The ranks of fintechs using Banking-as-a-Service to attract small business users to their sophisticated apps just got a jolt. An elephant by the name of Intuit just entered the room.

But it’s not just fintechs that are looking over their shoulder. Thousands of community financial institutions that consider small business relationships their bread and butter are — or should be — taking notice.

Intuit, with its popular QuickBooks accounting software, is arguably the best-known brand among the small business community. Now Intuit in cooperation with Green Dot and its Green Dot Bank, is going directly after small business checking accounts.

One critical difference from your typical hopeful neobank or long-established community bank: Intuit, via its QuickBooks accounting software, already “owns” a community of five million small business users. This includes a broad range of small firms, but many are Main Street Mom and Pop businesses with under 20 employees.

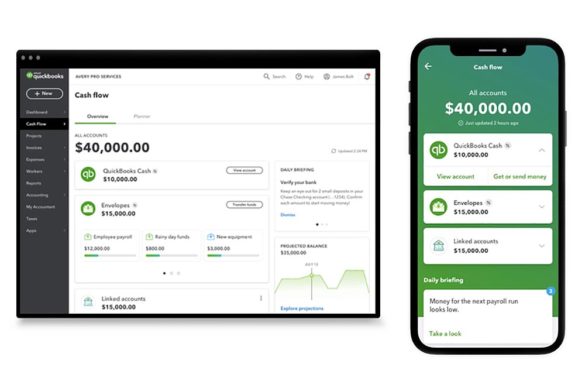

Until introduction of the company’s new QuickBooks Cash service, these firms could manage their companies’ finances via the software but needed to run the associated funds through deposit accounts at one or more banks or credit unions. This could mean manually pulling together data from multiple accounts in order to see where the business stands. With QuickBooks Cash, many small firms could find it not only more convenient but cheaper and faster to let Intuit and Green Dot provide a seamless service where accounting and many aspects of the deposit side of banking meet in one service.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Gobs of Financial Opportunity Waiting to Be Gathered

Many community banks would covet a business customer base of the size Intuit has already cultivated. The company describes the QuickBooks service as an “ecosystem.” Its members run $1.2 trillion of invoices through it and use the service’s payments system to process $55 billion of those invoices, according to Rob Daniel, Director of Product, QuickBooks Cash, in an interview with The Financial Brand.

Daniel says that QuickBooks processes $114 billion in payroll for small businesses annually via the ecosystem. And $1.7 billion in capital has been disbursed to Intuit customers from QuickBooks Capital, the ecosystem’s business lender.

QuickBooks Cash is a checking account that “will help make all this money movement instant, free and with an incredible amount of transparency,” says Daniel, who was an investment banker prior to joining Intuit. He says the intent is that QuickBooks Cash will become firms’ primary banking account, replacing traditional business banking relationships.

The account will have no opening fees, no minimum balance requirement, no maintenance charges, and no overdraft fees. As introduced it will enable deposits and payments to be made through the system. Companies will also be issued a debit card.

“We don’t support remote check deposit or check writing today,” says Daniel, “but you can expect us to support both in the foreseeable future. An incredible number of small businesses and even enterprise businesses still use checks — they represent a massive amount of B2B payments.” At that point, the company says, the QuickBooks ecosystem will provide complete cash-flow management in one place. This will eliminate the need to tap multiple outside providers, making Intuit’s QuickBooks look a lot like a bank.

Beyond avoiding many common fees, QuickBooks cash accounts earn an APY of 1%, which is 25 times the average rate paid on business banking accounts.

Read More:

- Google Banking: Great Leveler or Great Risk for Community Institutions?

- How Today’s Community Bank Becomes a Digital Deposit & Loan Machine

Meeting the Needs of Business People Too Busy for Banking

For Daniel, the ideal small business customer for the company’s software and the newly integrated bank account is someone whose business continues to engage in the daily blocking and tackling of running a company. This includes operating the actual business of the company while attempting to make sure that cash flow remains adequate to pay bills, payroll and taxes.

All that adds a level of complexity that distracts business owners from doing what they really love and what they’d originally set out to do, Daniel states.

In fact, he says, many small businesses don’t start out with a distinct business banking account, instead attempting to rely on the founder’s personal accounts.

“We’re seeing a lot of resonance with firms that are just getting started,” says Daniel. “Their default would be to mix personal and business money together in a personal account. QuickBooks Cash is serving as a catalyst to get to them to manage business funds separately.”

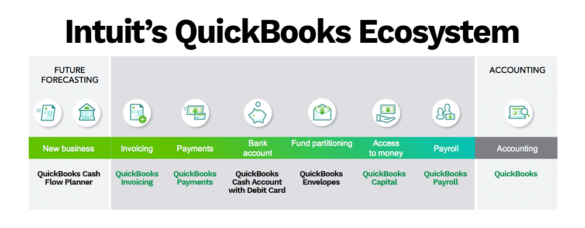

How QuickBooks Cash Fits into Intuit’s Ecosystem

In the diagram below, the functions with black captions are added or further facilitated by putting a financial account into the QuickBooks system.

“You can think of QuickBooks almost as an operating system for a small business,” says Daniel, “with an incredible collection of tools and services that can be included. We already made invoicing and accepting payment through the system doable. Now payments can come into our own small business checking account, QuickBooks Cash, and then from that same small business account, the customer can make payments via bill pay or funds transfer or debit card transaction.”

Adds Daniel: “QuickBooks Cash sits in the middle of the whole system. It is the glue that brings it all together.”

As a branchless operation, Daniel says, QuickBooks Cash won’t be a viable option for small businesses that rely heavily on cash transactions. But for most other businesses the branchless blend of bank and accounting software should have appeal.

QuickBooks has extensive artificial intelligence capability, Daniel notes. The addition of the deposit account to the system will help Intuit offer more sophisticated analysis of each company’s fiscal status including automated advice based on data external and internal to the company.

Take the Cash Flow Planner. “The planner takes in information about that business from all over the ecosystem,” says Daniel. “It also adds considerations around many similar types of businesses that are part of the ecosystem all across the U.S. That enables it to inform the user regarding what the firm’s future liquidity position may look like. This can help empower decisions that the small business firm’s management wishes to make.”

Besides incorporating automated tracking and monitoring with AI-based recommendations or advisories, QuickBooks uses the Cash account to provide software adaptation of a longstanding low-tech financial management tool. This is “Envelopes.”

Many small business owners literally earmark envelopes full of cash and undeposited checks towards future expenses that they know are coming. They don’t trust themselves to not spend the money before the bill comes due, so they intentionally hold out the funds from bank accounts so their illiquidity prevents them from spending essential funds.

While this can be effective to a point, it adds the risks of lost or stolen cash and checks to the obstacles facing small firms. QuickBooks Cash is set up to allow small business owners to set up virtual envelopes so they can partition earmarked money while getting it into their accounts and the QuickBooks system. This gains them safekeeping as well as a bit of interest through the Intuit/Green Dot accounts.

A key part of the idea is ready access to funds. “The money moves instantly,” explains Daniel. “It doesn’t take three or four days for a payment to settle from your payment processor into your bank account and another two or three days for the funds to be available for payroll. Because QuickBooks is bringing all of this together the same day you get paid, within 30 minutes the funds are in your account and you can use the money to fund payroll.”

This relies in part on another part of QuickBooks Cash, free instant deposit service. After a company has passed a security check, it can qualify for instant availability on deposits.

Read More: Fintechs Threaten to Disrupt the Small Business Banking Market

Relationships Versus Digital Experience

Of course, many members of the ecosystem already have business banking relationships.

“There is some resistance, some inertia,” says Daniel. “Many have deep and longstanding relationships with their banks. And some institutions offer the personal touch of a relationship manager and that adds some service quality. There is a stickiness to that.”

On the other hand, Daniel continues, younger firms, run by Millennial owners, tend to like the consumer-like digital experiences that an operation like QuickBooks can provide.

“That’s where we have more resonance,” says Daniel. “We’re already seeing that in our data.”

One factor that has helped move relationships to the new accounts is the overall emphasis on speed and availability of funds, says Daniel. This serves to counteract the natural tendency of firms that have already established business banking accounts to stay put, having hooked many other relationships to those accounts. Rewiring their banking is something many owners shudder at. Intuit’s hope is that the benefits offered will overcome that.

One plus that the company is relying on is that a QuickBooks customer can establish a Cash account in five minutes or less online.

“We’ve kind of unmoored ourselves from some of the traditional reliance on physical presence,” says Daniel, “which plays incredibly well in the current environment that has been accelerating society’s digital dependency.”

For its part, Green Dot chiefly will be in the background. “We own and manage the customer relationships,” Daniel explains. Beyond digital outreach to build its base, he points to the company’s numerous relationships with small business advisors such as accounting firms, which can help it establish more business banking relationships over time. In fiscal 2019 just over half of Intuit’s revenues came from the small business and self-employed market. Among its consumer-side businesses are financial services related to its Mint and TurboTax operations.

Big Opportunity for Green Dot to Continue Breakout from Consumer Banking

During a summer 2020 earnings call Green Dot CEO and President Dan Henry spoke with enthusiasm of his firm’s expansion from consumer banking BaaS to the business side, with the QuickBooks partnership set up as well as its arrangement announced shortly beforehand to provide business checking accounts for customers of Kabbage. He saw the two deals alone providing Green Dot with the opportunity to acquire millions of new account relationships. (Subsequently Kabbage announced its pending acquisition by American Express.)

These deals came as Green Dot, which offers payment and banking services on its own, separate from BaaS arrangements, completed a rebuild of its leadership team through external hires and internal promotion. This includes adding the former head of financial services at Walmart as Green Dot’s Chief Product Officer to assist in strategizing the company’s BaaS efforts. Green Dot Bank has total assets of $2.5 billion.