Thanks to digital leaders such as Amazon, Netflix, Nike and Spotify, consumers have grown to expect and desire personalized experiences more than ever. What once was limited to segmented offers, now extends to all components of the customer journey, including acquisition, customer engagement, size of transaction, frequency of purchase, cross-selling and even churn prevention and loyalty.

Personalization at scale can positively impact both short-term and long-term value for financial institutions – making marketing more efficient and providing an uplift in revenue and share of wallet. As customers and prospects become accustomed to real-time, contextual offers, personalization can even have a long-term positive effect on customer satisfaction.

Unfortunately, while most bankers say they recognize the need and potential for personalization, less than 20% say they are doing a good job at it. For many financial institutions, personalization at scale still presents a conundrum.

The foundation of personalization is the ability to use data and analytics to drive all engagement with the consumer. This requires making personalization an overarching priority, creating a strategy and operational capabilities to facilitate personalization at scale. As with digital transformation, top-management must make a deliberate decision to commit to personalized customer experiences across the organization.

While quality data and a unified view of the customer are the ultimate objective, an improvement in personalized experiences is possible with what most organizations have today. In fact, many organizations could dramatically improve personalization in a matter of weeks as opposed to months or years. For instance, a personalized cross-selling program can be built with information on past transaction behavior combined with basic demographic insight. Go for the low-hanging fruit first.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Customer Experience Suffers as a Result of COVID

According to Salesforce, 59% of consumers said the pandemic increased their expectations of financial institution’s digital capabilities, yet many banks and credit unions did not respond to this opportunity. In the rush to move transactions to digital channels, many organizations placed a priority on making the needed technologies work and keeping consumer trust intact, as opposed to delivering the speed and simplicity desired. As a result, only 27% of consumers feel the financial services industry is customer-centric. Even fewer (23%) believe the industry handled the pandemic well.

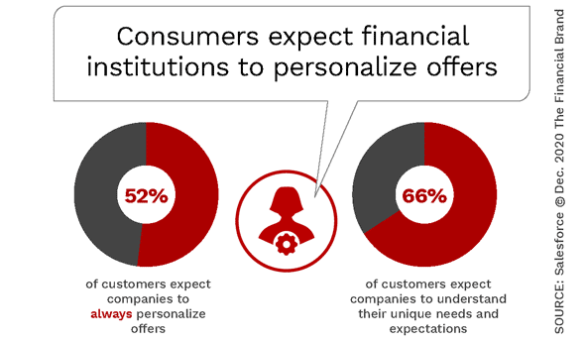

As expected, consumers want their financial institution to look out for their individual financial well-being. The challenge is that while 83% of consumers stated a concern about their long-term financial situation, and 66% want their bank or credit union to understand them on a 1:1 basis, few financial services firms (32%) are in alignment with this need.

Read More:

- Beyond Personalization: Three Reasons to Focus on Customer Journeys

- Digital Banking CX Boils Down to One Word: Speed

- Financial Institutions Benefit from AI, But Consumers Remain Skeptical

Consumers Want Personalization Across All Channels

Salesforce found that an overwhelming majority of marketers (99%) believed that personalization has at least some impact on advancing customer relationships, while almost 8 in 10 (78%) believed it has a “strong” or “extremely strong” impact. The expected impact has increased in each of the last three years of the research, as has the belief that customers and prospects expect a personalized experience.

Two-thirds of today’s customers expect their financial institution to understand their unique needs and expectations, with over half (52%) expecting offers to always be personalized, according to Salesforce. To accomplish this, banks and credit unions will need to use customers’ transactional and personal information to anticipate needs.

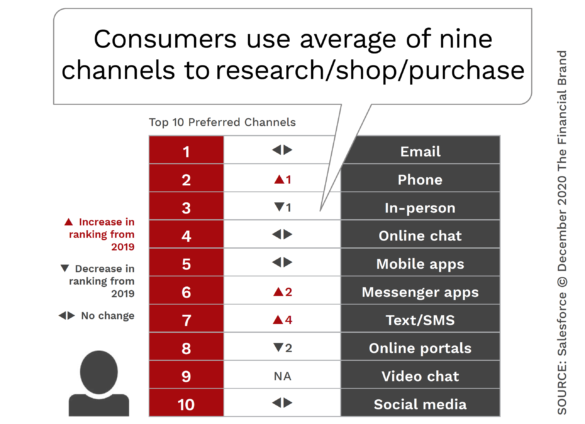

Data alone will not be enough to achieve this goal. Financial institutions will need to be able to deploy the insights generated across all channels in a timely manner. Much more than just addressing communication in a personalized manner, organizations will need to provide contextual recommendations using the channels customers use most often. This extends beyond traditional channels like email, phone, in-person and direct mail, to include online chat, mobile, texts and even video chat.

Beyond using multiple channels, financial institutions need to up their game when it comes to communicating consistently across all channels. Currently, consumers are not believing that data and insights are being deployed and used by all areas of their financial institution. This creates more ill will than goodwill. Now more than ever, financial institutions will need to collect data and deploy insights consistently to develop deeper, more connected relationships that will close the customer experience gap

Now’s the Time to Improve Personalization Maturity

To meet the expectations of consumers who want their financial institution to improve personalization, organizations will need to analyze data collected from inside and outside the organization and use this insight for customized, real-time interactions that will expand the relationship, build trust and reduce costs.

Personalization engines can assist in this process, improving marketing communication, enhancing online and mobile banking engagements, driving new content deployment and even helping to create personalized products based on customer behavior and event triggers. Leveraged well, a personalization engine can follow the consumer during their entire journey, from new account opening throughout the relationship building process. As opposed to being driven by organizational product goals, these engagements are driven by consumer needs in real-time.

According to Bain, some of the ways personalization engines can assist with improved customer experiences include:

- Customized offers and promotions across different channels at appropriate times

- Personalized content reflecting behavior changes and market dynamics

- Dynamic ads on social media

- Location-driven mobile messages to customers most likely to respond immediately based on geographic coordinates

- Defection monitoring based on unexpected balance and transaction decreases

- High value customer modeling to replicate customer journeys across database

Personalization Challenges

Despite the recognized need within the banking industry to improve personalization, most financial organizations are still in the early stages of their personalization efforts. Research from the Digital Banking Report found that 75% of financial institutions considered themselves inept at determining the next best product offering on an individual basis. According to the research, the vast majority of banks and credit unions are still defining their personalization strategy or are just beginning their pilot initiatives. Many firms still do not view personalization as a priority for various reasons, including:

- Data management. The vast majority of global financial institutions indicate that their greatest personalization challenge is the gathering, integration, and quality control of customer data.

- Data analytics. Internal and external expertise in analytics and data science is a challenge for many organizations.

- Deployment of recommendations. For many financial institutions, data silos, organizational structure and a lack of a single view of the customer prevents the timely sharing of customer insights and offers across the organization.

- Tools and technology. Most organizations are not yet structured for personalization strategies or do not have the tools in place to execute personalization at scale.

Getting Started

Delivering a personalized experience is no longer optional for financial institutions. But where does a bank or credit union begin?

The best first step is the identify use cases with the highest impact that can be implemented with the least amount of effort. These should be initiatives that will improve the customer experience, resulting in increased sales and engagement … without massive deployment of human or financial resources. Remember, the database does not need to be perfect for a limited scale personalization execution. Rather, the initiative can be built as a test and learn process, with measurement of results driving expansion.

Finding an external partner to help develop and deploy the personalization program will be needed at most organizations, since these partners can assist in avoiding the challenges and pitfalls that could stall the program out of the starting blocks. These partners can also help accelerate the achievement of results, creating a more personalized experience, greater customer loyalty, market differentiation, increased wallet share and substantially better top and bottom lines.