The Paycheck Protection Program generated a ton of fees for banks and credit unions, but the Covid-era emergency lending program made an even more lasting contribution to the banking industry in other ways.

Besides helping dramatically accelerate digital banking initiatives, it also generated new insights into the small business market, which financial institutions have struggled to serve well.

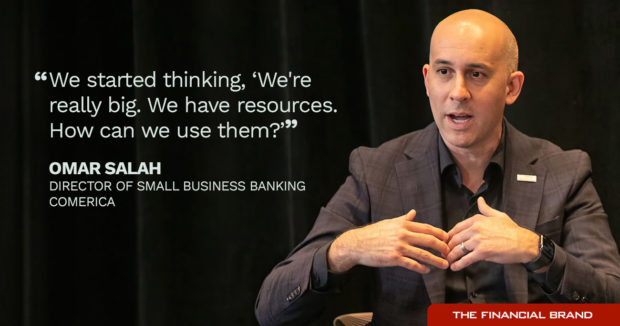

“That was a big eye-opener,” says Omar Salah, an executive vice president and director of small business banking at Comerica Bank in Dallas.

In surveying small business customers amid the pandemic, the $91 billion-asset Comerica realized it had resources that could help meet their needs beyond traditional banking services. The end result is a new program called Comerica SmallBizCo-Op, which launched in early 2023.

It is designed to retain small business customers and attract new ones by providing benefits such as advertising opportunities, discounts on office supplies, the use of coworking space and conference rooms, access to market research, and tickets to sporting events to entertain clients or reward employees. The benefits are free to all customers with a business checking account, regardless of the size of the banking relationship.

“We started thinking, “We’re really big. We have resources. How can we use them?'” Salah says. “Then we started tactically thinking, ‘What can we easily execute on? What if we started sharing our own resources with our small-business customers? And how does that interrelate with one of our core values, to be a force for good?'”

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Fighting Fintechs with Freebies

Banks can tap into a wealth of data that helps them understand and target the needs of their retail customers. But the small business market is more fragmented, and thus, more difficult to serve.

Stuck between consumer and commercial banking, small businesses are the “red-headed stepchildren of banking,” says Isio Nelson, a managing director at BAI who heads its financial services research. “And with 17 different industry categories and thousands of sub-industry categories, it is hard for banks to be experts in all and know enough about what drivers affect each.”

Nonetheless, the small business segment represents a big market for banks — and one that they risk losing to fintechs, which promise quicker access to capital, dashboards that offer insight on the overall finances of the business and other useful digital tools.

Small businesses represent less than 5% of the loan portfolio at Comerica, by Salah’s estimate. But it is a market the bank is actively pursuing.

In June, it launched a digital lending platform called Comerica Small Business Convenient Capital, built in collaboration with Amount, a fintech lender. The platform offers loans of up to $100,000 to small businesses across the country. Businesses submit — either digitally or in person — a streamlined application that typically takes less than 10 minutes.

In most cases, funding decisions are instant or within 24 hours. The loans are made by Comerica itself, with e-signature technology facilitating a digital loan closing.

While its lending platform is in direct competition with fintech lenders, Comerica’s SmallBizCo-Op is an offering that the bank sees as a differentiator.

Creating ‘Opportunity for All’ Small Businesses

The Co-Op program has its roots in focus groups the bank convened to gauge small business needs.

When Comerica posed questions about specifics like free advertising and discounts on supplies, for example, the response was “off the charts,” Salah says. More than 60% of the small businesses said they would become or stay Comerica clients just for the opportunity to advertise on its social media sites.

Expenses for the Co-Op program are minimal, since it does not pertain to underwriting, liquidity, interest rates, consumer protection or compliance, according to Salah. And because small businesses select the resources they want online, Comerica bankers don’t have to manage those details.

The bank is testing the Co-Op program in the Dallas-Fort Worth market, where more than 200 small businesses signed up in the first month. It plans to roll out the program in other markets in 2024. In addition to Texas, the bank has branches in Arizona, California, Florida and Michigan, with some of its businesses, like small business banking, operating in other states, as well as in Canada and Mexico.

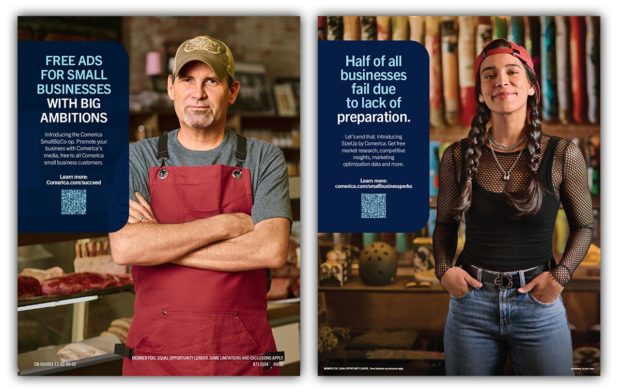

Comerica has been running traditional and digital advertising to promote the new offerings, and its work took first place in the integrated marketing campaign category of the Brand Slam awards from the American Bankers Association in September.

The bank credited the “Opportunity for All” campaign with providing a 24% lift in new customer acquisition over the baseline acquisition rates from the prior year and over control groups.

Read more:

- Flagstar Bank’s New Logo Is Just One Step in ‘Lifestyle Brand’ Makeover

- Digital Marketing Tactics, Trends and Tips to Know About for 2024

Making Comerica’s SmallBizCo-Op Compelling

The growing list of freebies available to small businesses include:

• Access to a business intelligence tool — Customers can use this tool, called SizeUp by Comerica, to get information about their industry, local markets, the competition, consumer spending and more.

• Advertising — Promotional opportunities are available in bank branches, at events the bank sponsors, and elsewhere. Comerica is also offering each customer one free radio ad from its media inventory, which includes spots at Texas Rangers baseball games, Dallas Mavericks basketball games, and Dallas Stars hockey games. The radio placement is a one-time-only perk.

• Sports tickets — Comerica will provide two free tickets to the home game of a professional sports team in the Dallas area once every 12 months. These can be used to entertain clients or reward customers.

• Discounts on supplies — As a big business itself, Comerica has some buying clout, and it is sharing the discounts it gets from office supply and tech vendors with small business customers. They can purchase office supplies for up to 40% less through the Co-op and get discounted pricing on computers and other technology.

• Coworking sites — Complimentary office space is available at Comerica locations in North Dallas for use by small businesses and nonprofits. Each site — there are 10 so far, with another one planned for 2024 — has secure Wi-Fi and equipment for AV presentations. There is also an assortment of common and private spaces, including conference rooms that can be reserved. The bank invested several million dollars in this effort, which it branded as Comerica CoWorkSpaces.

• A resource center for early-stage small businesses — Comerica says its resource center, dubbed BusinessHQ, is intended to help foster the success of “high-need, high-opportunity” entrepreneurs and creators. Those who fit the criteria to become “members” can reserve desks, private offices and conference rooms, use content creation equipment, get technical assistance if needed, and participate in “incubation fellowships.” The site, which opened in May, occupies 8,000 square feet on the first floor of a Comerica banking center in South Dallas.

Read more:

- How Small Business Owners Size Up Their Banking Relationships

- See all of our latest coverage of business banking

Generating Buzz for — and from — Small Businesses

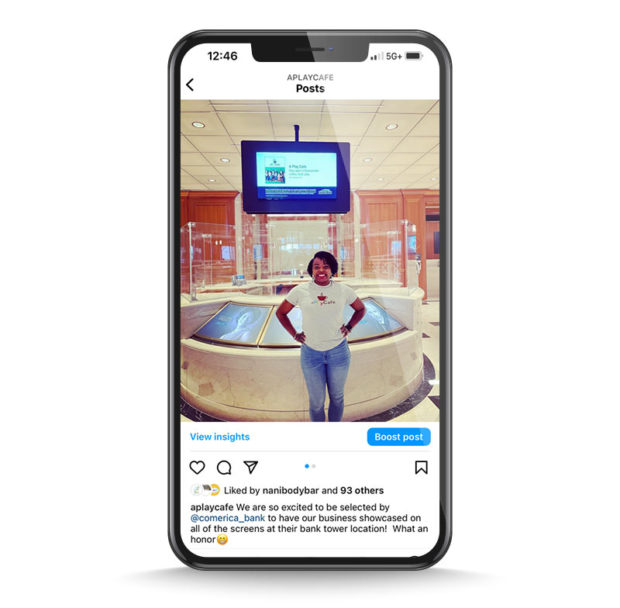

Leah Carter gives the SmallBizCo-Op program high marks. “I became a customer right as they were getting ready to launch everything,” says Carter, owner of A Play Cafe, an indoor playground and coffee shop in the Dallas suburb of Duncanville.

A serial entrepreneur, Carter had banked with larger, national institutions for her previous businesses. But for her latest venture, she wanted a bank with a nearby branch. The closest Comerica office is less than a mile from her shop, which opened in September 2022.

“It’s still a big bank, but I wanted a place where I could go and they knew who I was,” she says.

She tapped into the Co-Op program to score free advertising at Dallas Mavericks and Dallas Stars games, as well as on a screen in the lobby of Comerica Bank Tower.

Carter acknowledges that she can’t establish a direct link between the ads and an increase in customers. But, she says, “It’s still just really cool, especially for someone like me who’s building a brand with the intent of hopefully franchising.” When Carter posted pictures of the ads on social media, they generated more of a response than most of her other posts, she says. “There’s constantly pressure to post something engaging that people want to click and comment on. So, certainly, that was worth it right there.”

When Carter posted pictures of the ads on social media, they generated more of a response than most of her other posts, she says. “There’s constantly pressure to post something engaging that people want to click and comment on. So, certainly, that was worth it right there.”

But it is not just high-profile advertising and other perks that have impressed Carter. She also enjoys Comerica’s openness to her small business. A banker at her branch, for example, helped her apply for a business credit card, even though her company was brand new. Others had told her she should wait at least a year.

“I didn’t need the money, per se, because we were getting ready to open,” says Carter, noting she had tapped into her retirement account and personal credit cards for startup costs. “But I really wanted to start establishing credit for the business.”

People have recommended she divide her business among multiple banks. But for now, she is content to stay with Comerica, where she also has business checking and savings accounts. “I’m really happy with where I am and especially the expanded services with the Co-Op.”

Read more: