For ten years, the Accenture Global Consumer Pulse Research study has tracked the intentions and actions of consumers around the world. This year’s study included more than 16,000 bank customers, finding that digital is at the center of customer interactions. Virtually very customer is now a digital customer … albeit moving at different speeds.

Digital has become more important to consumers across the board, with some consumers having completely ‘gone digital’ … 20% of banking customers are digital-only users, preferring to prospect and purchase online. Alternatively, there are still consumers who still lean heavily on traditional channels, but even they are likely to use digital channels at different times for certain activities.

Despite this strong movement to digital, banks and credit unions continue to have vulnerability to churn as customers encounter confusing web sites, unacceptable call center wait times, and difficulty solving issues regardless of the channel they use.

As a result, traditional acquisition and retention strategies will need to change to take advantage of customers’ new channel preferences. For example, the Accenture research found that consumers between 18 and 34 years, are two to three times more likely than consumers older than 55 to want more digital interactions than companies currently support.

That said, the older group is still open to adding other channels and are experimenting with online interactions, using a wider variety of contact channels. By focusing on millennials, most companies are missing an important opportunity.

Winning financial organizations will meet or exceed customers’ expectations by consistently delivering better experiences regardless of which interaction channel the customer chooses.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Trends to Influence Digital Banking Strategies

The good news is that retail banking remains one of the top sectors who provide a positive customer experience according to Accenture. The bad news is that an important portion of banking consumers continue to actively consider other options. In fact, the survey found that 18% of bank customers switched completely and 27% added new providers.

At a time when every dollar of revenue matters and acquiring new customers looking for better alternatives is more costly than ever, market share is at stake. The challenge is whether or not bank and credit union investment in retention efforts are meeting the desire objectives.

The Accenture research identified eight trends to that can influence retention strategies, hopefully reducing customer churn and keeping pace with a quickly-evolving, increasingly digital consumer base.:

- Customers are buying, but less so from current providers. Globally, 27% of banking customers purchased/subscribed to a new financial product/service over the last six months. However, more and more consumers’ intend to buy less from their current providers. In fact, 21% of banking customers say they are not at all likely to buy more from their current provider.

- First-contact resolution is key to retention. 80% of consumers who switched providers due to poor customer service said they could have been retained. Yet first-contact resolution has consistently remained the top frustration factor for consumers in the past five years of the Accenture survey (cited by around eight in 10).

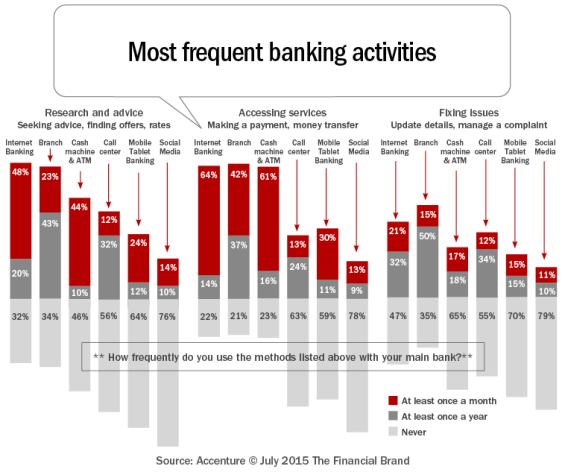

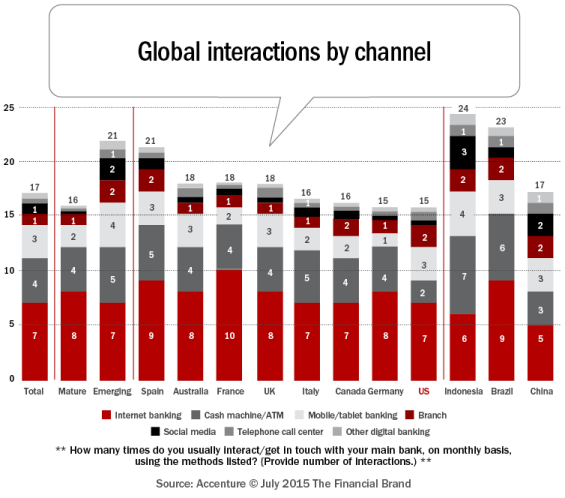

- Digital channels have significantly increased the number of overall interactions. More than last year, 58% of bank customers use mobile devices when prospecting or seeking support. The average consumer has 17 interactions with its main bank per month. Of these transaction, 7 are through online banking and 3 are with a tablet/mobile device.

- After switching to digital, customers want more services. 61% of banking customers expect to increase their online interactions across their lifecycle. Barriers banks will need to address include the lack of the right information provided by the channels, lack of trust in these channels and lack of knowledge of how to access these channels.

- High, but slower growth in, customer service expectations gives banks a chance to catch up. Unfortunately, the percentage of consumers switching due to poor service has decreased only slightly during the past five years, indicating that most organizations are still not giving consumers the kind of service they desire. The biggest issues

with providers are the failure to deliver on promises, inefficient and slow customer service, and lack of interaction convenience. - Customer loyalty program adoption is rising, but fails to keep customers committed for the long haul. One-third of banking consumers participated in at least one loyalty program, with consumers who stayed with their providers because of the program remaining at around 56%. The bad news is that participation in programs is primarily to gain access to the ‘best deals’, indicating a short-term loyalty that fails to keep customers committed for the long haul.

- Compelling offers could win back customers. More than 30% of consumers switched their bank providers in the past six to 12 months due to good competitive pricing, high customer service quality or good value for money. Somewhat surprisingly, consumers perceive switching hassle to be low, and about one-third of consumers who switched from a provider said they would consider returning within two years for better pricing or a superior product.

- Non-traditional competitors are gaining ground. Accenture research found that nearly half of customers would likely bank with a company they currently do business with but that does not currently offer banking services. The number surpasses 70% for those ages 18 to 34. In a separate study, Accenture estimated that competition from non-banks could erode one-third of traditional bank revenues in North America by 2020.

Winning the Battle for New Customers

“Simply ‘being more digital’ – closing down branches and rolling out better mobile and online banking services, for example –

will not give banks the differentiation they need to capture the attention of, retain and best serve today’s digital customers,” stated the Accenture research.

When analyzing consumers’ attitudes towards more innovative digital banking models, the survey showed that those models that heavily incorporate digital (for example, a pure digital bank), garner greater support in emerging markets as opposed to more mature markets (U.S., Canada, Australia and Europe).

Interestingly, banking models based on the bank using partnerships with non banking players that bring a wider range of products and services than those of a traditional bank generated higher interest and positive reactions across all countries. One-third of all consumers are generally open to such a business model.

As part of this expanded, partnering model, three digitally-centered roles emerge according to the research:

- Advice Provider: recommending specific, targeted buying suggestions

- Access Facilitator: to financial services and non-financial services partners

- Value Aggregator: through real-time, dynamically-priced offerings.

With this model, Accenture found that an immersive relationship with customers is created that increases penetration of purely digital customers and cuts digital churn by up to 50%. The benefits include:

- Increasing the quality of the customer experience by combining their vast amounts of customer and transaction data with digital capabilities.

- Growing sales through continuous daily customer interaction generated across partnerships and connections with provider partners who offer goods and services in every area of consumption, from retail and home services to health, security, travel, leisure, communication and transportation.

- Nurturing loyalty to the bank by developing digital capabilities of relationship managers, empowering them to keep pace with customer evolutions.

- Optimizing front – and back-office processes for speed, efficiency and scalability – thanks to high automation and partner integration.

“To drive customer engagement and capture a greater share of the digital opportunity, banking organizations must place themselves at the center of a digital, interconnected ecosystem of cross-industry providers and services that serve customers’ everyday needs. Winners will be those that manage to show solid customer metrics with strong retention/engagement,” concluded the study.