The ability to personalize communication and experiences is a relatively recent phenomena that responds to the desire of consumers to have individual experiences as opposed to an experience which is known to be shared by others. People are exposed to personalization in everything they encounter, including marketing messages, products, digital content, and even cars, making expectations even higher.

Consumers are attracted to personalized experiences because they make them feel special and unique. Personalization gives the impression that people matter on an individual level to the banks and credit unions that serve them. This is despite the fact that most personalization is an automated process, made possible by the collection of massive data sets and increasingly sophisticated analytics.

In one of the most-read self-help books of all time, How to Win Friends and Influence People, Dale Carnegie wrote, “Remember that a person’s name is, to that person, the sweetest and most important sound in any language.” According to Carnegie, using a person’s name when appropriate could better influence that person’s way of thinking.

As the amount of marketing messages expands exponentially, Carnegie’s advice has become even more relevant. According to the Econsultancy 2017 Conversion Rate Optimization Report, 93% of companies report having more success in converting prospects into customers when they personalize their marketing. But, what makes personalization so effective?

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Power of Control

The University of Texas did a study, Consumer Control and Customization in Online Environments that found that two factors drive consumer’s desire for personalized experiences: control and information overload. While marketing messages are coming at consumers from all directions, technology has put consumers in the driver’s seat in terms of what they see, experience and engage with. As a result, consumers are not only controlling trends through behavior and social sharing, but also the strategies that brands use to reach these same consumers.

Providing consumers the impression that they aren’t getting something generic or run-of-the-mill makes them feel in control. That’s because they are receiving a message or offer that was created and delivered based on previous activities, behaviors or purchases that help predict future activity. Done well, it is a win-win for both the consumer and their financial institution.

According to Psychology Today, when consumers feel a sense of internal control, they believe that they are in control of all aspects of life, which makes them feel happier, more successful and even healthier. Even though it is an illusion, it is important to the consumer and it is effective.

“Personalized products and experiences make us feel unique in a sea of sameness,” said Laura Bright, associate professor of communication at Texas Christian University in Fort Worth. “Brands now have so much information about their customers that they can instantly offer exactly what they want when they want it, which consumers like because it’s more convenient and time efficient. This customization and instant access to what they need also allows consumers to feel as though they’re in control.”

Help With Information Overload

The second reason why consumers prefer personalized experiences, according to the University of Texas study, is because it helps reduce information overload. Actually, personalization makes consumers think they are receiving less of an overload.

For example, when people know that the content being displayed on a website is in some way personalized to their needs, beliefs or behaviors, it makes engagement both easier and more desirable because there is less potential for wasted time. When a consumer believes someone else has done some of the sorting of content for them, it makes life easier. And, given the amount of information everyone is asked to process daily, this is a good thing.

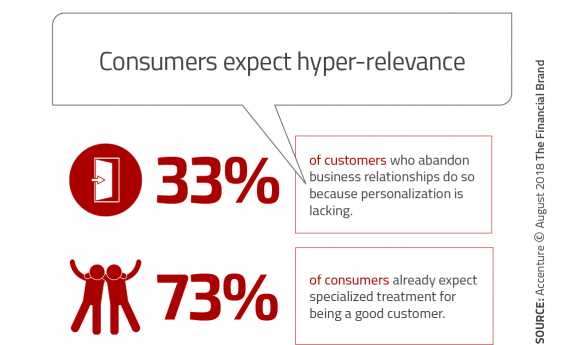

According to the 2018 Accenture Interactive Personalization Pulse report, 45% of potential customers have abandoned a website because the amount of information or number of choices was overwhelming. A financial institution that knows its customers well, however, can deliver those choices that best match an individual’s personal situation.

“The human brain hasn’t developed to cope with the flood of information and the thousands of mini decisions we’re faced with every day,” said Liraz Margalit, an Israeli-based web psychologist and head of Behavioral Research at global experience analytics company Clicktale. While the internet is responsible for generating much of this overload, “personalization allows companies to present customers with a shortlist of search results, product recommendations or service options specifically tailored to their personal needs and preferences, so they can easily work out what’s best for them.”

The Power of Choice

Despite wanting simplicity and personalization, people also want choices, and the ability to determine what is right for them. So, while financial marketers want to find ways to reach consumers in a highly customized manner, they want to provide relevant choices that both empower and enlighten. If done well, choice can actually enable control.

It is a matter of science. The brain serves as a filter for all of our senses, helping us to determine what we should, and should not pay attention to. The term, ‘selective attention’ refers to this process of being able to focus on one piece of information while ignoring others.

With the power of selective attention, the consumer can determine what impulses, information or senses to pay attention to and what to weed out to avoid being overwhelmed and confused. That is how we can eliminate ‘noise’ and only consume what we want. This increases the preference for personalization and customization by the consumer since choices are moderated.

The Power of Relevancy

Studies have shown that people have a positive reaction to seeing or hearing their name, confirming what Dale Carnegie observed years ago: Marketing communication is more effective when a person’s name is used. It is even more effective if only a first name is used as opposed to an entire, formal address. But this is only the tip of the iceberg.

Consumers also react favorably when they are not totally aware that a message is meant for them. Relevancy matters. If something relates to what we care about, we allow it to enter our brain for consideration.

The Importance of Influencing Behavior

When we discuss the power of personalization, we often mention the power of predictive analytics and the ability to predict future behaviors. We assume that predicting behaviors will lead to a positive action on the part of the consumer.

In reality, what we really want advanced analytics and machine learning to do is to help us predict the consumer’s response to messages and offers at a given time with a selected channel.

According to a report from Baynote, The Human Need for Personalization: Psychology, Technology and Science, experiences don’t have to be unique to each user, but tailored to satisfy their individual needs that may be the same as other consumers. “Personalization is much like a matchmaking exercise with the ultimate goal of pinpointing the best product or service from your catalog that best satisfies your customers’ needs.”

Because a consumer’s interests and needs may be similar to others, it is important to determine which consumers are similar and to deliver build strategies that will best influence behavior to take a positive action for the consumer and the company.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Psychology + Analytics

Because of some of the complexities of personalization and consumer behavior, financial institutions should apply psychological theory alongside analytics, allowing them to identify how external factors combine with their customers’ different personality traits, mindsets, expectations and preferences to impact on their decision to buy (or not buy) products. “Once organizations understand how their customers are likely to behave in any given mindset and situation, they can develop personalized experiences that will delight customers and drive sales,” states Margalit from Clicktale.

If banks and credit unions learn to recognize certain behavioral patterns, they can determine which type of personalized experiences individuals will find helpful in real time. “For example, they could send a personalized recommendation to an explorative or disoriented customer during the shopping process to help them make a purchase decision,” offers Margalit.

A Win-Win Proposition

Done well, personalization benefits both the consumer and the financial institution. And the banks and credit unions that best understand the psychology of personalization will do the best connecting with consumers.

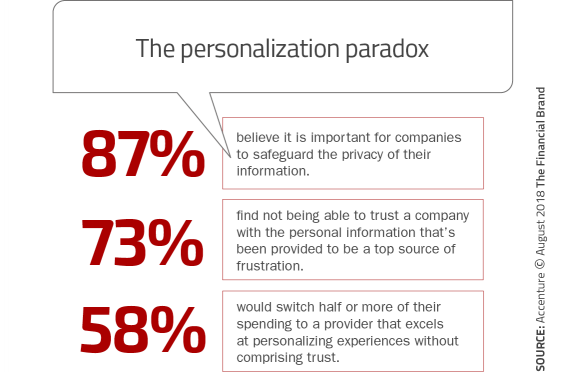

Consumers want the companies they work with to know them, understand them and reward them as an individual. For a bank or credit union to eliminate noise and provide financial solutions that apply to a specific need or are driven by a real-time behavior provides value to the consumer that builds trust and loyalty.

When a financial institution gets it right, personalization provides the impression that all customers have their own 24/7 personal assistant who can be trusted to help them make the best possible decisions. This is what they are receiving from the big tech firms and what will be the primary differentiator in the future.