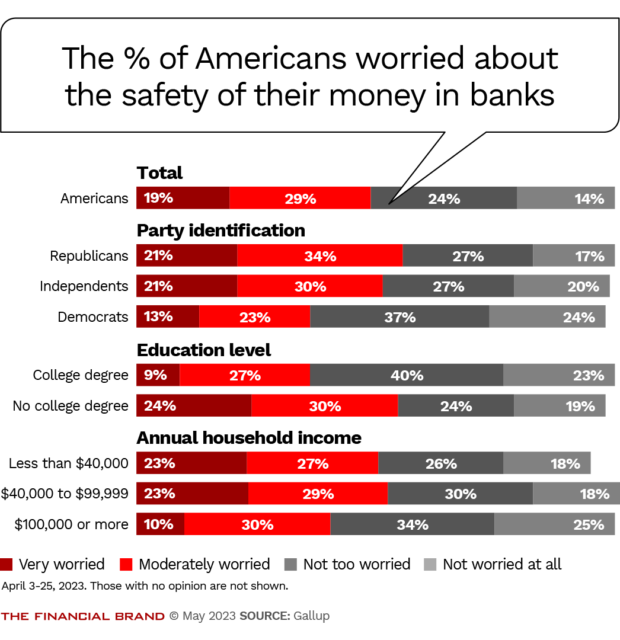

Just about half — 48% — of people polled said they were either “very” (19%) or “moderately” (29%) worried about the safety of their money in banks and other financial institutions, according to a Gallup survey conducted in April. However, a political bias appears to be influencing the overall poll numbers, with Republicans responding much more negatively than did Democrats.

The research firm correlates the consumer worry with sentiment reflected during the 2008 financial crisis, the last time Gallup gauged consumer worries about money held in banks. At the time, Gallup found that 45% of U.S. adults were very or moderately worried about the safety of their deposits. (The latest study reported a margin of error of plus or minus 4 percentage points.)

Gallup conducted the poll of just over 1,000 adults from April 3 to 25, following the failures of Silicon Valley Bank in California and Signature Bank in New York. The survey doesn’t reflect consumer sentiment since the failure of First Republic Bank, which was closed by regulators and taken over by JPMorgan Chase on May 1.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

What’s at Stake for Banks and Credit Unions? Deposits

The survey suggests financial institutions have more work to do to reassure consumers about the safety of their deposits. Many people may not fully understand how federal deposit insurance works and what is and isn’t covered, Gallup research consultant Megan Brenan says in a blog post about the poll. In the three recent regional bank failures, no depositor, insured or otherwise, has lost money.

Gallup’s airing of consumer worries comes at a time when debate over deposit insurance reform has already begun, with the Federal Deposit Insurance Corp. firing the opening round with a white paper.

Forbes blogger Frank Sorrentino writes that “some in the industry have begun a new narrative, looking for full FDIC coverage of all deposits. This response is a movement from one extreme to the other. While that policy might lead to a short-term calm, it sets the framework for a series of longer-term challenges, and makes way for potentially reckless competitors.” Sorrentino is chairman and chief executive at the $9.6 billion-asset ConnectOne Bancorp in Englewood Cliffs, N.J.

Right Side of the Political Aisle Drives Most of Deposit Safety Worries

Gallup found consumers identifying as Republican (55%) or independent (51%) were more likely to be very worried or moderately worried about the safety of their money in the bank than those identifying as Democrats (36%).

Adults without a college degree (54%) and about half of middle- and lower-incomes adults said the same, compared to 36% of college graduates and 40% with high-incomes.

Brenan explains these demographics may offer some insights into why many consumers worry.

She says a higher level of concern could have less to do with circumstances in the banking sector, and instead with “displeasure with the current presidential administration and the U.S. economic situation.” Beyond that, she says that “a lack of knowledge about how FDIC insurance works” could be a factor prompting consumers’ concerns.

“When banks fail, it is also unclear whether Americans’ heightened concern about their own deposits reflects a lack of awareness of the protections for small accounts provided by federal deposit insurance or their fear of a snowball effect that could bring down federal insurance as well.”

— Megan Brenan, Gallup

Some historical perspective: The level of worry consumers had about their money in financial institutions also fell into place along party lines in Gallup’s 2008 research — but in reverse.

“Republican President George W. Bush was in the White House when the financial crisis unfolded, and the views by party were nearly the reverse of those today,” says Brenan. Over half (55%) of Democrats were very or moderately worried compared to a little over a third of Republicans (34%). That research was conducted in September 2008.

How Much Should Gallup’s Findings Worry Banks and Credit Unions?

News that half the country appears to be skeptical about whether their money is safe in the hands of federally insured financial institutions is concerning. (Banks are insured by FDIC’s Deposit Insurance Fund, while the National Credit Union Share Insurance Fund covers credit unions. Both funds are backed by the “full faith and credit of the United States government.”)

The Gallup findings pose a critical question for banks and credit unions alike: What is the average U.S. consumer’s perceived risk threshold? How does a bank or a credit union executive reassure customers and restore their trust after a different institution fails?

There are limitations to the conclusions that can be drawn from the Gallup poll. For one, as noted above, the company has not polled consumers about this since 2008, so there is no recent comparison data in calmer times.

Gallup acknowledges this and adds that its December 2008 reading — contrasted with its September 2008 research recounted above — showed slightly diminished concern.

Read More:

- 3 Effective Tactics to Calm Customer Fears in a Crisis

- Timeline: A Historic Week for Banking & the Ongoing Fallout

- Read all of our coverage of the 2023 banking crisis

A Different Take on Consumer Confidence in Banks

Another survey asking consumers about their trust in banks following the March 2023 round of bank failures had a somewhat less worrisome result. Morning Consult’s study on consumers’ attitudes, released in mid-April, found no bank saw a “significant negative swing in trust.”

“This proves that consumers were able to separate the actions of a few banks from the stability of the banking system overall,” Morning Consult financial services analyst Charlotte Principato wrote in an overview of the survey.

It’s not that consumers aren’t thinking ahead, Principato cautions.

“Their trust in banks to do what is right does not mean there isn’t fear of more fallout from the recent collapses” of Silicon Valley and Signature banks. She indicated that the majority of those surveyed (65%) said they expected more banks to be put into FDIC receivership.

What Should Bankers Be Doing Now?

Surveys like these, and the rumor mill, will keep banks and credit unions front of mind for consumers for some time. How can local institutions provide perspective on national-level headlines?

Communications consultant Merrie Spaeth, who wrote “Why Silence Isn’t Golden on SVB & Signature Bank Failures” in the wake of those developments, has some advice that boils down to two words: think local.

She urges bankers to engage in grassroots-level communication. This goes beyond posting a handful of social media posts.

“The way to build public confidence and trust is to get in front of your local Rotary, Kiwanis Club, the local Republican and Democrat monthly meetings, the local realtors, the doctors’ groups and any other regularly meeting organization,” says Spaeth. “Ask yourself, ‘What would I like them to know about the role our institution plays in our community?'”

A Winning Strategy:

Think local. Get in front of community organizations and share the story of your bank or credit union, including how it is helping local businesses.

Spaeth warns that there’s no future getting into the “predictions game.” It’s inevitable listeners will ask you what’s coming. Don’t fall into that trap.

“Acknowledge the question,” Spaeth stresses, but with an answer like “I don’t have a crystal ball.”

“Then pull out and repeat the word ‘predict,’ and attach it back to a topic in your talking points.”

An example: “I predict that we’ll be having many conversations with our customers to help them assess their (fill in the blank.)”