The idea of banning cryptocurrency carries an allure for a wide, varied audience. Some on the paranoid right have suggested that the U.S. government will eventually ban Bitcoin and other cryptocurrency because they represent too great a threat to the state’s monetary control. Some on the jittery left have suggested that the U.S. government should ban crypto, because it is used almost exclusively by drug dealers and terrorists.

Crypto’s “strange bedfellows” power was on full display last week, during the Senate Banking Committee’s annual oversight hearing of the nation’s largest banks: Bank of America, BNY Mellon, Citigroup, Goldman Sachs, JPMorgan, State Street and Wells Fargo.

Senator Elizabeth Warren — a longtime critic of both crypto and big banks — managed to get each of the CEOs to pledge to root out any use of their financial networks to fund terrorism, and that any crypto company should have to follow the same anti-money laundering regulation that traditional banks have to follow.

Federal law enforcement officials have asked Congress to amend the Bank Secrecy Act, citing cryptocurrency as a way that terrorists get around being governed by the law. Warren acknowledged the oddity of the moment: “When it comes to banking policy, I am not usually holding hands with the CEOs of multibillion-dollar banks.”

But JPMorgan’s Jamie Dimon took the opportunity to go further than his colleagues.

“I’ve always been deeply opposed to crypto, Bitcoin, etc.,” he declared.

He told Warren: “You pointed out the only true use case for it is criminals, drug traffickers, anti-money laundering, tax avoidance, and that is a use case because it is somewhat anonymous, not fully, and because you can move money instantaneously and because it doesn’t go through – as you mentioned – all these systems built up over many years. Know your customers, sanctions, [Office of Foreign Assets Control] – they can bypass all that. If I was the government, I’d close it down.”

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

This was a strange claim for Dimon to make, not only because it is probably one of the few things that he and Warren agree on. As attractive as “closing down” crypto might appear to some, it is basically impossible for a democracy to do. It’s true that the U.S. prohibited personal gold ownership from 1933 to 1974; Bitcoin fanatics sometimes point to that episode as evidence that the government will eventually come after their digital gold. But the truth is that the U.S. had very little appetite for capital controls in its modern era.

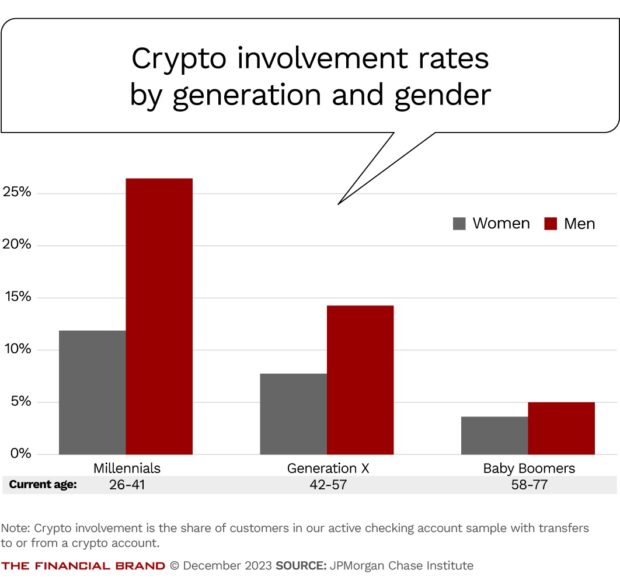

Of course, it is technically possible for the government to pass a law banning cryptocurrency, just as it is possible to pass a law banning alcohol. But various surveys have found that more than 2o% of American adults own some amount of cryptocurrency — turning more than 40 million Americans into criminals ought to give elected officials some pause.

And indeed, the gold prohibition that Franklin Roosevelt enacted in 1933 illustrates the logistical absurdity of outlawing cryptocurrency. When the government banned gold, citizens were told to turn their gold in (by all accounts, nearly everyone did) and were compensated for it.

And indeed, the gold prohibition that Franklin Roosevelt enacted in 1933 illustrates the logistical absurdity of outlawing cryptocurrency. When the government banned gold, citizens were told to turn their gold in (by all accounts, nearly everyone did) and were compensated for it.

Because crypto technology intrinsically crosses borders, it would be nearly impossible to know whether Americans were complying with a ban. And would today’s crypto holders be reimbursed? If so, at what price? At today’s market value, crypto reimbursement could cost as much as $1 trillion — where would that money come from?

“Various surveys have found that more than 2o% of American adults own some amount of cryptocurrency — turning more than 40 million Americans into criminals ought to give elected officials some pause.”

India, often called the world’s largest democracy, flirted for years with a crypto ban, but decided instead on taxation and regulation. A handful of authoritarian governments have tried to ban crypto, with limited success. Nigeria banned crypto transactions in its financial institutions, which seems only to have increased the volume of crypto trades in the country. For a few years, India flirted with banning crypto, but decided instead on regulation.

Dimon is too smart not to realize these things, which leads to the second level of strangeness: His own company is deeply involved in crypto and blockchain technology. In 2020, JPMorgan launched Onyx, which describes itself as “the world’s first bank-led blockchain platform for the exchange of value, information and digital assets.” Within Onyx is a unit called Blockchain Launch, which describes itself as “at the forefront of developing and commercializing new applications, networks and shared platform technology.”

As far back as 2019, JPMorgan launched its own stablecoin, JPM Coin, designed to facilitate cross-border payments. Surely the bank did not imagine drug dealers and terrorists as its target clients!

Finally, Dimon’s speech took place against a market backdrop in which Bitcoin is trading at its highest level in two years. As of this writing, one Bitcoin is worth more than $44,000, nearly three times its value at the beginning of the year.

Some, perhaps most, of the recent rise is attributed to the seeming imminence of spot Bitcoin exchange-traded funds in the U.S., but in terms of refuting Dimon’s claim, it almost doesn’t matter why Bitcoin is going up: Obviously, there are tens of millions of people across the globe who see some kind of use case for crypto that doesn’t involve nefarious activity.

The average Bitcoin or crypto holder might not be able to articulate the use case very well; the store-of-value rationale for crypto seems dubious, although the case is certainly more compelling when the market is going up.

Even if it’s a speculative investment, that’s not the kind of thing the U.S. historically has prohibited. By all means regulate crypto the same way that other financial institutions are regulated. But talk of crypto prohibition is simply fanciful.

About the author:

James Ledbetter is the editor and publisher of FIN, a Substack newsletter about fintech. He is the former editor-in-chief of Inc. magazine and former head of content for Sequoia Capital. He has also held senior editorial roles at Reuters, Fortune, and Time, and is the author of six books, most recently “One Nation Under Gold.”