Where are financial institutions falling short in their quest to become customer-centric and how can banks and credit unions begin to exceed customer service expectations?

According to findings from a new Carlisle & Gallagher Consulting Group study, 65 percent of consumers say their primary financial institution is not as good as (47%), or much worse than (18%) leading customer service companies. This is despite increased investment in customer experience initiatives by the financial services industry. (A SlideShare presentation entitled, Are Two Calls Too Many in the Eyes of the Customer? is available for download)

The key findings of the report include:

- Customer culture drives great customer service

- Customer experience is defined by first problem resolution

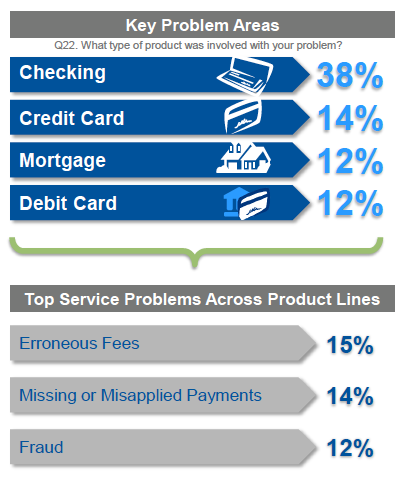

- Most complaints involve core banking products (checking, debit card, credit card, mortgage)

- Banks are not listening to their customers

- There is a correlation between complaint handling, satisfaction, loyalty and new business potential

These findings correlate with the just released ForeSee Experience Index that found that the financial services industry had the lowest aggregate score of any industry, including the lowest scores in retention, upsell and referral potential. In addition, financial services as a category had the largest gap between the highest and lowest scoring brands (American Express is 82 and Santander is 65), suggesting that there is much work to be done in offering the experience that customers expect from companies in this category.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Quick Problem Resolution Provides Challenge and Opportunity

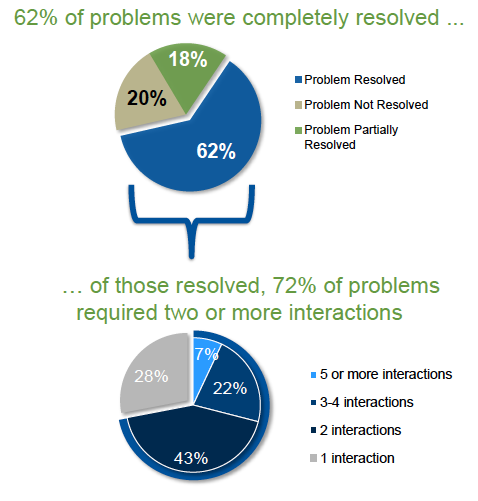

One of the impediments to customer satisfaction is that more than a third of consumers surveyed by Carlisle & Gallagher did not believe their problem* was completely resolved. Of the complaints resolved, a whopping 72 percent of the problems required two or more interactions, with close to 30 percent requiring 3 or more interactions. This is certainly not a path to success.

From an opportunity perspective, more than half of the customers surveyed said they felt like a valued customer when their issue was resolved with a single interaction and that their confidence in the financial institution increased by 38 percent. Conversely, confidence dropped to 17 percent and trust dropped to 10 percent when a problem required two or more interactions to be resolved.

While some complaints may be complex and require further research, this insight shows the power of resolving a problem quickly and completely. In fact, several studies done in the past have illustrated that a customer who has had a problem resolved satisfactorily can be more loyal than one that has never had a problem.

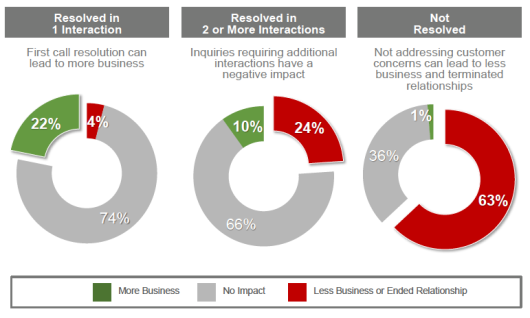

There is also a direct correlation between a customer’s experience and future banking relationship potential according to the Carlisle & Gallagher study. As shown below, while first call resolution can often lead to more business, slower resolution requiring additional interactions leads to higher dissatisfaction and lower potential for relationship growth.

“Banks have one shot to resolve their customer’s problems before they hurt confidence, trust and future banking relationships. Two calls is just too many in the eyes of the consumer when it comes to solving problems,” according to Patricia Sahm, Ph.D., Customer Experience and Channels Practice Lead at Carlisle & Gallagher.

Key Problem Areas

According to Carlisle & Gallagher, the key problem area for banks and credit unions are the core banking products, including checking accounts, credit cards, mortgages and debit cards, with fees and payments being the primary focus of service issues. As a result, focusing on resolving issues with these core products will have the greatest short and long-term impact on customer satisfaction.

“We were surprise that is was the rudimentary products that banks offer that are costing consumers the most headaches with personal checking leading the pack at 38%,” said Sahm.

Interestingly, the CG research also found that customers who did not have their problems resolved felt they shared ideas for problem resolution with their financial institution but were not listen to. This was especially true with debit cards (75%), credit cards (68%), mortgage issues (63%) and problems with checking accounts (60%).

For institutions hoping to improve satisfaction levels, being able to collect and leverage these insights may provide the foundation for improved customer communication and problem resolution.

Opportunities for Improvement

From recent research from Carlisle & Gallagher as well as ForeSee, it is clear that customer expectations are increasing daily with industries other than financial services setting the bar for success.

According to Patricia Sahm from Carlisle & Gallagher, “Financial institutions have a long way to go to become great customer service organizations. In today’s world of instant gratification, consumer expectations are being shaped by experiences outside of the financial services industry where content, interactions and features are richer, delivering a more engaging and rewarding experience for the consumer.”

With new compliance requirements, expanded transaction and communication channels and increased competition, the potential cost of poor complaint resolution is high. The good news is that, in an industry struggling with trust and service issues, there is a great opportunity for those financial institutions that meet or exceed expectations.

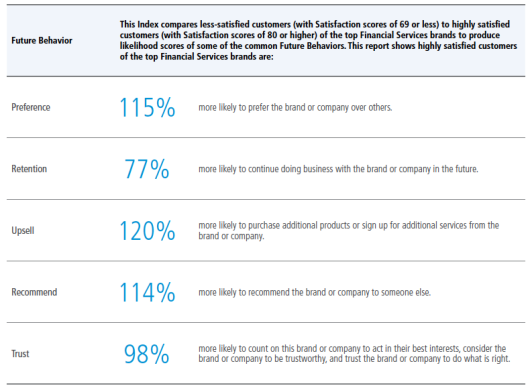

In fact, according to the study from ForeSee, customer experience is highly predictive of future business success. When comparing the financial behaviors of highly satisfied customers (scores of 80 or higher) to less satisfied customers (scores of 69 or less), highly satisfied customers are:

“Satisfaction studies are not beauty contests,” noted Larry Freed, CEO of ForeSee. “We see more and more CEOs monitoring and improving the customer experience because research shows that, when measured correctly, satisfaction predicts future financial results, revenue and even stock prices.”

Some of the recommendations provided by recent research includes:

- Manage customer expectations by sharing problems and solutions with transparency and communicating the type of service level that customers can expect. (if it’s going to take 24 hours for the problem to be resolved share this with the customer)

- Invest in solving the issues with core products first (this is where the most opportunity resides)

- Evaluate your complaint database to determine the primary issues needing to be resolved (spend time resolving those issues driving the most pain)

- Create a ‘first touch’ resolution process (find a way to avoid multiple interactions)

- Improve social channel problem resolution (consumers using social media to complain can impact the most consumers and expect the quickest resolution)

- Develop a robust listing program (customers are willing to share ideas on problem resolution . . . let them help)

- Share the results (employees will respond to tangible measurements)

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

As we look to the future, the impact of social media can’t be ignored. “The social media channel will serve as the benchmark in customer care, enabling customer communication across the banking enterprise and help break down silos within financial services organizations,” according to Pat Sahm.

“Beyond social media, banks and credit unions will need to create the feel of first touch resolution for the customer by enabling employees to take quick action to solve the customer’s problem. It’s all about creating a ‘prevent’ defense and a culture of customer advocacy,” continued Salm.

“In the next five years, consumer demands will continue to increase and regulatory requirements will only become more intrusive. Customer experience will need to be built into every aspect of the institution, no longer its own department.”

* ‘Problem’ as defined by the Carlisle & Gallagher research included inaccuracies, issues with fees, concern with speed of loan, mishandled funds or other concerns and did not include a basic inquiry about a transaction or to ask product questions.