More than a good customer experience, digital banking engagement involves personalized two-way interactions, using data, analytics, and real-time communication at scale. To build and grow loyalty, banks and credit unions must do much more than process transactions – they must keep customers engaged with the brand regularly.

The goal is to provide value beyond just products and services, displaying empathy for their needs that will strengthen the overall relationship, throughout the entire customer journey. The crucial importance of this capability is increasingly understood by banking leaders. Data from two studies reveal that by their own assessment, financial institutions are falling well short of what’s required.

According to Gallup, retail banking customers who are fully engaged bring 37% more annual revenue to their primary bank than do customers who are actively disengaged. Fully engaged banking customers also have more products with their bank, from checking and savings accounts to mortgages and auto loans. Finally, they also have higher deposit balances in their accounts than less engaged customers with the same products.

“Using data and analytics to understand customer needs and expectations is a tactic that 81% of executives say is critical for growing profits – but fewer than 25% believe their company uses effectively.”

— Gallup

In addition, according to the Zendesk Customer Experience Trends Report 2020, 70% of businesses are not meeting customer expectations – and over 80% of customers will churn after a bad customer experience – so there is a ton of pressure to succeed … and right away. To succeed, customer engagement must be focused on value for the customer first and the business second.

Customer engagement success can be achieved with the following strategies:

- Listen to your customers. More than ever, there is a need to not only listen, but to provide solutions that bring value that is timely, relevant, and easy to act on.

- Use your customers’ channel(s) of choice. You must provide the opportunity for your customer to have a seamless conversation with you on the channel(s) they are most comfortable with. That may go beyond channels like email, phone, chat, and text, to include social media.

- Empower customers to self-serve. Customers often prefer to help themselves with digital assistance. This is both faster for your customers and more efficient for your service agents.

- Leverage AI integration. Engagement, supplemented by artificial intelligence, allows financial institutions to automate some interactions, augment others with a human, and leverage insights to contextualize communication.

- Be authentic and empathetic. How does your organization avoid sounding inauthentic? Outstanding service and engagement must be centered on the customers’ need for financial wellness as opposed to a bank’s or credit union’s desire for product sales.

- Create a cadence of consistency. Keep the dialogue with your customers ongoing and the message consistent, inspiring customers to be evangelists of your brand.

- Build on small victories … now. It is often better to create small, repeatable wins for the customer today that create a strong value exchange than to spend years developing much larger initiatives that may miss the mark. Take action now and build on early wins.

- Seek scalability. Personalization can only work if it is scalable. Consider customer engagement software that can manage, analyze, and optimize the customer journey across multiple devices and platforms.

According to Zendesk, “Customers want to be treated as individuals, meaning they expect companies to know their preferences and purchase history. To do that, companies need to be able to harness their customer interactions across platforms and turn that data into actionable insights. Better digital customer engagement leads to more customer data and better customer experiences, which can lead to higher profits.”

Read More:

- Top Five Customer Experience Trends in Banking for 2022

- 7 Proven Ways to Deliver Exceptional Customer Experiences in Banking

- Why Most Banks Struggle to Deliver a Killer Customer Experience

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Current State of Customer Engagement in Banking

Most financial institutions are playing a game of catch up, trying to meet current and future customer needs using yesterday’s technology. As customers have changed their expectation of service and engagement, banks and credit unions must find ways to deliver unique, personalized, and contextual journeys.

This requires a shift from a traditional product-centric approach to a customer-centric approach that focuses on intelligent customer engagement. Done well, the result will be the ability to capture new growth opportunities by delivering greater value for customers now and in the future.

It is not surprising that previous research by the Digital Banking Report found that increasing customer satisfaction and improving efficiency were the top two customer-oriented objectives of financial institutions globally. It was also not surprising that cross-selling was a major objective. The good news is that there has been an increase in emphasis in providing proactive advice and increasing engagement opportunities as shown below.

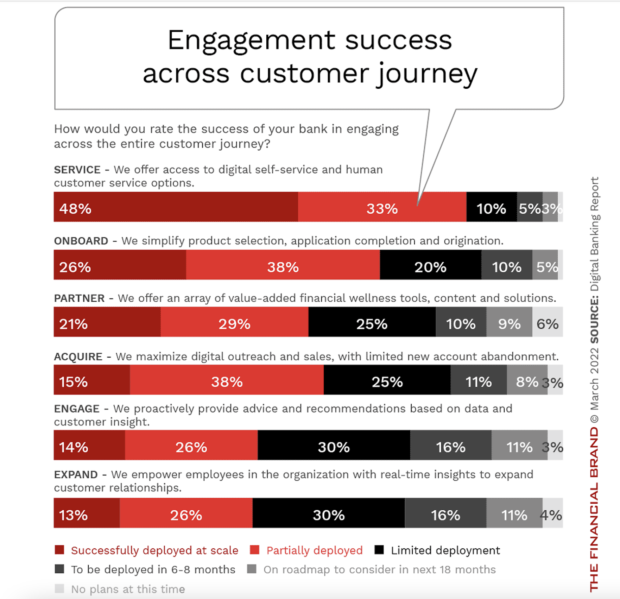

Despite good intentions, however, most financial institutions fall short of engagement success beyond the basic customer service interaction level. Key areas of concern include easy account opening and onboarding, the offering of financial wellness tools, proactively providing advice and offers, and the empowerment of employees with analytics to help customers.

These challenges are reflected in the self-reported ratings financial institutions provided relative to their customer engagement maturity. Except for offering some level of personal financial management (PFM) tools, and account aggregation capabilities, the engagement maturity level of financial institutions across all asset sizes and regions is extraordinarily low.

In fact, we found that less than 10% of all organizations can provide personalized financial recommendations, automated actions based on transactions, or lifestyle-related offerings using open API technology.

Banking Must Increase use of Engagement Strategies

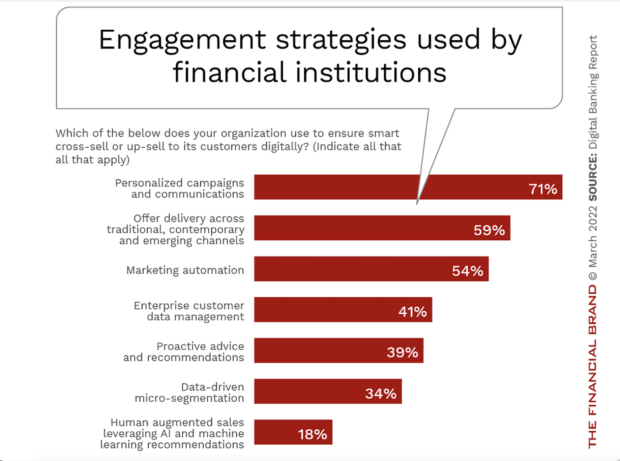

Despite the self-reported lack of maturity around customer engagement, financial institutions of all sizes are testing all forms of customer interactions. The challenge for most organizations is doing the type of engagement required at scale. To deliver this level of engagement, most financial institutions need to invest in updating existing technology and architecture.

In other research conducted by the Digital Banking Report, we find that banks’ efforts at personalization, multichannel communication, and marketing automation are often rudimentary at best. More advanced applications (proactive recommendations and human augmented engagement) are often impossible to deploy.

Building a Future-Ready Engagement Strategy

To move beyond delivering positive experiences, to engaging with customers in real-time on a value-added basis, will require an investment in modern technology, a data-driven analytical culture, and a focus on serving customer needs with proactive solutions.

Personalization and contextual engagement are the starting points. Viewing customer relationships in an empathetic way with a focus on financial wellness must be the ultimate mission. Done well, loyalty will increase and relationships will expand.