As more consumers move to digital channels, the ability to meet face-to-face diminishes. This not only changes the dynamics of customer experiences and engagement, but also impacts the ability to create an in-person selling opportunity. In response, more financial institutions are investing in creating engagement beyond simple transactions.

In a digital world, banks and credit unions can improve engagement and retention by personalizing the customer experience. Since most customers will only spend a limited time on their mobile banking app, banking website, or other traditional channel, it is more important than ever to deliver personalized and contextual opportunities that will increase the time of engagement across all channels.

Creating engagement based on a customer’s past transactions, current financial relationship, stated goals, financial wellness, or other behavioral activity will lead to higher levels of interaction, more purchases, greater loyalty, and enhanced lifetime value. In addition, engagement data as well as intended purchase data can create insights that can enable the customizing of subsequent interactions based on past engagement.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The 5 Characteristics of an ‘Engaged Relationship’

There are several differences between a transactional relationship and a relationship that engages the customer;

1. Build on listening. More than focusing on speed, ease of use and reliability, engagement systems ‘listen’ to determine sentiment and context. Good and bad changes in behavior are recognized and acted on. The listening may be based on internal or external (social) indicators.

2. Create conversations. While transactional systems use one-way (push) communication, engagement systems support and encourage two-way conversations across multiple media channels.

3. Integrate humans and machines. Going beyond the machine-driven interactions around transactions, engagement systems leverage combinations of humans and machines based on the urgency and opportunity of the engagement.

4. Move beyond just-in-time. Traditional transaction systems are based on just-in-time delivery. Engagement systems depend on real-time interactions that can provide predictive recommendations.

5. Leverage unstructured data. Transaction systems rely on highly structure internal data. Engagement systems expand beyond structured data to include unstructured insights such as chats, conversations, social comments, audio and video files, etc.

Personalization of the experience is at the core of the engagement process, creating contextual content, using interactive technology, product recommendations, and timely offers based on transactional and behavioral data – in real time. Leading organizations will empower employees across the organization to embrace engagement opportunities leading to more satisfied customers.

Read More: The Ultimate Customer Engagement Playbook in Banking

Building Brand Advocacy

The power of personalization and contextual engagement creates relationship and referral value over time. If a financial institution creates alerts, recommendations, and content that the customer finds valuable in improving their financial wellness, the overall relationship will be enhanced.

In addition, the more customers that consume (or potentially subscribe to) an organization’s content, the more likely the content will be shared with others. This not only creates the potential for new referral business, but the current customers will be less likely to switch to a competitor’s platform, where they will need to rebuild relationship influence.

Content is Underutilized in Banking:

Driving customers to insights that are personalized and support a financial wellness journey will often result in additional sales.

The goal of personalized engagement (vs. a transactional relationship) is to create a process where a financial institution uses empathetic communication to increase influence with customers as they increase interactions.

( Learn More: Consumers Demand Improved Digital Banking Customer Engagement )

Relationships Beyond Transactions

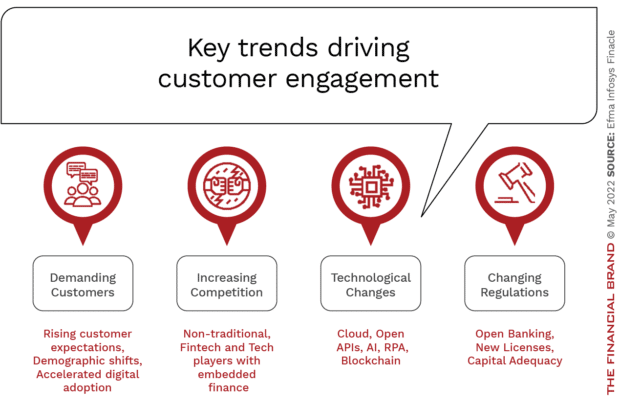

Over the past several years, competition has emerged from fintech firms to big tech organizations, as well as non-financial institutions that offer financial services. Consumers have many more choices of financial institution partners than ever and have become more likely to diversify their relationships across a wide variety of providers.

To build stronger relationships beyond the transaction, financial institutions must ensure that customers have a reason to keep engaging repeatedly over extended periods of time. In a digital world this can be achieved by adding higher levels of personalization, contextualization, and proactive recommendations on top of the traditional transaction and product-focused model.

Read More: Increased Digital Banking Interactions Require Greater Personalization

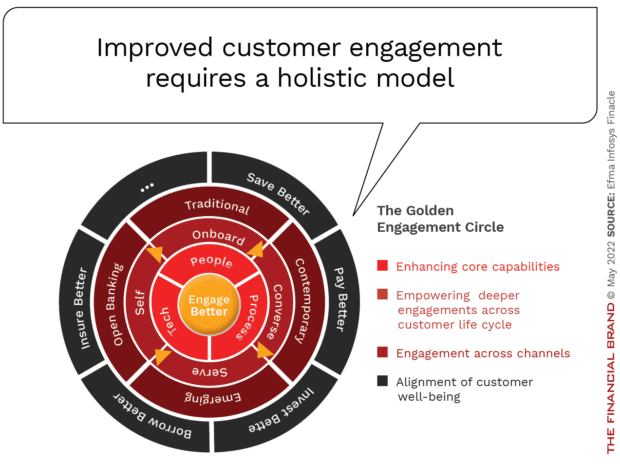

Moving Towards a Holistic Model of Engagement

Similar to digital banking transformation, the foundation of a holistic model of engagement involves people, processes, and technology. More importantly, top management must embrace the change in legacy business models that is necessary to achieve success.

Beyond investing in modern technology, financial institutions must provide the back-office automation and organization-wide deployment of insights to move from a product-focus to customer-focus mindset. Sharing insights across the organization can help provide employees the ability to recognize customers and cater to their interactions based on preference and prior behavior.

With people, processes and technology at the center of the engagement model, the ability to sell, onboard, converse, and serve will be greatly enhanced. This is because of the shift from a product-push to solution-pull communications plan. This plan leverages real-time insights and recommendations as well as easily accessible content to drive interactions.

Finally, to support the improvement of interactions across all current and future product lines, there needs to be the seamless integration of engagement across all channels and platforms.

As competition increases, the financial institutions that focus on more than transactions and active usage – strengthening the impact of engagement – will win.