With differentiation of product and pricing increasingly difficult, and convenience being defined by the simplicity of mobile and online engagement, financial institutions are rethinking how they deliver an exceptional experience across the entire customer journey. With consumer expectations increasing faster than ever, delivering emotionally rich journeys that lead to higher levels of engagement becomes an imperative.

Leading financial institutions are improving experiences by simplifying back-office processes and delivering intuitive solutions across all channels. Research from Forrester found that organizations that invest in experience transformation across people, process and technology demonstrate superior performance, including reduced costs, improved employee satisfaction, increased revenues and greater loyalty.

Return on Experience:

“ROX” is highest when you deliver an experience customers enjoy instead of making them feel like self-service is a barrier between them and the help they need, according to Salesforce.

In fact, Forrester found that experience-driven financial institutions were 1.3x more likely to exceed revenue growth expectations, 1.8x more likely to see improved customer satisfaction scores, and generate 2.5x more website visits compared to other firms. “Banks and credit unions must transform their organizations with an obsession for the customer, with processes that drive continuous improvement through customer insights, people who can design and deliver great experiences, and technology that enables those experiences,” stated Forrester.

Read More:

- The Future of Customer Experience in Banking is Personalized

- Now is the Time for Intelligent Digital Banking Experiences

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Consumer Behaviors Changed by the Pandemic are Sticking

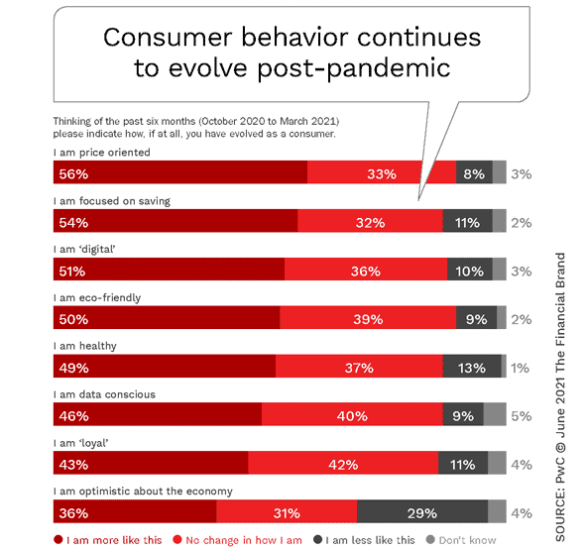

During the Covid shutdown, consumers had to respond immediately and adopt new habits. Many wondered whether these changes – many of which accelerated trends that were already in motion – would be temporary or permanent. PwC’s June 2021 Global Consumer Insights Pulse Survey, conducted in March 2021, found that the most changes are sticking.

Consumers are more price-sensitive, more savings-oriented, more digital and more conscious of the environment. They also want organizations who know them, look out for their well-being, and are “local.” In fact, research from PwC revealed that companies that make customer experience a priority can charge a premium of up to 16% for their products and services.

The Importance of Return on Experience

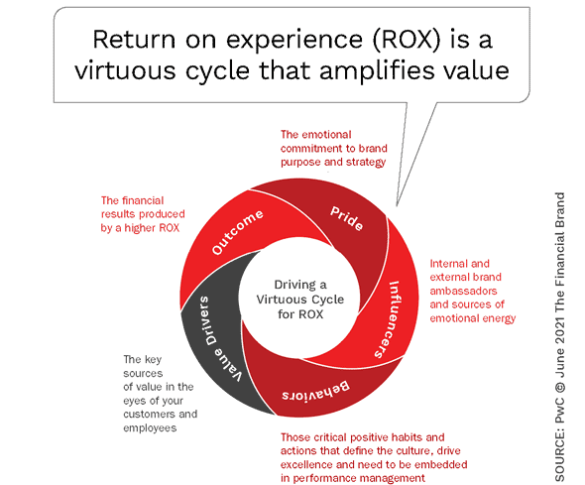

Financial institutions are increasingly exploring return on experience (ROX), a metric that captures the results of investments in digital experiences. The benefit of tracking these metrics is that it expands beyond traditional satisfaction scores or product-line measures to provide a global perspective on the bottom-line benefits of delivering superior experiences. This metric can also keep experience projects on track and make them more successful.

The ROX Equation:

ROX = Net Value of Benefits / Cost of Investment x 100%.

To measure ROX, you need to proactively track and measure key metrics related to the experience and your organization’s overall vision. According to Salesforce, some examples of what could be measured include:

- Acquisition Costs. In a digital world, lowering the cost of acquisition is key to competing with digital-first organizations. A great experience will lower the cost of acquisition because word of mouth replaces promotion costs.

- Speed to Serve/Customer Effort Score. In a digital world, experience is often positively or negatively impacted by the speed of task completion. Everything from opening the mobile app to making a deposit, transferring funds, updating account information or establishing a new relationship needs to be tracked. The more intuitive and fast the process is, the less the abandonment rate. How much faster can your channels perform? How much easier can you make an interaction?

- Time to Market. How much time does it take to develop and launch a new product or feature? The more agile the development and enhancement process, the more digitally mature your organization is. In many cases, financial institutions leverage third-party solution providers to assist with improving the time to market.

- Cost to Implement and Maintain. To improve digital experiences will usually require an investment in new technology, outside services and training. Alternatively, there may be a reduction in maintenance costs of outdated technology and processes.

- Level of Engagement/Traffic Growth. One of the newer metrics that has gained favor is relationship engagement rates. A customer is considered more loyal and the relationship is often more profitable based on the level of active engagement. The more inbound and outbound interaction, the better the experience.

- Customer Satisfaction. Instead of a traditional, single measure of satisfaction, digital satisfaction should be across channels and for each type of interaction. Without measuring satisfaction with individual experiences, it is difficult to improve the ROX.

- Click-Through Rate. When you want a customer to watch, read, download, share or buy, what percentage of customers take the action you are requesting?

- Sales Conversion Rates. How many new customers or sales are lost because of the complexity and slowness of a process? In many cases, improving the sales conversion rate (reducing the abandonment rate) can greatly assist in the engagement of a third-party solution provider, investment in new technology and commitment to resources to improve a legacy process.

What is Your Baseline?

To measure the improvement in customer experience across an organization, you need to build a baseline of where you are today. Not just the tangible components shown above, but the less-tangible elements that can improve the likelihood of program success. Some of the questions to ask, according to ROX research from PwC include:

- How strong is your employee emotional commitment to your brand purpose and the overall improvement of the customer experience?

- How big is the gap between knowing the critical components of the customer experience that need attention and taking action on them?

- Is your leadership and internal “influencers” committed to your customer and employee experience initiatives?

- How much value do you add to the customer and employee experiences?

- Are you currently measuring and of the customer and employee experience initiatives being undertaken?

- Do you have a direct correlation identified between experience improvement and revenue enhancement?

Read More:

- Beyond Personalization: Three Reasons to Focus on Customer Journeys

- Data and AI Must Play Bigger Role in Financial Marketers’ Growth Strategies

- Rethinking Financial Services with Artificial Intelligence Tools

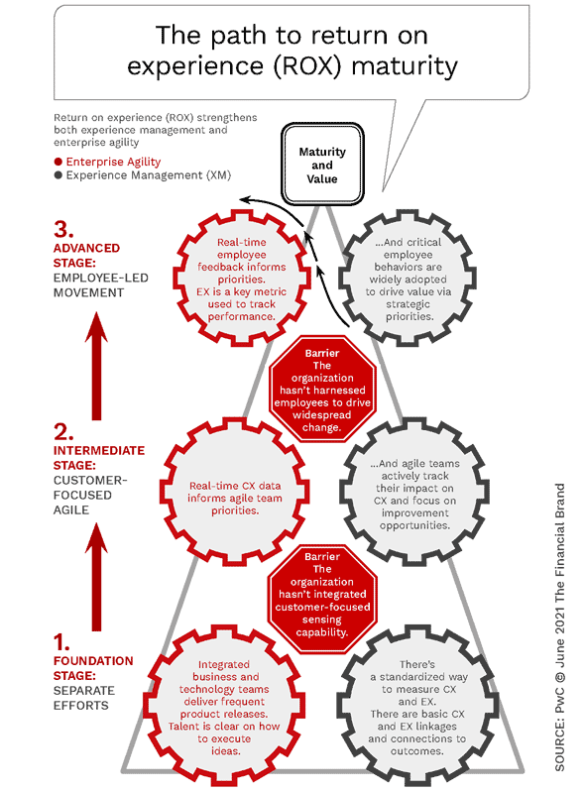

Improving Your Return on Experience Maturity

As with all components of digital transformation, the foundation for a strong return on experience is the unified commitment of leadership in the endeavor and building a culture that fuses customer experience with a positive employee experience. Even in a digital world, consumer engage with humans, either on the branch-based front line or through other channels. Even employees that do not have direct customer contact have an impact on the customer journey.

Building an Experience Culture:

Galvanizing employees and leadership around the mission of improved customer experiences will greatly improve the chances of improved ROX maturity.

“There is a huge upside in investing in employee experiences to improve customer experiences,” states the PwC research. This includes product knowledge, access to advanced analytic insights about customers, and tools to assist customers across their journey.

Additional actions beyond building a feedback loop between customer experience and employee experience that can improve the ROX maturity include:

- Understand “magic moments” across the entire customer journey that drive the greatest impact on customer experience. Know where investments can be made to get the best CX results.

- Understand behavioral differences that can create unique customer profiles for personalized experiences. The importance of data and analytics to create personas allows for content, marketing and proactive solutions to be created.

- Deliver value in exchange for personal data giving the ultimate control of the data to the consumer. Transparency is imperative.

- Earn the business by making the entire journey faster, easier and more empathetic than the competition. Leverage content and agnostic journeys to illustrate your desire to know the customer, understand the customer and reward the customer by improving their potential for financial success.

Improving the customer and employee experience is more important today than at any time in the past. The return on experience must be measured and understood across the organization and become the foundation for your organization’s mission. While nobody denies the desire to deliver a great experience, the path to success requires a paradigm shift away from cost containment to experience enhancement as an organizational goal.