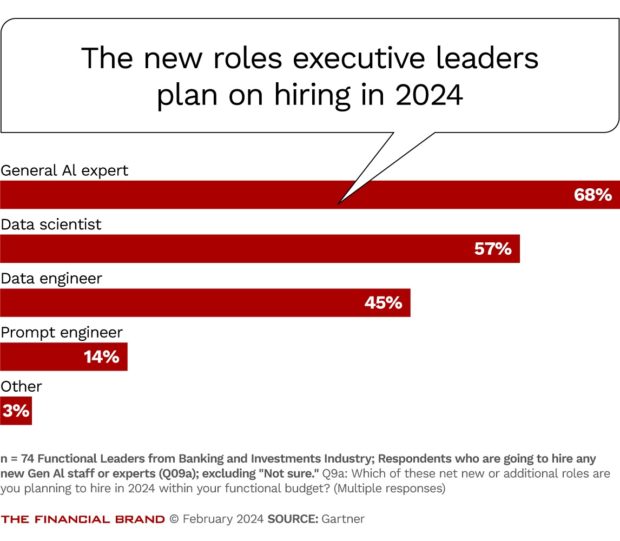

But as AI becomes the norm at banks, it’s likely these attitudes will change and roles will open for tech workers. In some cases, this may open up positions for internal employees to advance their careers.

“AI doesn’t replace jobs, AI replaces tasks.”

— Agustín Rubini, Gartner

Leaders at community banks should offer employees an opportunity to learn coding or other tech skills now, says Charles Potts, executive vice president and chief innovation officer of the Independent Community Bankers of America (ICBA), a trade group for small U.S. banks. This will help retain existing workers long-term.

“Offer a way for existing employees to continue to skill up,” Potts says. “Part of what a lot of bankers forget about is retention and growth of existing employees.”

AI will also increase the need for workers who may not be engineers, but are generally comfortable working with technology, Bates says.

“There will be more needs for people who understand and interface with computers,” Bates says. “It’s really people who can engage with computers at multiple different levels. I’m not talking about a full stack developer.”

Don’t Believe All of the AI Hype

Most experts agree that AI will make work better for employees. Bates calls what we’re experiencing right now the AI “hype cycle.” In other words, the swarm of media coverage of AI has led to anxiety about the technology.

While AI will certainly bring changes to banks, and other institutions, these changes are more than likely to be positive for employees, and customers. AI tools can help workers focus on more impactful and interesting work.

So before you panic about AI, it’s important to do your research on exactly how the technology is being used. You’ll likely find that AI won’t be replacing your job anytime soon.

“It’s not going to completely replace jobs, just augment jobs,” he says. “If I’m looking for gloom and doom for AI, I’m never going to see the important stuff.”

Caroline Hroncich is a freelance business journalist based in New York. She writes about workplace trends, HR, personal finance, banking, and more. Her work has appeared in MarketWatch, Business Insider, Employee Benefit News, the Society for Human Resource Management, and Cannabis Wire.