Banks face a perfect storm of headwinds. Fee revenue is dropping steadily, with this deterioration in non-interest income proving difficult to replace as regulators crack down on certain charges. At the same time, new customer acquisition has become more challenging as competition grows and consumers demand simplified account opening and improved value. Adding to these trends, mortgage originations have fallen 50% from peak volumes in 2015, with declines projected to continue amid higher interest rates and slowing housing market activity.

To overcome these headwinds, financial institutions must transform into agile, customer value-driven enterprises initiating strategies that increase their relevance and their role as primary financial provider in consumers’ lives. This will require a doubling down in data and artificial intelligence capabilities that can deliver personalized financial operating systems, accompanying customers across their financial journeys, thereby strengthening trust and loyalty. This scenario comes from new research from EY.

With continued economic uncertainty challenging the financial health of every consumer and business, banks and credit unions must focus relentlessly on understanding and delivering on customer needs, adapting business models to drive sustainable performance.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Holding Banks Back: Issues of Customer Primacy and Trust

Trust is a cornerstone of the traditional banking industry, yet it has been facing unprecedented challenges in recent years. This has led to notable erosion in the once unwavering confidence customers placed in banking institutions. This shift in perception stems from a confluence of factors, including high-profile financial crises, technological disruptions and evolving, rising customer expectations.

The increasingly dominant role of technology has expanded the concept of trust. As digital transformation swept through the financial landscape, online banking, mobile apps and fintech startups emerged as formidable competitors to traditional banks. These innovations not only offered convenience and efficiency, but also introduced concerns about data security, privacy breaches and cyber threats. This further undermined customer trust in the industry’s ability to safeguard sensitive information.

Trust Builds Loyalty and Advocacy:

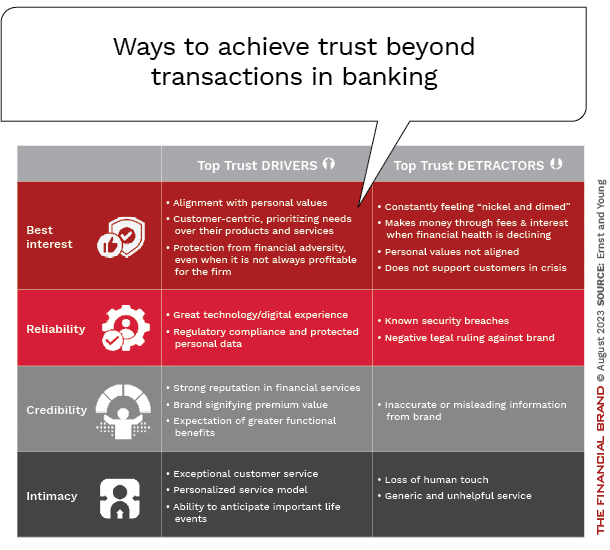

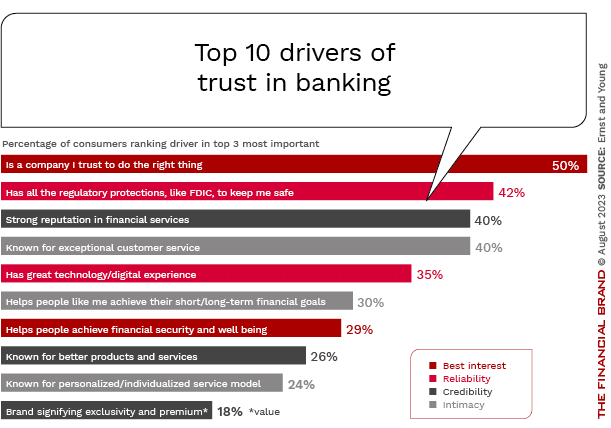

Consumers rank a company they trust to do the right thing, having regulatory protections, a strong reputation in financial services, and exceptional customer service, as the top drivers of trust.

In tandem with these shifts, what people expect has changed drastically. Many of today’s consumers demand personalized experiences, transparency and ethical practices from their financial providers. The misalignment between these expectations and the traditional banking model — often seen as rigid and opaque — has nurtured the perception that banks prioritize their own interests over those of their customers. Surveys show banking now ranks among the least trusted industries, behind sectors like tech and retail. Only 60% of consumers express trust in banks, according to EY’s research.

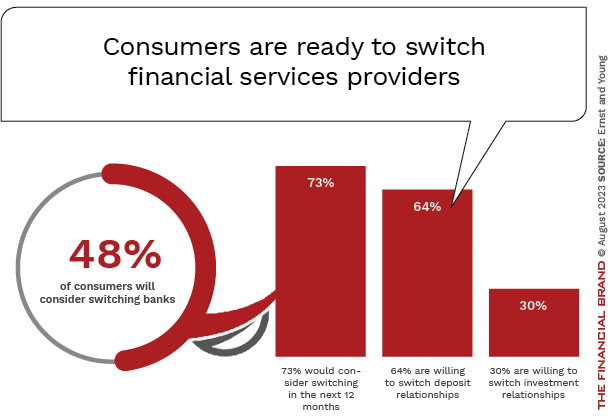

The result: Consumers are now more willing than ever to test alternative financial providers.

Ease of moving money digitally, coupled with dampened trust, drives this readiness to churn. In addition, desires for reduced risk, better rates and benefits, more personalized solutions, and solutions that improve financial lives also tempt consumers to test alternative providers.

EY reports that almost half of consumers surveyed would consider switching providers, with three-quarters open to switching in the next year. Regional and community institutions face the greatest deposit attrition risks, according to Federal Reserve data.

Consumer attention spans fragment as financial services permeate digital ecosystems. Banks now compete for share of mind against commerce, gaming and social platforms. Capturing attention requires meeting customers everywhere through seamless, networked experiences.

Read More:

- 14 Surprising Predictions on the Future of Banking

- Top Factors Defining Future Success in Retail Banking

Balancing Ubiquity and Utility to Re-establish Banking Primacy

How can banking institutions regain consumers’ trust and persuade them to see traditional institutions as their primary providers again? It requires transparent communication, responsible corporate behavior and a commitment to meeting the needs of an increasingly digital-savvy and socially conscious clientele. Banks able to master customer primacy and trust will gain lasting advantages, according to EY. Those who do so can reverse declining share of wallet and loyalty trends. But this requires understanding major shifts in consumer behaviors and crafting customer-obsessed strategies.

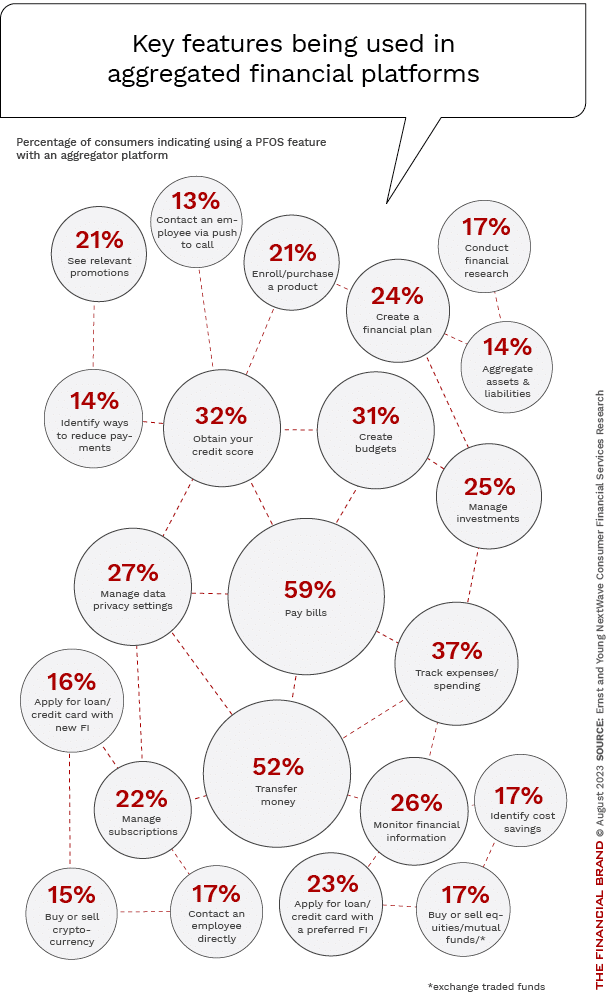

One of the foremost changes in consumer behavior is that people are continuously connected across devices, jumping fluidly between apps and sites. Their expectation is for anywhere, anytime access and instant gratification. According to EY research, the average consumer spends just 1.3% of their month on banking activities. That share is set to shrink further as financial functionality embeds itself in commerce and lifestyle contexts. This makes it increasingly difficult to reverse existing trust and primacy trends.

To re-capture people’s attention, banks and credit unions must tap technologies like AI and biometrics to securely serve customers in-the-moment across environments. This means reaching them on social platforms, at the point-of-sale and through daily apps. More than ever, financial institutions must earn attention within the flow of life by embedding empathetic engagements — not intrusive salesmanship.

Winning trust and primacy will increasingly require understanding consumer psychology and designing experiences that anticipate needs while respecting attention’s scarcity. Financial institutions that master the delicate balance between contextual presence and contextual solutions will flourish. Buy now, pay later solutions are built on this balance. Taking this concept a step further, imagine a financial institution using the combination of credit bureau “hits” and real-time locational data to offer discounted car loans … at the dealership … during a new car test drive.

Read More:

- The Future of Banking as a Service and Trends in Embedded Finance

- How Data and AI is Transforming the Future of Banking

Why Personalizing Financial Offerings is Critical for Banking

As the banking industry is being unbundled by innovative competitors, consumers are swiftly gravitating towards narrower solutions that nevertheless better address their needs, according to EY. Convenience and product differentiation used to drive consumer preferences, but those factors are yielding ground to products and services tailored to the specific customer.

This change of consumer preferences combined with modern technology provides traditional banks and credit unions unprecedented opportunities to not only cater to personalized needs but also to establish deeper trust and contextual engagement with customers. To take advantage of these opportunities, financial institutions need to develop AI-powered personal financial operating systems that orchestrate seamless, contextual and networked experiences across the entire customer journey. For instance, embedding lending within a real estate site simplifies and customizes the mortgage process during a major financial milestone. This elegantly matches supportive solutions to needs in pivotal moments.

A New Value Paradigm:

The consumer financial service market is headed to 'value constellations,' which will expand the opportunities for banks to grow consumer trust and strengthen their market position, and away from 'convenience bundles' that banks use today.

Done right, data-enabled platform combinations make banking more human, not less so. The key is using technology to simplify and connect, not overwhelm. Well-designed tools that seamlessly blend banking into daily life make finance frictionless, not a chore.

An important strategic shift to understand: Most traditional banks and credit unions will not have all of the products, services and solutions under their own roof. This new business model will require collaborations with third-party providers, including fintech organizations. Organizations will need to promote cross-functional alignment on customer objectives, embracing change agents, and solving for delivery velocity. By making customer value the priority, financial institutions could thrive amidst the next wave of consumer financial services disruption.