Is artificial intelligence coming for your banking job? That depends, experts say.

The more senior you are, the less likely your role will see an impact from AI. Generative AI technologies are much more likely to impact entry-level roles, according to research from Gartner. About 52% of entry level individual contributor positions will be impacted by generative AI, compared to 16% of first level managers and 17% of mid-level managers, Gartner finds. By the time you reach the executive level, that percentage shrinks even further. Just 3% of senior management (think: CEO, COO) are set to be impacted by AI technology.

AI is never going to fully replace human employees, and is widely expected to be a boon for the workplace. About 30% of the hours employees currently work will be automated by 2030, according to a report from McKinsey. This will free up some workers to focus on more strategic projects. But it will require some employees to embrace new skills — particularly those working in customer service and office support.

But why, exactly, are certain roles set to be affected more significantly than others? Below, we broke down which roles will be the most impacted by AI and the trends bank employees can expect over the next few years.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Entry-Level Jobs Will Experience the Most Significant Change

Less experienced workers will see the most impact from artificial intelligence. In some cases, certain tasks or responsibilities could be entirely automated, says Agustín Rubini, director analyst in the Financial Services and Banking team at Gartner.

“AI doesn’t replace jobs, AI replaces tasks,” he says. “The jobs that typically a junior person does, they have more tasks. Eighty percent of your tasks can be automated.”

This isn’t always a bad thing, Rubini adds. AI can open up new job opportunities for employees or make onerous tasks less difficult, freeing up time for more interesting pursuits.

“What you end up having is a worker who is being helped by IT to do some of their tasks, so they’re going to have to distribute their time in a different way,” he says.

However, while generative AI tools are getting smarter, they still aren’t very good at dealing with complicated people problems. There will always be a need for customer service jobs — but AI may be used to handle more basic queries or keep track of worker productivity.

Across the board, individual contributors are much more likely to use artificial intelligence than top managers. AI is “doing activities on a computer rather than being face to face with people,” Rubini says.

Learn more:

AI Will Create New Jobs at Banks

Big banks are rapidly developing AI technology — in some cases even outpacing tech companies.

For example, five big banks including JPMorgan Chase and TD Bank, published 67% of all the AI research done between 2017 and 2023, according to a report from Evident, a platform that tracks AI adoption in financial services. Capital One, Bank of America, JP Morgan Chase, Wells Fargo, and TD Bank filed for 94% of the AI patents in that same time period, the report found.

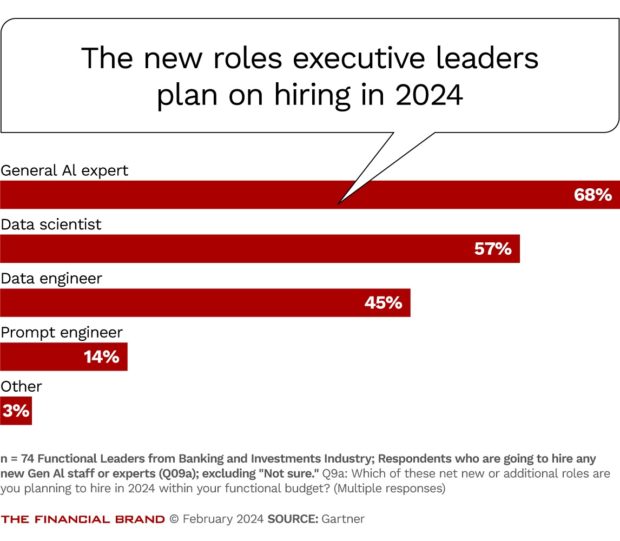

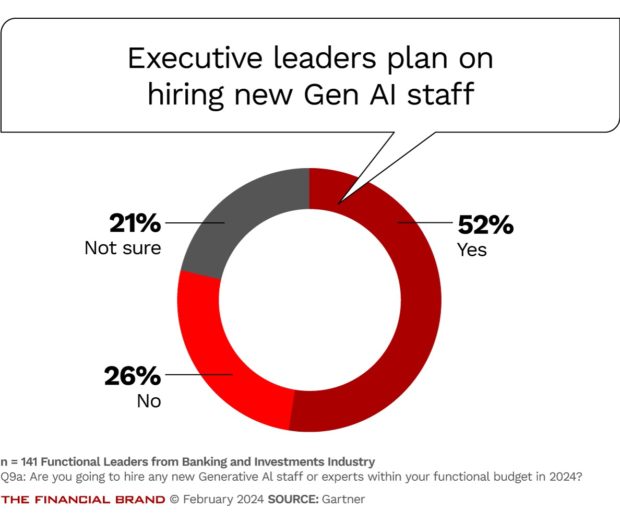

In some cases, banks are poaching tech talent from Big Tech companies. Roughly 68% of leaders say they are hiring for general AI expert roles, Gartner research found. The next highest role they’re hiring for is data scientists (57%).

And many are also investing in upskilling their current workforces. Ally Bank, for example, has a program specifically focused on improving workers’ fluency with AI, says Sathish Muthukrishnan, the bank’s chief information, data and digital officer. The bank has its own proprietary, cloud-based artificial intelligence (AI) platform called Ally.ai.

The AI fluency program gives workers the opportunity to learn more about the bank’s tools and policies surrounding AI. They also focus on how employees can incorporate AI into their work, and addresses common challenges and questions.

“We have several versions of training that we allocate and make available for our employees,” Muthukrishnan says. “The goal is to drive AI fluency for our organization.”

The drive for digital transformation needs to come from within the bank, Muthukrishnan says. Investing in developing current employees who already know your business and culture, is a good way.

“We want fair and equitable access to technology and more important AI. That should start from within,” Muthukrishnan says. “You have to give opportunities for internal employees and create a culture of a learning organization.”

Dig deeper:

- How CMOs Can Maximize Their Marketing Budgets & Prevent Cuts

- Why It’s a Good Time for Community Banks to Hire New Talent

AI Can Save Time on Difficult Tasks

Right now, the biggest way employees are seeing the impact of generative AI is by using large language models to synthesize information. Ally, for example, has used generative AI to help write more concise FAQs for the bank’s website, creating a more streamlined experience for customers, Muthukrishnan says.

“The time it takes to sift through information and arrive at an answer is considerably reduced, their ability to manage FAQs is so simple now,” he adds. Tools like ChatGPT can also help to write emails or other communications.

Generative AI could also be used to synthesize and transcribe information from earnings calls to create a summary, Muthukrishnan says. The tools save Ally’s investor relations teams tons of time when compiling information for earnings reports.

“It’s about how you apply the technology,” he says.

Every Bank is Different

Remember: No two banks’ AI strategies are the same. The impact of AI felt on everyday workers will likely vary greatly from organization to organization. Community banks, for example, may be slower to implement new technologies than mid-sized or large banks. However, community banks are still investing in these technologies at a rapid pace.

There are likely business opportunities that can be pursued using AI at every level of the bank, says Sophia Velastegui, chief product officer at Aptiv and the former chief technology officer for AI at Microsoft.

“Banks will need to evaluate jobs and divisions to uncover where the biggest business opportunities are for AI to provide a competitive advantage,” she says. “The real question is, what are key areas where both traditional and generative AI can assist?”