In the wake of COVID-19, 2021 is shaping up as a time when commodity products like business loans won’t by themselves create a successful commercial banking relationship.

More of the credit aspects of small business banking are moving to aggressive fintech business lenders, though many small businesses aren’t actually looking for fresh loans or credit lines right now. What many of them may really want in the year ahead is advice on how to navigate the remainder of the COVID-19 period, and how to participate in the recovery beyond that. This is where providing relationship managers can help small businesses and help institutions hold onto their business.

At the same time, holding onto small firms’ business will also hinge on perceptions of how well your bank can solve the pain points that small businesses often encounter in their banking relationships.

A review of studies on the state of small businesses and small business banking, and interviews by The Financial Brand, indicate that banks will need to find a way to provide advice to regular business customers without necessarily having frequent face-to-face contact.

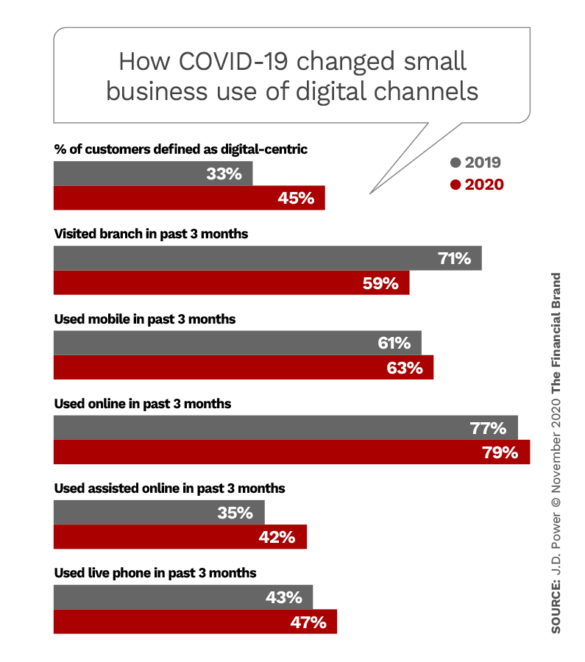

Even though many business customers actually favor going back to branches, a growing number of them have become digital-centric during the pandemic. This comes as some states have started to reintroduce levels of lockdowns that will affect small businesses as well as the banking institutions they work with.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

State of Small Business and Demand for Commercial Loans and Lines

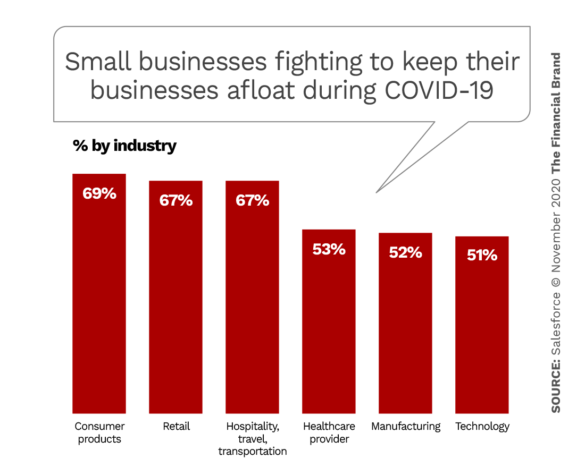

Over one million U.S. small businesses have already closed permanently, according to a Wall Street Journal estimate. One in five small business owners told the National Federation of Independent Business’ COVID-19 pulse survey that if the current economic picture doesn’t improve within six months that they expect to have to close their doors. And the group’s October 2020 study found that an additional 19% of owners estimate that they will have to close for good if conditions don’t improve within seven months to a year. The same research found that most owners don’t see conditions improving until at least 2021, with one out of four don’t expect a turnaround until sometime in 2022.

As popular as the Paycheck Protection Program loans proved, so far that appears to be a one-time deal and it turned out to be more of a grant program through its forgiveness aspects. While financial trade groups have spoken of their members being ready and able to lend, especially given the banking industry’s enormous current liquidity, the appetite for fresh conventional business credit is low, according to the October edition of NFIB’s Small Business Economic Trends report: “Credit markets have never been friendlier, and the Federal Reserve promises that will continue indefinitely. … Loan rates have never been so consistently low.” Yet 56% of the organization’s sample say they aren’t looking for credit and 29% say their credit needs have already been met. Only 3% of those firms queried said they had unmet credit needs.

For many firms a major problem is COVID-19 distraction. Rather than needing credit, many small firms responding to a survey by Doblin, a Deloitte business, said they needed support in reducing expenses (41% of the sample) and generating more revenue (40%). Beyond that, many say that the special situations that keep arising under COVID-19 have distracted them from core business efforts, such as operations, sales, marketing and business development. Time and schedule have become greater challenges than ever.

One owner of a small real estate business told Doblin that she had moved banks during the pandemic because of time pressures.

“My new bank was open on Sunday and that was the biggest factor to join,” she said. “I grew my relationship with the bank manager and that reduced stress.”

Read More:

- Fintechs Threaten to Disrupt the Small Business Banking Market

- Intuit Muscles into Banking with AI-Powered Primary Checking Account

- Good Digital UX Is Now Table Stakes for Small Business Banking Success

Role of Account Managers (and Alternatives When Firms Don’t Have One)

The J.D. Power Small Business Banking Satisfaction Study, which focuses on large national and regional commercial banks, finds that customers express greater satisfaction with services when they have an account manager.

Part of that satisfaction hinges on personal relationships, which now must largely be built and maintained remotely.

“While account managers are key drivers of small business banking satisfaction, the usage of branches declined significantly,” according to the J.D. Power study. “Customers are also increasingly opening new accounts via digital channels.”

As COVID-19 has pushed small business towards digital channels — as the chart below shows — this has skewed satisfaction towards digital factors. That’s chiefly because branches were closed for so long and in many areas continue to have curtailed hours and availability. J.D. Power found that overall satisfaction among digital-centric customers rose by seven points, while branch-dependent customers’ overall satisfaction improved by only one point. (The firm’s study defines “digital-centric” customers as those who use mobile/online banking and who have visited a branch once or less in the past three months.)

The impact of the COVID period on future patterns remains to be seen. When a “new normal” returns, 36% of small businesses surveyed by J.D. Power say they will return to branches, while 64% say they will use branches somewhat less than pre-pandemic, according to Paul McAdam, Senior Director, Banking & Payments Intelligence.

Many small businesses may be too small to warrant an account officer with some banks, according to McAdam, and for them mobile business banking is a strong factor in satisfaction. Types of small businesses that have adapted to digital channels include medical practices, law firms, insurance agencies, and architectural and engineering firms.

Help Needed with Problems Big and Routine

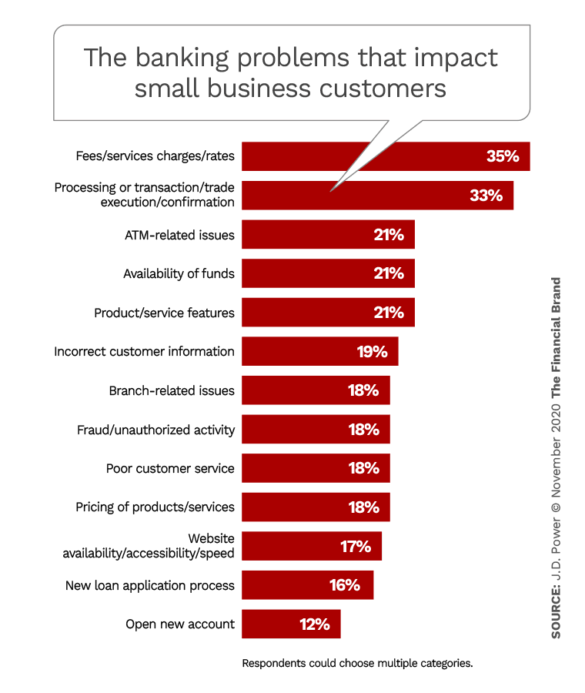

A key element in satisfaction with institutions was their perceived help during the application and funding phase of the Paycheck Protection Program, according to the J.D. Power study. This fed into multiple elements of the company’s satisfaction formula, including satisfaction with communication and advice and satisfaction with problem resolution. While PPP represented a significant one-time factor in satisfaction, many typical banking problems also contribute to satisfaction — and having a relationship manager to sort them out can help. Indeed, assistance with problem resolution from an account manager provides a major lift for the institutions Power studied.

The chart below illustrates the range of banking rough spots that customers require help with.

This chart underscores the variety of other factors that can also contribute to satisfaction, among them: waived charges, late-payment forgiveness, advice/guidance, and community support.

“These types of actions will remain relevant for the foreseeable future,” according to J.D. Power, ” as some small businesses will continue to struggle even after the pandemic subsides.”

“While the benefit of account managers is clear,” according to the report, “banks must find ways to improve the servicing levels provided to customers without an assigned account manager.”

Niche Players in the Wings Add Product Breadth

Banks need to figure this out because, even as they seek ways to make small business banking more profitable, relative newcomers push further into this segment. Research by Accenture indicates that 42% of small and medium-sized businesses surveyed believe that alternative providers can offer better service than traditional banks.

“42% of small and medium-sized businesses surveyed believe that alternative providers can offer better service than traditional banks.”

“Unlike in the past, when banks had been stable and unchallenged in serving the small and medium-size enterprise segment — because the hurdles made it tough to enter without a strong model — SME banking is becoming fragmented,” according to a paper from Accenture, “Bank of the Profitable SME Base.”

One example outside of the traditional banking sphere can be seen at American Express, which has been expanding the range of products and services available to small business. In an analyst interview at a Bank of America investors’ event, Jeffrey Campbell, CFO, put the company’s summer 2020 acquisition of fintech business lender Kabbage into perspective.

“Kabbage is really all about being able to offer a broader range of financial services products to our small business customers to build a stronger primary relationship, which is then all about driving more card spend, more short-term borrowing and more use of our non-card-based solutions.” He noted that Amex also offers some short-term business lending options apart from Kabbage already and that the fintech is in early days of offering a business checking product.

What Small Business is Increasingly Looking For

Research by Accenture during the pandemic finds that even while many smaller financial institutions earned kudos from small businesses due to their performance with the PPP, many have felt overlooked by their banks during the crisis overall. One part of the research saw firms downgrading their ratings of both their primary bank’s digital small business services and their relationship management efforts.

“We are not just a provider of financial products but also a trusted resource. We like to think that we aren’t just in the business of debits and credits.”

— Yury Nabokov, Machias Savings

One weakness Accenture identified is the practice of organizing the business banking market by the size of the business. This “demographic” approach follows tradition and even logic, to a degree, but it doesn’t quite work anymore. This practice can result in some firms being handled by the retail side of the bank, while others wind up in Commercial Banking. The core of the problem is that size alone isn’t always the best determinant.

“The diversity in the SME segment is causing banks in general to miss the mark in understanding and addressing customers’ needs,” the report states. “For example while 62% of SMEs we polled currently receive or would consider receiving access to remote advisory services, banks believe that remote advice is not scalable.”

This sounds like an opportunity going begging. The Accenture paper continues: “Only 25% of SMEs have given a ‘very good’ rating to relationship managers post COVID-19, possibly because banks’ rigid segmentation criteria impede relationship managers from providing SMEs with the service they want. The bottom line? SMEs are either overserved or underserved, which delivers optimal value to neither customers nor banks.”

Given that the J.D. Power research indicates that an account manager’s advice represents a major factor in customers’ satisfaction ratings of small business banks, this sounds like banks are not seeing the need.

There are alternatives to one-on-one account management relationships. One discussed by the Accenture paper is educational outreach.

Maine’s Machias Savings Bank runs Small Business Academy, a series of lessons in business management. This year the program went virtual to accommodate concerns about the coronavirus. Yury Nabokov, AVP, Customer Experience Manager and Marketing Strategist, says the program generally appeals to startup businesses as well as those that are ready to start growing after establishing themselves. The academy dovetails with the bank’s Fast Forward Maine workshop series, which concentrates on specific subjects. Previously a meeting that travelled around the state, in 2020 it has been presented virtually.

Nabokov says the bank invests in these programs to stress that “we are not just a provider of financial products but also a trusted resource. We like to think that we aren’t just in the business of debits and credits, but in the business of taking our commercial customers from point A to point B. Products and services by themselves are commodities.”

Accenture’s report makes it clear that loyalty is a fragile thing and that it can break and reform elsewhere. This exposes traditional banks to competition from new players operating within “ecosystems.”

Two examples are Square Capital, a business lender that is part of the Square payments ecosystem, and Intuit, which has been building out credit and deposit/payment functionality among the millions of users of its Intuit Quick Books products. (Square has been working on launching its own bank as well.) Both organizations have the advantage of seeing real-time data about the companies that are in their systems, an advantage that traditional business lenders typically don’t enjoy.

The ongoing COVID-19 crisis and the accompanying economic mayhem represent an opportunity for traditional institutions to provide guidance that many small businesses crave. Suggests the Doblin paper: “Banks could help businesses safeguard their future by offering to develop a tailored emergency protocol with small businesses, going through a guided tutorial or checklist to develop a specific plan for a variety of emergency situations.”