The financial services industry has been impacted by the increasing use of technology from smartphones to wearables. This transformation in methods of transacting has enabled more personalized engagement, allowing customers to engage engage in seamless banking across channels. This has also increased both the potential and complexity of creating a positive customer experience.

Unfortunately, according to the 85-page report, Improving the Customer Experience in Banking, the objective of delivering a positive customer experience has become secondary to other bank priorities, resulting in a transactional banking relationship for the customer. For financial organizations to change this dynamic, and meet the evolving needs of today’s customers, there are five areas that have emerged as crucial priorities:

- Move focus of digital engagement from cost reduction to experience enhancement.

- Leverage advanced analytics, machine learning and contextual engagement to provide a highly personalized experience.

- Allow the consumer to engage with their bank on the channels they prefer at the times they want to engage.

- Transition advisory and sales activities from being reactive to being proactive.

- Engage end-to-end throughout the customer journey, from shopping to account opening, to onboarding and through relationship expansion.

Our global research of banks and credit unions for this report was intended to better understand the ‘CX maturity’ of financial institutions and to provide a benchmark for future strategies. We would like to thank Deluxe Corp., who sponsored this year’s report development and distribution. Their partnership and commitment to improving customer experiences for financial institutions enabled us to collect insights never provided in the past.

Improving the customer journey and providing a positive customer experience (CX) was ranked as the number one trend, as well as top strategic priority, in the survey of global banking leaders for the 2017 Retail Banking Trends and Predictions report. Unfortunately, the research into CX maturity in banking found that many of the industry’s initiatives are unsupported, misdirected, underfunded and poorly measured.

Here are the key takeaways from the report, Improving the Customer Experience in Banking:

- While all FIs believe that improving CX is a significant priority, the importance is significantly less at smaller organizations.

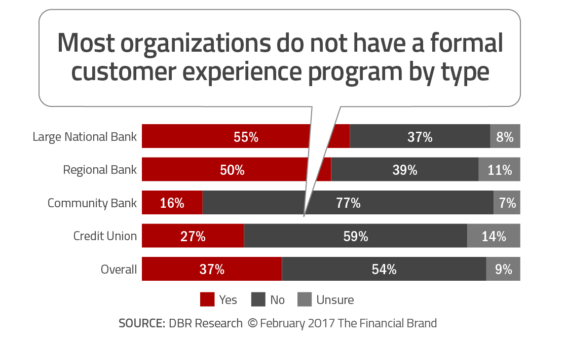

- Only 37% of organizations have a formal CX plan.

- The customer experience objectives at most organizations focus on internal benefits (selling and cost cutting) and not customer benefits (simplicity, ease, responsiveness).

- Despite research that shows digital experiences drive satisfaction, FIs focus too much on products and branch engagements.

- Investment in CX is increasing at most organizations, with more investment committed over the next 3 years.

- Most firms have seen only a modest impact of their CX initiatives.

- The biggest challenges in CX efforts are with data analytics, technology and getting a complete customer view.

- Measurement of CX efforts varies widely, with revenue measures mostly missing from the mix.

Read More: The Customer Experience Battlefield

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Digital Channels Drive Customer Satisfaction

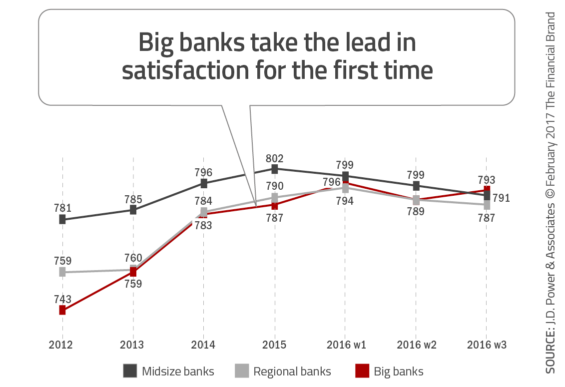

A positive customer experience is channel sensitive, with customers placing a higher weight on digital customer experiences more than physical or call center channels. In fact, in a recent J.D. Power, survey, the largest banking organizations improved in overall customer satisfaction, while midsize banks declined and regional banks plateaued. This was attributed primarily to improved mobile and online satisfaction.

Yesterday’s demands – including flexibility, efficiency and easy access for customers – have been expanded to include integration of banking activities across multiple channels, personalized service, and recognition of the past, present and future breadth of the customer’s relationship with their financial institution. Going forward, banks and credit unions need to focus most on building an improved digital experience and use it as a competitive differentiator.

“All banks must prioritize UX, design thinking and experience architecture to compete for the future right now. This is a trend that’s only going to advance.”

– Brian Solis, Principal Analyst for the Altimeter Group and author of the bestselling book: The Experience When Business Meets Design

Customer Experience Focus Varies Organization Type

Customer experience represents a recognized priority for financial organizations, with the majority of those surveyed for our research indicating that CX is at least a top 3 priority. Only 3% of respondents claim that customer experience is not a focus, while 35% indicate CX is the primary focus. The reporting structure also varied significantly between organizations, with less than 25% of institutions having a separate department for the function.

When we look at the prioritization by institution size and type, we see that the largest organizations are the ones where the focus is the greatest. This may be why recent customer satisfactions surveys by JD Power rank the largest banks at the top of the industry.

The question needs to be asked whether this is because these organizations already believe they have exceptional customer service and experience, or whether there is a lack of realization of the challenges at hand.

In the research for this report, it was found that the majority of organizations do not have a formal customer experience plan. In fact, less than 40% of the organizations surveyed indicated that they had a formal plan in place. This is a problem, given that the vast majority of the organizations surveyed agreed that CX was an important area of concern. Consistent with many other findings, community banks significantly lagged their peers in having a formal plan.

CX Objectives Have Internal vs. Customer Focus

When financial organizations globally were about their customer experience objectives, many of the goals revolved around how the bank or credit union could benefit as opposed to how the customer or member could benefit. In the survey, the top two answers provided were to improve the share of wallet (29%) and to gain efficiency (25%). We wonder whether customers believe that their experience is improved when their financial institutions ‘gain efficiency’? Improving customer advocacy was the lowest ranked objective in the research.

Banking Industry/Customer Satisfaction Mismatch

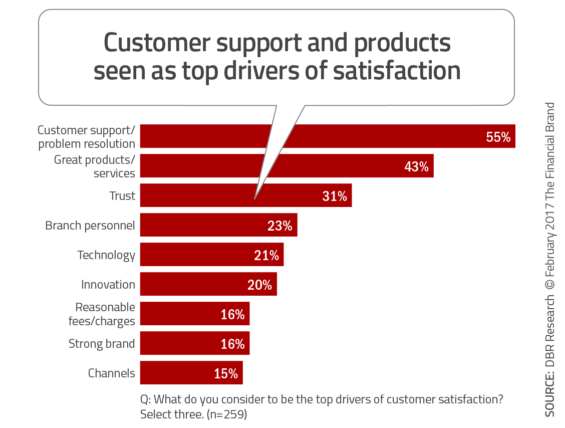

Given that consumers consistently say that items like safety, security, transparency, trust, etc. are ‘table stakes’, and that the impact of daily digital transactions can have the most immediate impact on improving the customer experience, how do financial institutions believe customers are satisfied? Unfortunately, when asked to select three drivers of customer satisfaction, ‘technology’ ranked 5th (21%), and ‘channels’ ranked 9th (15%).

At the top of the list were ‘customer support and resolution’ (55%) and ‘great products’ (43%). After the table stakes element of ‘trust’ (3rd place with 31%), financial institutions placed ‘branch personnel’ in the 4th position.

While there is no denying that customer support and problem resolution are important, they are a driver of satisfaction only when something goes wrong. Similarly, the importance of branch personnel is only important for those who visit the branches (less than 1/3 of those just 10 years ago).

As an industry, it has never been more important to focus on what is important to the majority of consumers … today.

“Our goal is not just about delivering access to resources and convenient solutions – it’s about anticipating and meeting our clients’ ever-changing needs.

– Michelle Moore, Head of Digital Banking at Bank of America

Despite Investment Increase, Impact Remains Modest

When asked about investment in customer experience initiatives, 72% of institutions indicated that they would

be increasing their investment in CX initiatives in 2017, with 15% saying investment would remain the same and 6% actually saying they were expecting a decrease in investment. When asked about investment over the next 3 years, commitment was close to unanimous.

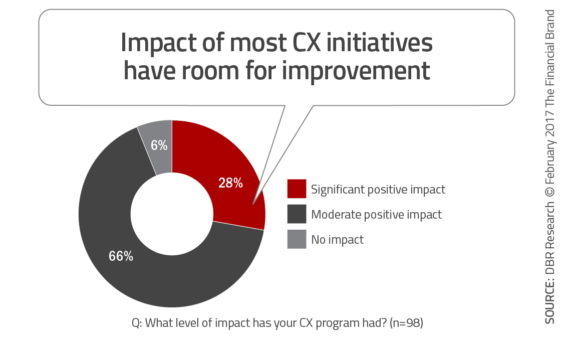

When organizations were asked about the level of impact their current CX initiatives have had, 66% of respondents said that their efforts have had a ‘moderate impact’. Only 28% of those responding said their program had a significant impact.

Part of this lackluster effect may be a result of poor or non-existent tracking or reporting (“I really don’t know if the programs have had an effect”). Alternatively, the result could be caused by ill-conceived programs that are focusing on the wrong areas of the organization (focusing on call center or branch satisfaction as opposed to digital engagement).

When we broke down the responses by size and type of organization, the largest firms were the happiest with their CX results. This may be caused by a greater investment being made, a stronger focus on the overall customer experience or because the larger firms are spending more time improving the digital customer experience.

What is of concern is that no community banks indicated that CX initiatives had a significant impact and that 25% of the community bank segment said their programs had a negative impact. That number seems astounding. This could be the result of a lack of commitment to improving CX, low investment or misplaced resources.

Digital CX Efforts Most Effective

When asked about the most effective individual customer experience initiatives, digital delivery (mobile and website) got the highest marks. Financial institutions who responded to the survey said that 80% of mobile and 55% of website initiatives were at least partially effective. While not receiving the highest marks for effectiveness overall, 70% of social media marketing efforts were thought to be successful.

It is interesting that 64% of customer analytics programs were deemed at least somewhat successful. That is not to assume that there is a great impact, but it is a positive sign to see that organizations are starting to feel the impact of the core of great customer experience … data.

CX Challenges Include Data Analytics and Legacy Systems

There is a great deal of discussion in banking around the need to deliver personalized, timely and relevant communications and offers that drive customer profitability, satisfaction and loyalty. Unfortunately, there is still a large gap between the aspirations of bank marketers and the ability to deliver on these goals.

The challenge is that while there are affordable and powerful tools available to create powerful omnichannel customer experiences, most bank marketers are using the same outdated data sources and marketing methodologies they have used for decades. For those marketers who do have the right tools at their disposal, many indicate an inability to use these tools effectively.

Challenges around data were at the top of the list in our research as well.

Survey respondents were also asked to select three of their biggest obstacles when trying to improve their customer experience. Not surprisingly, the top obstacles all were related to challenges that have been part of banking for decades. From outdated technology (49%), siloed systems (48%) and the lack of a consolidated customer view (42%), all of these challenges impact many key banking initiatives.

The lack of a clear strategy or corporate-level commitment to CX was mentioned by 32% of those surveyed, while lack of funding was mentioned by 17% of respondents. Most of the other obstacles related to data issues which was not a surprise.

Measurement of CX Success

The most mentioned measures of CX success in our survey were related to customer satisfaction, loyalty and retention. By not using more tangible revenue impact measures, it is believed funding for CX programs could be negatively impacted. This is reinforced by the fact that resources, executive buy-in & budgets are seen as hurdles to success.

The KPIs used to measure customer experience initiatives varied based on how the company views their CX strategy as part of the greater business. Six in ten (58%) respondents said ‘customer satisfaction’ was the primary yardstick for measuring individual improvements to the customer experience, while 45% use this metric for overarching institutional measures.

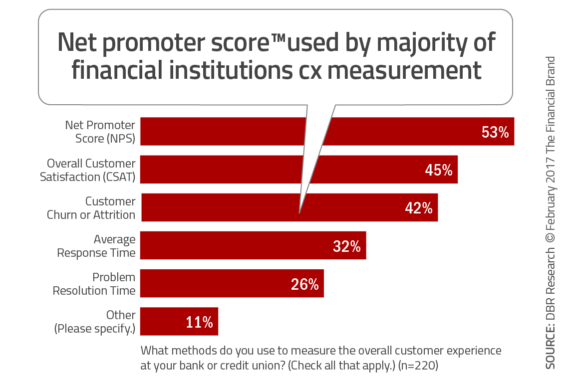

The second most common measurement of individual program success mentioned was ‘customer retention’, which was indicated by 38% of the respondents, with 42% using this as an overarching measure as well. The top measure of customer experience improvement as a total institution was Net Promoter Score (NPS) at 53%, with traditional KPIs such as response time, problem resolution times and task completion rates also being used on an overall and project basis.

The more data that can be drawn into understanding customer mindsets and creating actionable insights, the more decisively a CX team can act and convey the case behind their initiatives to key business leadership. This includes both structured and unstructured data that can fully personalize the customer experience.

Improving CX Results

As the banking industry responds to the “Age of the Individual”, big data and advanced analytics will define the winners from the losers. It is critical for banks and credit unions to deliver on the personalization promise to win the battle of having the best customer experience.

How customer insight is used can make a big difference to the customer experience – and ultimately to the profitability of the organization. The right information, analyzed in the right way, can ensure that the financial institution can provide the right offer at the right time – along with a seamless service at a lower cost. And that has to be good for everyone involved.

Regarding where to start, Ron Shevlin from Cornerstone Advisors probably summed it up best as an intro to the report, “Too much of the discussion around the ‘customer experience’ reflects a desire to simplify the complex, and find the silver bullet that fixes business problems and engenders customer loyalty. That’s too bad, because organizations that take a data-driven, process-oriented approach to improving customer experiences—often fixing just one little thing that stands in the way of customers’ satisfaction—can achieve competitive advantages.”

Customers no longer view their experiences within industry silos, but instead, compare their experience to leading firms such as Google, Amazon, Uber and Apple. Consumers want organizations to simplify engagement and make their lives easier.

Purchase the Report

The Improving the Customer Experience in Banking report, sponsored by Deluxe Corp., provides insight into the progress being made by financial institutions globally in the area of customer experience. Beyond a review of goals and investments, this report delves deeply into the strategies, effectiveness, challenges and measures around improving CX in the banking industry.

The Improving the Customer Experience in Banking report, sponsored by Deluxe Corp., provides insight into the progress being made by financial institutions globally in the area of customer experience. Beyond a review of goals and investments, this report delves deeply into the strategies, effectiveness, challenges and measures around improving CX in the banking industry.

The report includes the results of a survey of more than 250 financial services organizations worldwide. The report has 85 pages of analysis and 52 charts/graphs. Most importantly, the cross-tabs by organization size and type allow a comparison of peers. There are also guest articles from Bank of America, Brian Solis and other experts on customer experience.

Subscribers to The Digital Banking Report and those wishing to purchase the complete report can access it by clicking here.