A few weeks back, I wrote an article commending GoBank on their excellent new customer onboarding communication. Using the informal tone that is consistent with the GoBank brand, they made it clear how I could best use my account and what I could expect from them.

I have been using my GoBank account quite a bit over the past several weeks, and I continue to be impressed with the way the they excel at nearly everything they do. Like most of the better mobile banking applications, I can easily make a deposit by taking a picture of a check. If I’m paying another person, I can instantly send money using their email address, phone number or even Facebook account and they will be notified immediately by email or text message.

Since I didn’t receive any physical checks with my GoBank account (it is truly a mobile banking account), I can pay many bills like phone or cable electronically. If I need to pay a business that doesn’t accept e-payments, or I just need to give someone a check (yuck) then I can send it through GoBank easily as well. I simply enter the information and GoBank will mail a paper check free of charge. I can also set these analog payments up to send out regularly if I need to.

But that’s just the beginning. Here are seven other reasons I really like GoBank and how the brand is fulfilling its commitment to ‘make common actions super easy’ (think one click).

1. Customized Debit Card

While GoBank is mostly a mobile banking account, they do provide a debit card. As part of my onboarding process, they allowed me to customize my GoBank debit card with any picture I wanted.

While this is available at many online and traditional banks, GoBank didn’t position the feature as an afterthought but rather as a way to personalize my new account for a $9 fee if I didn’t want the standard card.

I opted for the personalized card and it appears I was not alone. Lewis Goodwin, CEO of GoBank, said they wanted customers to start off with something fun. “$9 seems like a price people are willing to pay to have free-reign over their debit card design,” he told me.

Read More: GoBank Makes Great First Impression With Fantastic Onboarding Email

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

2. Balance Bar

With most mobile banking apps, I need to sign into my mobile banking application just to see an account balance. Why is that? Even if someone did manage to steal my phone and see my balance, they couldn’t get funds from my account. GoBank makes the primary task of getting a balance inquiry immediate with their Balance Bar.

On the GoBank login screen, I have the option to peek at my balance without logging in. I simply authorize the capability as part of my initial security settings and I am ready to go. When the GoBank login page appears, I simply slide the bar at the bottom of the page for my balance. This capability alone has moved them forward in my assortment of mobile banking partners.

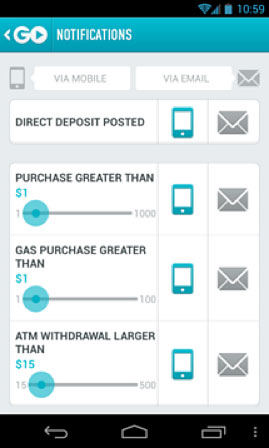

3. Custom Alerts

Rather than having a preset array of notifications that are automatically attached to my mobile banking relationship, GoBank allows me to customize a wide assortment of alerts both by type of alert and the way I’d like to receive those alerts — mobile notification and/or by email. The following are the alerts currently available:

Direct Deposit Posted

Direct Deposit Posted- Purchase Greater Than (value from $1 – $1,000)

- Gas Purchase Greater Than (value from $1 – $1,000)

- ATM Withdrawal Greater Than (value from $1 – $1,000)

- Daily Balance (once a day alert via mobile device or email)

- Balance Lower Than (value from $1 – $5,000)

- Budget Reminder – Money Coming In (set for 1-5 days before)

- Budget Reminder – Money Going Out (set for 1-5 days before)

The options for alerts will undoubtedly change and expand over time based on customer input. What is nice is that all of the alerts can be set in a very simple, easy to understand way — just like with everything associated with GoBank.

4. Negotiable Monthly Fee

The most revolutionary part of GoBank is the ability to specify a monthly “membership fee” at any level you want from $0 – $9 (again using a sliding bar). If someone isn’t sure what to pay for their monthly membership, GoBank provides industry factoids using several sources. Sample insight includes:

- Most Americans pay $12 per month just to keep a bank account open (source: Pew Charitable Trust)

- In 2012, Americans paid $32 billion in overdraft fees. GoBank has no overdraft or penalty fees.

- GoBank has 42,000 free ATMs — more than twice as many free ATMs as BofA or Chase

I’m sure I’m not the only customer to actually accept a fee for my new account — despite the fact that almost all of my banking relationships are free. I set my fee at $3 since that is what I am used to paying for a withdrawal at ATMs outside of my current network.

GoBank also notes that my fee will be deducted every 30 days and that I can change my membership fee at any time up until midnight on the day prior to the charge.

And by the way, I love the term “membership fee.”

Read More: Should Credit Unions Charge Membership Dues?

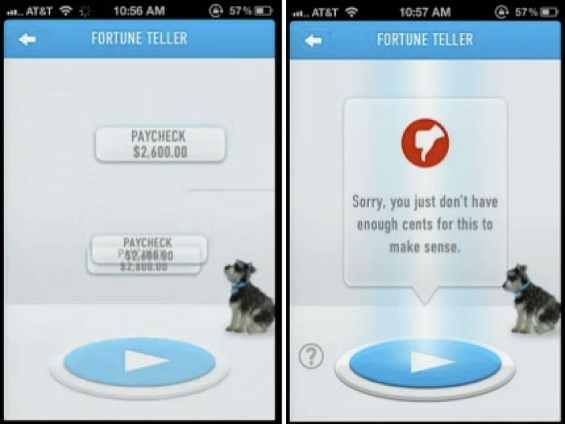

5. GoBank Fortune Teller™

The Holy Grail of most robust mobile banking apps is the ability to build a complete personal financial management (PFM) integration. GoBank avoids overcomplicating the budgeting process. Simply input the payment reminder (rent, cable, electricity, gym), provide an amount and indicate the frequency. The same is true for deposit reminders. Once a budget is set, the power of the GoBank Fortune Teller™ comes into play.

I can use the Fortune Teller to double-check my budget before I spend. I simply tell the Fortune Teller how much it costs, and GoBank gives me a quick yay or nay based on the budget I’ve set. And since mobile deposits and payments post immediately, my Fortune Teller update represents a real time balance.

There are no fancy graphs, charts or analysis of my budget as part of the GoBank PFM proces — just the basics, and done very well.

6. GoBank Communication Style

Not surprisingly, GoBank is not keen on bank speak. In fact, I have yet to receive any communication from GoBank that was not generally informal; it’s a minimalist’s dream. While many customers of GoBank will find this refreshing, many bankers I’ve spoken with think the communication is not “professional enough”

For me, the style is perfect. In fact, instead of burying me in the account’s terms and conditions (which I’ve never read once in my life), they simply make their formal documents available online if I want to view them.

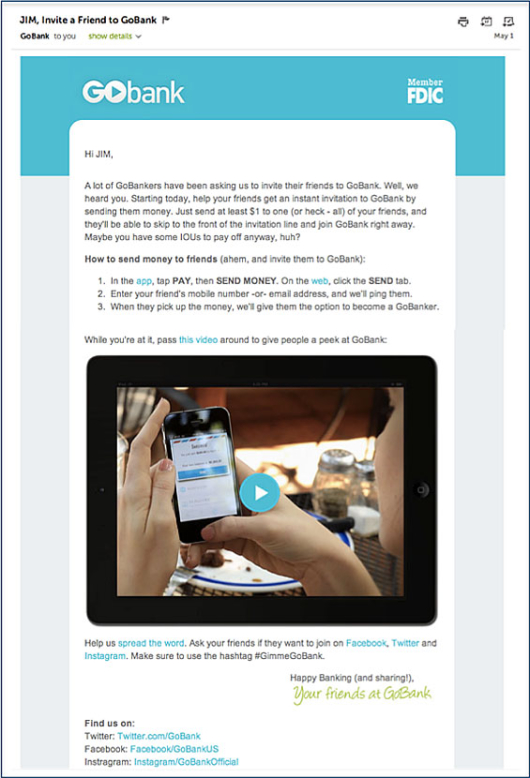

7. GoBank Referral Program

While not exactly innovative from a strategy perspective, GoBank definitely has developed a very simple and powerful referral program for their mobile banking application. Because GoBank is still technically in beta (until the July 4th holiday), there is a virtual line of people waiting to open an account. To help a friend move to the front of the line, GoBank allowed current customers to invite friends simply by sending them $1 using the person-to-person payment feature. For the recipient, redeeming the $1 they get couldn’t be easier, taking as little as 15 seconds.

What is cool about this strategy is that I am actually using the payment app to refer a friend, which familiarizes users like me with the simplicity of their mobile P2P payments tool. On the recipient side of the equation, they are being given money from a friend to try GoBank leveraging the power of word-of-mouth marketing.

What’s Next? Rollout of GoBank

According to the GoBank presentation at FinovateSpring a few weeks ago in San Francisco (see 7 minute presentation below), the rollout of the GoBank app will occur on July 4. GoBank will be using social media such as Facebook and Twitter to create buzz around the GoBank offering. There will also be targeted digital media used as well as partnerships with key financial and technology insiders and several web properties according to Steve Streit, President, CEO and Chairman of Green Dot (the banking holding company for GoBank). Many of these partnerships will focus on households who may be underbanked at this time.

Partnerships with large national retailers are expected, where displays and informational brochures will be utilized promoting trials of the service. Rite Aid has already been announced as a retail partner for the introduction, with Kmart and other retailers expected to follow.

Finally, product placements on national television are also planned, with the first announced partnership being with Project Runway.

From my perspective, GoBank will do well in the marketplace following their KISS strategy that does not overcomplicate mobile banking. While there will definitely be offerings in the marketplace that will have more ‘bells and whistles’, it is clear that the differentiation of GoBank in the marketplace will be to provide basic banking services, with fair pricing, no surprises, using extraordinarily clear communications with nothing a typical banking customer doesn’t need.