Do your marketing efforts reach your target audience across all devices, browsers and touchpoints, or do you simply send messages using one channel at a time? Do you know what channels a customer used before they bought from you – and can you attribute the purchase to the right channels to optimize future programs? Most importantly, is the experience your customer receives seamless and consistent, no matter what platform or device they use to connect with your institution?

The goal of identity resolution is to provide a single view of each customer across multiple channels. By creating a profile of each customer, financial institutions can understand the entire customer journey, providing the opportunity for marketers to connect at the right time, with the right message, on the right channels for the best result – for both the institution and the consumer.

Identity resolution breaks down the complexity of marketing attribution. It enables banks and credit unions to better respond to customers who increasingly expect to be recognized and offered personalized solutions in real time and reflecting context. For a marketer, this process improves effectiveness and efficiency, building insights into how to acquire, engage and build relationships.

“Identity is the foundation that allows brands to deliver relevant messages, while reducing waste, customer churn and optimizing return on marketing investment,” said Ric Elert, President and chief operating officer at Epsilon. “When brands get identity right, it gives them a fighting chance to not only survive but thrive.”

Read More:

- Digital Banking Consumers Demand Hyper Personalization

- Insights, Analytics and Personalization in Financial Marketing

- Marketing Automation and Personalization Critical in Digital Banking Relationships

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Why is Identity Resolution Important?

With consumers using multiple channels before they make a purchase, and using multiple devices interchangeably expecting a seamless experience, it has gotten exponentially more difficult to understand the complete customer journey. Identity resolution helps marketers connect the dots across all online and offline touchpoints that each individual customer uses.

Without such capability, banks and credit unions risk wasting marketing dollars and the ability to measure success across channels. There is also the likelihood that you will over or under communicate with customers at key times of the relationship, creating ill will.

According to a study of just over 200 marketing and consumer data decision makers conducted by Forrester Consulting on behalf of Epsilon, only 40% of financial services companies are confident that their customer ID profiles are both complete and accurate. This means marketing investments are being wasted and that there is a risk of privacy and compliance issues.

Other findings included:

- Only 43% of financial services industry respondents say their brands use their ID resolution programs to measure online and offline marketing performance.

- Only 29% of respondents said that they receive excellent support from identity resolution programs for reducing marketing waste.

- Only 33% said that they receive excellent support for decreasing customer attrition and 42% for helping increase revenue per customer.

“We speak with marketing executives who tend to be too focused on data collection or campaign execution and aren’t thinking about measurement,” said Elert. “Brands that are seeing real results from their people-based advertising are committed to looking at all these areas holistically.

The Building Blocks of ID Resolution

The mission of identity resolution is to connect with customers with a high level of personalization and continuity of voice encouraging meaningful interactions. Or, more simply, to know enough about your customers so that they feel like you know them, understand them and want to help them.

Done well, and your organization benefits from less marketing waste and an improved brand perception.

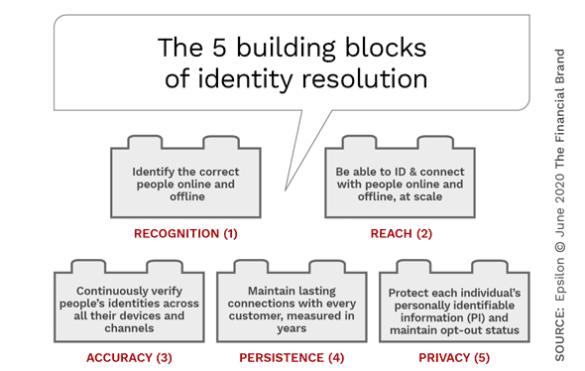

According to Epsilon, there are 5 building blocks to a strong identity resolution strategy:

- Recognition. Using data not only available within your internal database, but also looking at behavior and channel usage beyond what consumers do with your brand.

- Reach. The need to reach your customers as real people, not just cookies or devices, to avoid hurting your reputation by messaging them too frequently.

- Accuracy. The importance of identifying customers across all of their devices and browsers, consistently and at scale, for a better customer experience.

- Persistence. Being able to follow the customer as they change along their customer journey with updated data actions both online and offline.

- Privacy. To proceed with confidence, data must be scrubbed of personally identifiable information (PII) before it is used to comply with the European General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). This step also involves ongoing management of opt-out status.

Identity resolution at scale is best done with a partner you can trust. In addition you need to be able to continuously verify their ability to manage the different building blocks well. The risk of mismanagement goes beyond wasted marketing dollars and a bad customer experience. There are privacy and compliance ramifications.

In fact, Forrester found that many identity resolution programs face challenges. In the firm’s research, just half of financial marketers, at best, said they’re fully capable of fundamental identity resolution capabilities including identifying customers across devices, controlling communications frequency and sequencing, or building a single customer profile using all available customer data points.

While it is a very involved process to combine large data sets, multiple devices, the right privacy infrastructure and a massive media network, there are partners in the marketplace that can assist in the process. As with any solution provider selection process, it is best for the evaluation to include multiple options as well as references from peer organizations.

Recommendations for Financial Institutions

The ability to not only be able to identify your customers and members across devices and platforms, but to communicate with them with laser focus in real-time and measure the results of your initiatives is no longer optional. Consumers expect this level of personalization.

Consumers won’t accept inconsistent messages when they use different devices. They lose trust in banks and credit unions that keep reaching out to them with offers after they have purchased a product. And they get angry if you try to sell them after they have opted-out of your communication.

To avoid these issues going forward, and to recognize the benefits of identity resolution, Forrester provided recommendations for all financial marketers.

- Focus on early wins. The earliest benefits of identity resolution usually revolve around reduced waste. Better customer profiles improves targeting and uses attribution to determine the best media mix for communication … on a customer level.

- Understand the full benefits of identity resolution. Once early wins have been achieved, don’t stop there. Beyond targeting, take advantage of the benefits across the customer journey and all touchpoints.

- Leverage broad range of identifiers. There is a need to look beyond using just email addresses and authenticated data as the basis of identifiers. This allows for improved customer profiles and better marketing results.

- Enlist leadership support. Because of the scope of a well executed identity resolution program, top management must have a complete understanding of all components of the program. This includes both the benefits of the program as well as what can/will potentially go wrong.

- Select partners wisely. It should come as no surprise that since an identity resolution program involves customer data and privacy ramifications, selecting the right vendor is critical. Even after a vendor selection is made, there must be checks and balances in place for ongoing performance reviews.