Are banks about to become tech giants? The financial world is witnessing a fascinating dance between two transformative technologies: artificial intelligence (AI) and cryptocurrency.

While both hold immense potential to redefine our financial lives, their current adoption rates paint a contrasting picture: AI is rapidly infiltrating the banking sector, while cryptocurrency remains largely on the periphery, waiting for its moment in the spotlight within the institutions.

Is AI another bubble waiting to burst or is it the advancement banks and consumers have been waiting for?

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Cryptocurrency: A House of Cards or a Long-term Strategy?

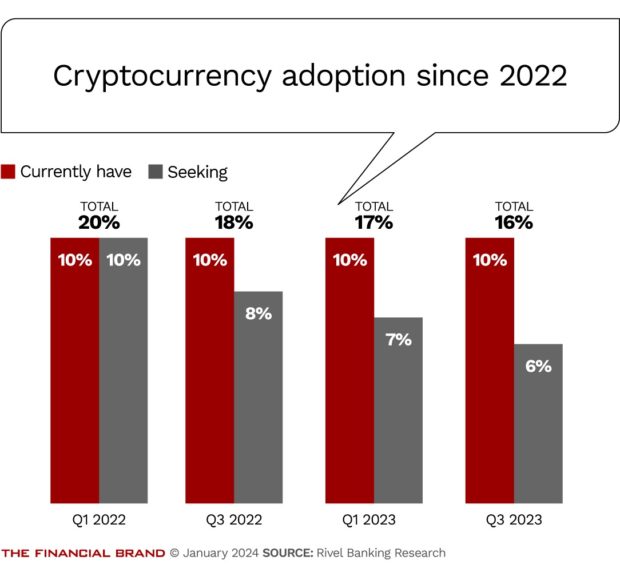

While some banks offer cryptocurrency trading or custody services, the scale is miniscule compared to AI integration. Regulatory uncertainty surrounding cryptocurrencies and the volatility inherent in crypto markets poses significant risks for risk-averse financial institutions. Most importantly, consumers broadly haven’t yet embraced the digital currency.

According to Morning Consult’s primary research into crypto owners, the value of the investment is the main reason U.S. consumers say they own cryptocurrency — and relatively few use it primarily as a means of paying or sending money to others. For that reason, it’s even more important that financial institutions consider what consumers need for their own holdings.

In Rivel’s 2023 Q3 research, only 19% of consumers had interest in storing and managing their crypto through a traditional bank. Millennials were the highest demographic group at 29%. Unless there is a shift away from crypto merely as digital value storage toward more of a digital service, it does not seem likely that crypto integration by financial institutions will become widespread.

While regulatory hurdles and infrastructure limitations remain concerns, the biggest obstacle for institutions might hit closer to home: low consumer participation. Following the implosion of the exchange FTX, crypto trade volumes are now half Q4 2021 levels. Banks have little incentive right now to dive headfirst into this volatile market.

Dig deeper:

- Can Jamie Dimon (Or Anyone Else) ‘Close Down’ Crypto?

- Does Michael Lewis’ ‘Going Infinite’ Go Soft on Bankman-Fried?

AI: The Present Powerhouse

The explosive popularity of consumer-facing generative AI tools — like ChatGPT and Google’s Bard in the past year — has only amplified the buzz within banks and credit unions. They’re recognizing the immense potential of AI, not just to streamline back-office operations, but to revolutionize customer service experiences and pave the way for innovative products and business models. This shift represents a transformative moment in financial services, driven by the promise of personalized engagement, enhanced efficiency — and even entirely new ways of interacting with money.

As seen through recent EY research, financial services leaders found three key ways AI will benefit the industry: 46% said risk reduction from data processing, 38% said creation of new offerings and hyper-personalized marketing and 37% said improving data management process and accuracy.

Where AI Will Fit Into the Picture:

There are three primary ways that artificial intelligence will aid the banking industry, according to EY: risk reduction, a creation of new offerings and improving data management and accuracy.

Consumers align with that sentiment, and demand better personalization in both offerings and service. Nearly one quarter (24%) of consumers would leave their current institution due to customer service issues. In terms of what’s most important to consumers’ experience, almost all can be potentially improved with effective and robust AI integration: well-trained staff, responsiveness, ease of finding answers, and prioritizing financial well-being, Rivel Banking Research’s 2023 Q3 data show.

Despite years of experimentation and a wave of AI-powered programs rolling out at major banks like JPMorgan Chase, Wells Fargo and Goldman Sachs, a surprising statistic casts a shadow: only 10% of consumers even realize their bank uses AI. To bridge this gap, banks could embrace open communication, educational campaigns and even transparent AI assistants. Institutions should herald their innovations including fraud detection, improving the customer service experience through better suggestions, and speedier loan processes. Is this a missed opportunity to build a lasting relationship?

In today’s crowded financial landscape, standing out means more than just having a catchy slogan. On average, through Rivel’s research, a financial institution is only considered by 6% of those consumers looking to switch — creating a narrow consideration set and highlighting the tight battle for awareness in the market. AI offers a way for banks to truly connect with their customers, understand their needs and offer tailored solutions that go beyond a one-size-fits-all approach. Is the investment worth it?

The answer is a resounding yes. Because in the future of banking, it’s not just about numbers on a screen, it’s about building relationships, one personalized interaction at a time.

Read more:

- Lessons from Ally’s Experiment with GenAI Marketing

- Unlocking the Promise of AI for Loyalty in Banking

What’s Next for this Remaking of Finance?

AI and cryptocurrency possess transformative potential for personal finance, but their current trajectories diverge. AI has rapidly infiltrated banks, promising personalized service, efficiency and innovative products. Yet, consumer awareness lags, raising concerns about transparency and trust. Conversely, cryptocurrency remains on the periphery, hampered by regulatory uncertainty, market volatility and low consumer adoption. As FTX’s collapse illustrates, this cautious approach may be wise.

AI offers a clear path toward customer engagement and differentiation, so a shift toward more digital services may be more effective than embracing volatile digital currencies at this stage. Ultimately, the future of finance will be shaped by how an institution implements and promotes their choice to venture into AI. Utilizing AI to cement customer relationships, and eventually trust, will ensure retention of current customers while building a reputation for service and dependability.

For more information on Rivel Banking Research’s benchmarking, market opportunity highlights and on-hand brand perception insights for your institution, contact Corey Wrinn at [email protected]