The report: The Intersection of AI & Financial Services

Published: November 2023

Source: Arthur D. Little

Why we picked it: The report’s subtitle, “How AI is supercharging embedded finance,” suggests a powerful intersection of two transformative trends in financial services that are typically treated as separate. AI in banking is often spoken of as an end to itself. Embedded finance often seems like the quieter cousin of banking as a service. But a combination of the two could actually turn out to be the saving grace of traditional banking.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Executive Summary

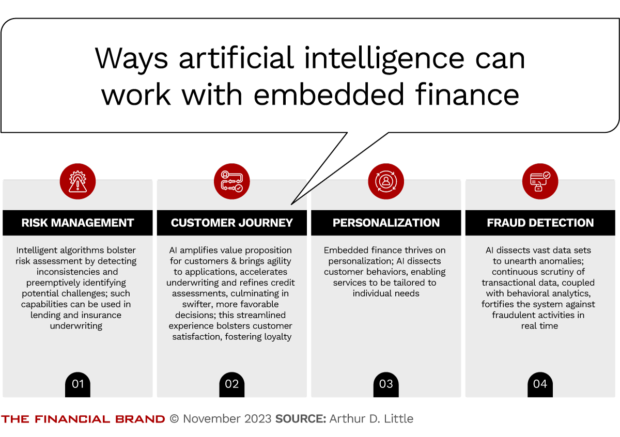

In the white paper’s introduction is a line that explains why this pairing clicks: “AI has the potential to lift embedded finance to its fullest, offering tools to combat fraud, curate personalized experiences, and manage risks.”

Embedded finance drops financial functions — payments, credit and more — directly into the purchase path of commerce. Ultimately, the consumer follows a seamless path between their product exploration and the eventual sale. The rest is, well, embedded. That’s the ideal, a combination that boosts the seller’s likelihood of closing the sale and gives the financial services provider, if not quite an exclusive, a decent shot at capturing payment or lending volume.

AI’s contribution is to make this work better. The report includes a detailed table showing 10 embedded finance use cases with side-by-side explanations of how they work without AI and with AI. One example is embedded credit underwriting. Without AI, static credit-scoring models tend to cut out higher-risk applicants. With AI, more people can qualify for credit, the paper contends.

Quotable: “AI has moved from facilitating to creating, innovating, and shaping finance in real time. Its profound impact on embedded finance is rapidly expanding, and some might argue that we are only beginning this journey.”

Backing that up are three short examples. One describes how Shopify uses AI to offer individualized solutions to its merchant customers. The report says this increases their potential sales on the platform.

See all of our latest coverage on artificial intelligence.

Key Takeaways from the AI Report

• The real-time refining of nearly every aspect of embedded finance is the prime reason to marry it to artificial intelligence. With the ability to analyze huge amounts of historical and behavioral data in an instant, AI can cook up targeted recommendations and, through generative AI, produce personalized messages about those suggestions.

• Establishing and then maintaining trust will make or break this combination: “An e-commerce platform offering financial services will gain trust faster if its AI-backed systems demonstrate transparency, minimize errors, and preemptively address user concerns.”

• “Model risk” is real. AI models can generate unintended outputs that technologists, not encouragingly, call “hallucinations.” Many people already have misgivings about AI and when the tech falters — think of the last weird recommendation your streaming service or Amazon made — it makes folks wonder.

Read more: Why AI Tech Projects Often Flop in Banking and What to Do

Our Take

What we liked: Little’s consultants talk about many more aspects of artificial intelligence than just generative AI. Where they do cover gen AI, they make a more practical case for it than we’ve seen many authors make. The conclusion of that section is that large language models, the category for software like ChatGPT, make embedded finance about more than numbers: “It’s about delivering a thoughtful, personalized user experience.”

The paper covers both sides of the sales and financing relationship, explaining what works better both for the banking providers and the merchants. It calls the latter “embedders.”

What we didn’t: A strong section discusses challenges and ethical issues and that does a good job of summarizing both. However, in addressing risks of bias being built into AI routines, the paper calls for “explainable AI,” or “XAI.” (Pron. “Ex-A-Eye,” not “Xy.”)

This term comes up several times in the paper. It was new to us but was never fully, uh, explained. A sidebar about XAI would have been welcome education.

Things that made us go “Hmm:” Often bankers worry about becoming the “dumb pipes” that other players will exploit. The paper suggests that three-way alliances will develop, partnering fintech, AI companies and large traditional banking institutions to offer strong embedded finance solutions. However, the paper adds this: “The current ecosystem seems harmonious, but banks, fintechs, or colossal tech corporations may emerge as predominant players.” Watch for rumbles to come.

Read more: ChatGPT Will Become ‘ChatOMG!’ in 2024, Forrester Predicts

How Compliance Will Continue to Challenge Banks

In several places the authors stress that compliance will be a key part of the AI-embedded finance combination. The White House is up to its third executive order concerning artificial intelligence and banking regulators still seem to be in aggressive, catch-up mode.

This level of concern may only ratchet higher as AI plays a larger role in banking in general and embedded finance specifically. “Governments will establish frameworks ensuring data sanctity, algorithmic fairness, and consumer protection,” the report says. “These regulations might also trigger industry consolidation.”

Read more: Making Banking Frictionless: The Rise of Embedded Finance

Extra Credit

In searching for more about XAI we found some very interesting resources. One is a page Capital One maintains that provides education on AI topics. The articles seem to be written by staff experts and they are a bit technical.

Another is detailed take on XAI on Wikipedia, that digs into this potentially useful tool as banks wade deeper into AI.