Small business optimism is improving. In the J.D. Power 2023 U.S. Small Business Banking Satisfaction Study, small businesses expressed a brighter outlook and showed better financial health than a year earlier. They reported improved access to affordable funding to meet business goals and increased confidence in their ability to weather a cash shortfall.

With these improvements, the percentage of those who view their business as cash and/or capital constrained shrunk to 46%. That’s down from 50% a year earlier and 48% in 2021.

Yet, their optimism still remains below pre-pandemic levels, as market conditions continue to be challenging. More than half (55%) say that inflation is having a negative effect on their business.

With this blend of optimism and pressure, it’s no wonder 76% of small businesses are interested in receiving advice from their primary financial institution. And the banking industry is doing a slightly better job of responding to this need, with 57% of small businesses saying they received advice in the past 12 months, an increase of 3 percentage points from 2022.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Types of Advice Small Businesses Want Most

Providing advice is a fantastic opportunity for banks. When small businesses receive advice, ratings of satisfaction, likelihood to recommend and likelihood to reuse the bank increase significantly. Small businesses that receive advice also are more likely to apply for credit, report better approval rates for new credit and are more likely to use services like cash management, lines of credit and wealth management with the bank. Customers who receive advice are generally a bank’s best customers.

Banks across the country deploy a range of approaches — both in person and through digital channels — to provide advice to small businesses. But no matter a bank’s definition of “small business banking” or its service model for managing these relationships, there are three overarching types of advice that small businesses want to receive today: guidance that will help them avoid fees, better manage their spending, and improve the credit score and creditworthiness of the business.

Advice that small businesses want to receive from their primary bank:

- How to avoid fees

- How to better manage spending and savings

- How to improve the business’ credit score and creditworthiness

Yes, small businesses will still seek advice regarding business financing options, ways to gain better investment returns, counsel on expanding or selling the business and other important matters. But these three topics are foundational. They are broadly relevant to small businesses, and research shows that each one is a satisfaction driver. Engaging with small businesses on these topics will boost satisfaction and other important loyalty indicators.

Competitively, it’s time to get moving. Most of the nation’s largest banks are building strong levels of client engagement around these topics. Some regional banks are as well.

Help With Avoiding Fees

Of course, small business clients universally like the idea of not paying fees — and most do not do so.

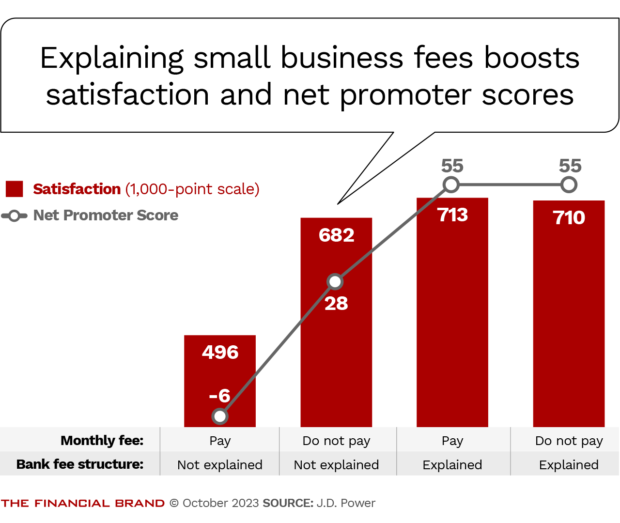

But four in 10 small businesses — 41% — pay a monthly fee on their primary business checking account, whether that is called a maintenance, service or analysis fee. And there is no question that communicating and explaining fee structures softens the blow.

Even among small businesses that pay fees, loyalty metrics stay in healthy ranges when a client feels the bank has been transparent and explained its fee structure well. The added benefit of effectively communicating about fees is that clients have a better understanding of them, which ultimately reduces fee-oriented problems.

The bar is rising, though. Increasingly, small businesses want their bank to proactively communicate how they can avoid being charged fees in the first place. When banks do this, satisfaction improves beyond the high levels attained when fee structures are explained. But today, only 30% of small businesses say that their bank is communicating how to avoid fees.

Small businesses recognize Bank of America for having this type of proactive communication. When small businesses meet the requirements to have their business checking account monthly fee waived, BofA communicates this, along with the specific waiver requirements that were met. BofA also regularly encourages clients to avoid fees by becoming a member of their Preferred Rewards for Business program.

Read more:

- Comerica’s Innovative Co-Op Initiative Stands Out with Small Businesses

- 5 Ways Banks Can Prevent Small Business Defections to Fintechs

Guidance on Spending and Savings

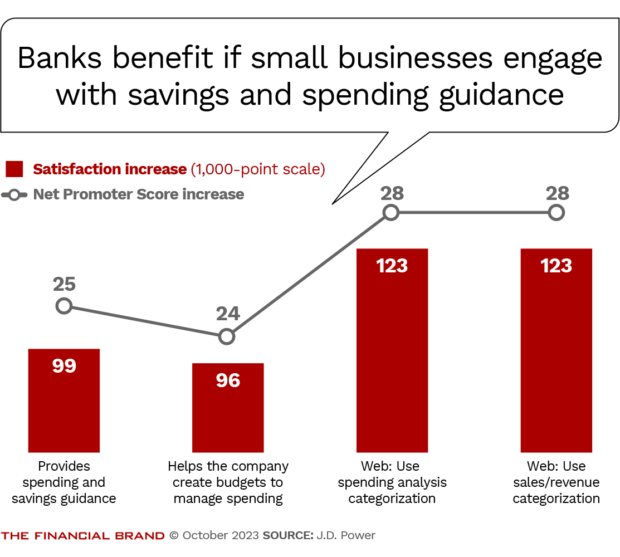

Insight on spending helps a business avoid fees and make better decisions about where to spend and where to save. Insight into budgeting and saving money improves the ability of a business to ensure it remains profitable and has the necessary resources to grow.

Small businesses respond favorably to bank engagement around these topics.

Satisfaction levels peak when small business clients use digital financial tools to help them manage the business, particularly tools that categorize spending and revenue. In addition to helping manage cash flow, these tools enable businesses to dive deep to understand spending by category and sales by product and client.

Two banks that stand out in the small business research for being particularly strong in providing these types of digital services are Bank of America (for its Cash Flow Monitor) and U.S. Bank (for its Business Essentials Dashboard).

Read more:

- What Small Businesses Want from Mobile Banking Apps (But Don’t Get)

- How Wells Fargo Rebooted and Personalized Digital Business Banking

Advice on Improving Credit Scores and Creditworthiness

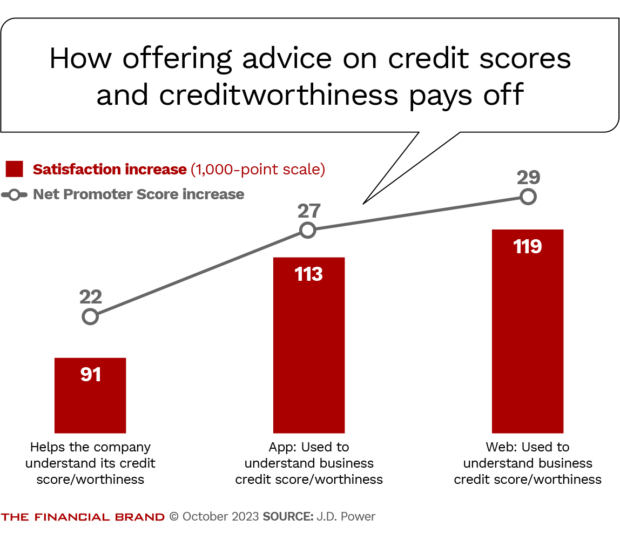

Creditworthiness is the next step. Small businesses want to understand where their credit score stands today and how to build creditworthiness. But only 24% of small businesses feel that their bank has helped them understand these things.

Those that feel their bank has helped have higher rates of applying and getting approval for new business loans and lines of credit. They are more likely to have a business credit card, a line of credit or a Small Business Administration loan with the bank.

Capital One stands out in this effort. It has built on its successful CreditWise program for consumers, and small business clients recognize the bank for helping them learn about their business credit scores, how they are calculated, and why they are important. And beyond education, Capital One’s clients are more likely to believe the bank has helped with improving the credit score or creditworthiness of the business.

See all of our latest coverage of business banking.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Steps Banks Should Take Now

Is your bank marketing products, tools and insights related to these three types of advice? It should be.

This isn’t just a marketing recommendation; rather, it’s necessary to rethink in-person interactions and upgrade digital content and tools. Communicate through a variety of mediums and during key customer journeys. When providing these forms of advice to small businesses, remind them of the progress they are making. Have visual celebrations and find ways to encourage them to continue using the advice provided.

These three types of advice help small businesses become better clients of the bank. Encouraging them to use the bank as a resource to gain greater control over their finances is a clear win for both the business and the bank.

About the author:

Paul McAdam is senior director of banking and payments intelligence at J.D. Power.