The report: The State of Automation in Financial Services 2024 [January 2024]

Source: SMA Technologies

Executive Summary

Facing talent shortages, growing workloads and shrinking budgets, many financial services organizations are looking to automation to improve efficiencies and operations. SMA Technologies, a workload automation software company, surveyed 580 U.S.-based executives from the banking, credit union and insurance sectors to learn more about integrating automation technologies into their operations.

Despite the positive trends, SMA’s research found several disconnects between financial services organizations’ ambitions and outcomes. Many say they have insufficient budgets, limited resources and a lack of talent to implement automated solutions.

To overcome these barriers, financial services organizations should gain executive buy-in and support, adopt better training, seek low-code adoptions and adopt a change management culture that prioritizes innovation.

Why we picked it: In the frenzy around AI, it’s easy to lose sight of the potential impact of simpler automation solutions that are widely available today. While many banks have implemented some level of automation, there remains much more that could be done.

Key Takeaways

• Most respondents have already integrated some form of automation — and many are planning substantial investments in the future.

• Automation technologies are improving customer engagement and satisfaction, streamlining processes, reducing manual errors and enhancing operational efficiencies, resulting in cost savings and a better ROI.

• Over half (52%) of respondents report saving at least $100,000 annually from automation.

What we liked: The report takes a good look at automation, highlighting the types of tools used in the financial services industry and the challenges that organizations face.

What we didn’t: 60% of surveyed organizations have less than $1 billion in assets, so the viewpoints expressed are primarily from smaller institutions.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The Current State of Automation

Today’s financial services organizations face many challenges, ranging from evolving customer expectations and economic uncertainty to competition from fintech and a growing regulatory burden. At the same time, they are also facing internal constraints such as shrinking budgets, limited resources and growing workloads.

The resulting burnout makes it hard for financial services organizations to recruit and retain skilled talent. Meanwhile, many of these organizations still operate with siloed operations, impacting their ability to extract and use data across the entire enterprise.

“Today’s most robust automation solutions are designed to help financial services organizations get time back to focus on strategic and growth-oriented initiatives in a competitive industry. These types of solutions are needed more than ever.”

Recognizing these pain points, many organizations are now adopting automation technologies at a record pace. One KPMG study found more than half (53%) of financial services executives identified “improving processes across the business” as the leading innovation goal for their technology function.

Complacency crowds out urgency: Despite recognizing automation as vital to future success, financial services organizations aren’t automating their operations urgently. While nearly all respondents reported some automation in their operations, the median percentage of operations automated ranged from 41 to 50%. Respondents were also generally satisfied with their automation, giving a satisfaction score of 7.5/10. However, there remains room for growth as 40% of respondents said 40% or less of their operations were automated.

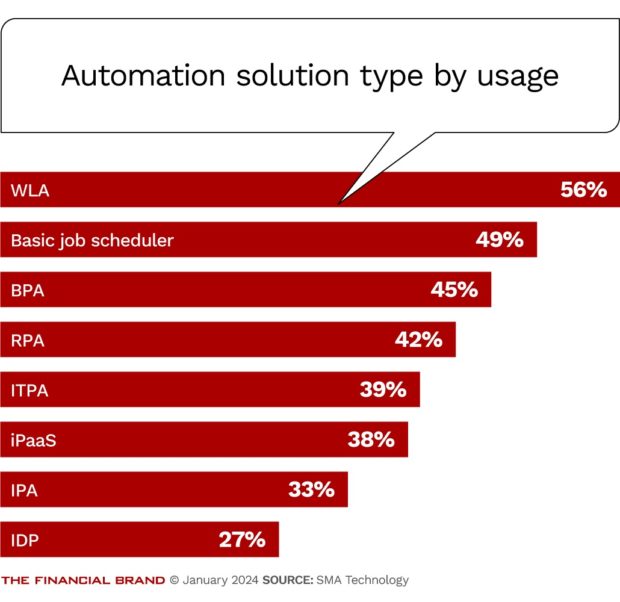

A new wave of automation tools: The report identifies several types of automation solutions:

- Basic job scheduler

- Workload Automation (WLA)

- Robotic Process Automation (RPA)

- Business Process Automation (BPA)

- IT Process Automation (ITPA)

- Intelligent Document Processing (IDP)

- Intelligent Process Automation (IPA)

- Integration Platform as a Service (iPaaS)

Of these tools, respondents said they were most satisfied with RPA, IPA and WLA. They reported the lowest level of satisfaction with iPaaS. However, this may be because the technology is relatively new, costly and lacks purpose-built options for financial services.

Solution types: More than half of respondents used WLA, making it the most widely implemented solution type in financial services. As an established technology with a decades-long track record, ongoing investment signals that modern platforms have adapted to financial services organizations’ changing needs.

Basic job scheduling closely trailed WLA in terms of implementation type. Nearly half of organizations used simple scheduling software to perform low-level automation tasks. However, many are also realizing the limited capabilities of basic job schedulers and are investing more in automation solutions that can meet the evolving needs of IT.

Challenges, Costs and Savings

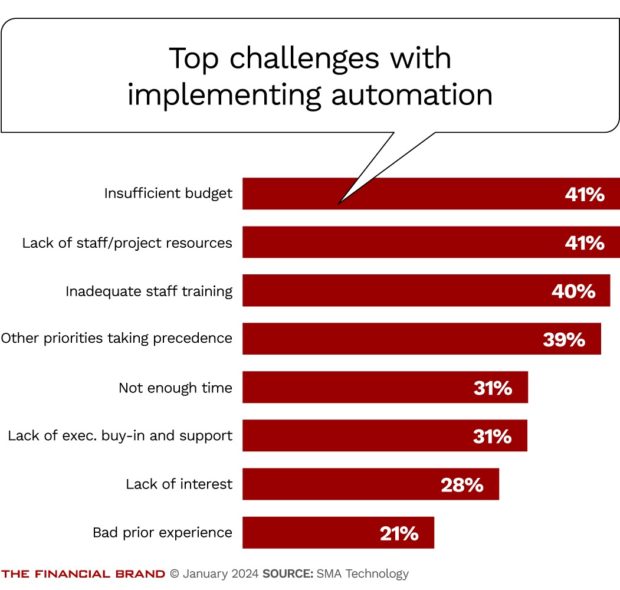

Budgetary concerns and misconceptions: When asked what prevents organizations from achieving their full automation goals, the survey respondents mainly cited cost, budget and money.

While many believe the budget is a concern, significant investment is not a prerequisite for effective automation. More critical than expenses is implementing the right solutions. By implementing a comprehensive end-to-end automation strategy, capable of orchestrating diverse processes and technology systems, financial service organizations can achieve significant cost and resource savings that more than cover their upfront investment.

And while respondents listed legacy systems as a common automation barrier, legacy systems are often actually a surmountable hurdle for advanced automation solutions.

Automation goals are spreading: Increased efficiency, time savings, faster processing and cost savings topped the list of reported goals for automation. Additionally, approximately a quarter noted better customer service outcomes and revenue growth among their top three goals, indicating leaders grasp the potential of automation to drive critical business objectives, not just improve internal processes.

Learn more:

- Power of GenAI Lies in the Augmentation of Bankers

- Webinar: Ongoing KYC and the Power of Automation

- Solving the Mortgage Lending Challenge Through Smart Automation

In fact, automation goals aligned with broader business objectives were common among the leaders in automation. Organizations with more than 80% of their operations automated cited revenue growth, digital transformation and better customer service as goals. In contrast, slow adopters cited increased efficiency, time savings and faster processing, rarely having more strategic goals.

Cost: Banks and credit unions are spending a lot on automation. Despite the predominance of smaller institutions among the survey participants, more than 90% reported spending at least $100,000 on automation in the past year, more than half spent over $250,000 and nearly 20% spent $500,000 or more.

Saving with automation: Respondents broadly said they benefited from considerable cost savings from automation. Approximately half (52%) reported saving at least $100,000 annually, while a fifth (19%) saved $250,000 annually.

Overcoming Barriers to Automation

There are several things organizations can do to address common obstacles to automation implementation:

- Executive buy-in and support: Support for automation starts at the top. IT leaders need to take the time to explain automation to leadership, share how it aligns with their goals and values and impact the bottom line.

- Training: Implementation is only the start of automation. A successful process features a state where IT is comfortable administering its new automation environment and creating new workflows.

- Low-code/No-code options: While many organizations struggle with talent, this doesn’t have to be a barrier to deploying automation. Most automation solutions now offer low code and no-code options, such as self-service capabilities, which enable front-line and non-IT users to initiate fully automated workload routines with nearly zero downtime.

- A change management culture: Competition is tough in the financial services industry. SMA notes one study that says half of today’s firms won’t even exist 20 years from now. As maintaining the status quo is no longer an option, teams must understand the importance of continuous innovation and improvement.