The Digital Banking Report has consistently found that financial institutions rank improving the customer experience as the top strategic imperative that will drive success in the future. Yet, in spite of this stated priority, few organization have invested in the key components required for an enhanced customer experience or achieved the level of success desired.

At the same time, consumers have become more demanding of what they expect from organizations across all industries. Instead of traditional forms of convenience, such as geographic proximity, consumers increasingly want to engage with companies that have advanced products that can save them time, make daily interactions more simple, and show empathy to their personalized priorities.

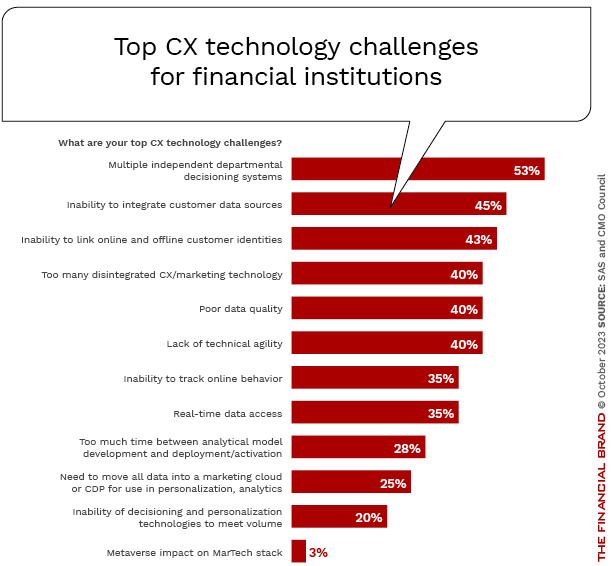

In financial services, these increased demands have come at a time of massive increases in alternative fintech and big tech competitors that are willing to deliver the highly personalized engagement levels wanted across the entire customer journey. Headwinds to delivering contextual experiences in banking also include cumbersome data silos at most legacy financial institutions, more stringent privacy laws and changes by tech companies that have marketers scrambling to get the external data needed to deliver value.

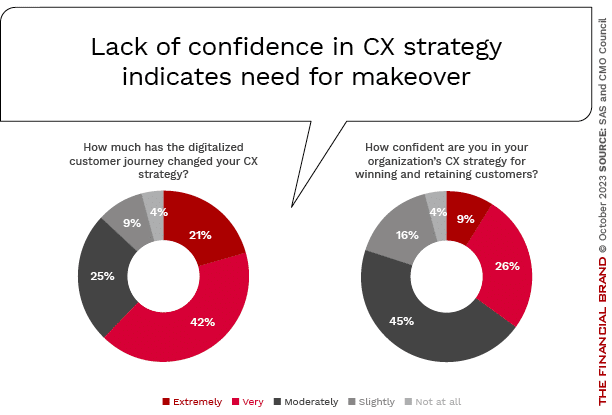

A recent study by SAS, in conjunction with the CMO Council, found that more than 60% of marketing leaders across industries say the digital customer journey has dramatically changed their CX strategy. Unfortunately, more than three-quarters of marketers aren’t very confident that their CX strategies have the ability to win and retain customers in this new environment.

The solution is not simple. It requires the combination of data, insights, technology and an orchestration of both digital and human channels – on a personalized level – that displays to the consumer that you know them, understand them and will reward them with frictionless engagement options and empathy in real-time. According to the research, this will require that brands:

- Understand the components of customer loyalty.

- Improve their CX maturity.

- Create a balance between privacy and value that creates trust.

- Deliver on the potential of advanced marketing technology (martech).

- Leverage AI to create increased engagement and satisfaction.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Understanding the Keys to Customer Loyalty

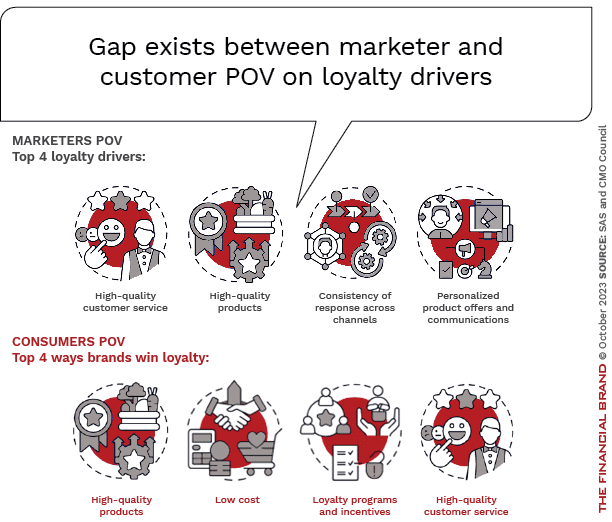

Marketers and consumers both prioritize certain factors when it comes to loyalty, but there are some differences. Marketers emphasize high-quality customer service, top-notch products, consistency across channels and personalized product offers and communications. In contrast, consumers prioritize high-quality products, affordability, loyalty programs and good customer service.

Over the last several years, brands are increasingly emphasizing personalization and brand consistency over cost as a means of differentiation. While product quality and price continue to matter, they are considered essential requirements. This shift requires marketing to increase the use of data, advanced technology and artificial intelligence to deliver on other aspects of the customer experience that drive loyalty.

The SAS report states that consumers may not place personalization at the top of their loyalty factors because the basics are being met by many organizations. Alternatively, most consumers may not view contextual engagement or empathy as part of the definition of “personalization,” but as a component of high quality products. Either way, financial institutions must better understand the psychology of their customers to bridge the gap between what they say and what they do.

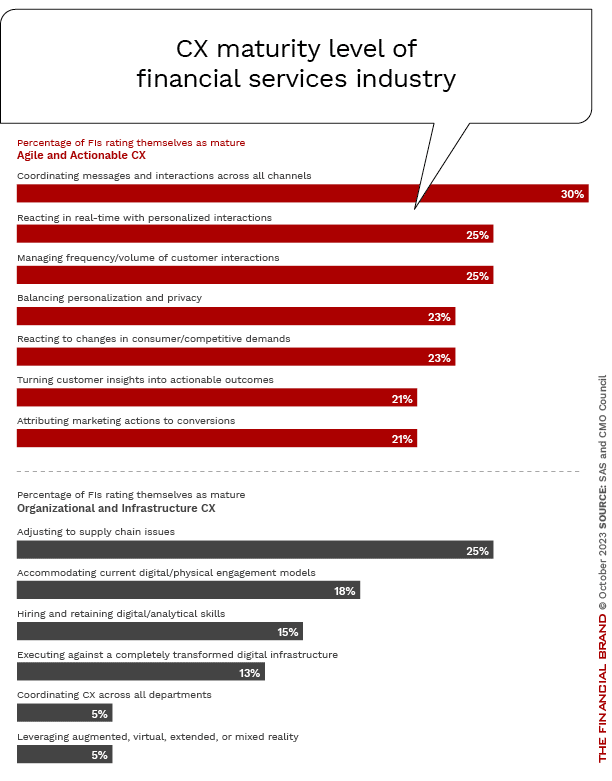

Lack of CX Maturity Challenges Marketers

The research makes a clear case that even after massive digital acceleration, many financial institutions still struggle to realign customer experiences for the digital world. A significant percentage of banking marketers say the digitization of customer journeys dramatically changed their CX strategies. However, more than half lack confidence that their revamped strategies can actually retain and engage customers.

This highlights an imperative for banks and credit unions to reimagine how they deliver experiences amidst surging disruption. Today’s consumers demand omnichannel convenience, personalized real-time engagement, and mobile-first, digitally integrated experiences. Legacy financial institutions that cannot deliver on these digital imperatives risk losing ground to more agile competitors.

Banks adept at deriving actionable intelligence from customer insights and nimble enough to act quickly can foster much deeper consumer relationships through advanced engagement. The key to seizing these CX possibilities lies in fully utilizing data, analytics and technology to revolutionize how engagement is supported.

To unlock the speed and agility demanded in digital markets, banks must reinvent infrastructure from the ground up. Transitioning core platforms to the cloud will provide the elasticity and resilience needed for always-on, data-driven customer experiences. APIs and microservices will also prove critical – allowing more nimble development of CX capabilities that can snap into an open architecture.

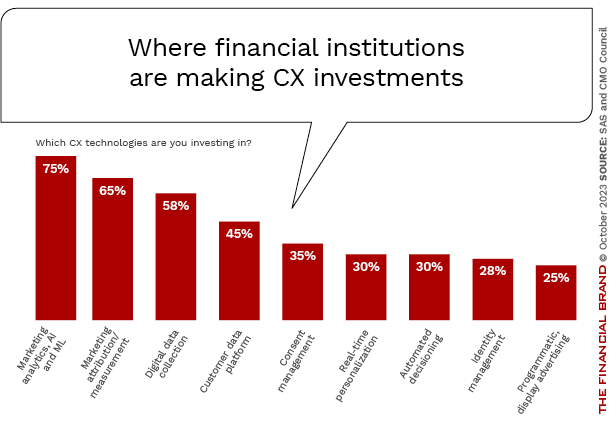

While 75% of financial institutions are investing heavily in artificial intelligence and machine learning to elevate CX, only 45% are focusing investment on foundational data platforms, and only 30% are investing in real-time personalization. This risks initiatives underperforming expectations, with AI unable to draw connections from fragmented sources and engagement suffering due to lack of contextual engagement.

The research strongly signals that banks’ AI ambitions will necessitate higher investments across virtually all CX technologies. Combining rich, holistic data sets with AI’s analytical powers will enable next-level intelligence – from predictive behavioral modeling to ultra-personalized recommendations. Data, AI and effective deployment of solutions across the customer lifecycle must evolve in lockstep for CX gains.

Read More:

- Financial Services Entering New Era of Customer Engagement

- Digital Redefines Customer Engagement Playbook for Financial Institutions

- 9 Secrets to Building Customer Engagement in Banking

Balancing Privacy, Personalization and Value Transfer

SAS found widespread consumer distrust in how brands handle personal data and privacy. Over 65% of consumers feel they lack control over how brands use their data. More than half believe brands fail to keep them informed on data usage or disclose security breaches transparently.

Despite these concerns, privacy ranks lower among factors that currently drive brand loyalty. In fact, over 80% of consumers are willing to share personal data in exchange for something of value like rewards or personalized offers. This willingness has risen notably since before the pandemic, according to the research.

The key is offering value in return for data. When consumers don’t see value from data collection, they resent the lack of control and are primed to act against brands. To address privacy concerns while delivering personalized experiences, brands need adaptable customer data platforms. These can integrate data silos, manage consumer consent, and synchronize online and offline data. Agile data systems that rapidly incorporate new sources will be critical.

First-party data strategies are also essential because third-party data options are declining. Brands must focus on capturing and applying consumer permissioned data to drive differentiation through relevant experiences. Handled responsibly, first-party data powered by value exchange will be pivotal for increased customer engagement.

Read more:

- A Generative AI Decision-Making Guide for Banks & Credit Unions

- The Future of Value: Rethinking Banking in an Era Beyond Money

AI is the Gateway to CX Excellence

The SAS research makes a case that AI is the tool that can help both financial institutions and customers. “On the customer side, AI can serve up better, more rewarding experiences. On the marketing side, AI can produce algorithmically driven attribution that ties CX actions to business outcomes,” the research states.

AI can predict the near future with a high degree of confidence and power real-time communication that is highly personalized. This helps marketers get out in front of CX and deliver the right experience or content to the right person at the right time in the customer journey.

More than ever, investing in AI/ML is marketing’s top priority for addressing the digital journey. Predicting behavior and omnichannel personalization are AI’s top uses. This aligns with pre-pandemic research showing increasing reliance on AI-powered intelligent systems for engagement.

AI also enables more accurate attribution by uncovering patterns between touchpoints and outcomes. Algorithmic attribution identifies which interactions and journeys actually drive conversions. AI analyzes paths of both converting and non-converting customers to pinpoint what triggers desired outcomes.

AI’s analytical prowess is critical for elevating CX relevance and optimizing marketing spending. By predicting needs, personalizing engagements, and clarifying attribution, AI can help financial intitutions maximize impact across the customer lifecycle.