The priorities of every financial institution have been impacted by the pandemic, with some firms believing that a greater investment needs to be made in technology, others focusing on new products and services, and still others wanting to improve components of trust and security. The foundation of each of these priorities is a combination of a need to improve customer experiences while managing operating costs in an uncertain economic environment.

The reassessment of corporate priorities is being done with the backdrop of consumer standards for engagement that have moved away from one-size-fits-all transactional experiences to contextualized experiences that are personalized across multiple touchpoints and channels. At the same time, as consumers widen their scope of understanding of what can be achieved with digital engagement, more of them will be willing to pay more for services that enhance their financial lifestyle through real-time insights, proactive recommendations and simplified engagement.

According to Salesforce’s Trends in Financial Services report, there is an urgent need for the industry to transform data and insights into actionable outcomes that are consumer-centric. The ability for banks and credit unions to help customers reach their full potential will be key to determining future success. This must be done at scale and with increased levels of personalization.

Read More:

- Now is the Time for Intelligent Digital Banking Experiences

- 7 Essentials of Digital Transformation Success

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Banking Priorities Conflict With Consumer Expectations

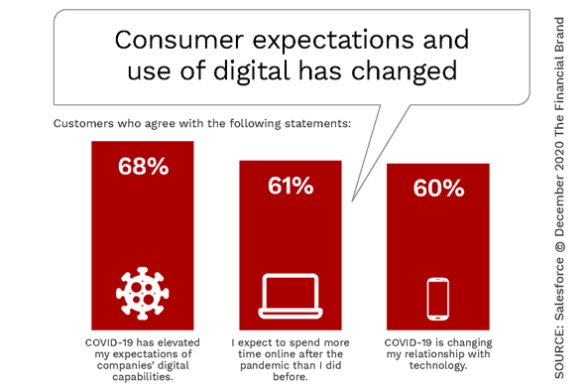

Consumer expectations of their financial institution were already increasing before the pandemic. According to Salesforce, 68% of customers say COVID-19 elevated their expectations of companies’ digital capabilities illustrating the paradox of consumer needs versus banking’s ability to deliver on these expectations. These increased expectations came at a time of a sharp rise in digital usage and shifts in how digital technology is being used.

Despite these increased expectations, Salesforce found that the prioritization of improving customer expectations dropped during the past year. After years of being the top priority for financial institutions, the focus on delivering improved customer experiences fell in importance to the fifth position after 1. implementing new technology, 2. building increased trust, 3. developing new products and 4. automating processes. Somewhat surprisingly, the prioritization of increased personalization remained as a 7th priority (the same as in 2019).

This de-emphasis on customer experiences by financial institutions has not gone unnoticed. From low ratings in providing great customer support, to the inability to deliver on being customer-centric, financial institutions are falling behind at the worst possible time … when consumers are feeling the pain of the pandemic from a health and financial perspective.

- Beyond Personalization: Three Reasons to Focus on Customer Journeys

- Digital Banking CX Boils Down to One Word: Speed

Financial Wellness is Part of the CX Equation

Very few consumers or small businesses were not impacted financially by the pandemic. In fact, even those who did not experience an immediate negative impact changed their financial habits once COVID-19 gripped the world.

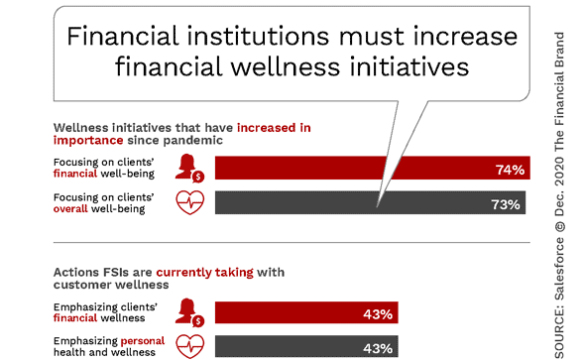

As with many components of customer experience, there is a gap between the knowledge of what is needed and the actual implementation of programs to address consumer or small business needs. While close to three-quarters of institutions understand the importance of helping clients with financial and non-financial well-being, less than half are taking actions to address these needs. Such actions will be a major differentiator for all financial institutions in 2021 and beyond.

The Power of Personalization

Continuing a trend that started well before the pandemic, consumers expect their financial institution to understand their unique needs and expectations and to personalize all communication on the micro level. According to Salesforce, two-thirds of consumers expect their bank or credit unions to know them, understand them and reward them, with 52% wanting personalized offers. Unfortunately, only 34% of consumers felt their bank or credit union treated them as individuals.

Beyond simple personalization, 68% of consumers also expect their financial institution to demonstrate empathy, while only 37% of these same consumers stated that their financial institution delivered on this expectation. In other words, there is still a tremendous gap between consumer desires and financial institution deliverables regarding contextual and personalized experiences. “The most successful financial institutions are more likely to recognize the increased importance of virtualization, personalization, and automation to help turn data from a resource into an asset,” Salesforce states.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The Solution: Autonomous Finance

Financial institutions have a wealth of data and insights connected with each customer. The key is to deliver actionable insights within the organization and directly to the consumers and small business customer – at scale – across the entire customer journey. This requires virtualization, personalization and intelligent automation to deliver instant positive engagement at all touchpoints consistently.

Success with back-office digitalization and intelligent automation will support both efficiency objectives as well as revenue objectives within the organization. These include, but are not limited to automating repetitive actions, like account transfers and bill payments, providing personalized product and service recommendations and eliminating product silos with cross-service ‘autonomous finance’ for optimal management of relationships.

According to Rohit Mahna, SVP and General Manager for Financial Services at Salesforce, “Autonomous finance will be critical not only for repairing the customer experience, but also for unlocking brand-new sources of value.”