Every retail bank has been disrupted by the changes in customer behavior in recent years — it’s just a truism to say that now. Some have lived up to heightened digital expectations and remained competitive, while others have struggled.

Banks often rely on legacy enterprise technology that makes it difficult for them to offer the digital and mobile-first experiences customers expect. This isn’t because they lack a willingness to invest in technology; rather they lack staff with the next-generation tech capabilities to design and product manage these digital experiences.

They need to find the right people — and quickly.

But how?

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

The Technology Talent Crunch

Research from The Josh Bersin Company suggests that, by 2025, two out of five job postings aiming to recruit talent with a mix of technical and business skills in retail banking will not be filled.

You might think that, despite the historically low unemployment levels we’re still seeing in advanced economies, this is a problem that can be solved by simply spending more money on existing recruitment practices to fill the vacancies. However, it is important to note that the kind of people retail banks want to attract are also the same highly skilled, digitally savvy people that their challenger bank rivals want.

It'll Be Worse by 2025:

The portion of job postings seeking a mix of technical and business skills in retail banking that won't be filled:40%

Adding to the complexity, these hires are also in demand at insurance, payments and fintech brands. The same talent pool is being hotly pursued by leading companies in industries very far removed from financial services as well, including IT service providers and firms in the consulting, aerospace and automotive sectors.

The reality is you can’t hire your way out of the problem.

Banks Need to Rethink Their Workforce Strategy

Research highlights the simple truth: the shortage of people to fill financial services technology positions is a massive talent crunch that cannot be solved solely by dipping into the talent market. If a promising Gen Z talent is weighing offers from a traditional bank on the one hand and a big tech firm like Apple or Google or an exciting fintech startup on the other, who, realistically, is she going to say “yes” to?

Even while retail banks are offering high compensation packages right now to get people on board — a 36% year-over-year increase in advertised salary post-pandemic — there just aren’t enough potential candidates out there, and competition is fierce.

Right now, nearly every industry is in some phase of digital transformation, digital disruption or industry reinvention. In a world where everyone wants to have a strong digital presence, what can legacy sectors like banking do to meet the talent-sourcing crisis that could very well render them irrelevant?

Based on our global research, the banks that stand the best chance of navigating the crisis successfully are the ones that have reinvented the way they approach the talent challenge. In fact, internally, the highest-performing retail banks don’t see themselves as banks anymore, but as technology companies that happen to offer financial services.

We call these players “pacesetters.”

See all of our latest coverage of digital transformation.

Some Retail Banks Stand Out: Meet the ‘Pacesetters’

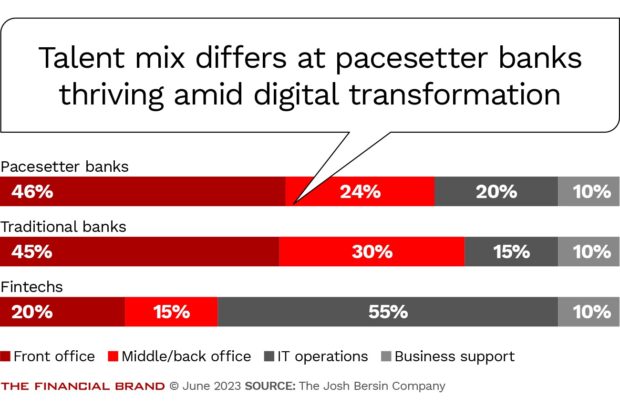

What are the characteristics of pacesetters? In our study of 200 banks worldwide, we found these standouts have vastly different roles, job titles, skills, and distribution of labor than their peers.

The banks getting their acts together see the current state of digital transformation not as a technology challenge, but as a talent challenge. As such, they have been willing to engage with systemic people solutions to shake up their talent mix.

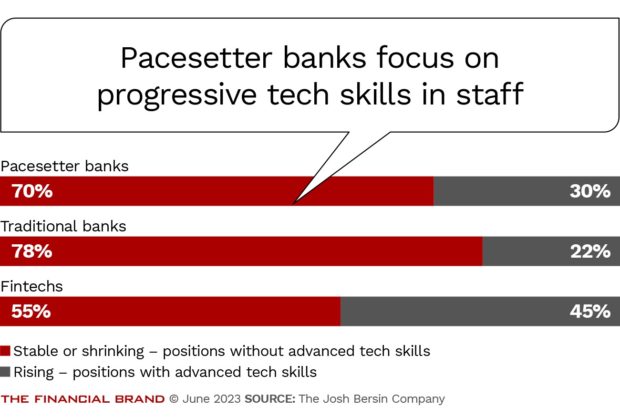

At the ground level, pacesetter banks are shifting their recruitment approach from hiring based on a particular profile to prioritizing the next-gen skills needed to accelerate their digital transformation. They focus on technical skills such as extreme programming, microservices or Kubernetes, along with skills related to product management and the seamless end-to-end design and delivery of digital products.

In some cases, retail banks do engage in a focused recruitment approach that involves trying to poach highly skilled technologists, regardless of their current industry or whether they have banking experience.

Still, secondary strategies are beginning to emerge. There are banks trying to address their skills gap by simply acquiring companies with the desired talent. This might work as a temporary measure, but a much more sustainable practice is to strengthen internal retention and upskilling muscles — that’s what the best are doing.

Banks must also focus on creating enduring, employee-focused organizations, where culture is a stronger force than rigid rules. People need to feel like they will be supported and trained to grow over the long term.

Pacesetter banks are not just great in their people practices; they outperform their more traditional bank competitors, so they have better return on equity, enjoy lower employee churn, and have a reputation as employers of choice.

Read more:

- Banks Should Scavenge Troubled Fintechs’ Talent and Tech

- How to Ensure an Effective Change Management Effort

Digital Transformation Isn’t a Part-Time Job

How can banks become pacesetters? First, look around and see if your environment is already encouraging digital-first experiences. Pacesetters have transformed their branches — you don’t enter a branch and see the typical tellers and specialist bankers. Rather, there is a lot of automation in the branch and universal banking professionals who help customers with their financial needs using digital terminals.

Our research shows that pacesetters are also much more operationally efficient than their more traditional counterparts, with far fewer people in middle and back-office roles (1.6 times less). They have systems to automate these types of administrative and repetitive tasks, to allow people to focus on higher-value work. They also tend to have 1.3 times more the number of dedicated IT people to manage this infrastructure.

A Winning Talent Strategy:

Pacesetter banks have used automation to reduce the number of middle and back-office employees they need. Instead, they're retraining talent to move beyond obsolete roles and adding more jobs focused on modernizing the organization.

Pacesetters invest in people to oversee their digital transformation. They employ 7.6 times more people in senior software engineer roles and 2.3 times more people in transformation roles who are scouting for opportunities to modernize the organization. Because they recognize the importance of such roles, they don’t just tack more tasks on to existing jobs, then look for incremental results whenever the workload allows — they create dedicated positions.

Read more:

- The Value of Turning Bank Employees Into Entrepreneurs

- How Community and Regional Banks Can Win the Talent War

Top Priorities Are Retention and Reskilling

No single bank, even among the pacesetters, has everything fully figured out. But pacesetters have this in common: They acknowledge that all of their people practices are interconnected and affect each other — and they are willing to explore how adjusting these can improve the employee experience. Among other characteristics, they approach reskilling differently than the typical traditional bank, boldly reimagine the work environment and prioritize a variety of strategies that strengthen retention.

But they don’t all follow a single formula. One example of a bank that has completely redesigned its ways of work to embrace the new digital era in consumer banking is ING. Rabobank allows its team members to choose a hybrid work schedule that suits them best as individuals. DBS, a digital bank from Singapore, prioritizes automation and relies on technology to offer both customers and employees top-notch digital experiences. Their stories showcase that there are multiple ways to rethink and modernize a retail bank.

A characteristic that unites all the pacesetters is a recognition that traditional ways of working are no longer effective. Survival in the consumer banking industry requires a data-informed shift towards digital transformation. Pacesetters are willing to take the necessary steps to make this happen.

About the author:

Stella Ioannidou is the director of research at The Josh Bersin Company, a research and advisory firm specializing in HR and workforce strategies.