Customer experience has always been defined as the consumers’ perception of how your organization treats them. These perceptions are based on each individual’s own priorities, and they impact each person’s level of engagement with your financial institution and their future buying decisions and loyalty.

In other words, if your institution gives them positive experiences, they will continue to do business with you, increase the scope of their relationship, and recommend your bank or credit union to others. Beyond simply resulting in more transactions, positive experiences translate to trust and the potential exclusion of competitors when consumers decide who to give their business to next time.

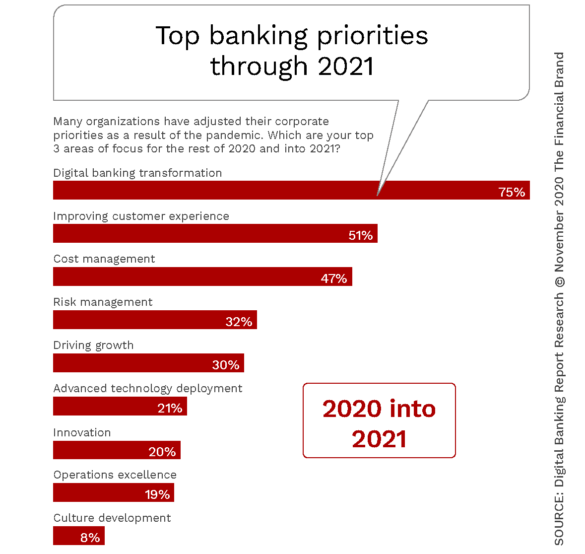

When Digital Banking Report asked financial institutions globally about their top strategic priorities through 2021, improving the customer experience came in second only to focusing on digital transformation. This is understandable, given the almost immediate shift to digital channels caused by the pandemic.

The foundation of an improved customer experience is the need to know your customers, understand their behavior and needs, and reward them for their relationship. This “reward” is often not in points or special offers as much as is it in the ability to provide contextual guidance and financial recommendations based on real-time needs and opportunities.

The key is to use data and advanced analytics not just to know the customer within the organization, but to continually illustrate to the customer that you understand their customer journey. Without the deployment of insights for communication to the customer, the most important component of customer experience is missed.

The good news is that when you improve the experience from your customers’ perspective, there is proof that your organization will improve satisfaction, increase sales, expand depth of relationships, increase retention, and positively impact your institution’s bottom line.

When we look at the major customer experience trends for 2021, clearly the pandemic impacted expectations. It is also clear that the importance of positive customer experiences has never been greater. While some of the trends for 2021 are extensions of what we have seen in the past, others are new expectations caused by the combination of digital, economic and social changes we have seen in the past 12 months.

- Speed and Simplicity Rule. Customers will no longer base their experience perceptions solely on price, product or convenience. Instead, expectations will be based on digital speed, simplicity and contextuality.

- Channel Uniformity Assumed. More than ever, consumers will expect a consistent experience across all channels and platforms, in real-time.

- Design Matters. Consumers will make a decision whether a website or mobile app is right for them in milliseconds based on the design alone.

- Proactive Personalization Required. The importance of personalization and proactive recommendations has increased significantly as consumers have become used to the experiences of digital tech firms like Amazon, Netflix, Google, and numerous new fintech players.

- Sustainability Increases in Importance. Consumers will expand their evaluation of experience with financial institutions to include social components that include community investment, gender and racial equality and other sustainability issues.

- Technology as an Enabler. While consumers want the impact of what advanced digital technology can provide, they will mostly want things to work … quickly and without friction.

- Customer Impatience Grows. The impact of a poor customer experience will be faster and more dramatic than ever … and often undetectable initially.

Read More:

- Now is the Time for Intelligent Digital Banking Experiences

- 7 Essentials of Digital Transformation Success

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

1. Speed and Simplicity Rule the Customer Experience Race

When we look to a pandemic-impacted customer experience criteria set, digital simplicity and speed of engagement — rather than clever words and expanded product options — will drive trust, loyalty and retention. In the future, simpler experiences will be viewed as more valuable to consumers, with the majority of consumers willing to pay a premium for it.

Google, Netflix, Apple and Amazon are all brands built on services that are highly complex in terms of digital capabilities, but ultimately offer solutions that are tailored to users and make their lives easier via simplicity. That is where competitive differentiation will be achieved in the future. However, while clarity will help set competitors apart, financial institutions will still need to simplify products, redefine back-office processes, and provide straightforward customer communication.

At a time when people have less free time and increased decision-making responsibility, a culture of simplicity demonstrates customer centricity. When simplicity and clarity are the primary objective for an organization, the customer will feel in control, bolstering their confidence and providing peace of mind.

2. Channel Uniformity Is Assumed and Institutions Must Adapt

Today’s consumer no longer distinguishes between digital or offline engagement, and interacts with their financial institution through different touchpoints. These touchpoints will change over time based on where a customer is and what else they may be doing.

The same transaction may be accomplished online, using a mobile channel, in a branch, with a call center representative, on a voice device or even using a video channel. Whatever option the consumer selects, they will expect to have the same brand experience – in real time – every time. In a digitally enabled world, banks and credit unions must adapt to this expectation of uniformity of the buying and contact experience.

When we add the need to personalize the experience in real time, financial institutions will be dealing with a new approach to the customer which requires a significant transformation of current internal processes. Part of this transformation will be the monitoring and measurement of the customer experience across the entire customer journey.

Read More:

- Digital Banking CX Boils Down to One Word: Speed

- Financial Institutions Benefit from AI, But Consumers Remain Skeptical

3. Design Matters And You Can’t Blow It Even Once for Most Consumers

A bad online or mobile experience can significantly damage your brand and the potential for sales and future engagement. For example, 57% of customers won’t recommend a business with a poorly designed website or mobile app.

What is amazing is that it takes about 50 milliseconds for your customers and prospects to form an opinion about your website that determines whether they like it or not — whether they’ll stay or leave. That opinion is developed even faster for a mobile app.

Remember, for any given search query, there are dozens or more search results that fit the needs of the user. With the consumer scrolling for the best fit for any inquiry, they will determine which firm to do business with based on first impressions. And these impressions are usually being made from a mobile device.

So, if you can focus on the redesign of any of your platforms, start with the mobile app. Our research has shown that the biggest banks are redesigning their mobile platforms at a much greater frequency than their website.

4. Proactive Personalization Required

Just knowing who your customer no longer suffices. As a result of the many new digital interactions consumers have experienced since COVID disrupted life, people now want you to be in a position to help them manage their money like a GPS system manages direction to a destination.

Banks and credit unions will take information from past interactions, combined with internal and external insights to use it to instantaneously customize the customer’s experience. Amazon’s recommendation engine and Netflix’s intelligent viewing algorithm are excellent examples of how this will play out.

While remembering what a customer did in the past is a good start, the proactive personalization capability will also need to optimize the customer’s journey on their behalf. This includes building new customized solution sets that will optimize financial outcomes, similar to how a GPS system changes the recommended route due to real-time changes in traffic patterns.

Part of the proactive personalization process will include focusing on how an investment in journey mapping improves the economics of delivering products and journeys to a customer segment — and how powerfully it reinforces engagement – as opposed to just how it drives sales or reduces costs.

5. Sustainability Increases in Importance

The global health challenges and social justice protests over the summer highlighted the importance of creating a customer experience that reflects the broader scope of sustainability. Globally, consumers will expect banks and credit unions to operate in a way that supports community investment, social and gender equality and even environmental issues.

As more consumers seek out firms that meet their own personal values on social, economic and environmental issues, financial institutions will need to put words into action that customers see as part of the organization’s brand and culture.

According to a 2020 survey, customers are most likely to return to a brand for the product’s quality, but sustainable business practices come a close second. In fact, 68% of consumers say they’re motivated to be loyal to a brand by knowing that they share the same values.

Sustainability isn’t just about switching your own organization’s practices to become more socially aware, environmentally friendly or ethical. Going forward, consumers want you to help them behave more sustainably, too.

6. Technology as an Enabler of Superior CX

While technology will be an important component of the overall customer experience, it will not be what consumers look to when assessing how well an organization is doing. The technology that drives an experience will be invisible.

According to PWC, “Customers expect technology to always work (and are unlikely to take note of new technology unless it malfunctions or interrupts the seamless, friendly experience). They want the design of websites and mobile apps to be elegant and user-friendly; they want automation to ease experience. But these advances are not meaningful if speed, convenience and the right information at the right time are lacking.”

Investing in the next shiny object is not a winning strategy. Financial institutions need to decide which digital tools to use after business objectives are established and leadership commits to integrating the technology, people, process and culture to support the consumer experience.

The customer experience needs to be designed from the outside in and built from the inside out. This means that technology is determined once the customer provides input and processes are reset for digital.

7. Customer Impatience With Substandard CX Grows

The impact of a negative experience will be faster than ever before, possibly without the opportunity to get it right once a customer becomes upset. One in three consumers (32%) say they will walk away from a brand they love after just one bad experience, according to PWC.

Adding to this impatience are the countless options consumers have at their fingertips. If your bank or credit union doesn’t immediately appeal to them, another brand certainly will. According to recent research, 29% of mobile users will switch to another app or website if they fail to find what they are looking for within three seconds. With so many new products and services available, once a consumer starts shopping, they already know the experience they want.

An additional warning: When a current customer becomes disenchanted, they may not tell you, and they may switch providers without formally closing their current relationship. In other words, in a digital world attrition may be both invisible and non-negotiable.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Where Financial Institutions Should Start Their CX Rebound

No financial institution can achieve digital banking transformation or improve all components of customer experience overnight. The best strategy is to start with looking at what your customers expect from you in a pandemic-impacted world.

While they may have been satisfied with the almost instantaneous digital transformation you did when the physical world shut down in early 2020, new, much more elevated expectation lie ahead. Find the best opportunities to create fast, simple and customized digital experiences that enhance the overall customer journey.

Use the same level of urgency and crisis management to create differentiated experiences that provide a competitive advantage in 2021. While much about the future remains unknown, it is clear that financial institutions that prioritize the integration of digital and CX will be best positioned for it.