The digital revolution has changed how consumers want to engage and transact with their financial institution. Many consumers are managing their money online or with mobile apps, rather than visiting a branch. In a survey, 63% of consumers said that they have applied for a loan online within the past three years, 69% executed an investment, and 58% purchased insurance, according to research that IBM’s Institute for Business Value conducted in June 2023 with Red Hat and the Banking Industry Architecture Network, or BIAN.

This has major implications for the banking industry. As people spend more time on digital platforms, they expect personalized financial services to be seamlessly integrated into their daily journeys. The rise of digital wallets, person-to-person payments, instant money transfers, and other innovations have acclimated consumers to “embedded finance” — which is financial products woven into nonfinancial digital ecosystems.

Legacy financial institutions that rely on bricks-and-mortar distribution networks face an existential crisis in this new paradigm. Physical geography lacks scalability and the cost structure of large branch networks is harder to support at a time of with thinner margins and digital-only competitors. Banks and credit unions must engage in a digital transformation effort to embed relevant offers where consumers want them, or risk losing mindshare and market share.

“On the one hand, technology and options that competitors have, both traditional and nontraditional, are compressing the market opportunity for traditional financial institutions, particularly when the tech-fins are getting into financial services.”

— Shanker Ramamurthy, IBM

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

The Platform Imperative

Executives at many banks and credit unions understand that, for their institutions to remain relevant, they must pursue embedded finance and build business models that include taking part in a broader digital ecosystem.

IBM surveyed 1,000 executives from international financial institutions about the role embedded finance plays in their business strategy. It found that 70% of banking executives view embedded solutions as either core or complementary to their existing strategies. And nearly 75% have initiatives underway. The question is whether these initiatives are expansive enough.

Success requires more than an understanding of the embedded finance concept or simply bolting on digital banking channels. Banks and credit unions need flexible architectures, strategic partnerships and technology like artificial intelligence to seamlessly embed relevant financial services into third-party platforms.

Going Where the Consumers Are:

Embedded finance is not simply a new form of cross-selling. It’s an engagement model that lets financial institutions enable consumers to transact while they are in the midst of a digital activity that is unrelated to banking, whether that is shopping, planning a vacation or scheduling an orthodontist appointment. Succeeding with this approach requires a fundamental rethinking of the role financial institutions play.

This ecosystem approach represents a massive cultural shift for institutions and their executives accustomed to owning end-to-end distribution and product development. As open business models rise, banking executives must adapt to rapid changes in the marketplace and find potential nonfinancial partners that own existing customer journeys.

In the IBM survey, banking executives cited online retail and consumer lending as the industries offering the most opportunities for embedded finance. These are also their highest priorities in terms of finding platform partners. Another priority industry is health care. As medical expenses rise, bankers anticipate that embedded financial services will offer a way to cover the gap between the cost of treatment and insurance.

“By embedding relevant financial services unobtrusively into consumers’ digital lives, both banks and their customers win. But institutions need to pick up the pace of change to shape the embedded finance revolution,” says Shanker Ramamurthy, managing partner, global banking and financial markets, IBM Consulting.

Change is always a challenge, especially when it could take years to see benefits. Obstacles that hinder progress include legacy systems, siloed business models and lack of standardization for application programming interfaces, or APIs. But embedded finance offers meaningful rewards, such as additional revenue streams and improved financial performance.

Listen to the Banking Transformed podcast with Shanker Ramamurthy.

The Gap Between Bankers and Consumers

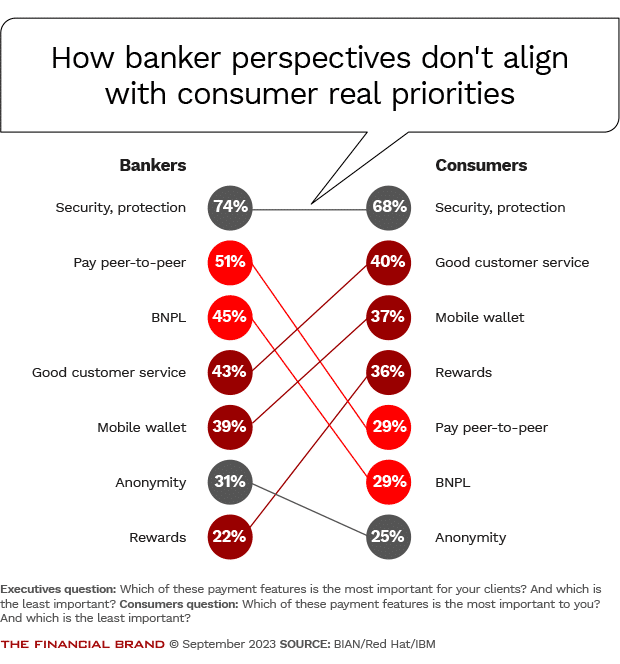

IBM also surveyed 12,000 consumers of financial services in 12 countries for its report. It found a disconnect between what bankers think is most important to consumers and what consumers say their priorities actually are. While consumers want great service, a mobile wallet and personalized rewards, most bankers underestimated the importance of these factors.

“Good customer service is identified as the second most wanted feature in a banking relationship, right after security and protection. Generative AI can add tremendous value to better match client expectations with AI-augmented services, rendered at scale.”

— Paolo Sironi, IBM

For example, while bankers and consumers are aligned on the importance of security, bankers ranked peer-to-peer payments and buy now, pay later as more important relative to other payments features than consumers did. The bankers also considered good customer service to be relatively less important, whereas consumers ranked this as the second most important priority.

To succeed in the platform economy, banking executives need to walk in their customers’ shoes. Ecosystem relationships cannot simply be transactional. They must be symbiotic, with shared goals, coordinated user experiences, and incentives that promote collaboration. This is where generative AI can add value by boosting the quality of digital customer interactions with higher levels of personalization and the potential for greater engagement.

Read more:

- Citibank Courts Merchants with a Twist on Embedded Payments Options

- Why KeyBank Believes Embedded Banking Is the Future

Overcoming Barriers to Change

The path to embedded finance is not without obstacles. Banks and credit unions of all sizes contend with legacy back-office technology, siloed business lines, talent shortages, and risk management gaps that hinder the ability to effectively collaborate across ecosystems. In the IBM survey, 53% of banking executives cited outdated core systems as the most significant challenge to overcome. Monolithic, inflexible architectures restrict the ability to quickly integrate services into third-party platforms.

Other challenges holding institutions back included:

- Inadequate API standards (52%)

- Lack of long-term funding (40%)

- Gaps in controls and security frameworks (37%)

- Difficulty sourcing talent (35%)

“Banks that are still struggling with foundational elements might not have the bandwidth to focus on the more advanced factors that drive competitiveness and success. But addressing the most fundamental strategic stumbling blocks is necessary to transform embedded finance partner relationships,” the IBM report says.

Ultimately, succeeding with embedded finance requires financial institutions to simultaneously transform technology, culture, operations, and governance. Those taking a systemic approach will gain first-mover advantage. By tackling impediments holistically, financial institutions can capitalize on the platform revolution more quickly.

Read more:

- How Embedded Finance Is Blending Banking and Commerce

- See all of our latest coverage of digital transformation

The Time to Act is Now

The window of opportunity for financial institutions is closing fast, given the speed of change in the banking industry. Leading banks and credit unions are already placing bold bets, orchestrating new ecosystem experiences that embed banking into the everyday journeys of consumers in places beyond their own institution’s website and app.

To pursue an open finance strategy, business lines, technology teams, and risk and compliance officers must work in unison. This requires leadership that will embrace change as opposed to seeing the horizon through the lens of the past. On the business side, core banking systems need to become more modular, allowing capabilities to be integrated in a composable manner, focusing on speed and scale of deployment. Financial institutions must be flexible to meet the needs of different platforms and use cases.

“Recognize you’ve got to start now, at a minimum with pilots and proof of concepts, and can kind of learn your way. Try, fail, figure out what works, innovate, get on that innovation circle, to accelerate your path to the future.”

— Shanker Ramamurthy, IBM

Bank and credit union executives must shift their mindset, accepting that technology is no longer a support function for banking, but the core product that financial institutions provide. Critical to this new mindset will be the development of partner-focused APIs — APIs that support easy onboarding, timely issue resolution, rapid new capability development, and always-on platform availability.

According to the IBM research, 88% of financial services executives measure success of their embedded finance solutions as a combination of these three KPIs: revenue generated (69%), final users served (43%), and API calls (41%). API calls replace legacy host-to-host connection methods to simplify data-sharing and boost efficiency.

As this finding suggests, bankers tend to prioritize inward-looking KPIs over those that are more ecosystem-oriented. But it is the success of platform partners that ultimately drives more embedded finance revenue for financial institutions. When nonbanking third parties were asked what they found important for success, adequate operational support, easy onboarding of solutions, rapid API development, personalized consumer journeys, and 24×7 platform availability were the top priorities.

Yet, among the bankers, these were lower in importance. For example, only 22% cited “time to onboard new partners” as an important measurement of success and only 33% cited “platform availability.”

Recommendations going forward include:

- Embrace change: Recognize that embedded finance represents a cultural and business model shift — it’s not just bolting on digital channels. Banks must be ready to collaborate across ecosystems in new ways.

- Invest in the future: Don’t underestimate the investment required, both in technology modernization and developing new organizational capabilities. Executives must commit funding and alignment for multiyear initiatives.

- Establish KPIs: Make sure customer priorities are understood and reflected in embedded strategies. Establish KPIs that focus on partner experience, ease of integration and co-created value.

- Commit to customer-centricity: Leverage exponential technologies like AI and cloud to enable the scale, personalization and immediacy consumers expect from embedded finance. But lay the architectural foundations first.

- Innovate incrementally: Start small, focus on target ecosystems, and learn fast. Use pilot initiatives to build capabilities before expanding embedded finance more broadly.