Over the past several years, digital technologies have changed the once staid banking industry. The collection and advanced analysis of data has changed the way customers are viewed, and the introduction of mobile devices has altered the way consumers access their bank. In short, digital transformation is on the front burner of all banks and credit unions.

At a time when most organizations are still playing catch-up, a new wave of digital technology has the potential to change the way organizations deliver banking services even further. These new technologies include artificial intelligence (AI), the internet of things (IoT), blockchain, open banking platforms with application program interfaces (APIs) and robotic process automation (RPA).

With the potential to increase efficiency, decrease costs and enhance the customer experience, these digital-enabled technologies will result in disruption of the way people do their banking and potentially what organizations deliver these services. We are already seeing organizations testing many of these digital technologies, hoping to win the battle to become the ‘bank of the future.’

Read More: Why Bank + Fintech Partnerships Are Going Nowhere

The Evolution of Banking

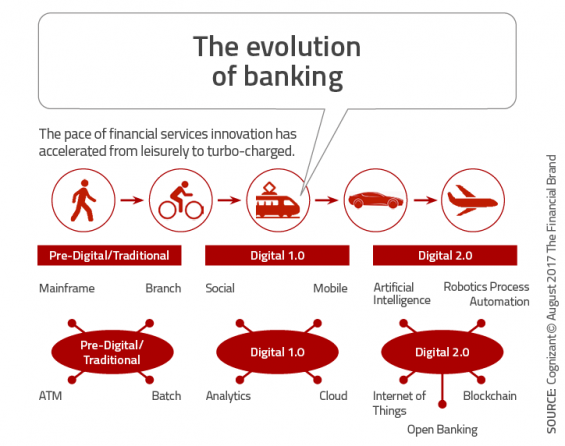

For decades, the banking industry was based on branch-based and mainframe-supported operations, that focused on the efficiency of processing transactions in person, at ATMs, on the phone and with plastic cards. Relatively recently, the impact of digital technology has moved banking transactions out of the branch and on to mobile devices, with advanced data analytics allowing for personalized delivery of services.

The pace of digital change is about to accelerate exponentially, however, with the integration of AI, robotics, blockchain, open banking APIs and the internet of things. The smarter use of data, combination of non-financial and financial solutions, and new, real-time delivery alternatives could significantly change the entire structure of banking, according to a white paper from Cognizant.

We are already seeing multiple tests of all of these technologies to different degrees across the industry. While just scratching the surface of potential, these tests are important to keep pace with consumer expectations.

- AI and Machine Learning: Organizations are testing the use of chatbots to improve customer service, while machine learning is being used to decrease fraud and improve personalization.

- Robotic Process Automation: Alerts and notifications are being automated with RPA.

- Internet of Things: Mobile device geolocation is increasingly being used for enhanced credit/debit card security, with firms also testing the use of voice-first digital assistants to conduct transactions.

- Blockchain: Blockchain technology is being used by many firms for secure document transfer and to reduce settlement costs.

- Open Banking APIs: Several traditional banking organizations are partnering with non-traditional providers to offer expanded banking services.

Read More: Financial Institutions Benefit from AI, But Consumers Remain Skeptical

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Building the ‘Bank of the Future’

The impact of new digital technologies will be felt across the entire banking value chain, impacting the competitive structure and the ways people bank. More than ever, the transaction-based component of banking will be commoditized, with differentiation achieved through the personalized experiences provided the consumer.

While the cost structure of delivery will need to be minimized, winners will be those firms that can bring together the new digital technologies in a way similar to what consumers experience from non-financial firms. This will become increasingly important as the financial needs of digital generation expand with age.

According to Cognizant, the winners in this battle will be characterized by the following:

- Orchestrator of Personalized Customer Journeys: Using expanded data and traditional and non-traditional solution sets to manage experiences contextually and across channel touchpoints.

- Aggregator of Capabilities across Banking Ecosystem: Delivering highly custom solutions from across banking ecosystem including fintechs, tech firms, and other banks and non-banking organizations through open APIs.

- Provider of Platform-Based Offerings: The bank of the future will be platform-based, with high levels of front and back-office digitalization to allow for agility, rapid innovation and real-time insight.

- Intelligent Processor of Expansive Data: Using AI and machine learning from transactions, behavioral data, etc. to ascertain future customer needs and intent and deliver customized solutions.

- Provider of On-Demand Offerings: Eliminating on-premise systems dependency, using the cloud to improve agility, flexibility, etc.

One of the keys to delivering in the new digital banking ecosystem will be the elimination of internal silos. Not only is this required for improved data analytics, but is important when trying to deliver customer- as opposed to product-centric solutions. It is important to combine the best of internal capabilities with the best of what is offered outside the bank or credit union – which is only possible with an integrated perspective.

Read More: Banks Need to Buckle Up for These Big Data Trends

Importance of the Human Touch

Despite the shift to digital technologies, a human touch will still be highly desirable for consumers. According to Cognizant, “A well-thought-out framework will be necessary to determine the right balance between human and machine intelligence.”

As opposed to an overnight change in the way people do their banking, the channels organizations deliver financial solutions, and the organizations that are competing for business, there will be incremental changes based on the investment required and value received. Organizational culture around innovation and change will determine the leaders, with the consumer being the ultimate winner.

In the end, the banking ecosystem will most likely expand significantly to include both traditional and non-traditional financial services. This expansion will lead to greater competition (and cooperation) between existing and new players.