To respond to the expectations of today’s consumer, financial marketers need to be able to acquire data insights at speed and scale. Armed with real-time and relevant insights, marketers will be better able to detect changes in needs and behaviors, closing the gap between data and action, and improving customer experiences and engagement.

According to a CMO Council study, nearly 80% of marketing leaders in all industries say data, analytics and insights are very important to winning and retaining customers, with 91% saying that direct access to customer data provides a significant competitive advantage. Unfortunately, at the same time, 62% of all marketers are only ‘moderately confident’, ‘slightly confident’, or ‘not at all confident’ in their data, analytics and insights systems.

The CMO Council research found that high performing marketers separate themselves by excelling at the following capabilities:

- Accessing real-time behavioral insights

- Closing the gap from data to action

- Avoiding data blockers

- Creating adaptable/agile data systems

- Making artificial intelligence pervasive

To be successful, financial marketers need a plan for ongoing improvement, balancing human intuition with data insights. The also need to realize that investing in modern technology may be required, and third-party solution providers may be part of the gateway to success. It’s also important to create a culture that supports the ongoing collection and utilization of data to drive decisions across the organization.

Read More:

- Power of Customer Insights Will Separate Digital Banking Winners & Losers

- Exceptional Customer Experiences Depend On More Than Data Alone

Data Insights Deliver: Bank Reaches 113% ROMI with Segmentation

Uncover the techniques behind this bank's impressive ROI boost through data-driven marketing.

Read More about Data Insights Deliver: Bank Reaches 113% ROMI with Segmentation

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Why Speed of Data Matters

Effective financial marketing requires access to internal and external data that can be leveraged to create insights for improved business decisions and better customer outcomes. Beyond traditional transaction and historical sales data, financial marketers need to understand buyer intent in real-time, since most prospects and customers conduct their research and make buying decisions online before ever walking into a branch.

Understanding Buyer Intent:

The most common buyer intent signals are search keywords, which change depending on the buying stage.

The reward for understanding buyer intent is that financial marketers can better identify where potential customers are in their individual journey, delivering highly targeted and personalized content at the right time. Engagement and response to this content then leads to increased content response, conversion, cross-sales and loyalty.

“Buyer intent data signals come from multiple sources, including website and CRM, social media, content consumption, third-party data, search, etc.”, states the CMO Council report.

Importance of Acting on Insights … Instantly

Traditional customer segmentation and targeting simply keeps you even with the competition. True differentiation is achieved when data collection and insight development are built for immediate actionability. In other words, generating real-time insights is only half the battle. The best financial marketing organizations are also the first to adapt and act on these insights.

Examples of dynamic messaging includes being able to build content around current marketplace trends and delivering product and service recommendations at a customer’s moment of need. These opportunities occur in an instant. The objective is to be proactive as opposed to reactive, leveraging digital communication channels to their fullest.

Needed: Data GPS:

Existing data and analytics systems that rely solely on historical trends are no longer good enough.

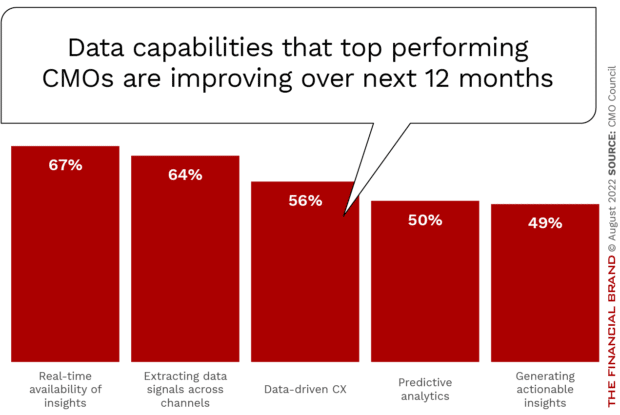

The importance of speed in marketing is reflected in the CMO Council research. The top five data capabilities that leading marketing organizations are focused on over the next 12 months are: real time availability of insights, extracting relevant data signals across channels, data-driven customer experience, predictive analytics, and generating actionable customer insights.

Despite the increased focus on speed of data insights, the top two data capabilities that still remain out of reach for many financial marketers are real-time availability of insights and the ability to act on insights in real time. The challenge of delivering messages that are predictive remain out of reach for most.

Read More: Banking Industry Fails to Meet Personalization Expectations

Barriers to Success

Most financial marketers realize that they can’t succeed independently. They require outside resources to deliver on the expectations of consumers. The challenge is choosing the right combination of partners and solutions. Making matters worse, there are currently 9,932 marketing technology solutions available, up from 8,000 just two years ago, according to the 2022 Marketing Technology Landscape.

The CMO Council study found that the top three barriers to data access are insufficient technology, lack of data management processes, and data control lying elsewhere within the organization. Data silos and a skills shortage also hold back data marketing at speed and scale. In response, seven out of ten marketing leaders increased their marketing technology spend last year.

When data and analytics are in the hands of a single unit within an organization, marketing and the overall customer experience are negatively impacted. This is because data insights are no longer available in real time and there is a lack of data and insight democratization where all units of an organization have access to data for business decisions.

Read More: Digital Banking Transformation Requires Speed and Scalability

The Power of AI

Artificial intelligence adoption across the organization is at the foundation of financial marketing maturity. Yet, many financial institutions have struggled to move past the experimental stage, according to McKinsey. Reasons include the lack of a clear AI strategy, an inflexible and investment-starved technology core, fragmented data assets, and outmoded operating models that hamper collaboration between business and technology teams.

McKinsey recommends a five-tiered approach to instituting and implementing AI software, which it says has improved financial institutions’ relationships with customers.

- Identify high-value opportunities.

- Rapid activation and optimization at scale.

- Invest in fit-for-purpose martech enablement.

- Commit to creating a truly agile operating model.

- Invest in talent and capability building.

81% of marketers say hiring more talent with AI skills is the most critical need to developing their AI capabilities. Yet hiring more talent is the biggest AI-related challenge for many organizations.

“AI in marketing has the potential to greatly impact campaign planning, media buying, targeting, personalization and other critical marketing functions”, states the CMO Council report. “It might soon be able to create content, including advertisements, without the involvement of human marketers.”

Despite data being more abundant and accessible than ever, there still needs to be a human element to collection, analysis, deployment and measurement of results. Combining the strengths of both technology and human experience is the key to building a stronger data culture and a more effective customer engagement model that will drive revenue and loyalty.