Two key findings from consumer research by Raddon deserve close attention by financial marketers.

The first concerns where consumers are going most frequently for rate information. The second is where they more frequently wind up heading to open deposit accounts. The study found evidence that as consumers turn to the internet to find the best rates they can for their money, they are paying more attention to online banks and credit unions and displaying greater willingness to open accounts there than was seen in earlier Raddon research.

Considered together, they suggest actions that financial marketers must take to make it as easy as possible for consumers to find out what their institutions are offering and to make it simple and quick to close the deal.

Or else busy consumers will put their money with someone else. The pending arrival of the Google Cache transaction account just adds to the urgency to get the digital storefront in shape now.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Consumers May Be Skeptical About Rate Sites

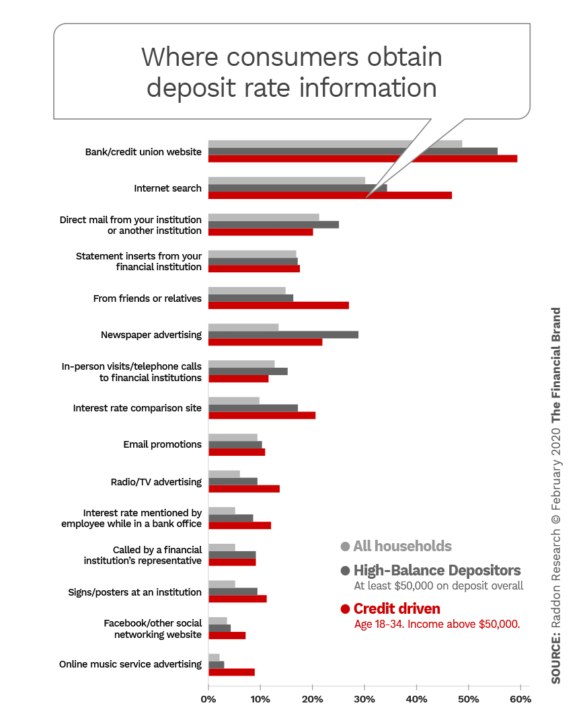

The Raddon report, “Deposit Insights: Rate-Seeking Roller Coaster,” indicates that where consumers are going online in their hunt for rate is not where some might think they would be going in the age of the platform. Added to this is the finding that some low-tech ways of getting the word out about rates being offered continue to have legs — although those legs may be a bit shorter.

As illustrated in the bar chart below, the Raddon study found that the #1 place where consumers go for information on deposit rates is the individual websites of banks and credit unions in their home market. They may be going to the site of their primary financial institution, or another institution that they are already doing business with, says Andrew Vahrenkamp, Senior Research Analyst and Program Manager at Raddon Research. Alternatively, they may be cruising the web among the local providers that they know or checking others because of a window poster or some other signal that stuck in their minds.

The second most common source for rate information is internet search. After that, the ranking becomes downright “classic,” with direct mail, statement stuffers from one’s primary financial institution, friends and relatives, and even newspaper advertisements ranking above rate comparison sites such as NerdWallet and Bankrate.

Part of the reason that something like newspaper advertising ranks above interest rate comparison sites is because some institutions still treat higher-rate time deposits as a liquidity source that can be turned on and off. Their “tap” comes in the form of an attractive ad in a print publication still read by older, affluent consumers. The study found that 27% of higher depositors, defined as those with $50,000 in total deposits, still read print, versus 13% of the total sample.

However, Vahrenkamp thinks there’s a more fundamental reason at the heart of the pattern seen in the study. While a rate comparison site would seem like a time-saving tool, and while they frequently come up first when a consumer Googles “best rates on savings” or cards or other products, they aren’t the first place searched. Vahrenkamp, who has worked at financial institutions in marketing positions, says the finding didn’t surprise him.

“Consumers recognize that these sites don’t necessarily give you the best options out there,” says Vahrenkamp. “They give you the rates of whoever pays them to list their rates. The good rates in your own market may be harder to find.”

(The scope of comparison sites varies, and the role of promotional listings and other types of paid exposure versus research-based listing on the sites is typically disclosed, with varying degrees of visibility. This is described in more detail in another report on The Financial Brand.)

Read More:

- How Comparison Sites Are Radically Altering Bank Product Marketing

- Consumers’ Surprising Views on the Future of Banking

- Most Retail Banks Score Poorly for Digital Marketing

Internet Savings Accounts Coming into Their Own

The Raddon report marks a watershed moment for deposits:

“For years, we saw a relatively flat acceptance of internet-based savings accounts, with around 14% of households consistently using the accounts and about a third more considering usage. That dam has broken. 22% of the study respondents now say they use an internet savings account, with another 34% considering it.”

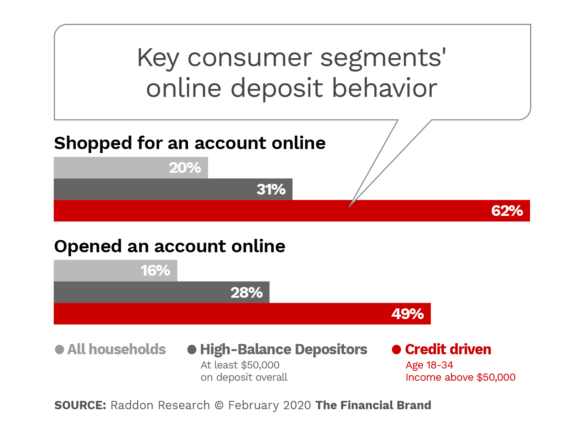

The shift towards searching for deposit accounts online is responsible for this, the report states. It notes that 20% of all households say they shopped for a deposit account online and 16% opened an account online. And 57% of all households that opened any sort of deposit account opened an account online. Further, 62% of credit driven households — which includes higher-earning Millennials — shopped online, possibly fueled, the report says, by online banks specifically targeting these affluent Millennials.

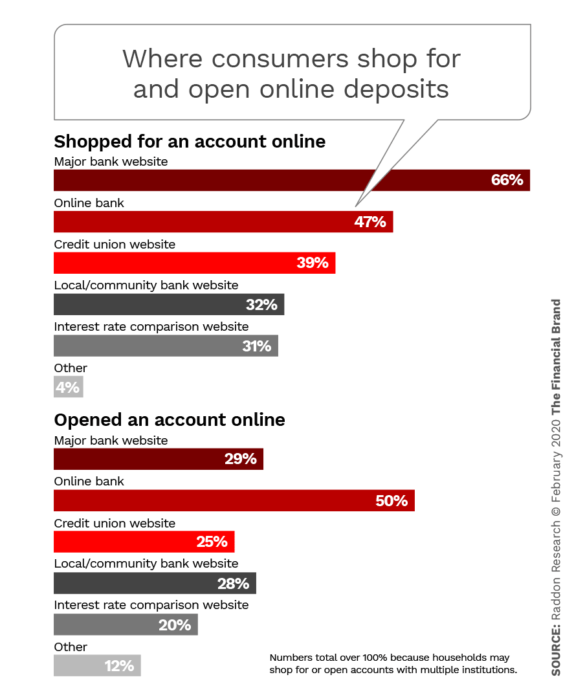

As the chart below demonstrates, when the places that consumers shopped online are compared to where they actually opened accounts online, internet banks have the most impressive batting average.

You can see how some of this is playing out in comments online bank officials have made in earnings discussions:

- Ally Bank increased deposit customers by 20% in 2019, a company record. The bank is now 75% funded by deposits.

- Discover Financial Services grew deposits by 22% and that now represents 55% of funding. The goal over the next few years is to raise the latter to 70%.

- CIT Group, Inc. grew its direct bank’s customer base by 45%.

- First Internet Bancorp grew deposits 18% and has started offering online small business deposits as well.

Read More:

- Direct Banks May Be Good, But They’re Not Unbeatable

- The Forgotten Challenger Bank That Is Still Disrupting Banking

Key Steps to Take So Consumers Go with Your Offer

Given that the top place consumers go shopping for deposit rates is on institutions’ own sites, Vahrenkamp says financial marketers should determine how easily their deposit products and rates can be found.

First, how quickly can the site visitor find deposit products on the site? Vahrenkamp insists that the link to that part of the site be very visible. The consumer should not need to click more than once to get to usable information.

Second, how accessible are the actual rates, which is the main thing the shopper is looking for? Some institutions will avoid the necessity of updating HTML code to reflect rate adjustments. Instead they will provide a link to a PDF containing current rates. It’s essentially the paper rate sheet once sent to all branches by headquarters — and a major league mistake to Vahrenkamp.

He thinks many people will have trouble finding the link. And there is always the chance that people won’t want to click yet again. Further, don’t forget how much search occurs on mobile devices now.

“Imagine trying to download and read a PDF on your phone,” Vahrenkamp exclaims. “That’s a nightmare.”

He suggests that bank and credit union marketers seeking examples to emulate look at the sites of fintechs and challenger banks that offer deposits. Having started fresh with no analog process to switch over to digital, they offer “best in breed” approaches, Vahrenkamp says. In any event, he considers mobile account opening to be a must-have.

“Make it completely seamless,” he advises.

While the Federal Reserve has been indicating no major rate moves for 2020 — one commentator predicted rates would be like a “lazy river” — the Raddon report finds that consumers’ interest in tracking rates has increased over previous editions of the study.

Product design is also important to consider and the target market for the deposit offer as well. Vahrenkamp says there is a relationship between rate and the degree of flexibility and liquidity that an account offers. So, a demand deposit pays the least, or even nothing. However, he adds, if the factors of rate and flexibility were plotted on a graph, the marketer would find that the slope of the resulting line varies among the generations.

Further, marketers have to consider generations in deciding what makes an attractive offer. The oldest marketers may remember the days of the late 1970s and early 1980s when double digit savings rates existed on CDs, though passbooks still paid a very low rate for the day.

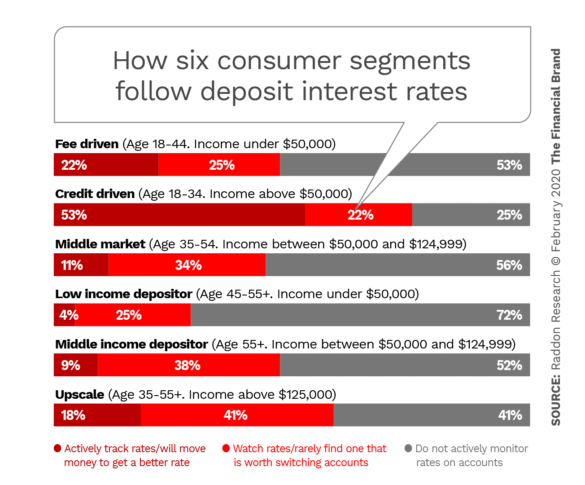

Toss those memories, advises Vahrenkamp, because younger generations weren’t around. To them, he explains, the chance to pick up an additional percentage point in interest means a lot. In the chart above, Credit Driven consumers, who are 18-34 and make $50,000-plus, are the most intensive rate watchers and most likely to move for a better return.

“And they will move money quickly,” Vahrenkamp notes. This is clearly part of the thinking of some of the nation’s biggest banks, which tee up high-yield savings accounts in markets that they aren’t physically located in but which they are reaching out to digitally.

Make deposits somebody’s job. Vahrenkamp’s last point reflects his frustration with a longstanding gap. Just about every financial institution has some officer overseeing lending. Yet he says it is rare to find an institution where someone owns the deposit function. It lacks the status of credit.

While it is the industry’s key fuel, he says, “they don’t seem to see it as a strategic need. Everyone puts their two cents in, but you don’t have a cohesive product strategy.”