Many financial institutions are aware that H&R Block is building a platform of consumer financial services, but they may have missed Block’s intentions in the small business area. Given that business banking continues to be the bread and butter of regional and community banks, the tax-preparation company’s commercial banking push must be taken seriously, especially since the pandemic has driven an increase in startup activity,

Both the consumer and business banking expansions have been proceeding under the company’s “Block Horizons” strategic initiative, an effort to continue to broaden Block’s product base in ways that complement its existing business lines.

Building Blocks:

More than 2 million small firms use H&R Block for their business taxes, giving the company a strong base for cross selling business banking services.

Block officials have said in earnings calls that its business tax clients already obtain additional services from the firm’s offices. This has chiefly been a matter of cross-selling personal services.

“We understand that to fully capitalize on the opportunity in this category, we must intentionally focus on the unique needs of small business owners, creating very specific products and services that provide personalized experiences relevant to their business needs,” Kirk Simpson, CEO and Co-Founder of Wave Financial, told analysts at the end of 2020. Wave was acquired by Block in 2019 and Simpson remains with the company.

The parent company’s hope is to drive more business to its 360 Block Advisors locations, which specialize in small business matters. Block officials have told analysts that they consider this a multi-year push that will produce profits in the mid-term future.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

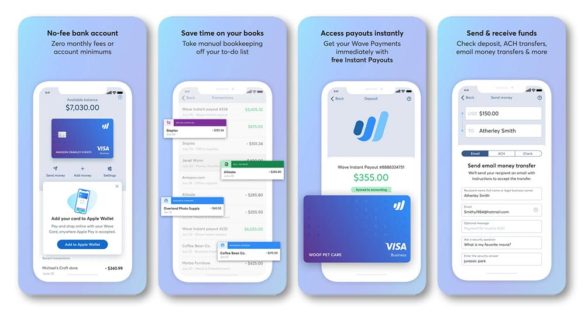

Banking App Overlays Free Accounting and Invoicing Software

The centerpiece of Block’s business-side effort is being built on the Wave acquisition. Wave, founded in 2010, offers free desktop software designed to help “microbusinesses” of five employees or fewer to perform basic accounting, invoicing and related tasks. Wave’s revenue comes from selling other services, such as payroll processing and payments software solutions.

Wave has a base of approximately 400,000 users and its revenues grew by 35% by the end of June 2021, the end of Block’s fiscal year. Company figures indicate that much of the flow of invoices issued through Wave aren’t going through its own payment system yet, indicating strong potential.

In mid-2020, after the acquisition, Wave introduced the beta version of its app, Wave Money. Among other goals, Block hopes use of the app will drive more volume to its own payments channels. Another opportunity is seamless flow of data from the app into Block tax preparation. (As of early August 2021 the app was coming out of beta but was only available through the App Store.)

This free app includes access to Wave’s original set of services, and added on banking services. This includes a free business banking account with no account minimum or monthly fee, a debit card and mobile app, including business mobile remote capture.

The banking services are provided through a banking as a service arrangement with Community Federal Savings Bank. Deposits are growing, according to officials, though no specific totals have been disclosed.

Serving Small Businesses Comprehensively Yet Simply

Simpson says that a key need for the market is the ability for small firms to handle the financial side with minimum time commitment. This calls for simplicity in approach and tools for small firms to be paid faster. He says Wave has been careful through its development not to add features at a level that would appeal more to outside accountants, as that would nix the appeal to owners themselves.

“This isn’t something many small firms do well,” says Simpson in an interview with The Financial Brand. “They are usually managing it through Word documents, spreadsheets and shoeboxes.” Adding a product like Wave by itself is a step up.

Simpson sees the app as the next stage, making Wave more accessible while adding banking services. Business users will save an estimated $425 in bank fees, on average, the company estimates. There are over 400,000 users of Wave, and already thousands are using the Wave Money app, according to Simpson.

Longer-term, Simpson says, Block will look beyond deposit services for potential expansion.

“Once we have the small business owners using the small business account, there are all sorts of opportunities around lending,’ he says.