Digital transformation in financial services goes beyond just providing consumers an online or mobile account-opening solution. Optimally, banks and credit unions should build a process that connects with the consumer before an account is even opened and continue throughout the entire customer journey, at the optimal times of communication and on the device(s) preferred.

This engagement process should improve the customer experience on an ongoing basis, rather than being a series of disjointed communications. In fact, each engagement should collect insights that the institution can leverage for future communications, creating loyalty that will be hard to penetrate.

Done well, digital engagement should not just represent a great communications process, but should reflect changes in the back office that simplify all stages of engagement. Most importantly, these stages should connect seamlessly across channels, eliminating the need to visit a branch while allowing consumers to switch channels when desired.

Done well, digital engagement should not just represent a great communications process, but should reflect changes in the back office that simplify all stages of engagement. Most importantly, these stages should connect seamlessly across channels, eliminating the need to visit a branch while allowing consumers to switch channels when desired.

Overall, how financial institutions develop their engagement strategies matters. This requires new acquisition strategies — attracting the right type of consumer who can provide scale and longevity of relationship. Then, it is imperative that all stages of engagement, across the entire customer journey, focus on a seamless, personalized and value-driven relationship.

The just-released report Digital Banking Customer Engagement, sponsored by Harland Clarke, provides a perspective of where digital engagement in financial services is today and where it may be tomorrow. More importantly, the report provides the foundation for financial executives to create a customer experience similar to that provided by big tech leaders.

Read More:

- Financial Services Entering New Era of Customer Engagement

- Digital Redefines Customer Engagement Playbook for Banks

- 9 Secrets to Building Customer Engagement in Banking

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

New Account Opening Channel Options Remain Limited

The way financial institutions respond to the shift to digital channels has become a competitive differentiator. More and more, consumers opening a new checking account or getting a new credit card or loan are making decisions based on the ease of account opening and the capabilities of digital banking apps. This is why the largest financial organizations are gaining market share and the highest customer satisfaction ratings.

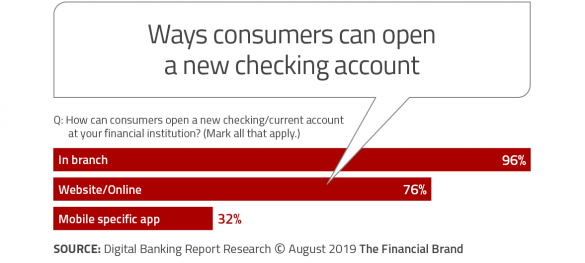

It is both encouraging and troublesome that the ability to open an account on a website/online has increased from 66% in 2017 to 76% in this year’s study. It is also good that the ability to open a new checking account on a mobile device has increased from 18% to 32% during the same period. However, while there’s been growth, the reality that so few organizations allow consumers to open a new checking account on a mobile device remains a major concern.

Ongoing research continues to incorrectly state that “consumers prefer to open a new account in a branch.” These misleading research results fail to reflect what’s really going on — many banks and credit unions don’t make the digital process easy or seamless. Nor do they integrate it across channels.

When we look at the responses based on both size and type of organization, we find that the move to digital account opening is most prevalent among the largest organizations and more likely with credit unions than among community banks.

Read More: The Psychology of Personalization In Banking

Consumers Still Need to Visit Branch Way Too Often

While it would initially appear that having an online or mobile account opening capability would provide encouragement around engaging the digital consumer, the reality is not that simple. This is because, a digital account opening capability does not mean the consumer is able to complete the process on the same channel.

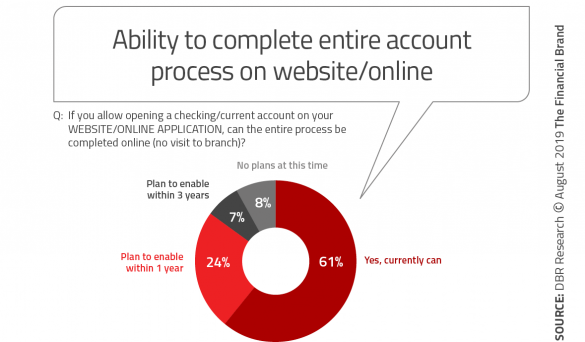

In our research, 61% of the institutions surveyed indicated that the entire online account opening process can be done without coming into the branch at all. This compares with only 43% in 2018. While this is still below where it needs to be, there appears to be an increasing commitment to being a digital financial institution.

Our question continues to be: If you allow consumers to initiate the process online, but still require signatures, documentation, ID verification or even funding in a branch office, has the process been built for the benefit of the financial institution or the customer?

At a time when ID verification and signatures can be generated and confirmed digitally, it remains a mystery why so many organizations still require these components in person.

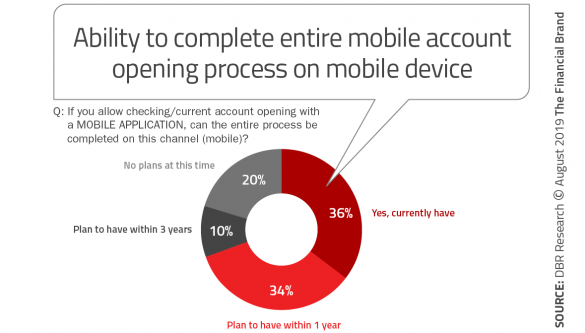

The number of financial institutions that provide end-to-end checking account opening with a mobile device (36%) is far lower than those who said they offered online account opening (61%). That said, there has been a significant growth in the percentage of organizations that could provide end-to-end mobile opening vs. 2018 (17%).

It is also encouraging that 34% of organizations hope to offer this capability within a year and that only 20% don’t plan to offer this functionality.

Read More: 6 Insights To Get Your Digital Engagement Strategy Right

Successful Digital Engagement Must be FAST

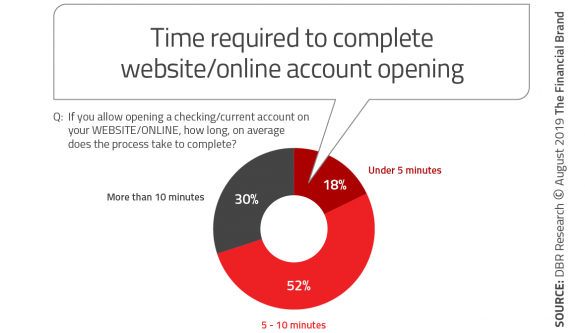

Today’s digital consumer expects ease of use, a clean design and speed of execution. Unfortunately that does not seem to be the norm when a person wants to open an account online or on a mobile device.

While the speed of website applications has improved since 2017, it is still far too slow, with only 18% of organizations able to provide the customer an account opening process that takes less than 5 minutes (compared to 14% in 2017). This indicates that while more organizations have converted paper processes to digital, there is not a focus on the underlying back office steps that can slow account opening down.

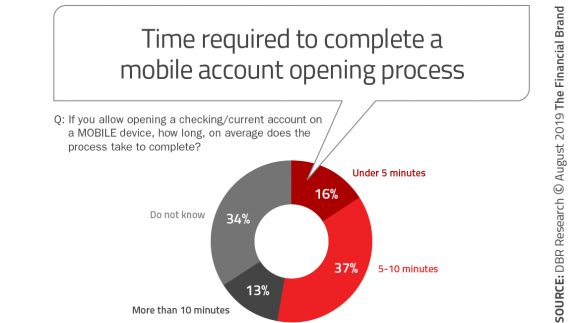

For a mobile consumer, speed is even more important than for an online account opener. Our research indicates that most financial institutions that offer mobile account opening understand this, with only 13% of organizations indicating an account opening process that exceeded 10 minutes. That said, only 16% allow a customer to open an account on a mobile device in under 5 minutes.

Interestingly, the number of organizations that do not know the speed of mobile account opening far exceeded the percentage that did not know the speed of online opening. This may be partially caused by the number of organizations that have only recently supported this channel or because it is not a high priority.

Multichannel Support Still Missing at Most Organizations

If a customer starts their account opening using an online or mobile app, they expect to be able to ‘save and resume’ their account opening process on an alternative channel similar to how a purchase from Amazon using a computer can be completed on a smartphone (or visa versa). This is especially important given the length of time it takes to open a new account and the fact that some opening requirements may need to be completed in a branch.

In 2018, our research found that 45% of institutions did not allow a customer to stop and restart the process using a different channel. This number dropped to 36% this year, with 58% able to resume on the channel they started on (up from 45% in 2018). This indicates that more institutions understand the need to ‘save and resume’, yet haven’t taken the ability to the full potential.

The fact that only 39% offer the ability to restart the process in the branch indicates that 61% of consumers will be forced to restart the account opening (allowing the branch employee to not only record the opening as a ‘branch opening’, but also possibly getting an incentive for doing so).

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Improving Digital Customer Engagement Not Optional

Improving or offering digital account opening should be a strategic objective for all institutions that believe digital is a competitive necessity.

For digital account opening to succeed, the experience needs to improve significantly. Here are some “must haves” for the process to entice digital consumers.

- Simplicity of data capture: Leverage pre-fill capabilities from mobile or online devices, collecting email addresses early in the process.

- Clear instructions: Provide ways for consumers to get directions if needed.

- Save and resume: Allow consumer to stop and restart on any channel.

- Abandonment follow-up: Collect email address early in process and follow-up with people who stop the process midway.

- Simplify KYC: Leverage new digital ID verification functionality.

- Simplify disclosures: Provide easy to understand transparency of fees and rules.

- Funding: Take advantage of mobile deposit, ACH and other digital funding options.

- Simplify design: Rather than simply converting paper or online to mobile, redesign and reimagine mobile from the ground up.

- End-to-end functionality: Don’t require the consumer to leave the digital channel chosen initially … unless they want to.

- Relationship expansion: Use AI and other insight capabilities to offer additional digital services at the time of account opening. These include direct deposit, bill pay, automated savings capabilities, etc.

Our research shows that the banking industry has finally crossed the 25% threshold of financial institutions that offer the ability to open new accounts on a mobile device. But, it is also found that few organizations have optimized the process for mobile.

With the account opening process being one of the very first experiences someone has with your brand, it is important to ensure that it creates a positive and lasting impression. Our research finds that large banks continue to outpace the industry in the ability to support mobile account opening and post-opening sales. For every institution, offering and improving mobile account opening must become a strategic imperative.

Digital Banking Customer Engagement

The Digital Banking Report, Digital Banking Customer Engagement, sponsored by Harland Clarke, provides insight into the progress financial institutions are making around building personalization and contextual engagement. The report includes the results of a survey of more than 300 financial services organizations worldwide. The report includes 71 pages of analysis and 32 charts.

The Digital Banking Report, Digital Banking Customer Engagement, sponsored by Harland Clarke, provides insight into the progress financial institutions are making around building personalization and contextual engagement. The report includes the results of a survey of more than 300 financial services organizations worldwide. The report includes 71 pages of analysis and 32 charts.

Subscribers to The Digital Banking Report and those wishing to purchase the complete report can access it immediately by clicking here.