It is no longer just the domain of large banks to be able to leverage considerable technological sophistication and vast data resources to give consumers specific financial solutions. The cost and access to insight and communication tools have improved so they can be used by financial services firms of all sizes to deliver the level of customization expected from today’s consumer.

More and more financial organizations are seeing the benefits of a personalization strategy, thanks to new digital applications and advances in predictive analytics. Now, more than ever before, a financial institution can take what it already “knows” indirectly about an individual (from transaction data and other sources) and transform this data into insights that are predictive, personally relevant and useful.

According to D. Scott Andrick, Sr. Director – FS Sales & Marketing Pegasystems Inc.:

“To create personalized, insightful experiences, banks will need analytics for every single outreach and interaction. Those that think this sounds impossible couldn’t be further from the truth – and will quickly fall behind their competitors. Today’s AI and machine learning capabilities automatically creates self-learning models – efficiently and in real-time – so that customers get the best possible contextual experience with each interaction.”

What would the consumer relationship with a financial institution be like after a few of these positive – and personally relevant – digital interactions? What would that relationship look like after a year of such guidance? Banks and credit unions currently have both the data and digital platforms to make these kinds of positive behavioral interventions possible, and the decision support technology is readily available to make them practical.

The question is … how well is the banking industry delivering on the personalization promise? This was the foundation of research completed by the Digital Banking Report and Pegasystems entitled, The Power of Personalization in Banking 2018. This research sought to determine:

- The degree financial organizations think their customers/members would say their primary financial institution “knows and looks out for them.”

- The degree financial organizations think their customers/members value their relationship with their primary financial institution.

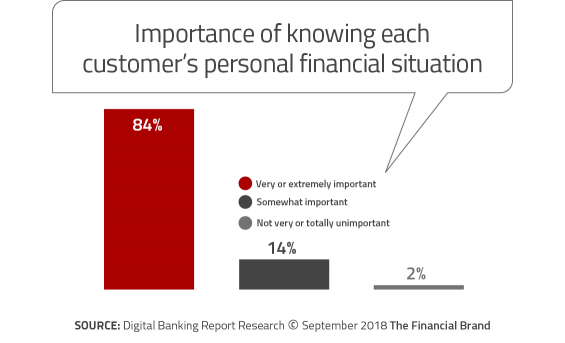

- The importance of knowing each customer’s personal financial situation.

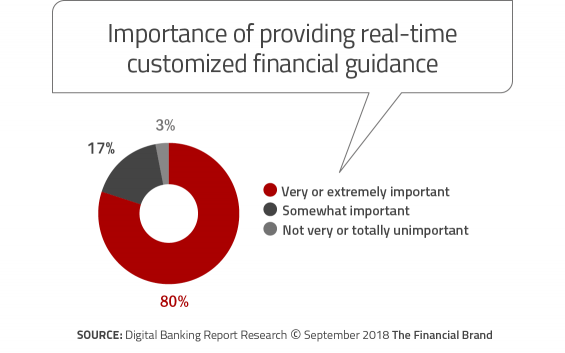

- The importance and ability to provide real-time personalized guidance.

- Current use of personalized contextual alerts and notifications.

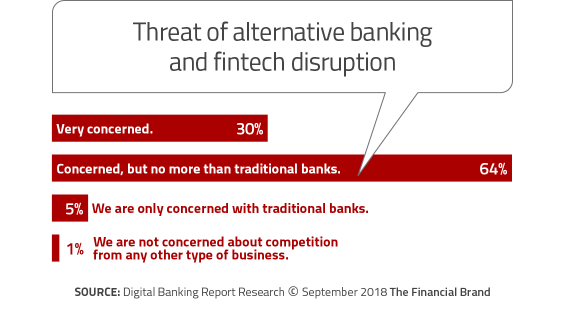

- Perception of alternative financial services firms (fintech and big tech) as a threat.

- Prioritization of alternative digital strategies.

Click Here to Download the Personalization Research

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Consumers Want Personalization… Now

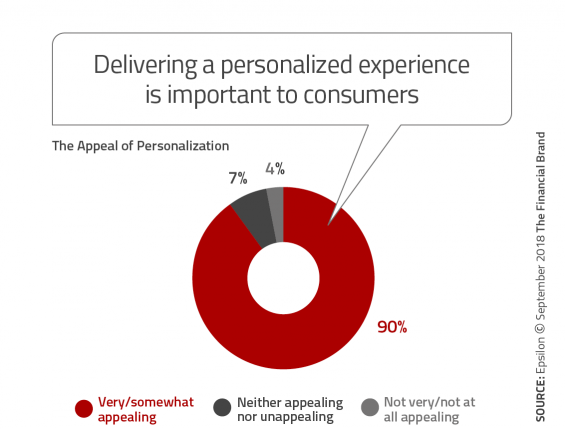

Research from Epsilon indicates that consumers want and expect personalization, and that they are most comfortable with providing personal data when they are able to manage and control the resulting experiences. Financial incentives like tailored discounts and offers are the greatest motivators to provide data.

Key findings from the Epsilon report include:

- 90% of consumers feel that personalization is “very/somewhat” appealing.

- 80% of consumers are more likely to do business with a company that offers personalized experiences.

- 66% of consumers feel that companies are doing “much/ somewhat better” in their efforts to personalize their experiences.

Despite consumers’ growing comfort with (and demand for) personalized interactions, a significant percentage of consumers are still protective of their personal information. Therefore, financial institutions have to tread carefully. Twenty-five percent of consumers see getting personalized offers as “creepy,” and 32% say that getting personalized experiences is not worth giving up their privacy. More than one-third (36%) feel that companies don’t do enough to protect their private information.

Read More:

- The Psychology of Personalization In Banking

- Digital Banking Consumers Demand Hyper Personalization

- Banking Industry Fails to Meet Personalization Expectations

Financial Organizations Understand Importance of ‘Knowing the Consumer’

There was general consistency across all institution types and asset ranges when financial institutions were asked about the importance of knowing their customers’ and members’ personal financial situations. Only 16% of organizations surveyed didn’t think it was either “very” or “extremely” important to know their customers/members.

The importance of knowing the current financial situation of consumers is aligned with what consumers believe should be known about them. Unfortunately, consumers made it very clear that they don’t believe their primary financial institution really knows the important components of their financial life.

Banking Firms Understand Importance of ‘Providing Real-Time Guidance’

As with the question regarding the importance of knowing consumer’s financial lives, there was consistency across the board when institutions were asked about the importance of providing real-time, customized guidance. It is interesting that the 80% agreement on the importance of “providing real time guidance” was not higher than “knowing the customer” (84%). Bank and credit union executives understand that providing real-time insight is a major advantage of digital-only banks and fintech providers.

In line with other questions asked around the importance of personalization, 76% of organizations believed that personalization had a “major” or “strong’ impact on relationship building.

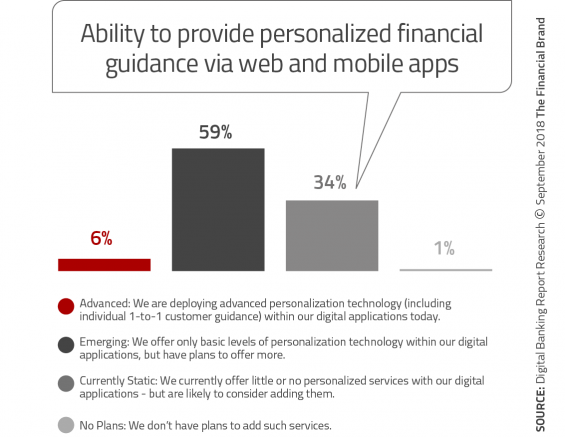

94% of Banking Firms Unable to Deliver on ‘Personalization Promise’

To determine the “personalization maturity” of financial institutions, we had the responding organizations rate themselves as “Advanced”, “Emerging”, “Static” or having “No Plans” to provide contextual, personalized insights and solutions to consumers.

As would be expected, the largest financial institutions had the highest self-assessment around the ability to provide real-time contextual guidance. That said, less than 20% of the large national and regional banks considered themselves “Advanced” in this capability.

While it was somewhat encouraging that almost 60% of financial organizations in all asset ranges considered themselves as “Emerging” (10% higher than in 2016), the overall percentage of institutions believing they were “Advanced” is lower than in 2016. Bottom line, 94% of financial institutions are still unable to deliver on the “personalization promise.”

As was the case in 2016, we found that the ability to provide personalized guidance by financial institutions of all sizes is limited. When we asked about the ability to provide basic contextual alerts and notifications, only 26% of organizations considered themselves advanced in this capability. More concerning, less than 20% of organizations were able to provide personalized offers, with less than 10% able to provide real-time spending analysis or advice based on activity.

“With a whopping 59% of bankers offering ‘basic levels of personalization technology’ and only 6% ‘deploying advanced personalization technology, including individual 1-to-1 customer guidance’, it’s time to take action. This Digital Banking Report will arm banking executives with the insights to fund the next personalization initiative to create experiences that customers crave and demand.” – Christine Parker, VP of Financial Services and Global Industry Market Lead, Pegasystems

Banking Firms Increasingly Concerned About Fintech and BigTech Firms

With very little variation across organizational type and asset size, 94% of legacy financial organizations are either “very concerned” or “extremely concerned” about fintech start-ups. This increased from just above 50% in 2016.

This represents the largest variance of any response that we collected compared to two years ago. In many ways, based on the current ability to deliver personalized services and the lack of apparent urgency by organizations of all sizes, these concerns are probably justified. In fact, there is evidence that the industry may be even more concerned since only 1% of organizations were “not at all concerned”. This comes at a time when consumers have an increasing awareness of what digital organizations can provide in personalization benefits.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Personalization is THE Competitive Differentiator of the Future

Across all industries, consumers expect their financial institution to understand their needs and deliver personalized solutions similar to what they receive from Google, Amazon, Facebook and Apple. Unfortunately, despite advanced AI technology, most personalization expectations remain unfulfilled.

Consumers want their financial institution partner to securely manage their finances, understand their goals and preferences, and proactively deliver the right offers and services to help them achieve financial well-being. This personalized engagement will differentiate itself not only from other banks but from fintech start-ups as well.

To get to the level of understanding desired, consumers are willing to share insight with their primary financial institution according to the CGI research. This is in stark contrast to the amount of insight most financial institutions are willing to ask, collect, and utilize for the benefit of the consumer.

Financial services leaders of the future will be able to access a single source of insight and intelligence that will enable seamless back-office processes and digital customer experiences that are in real-time and add value both for the organization as well as the consumer.

These qualities will be the foundation upon which everything else in the organization is built. It will also be the point of consumer differentiation for traditional financial institutions, fintech firms, big tech organizations and non-financial players.

Purchase The Report

The Power of Personalization in Banking report, sponsored by Pegasystems, provides insight into the progress financial institutions are making around personalization and contextual engagement. The report includes the results of a survey of more than 200 financial services organizations worldwide. The report includes 82 pages of analysis and 36 charts.

Subscribers to The Digital Banking Report and those wishing to purchase the complete report can access it immediately by clicking here.