Governments in many countries have recently introduced COVID-19 crisis small business financial relief programs that are intended to keep small businesses from failing in the short term. In some cases, these programs extend to the employees of these businesses that make up the lifeblood of local economies. While these loans, grants and forgivable payroll continuation initiatives are helpful, they are not enough for most small businesses to stay in business in the long term.

The reality of this health and economic crisis is that ‘business as usual’ may not occur for months if at all. Most small businesses will have revenue challenges as consumers continue to be concerned about coming in close contact with others and as people have become accustomed to shopping online, eating home cooked meals, spending less, etc.

The question for financial institutions becomes, how can the financial services community help local small businesses survive in the immediate and long-term? How can organizations that may not feel comfortable offering loans to struggling small businesses assist in unique ways to help an entire SME ecosystem in their respective communities?

Some exciting options have just been introduced by Chinese digital banking and e-commerce provider Alibaba. They may be a model for other financial and e-commerce providers in the future.

Read More:

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Small Business Challenges are Huge. But So are the Opportunities

Small businesses are the backbone of the economy in every country. In the U.S., businesses with fewer than 100 employees account for 98.2% of all businesses, and those with fewer than 20 employees account for 89% of the business marketplace. Before the coronavirus crisis, more than 500,000 new small businesses were started each month.

Not all of these were the storefronts we visualize, like restaurants, bars, florists, bakeries or galleries. Some were small e-commerce firms and an increasing number of small businesses being solo freelancers or gig economy contractors who depend on other businesses for their livelihood. In fact, according to the SBA, more than 50% of small businesses were home-based.

Some additional insights that provide a perspective on the small business segment:

- Before the coronavirus crisis 84% of small business owners felt optimistic about the future of their companies (StartBlox)

- Almost two-thirds of small business owners begin with only $10,000 in capital (Intuit)

- Approximately a quarter of small businesses begin with no financing (LendEDU)

- More than 80% of small businesses fail due to cash flow problems (Fundera)

- In 2019, only 40% of small businesses were profitable (SmallBizTrends)

- Only 64% of small businesses had their own website (Clutch)

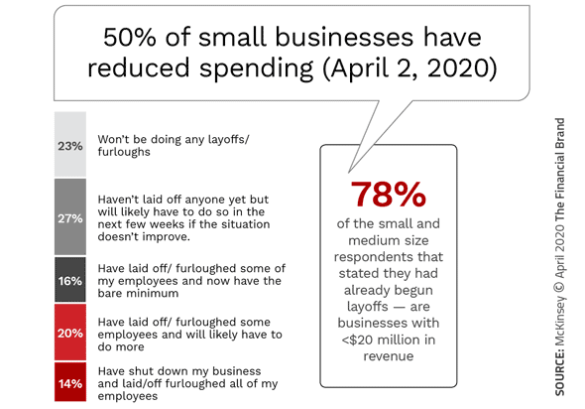

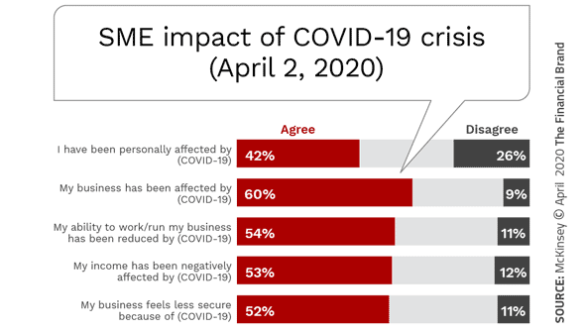

From these basic statistics, it is clear that the majority of small businesses do not have the foundation to survive major business interruptions. This fragility limits the availability of traditional small business borrowing, with many small business owners already tapping out their personal credit card limits.

Read More: When Opening Accounts in Branches Becomes Impossible

Alibaba Responds to COVID-19 SME Crisis

The U.S. and most of the rest of the world are still waiting for the “flattening of the curve” as it relates to the health and economic impact of COVID-19. Alternatively, China is slowly returning to a highly revised normal as coronavirus cases have dropped significantly.

Not surprisingly, small businesses – many of which have been closed since the beginning of the Chinese New Year in January – have not recovered. The good news is that China’s largest e-commerce and fintech firm Alibaba is offering support for small and medium enterprises (SMEs) beyond funding. They are helping firms run their businesses better.

Funding

One of the major benefits that firms like Amazon, PayPal, Cash and Stripe have is an “insider” understanding of the details of each of the businesses they serve. These financial and digital retail organizations see every payment received from a customer and, in the cases of payment platforms, many of the expenses of small businesses.

For instance, because PayPal understands my Digital Banking Report business model, they are comfortable offering a line of credit when my traditional bank may not consider this support. This illustrates the power of customer insights, especially when working with SME firms.

To leverage insights that only Alibaba has, merchants using the Alipay platform can apply for loans offered by the “no-contact micro loan” campaign jointly launched by MYbank, an online bank under the Ant Financial brand. The program provides loans with no interest for a period of one month to more than 350,000 street-side merchants and other small, independent businesses in the city of Wuhan.

The program is expected to provide financial support to around 10 million micro-and-small business enterprises around China as business slowly returns to normal. Alibaba will also offer immediate settlement of payments, allowing merchants to be paid as soon as Alibaba receives the money from consumers.

Marketing Support

To provide support for businesses on a local level, Alipay has set up a special section on its landing page that allows their 900 million users to easily locate merchants and their products and services. The new placement on the Alipay app also shows livestreams of tourist destinations on a local level, restaurants to visit and specialty shops.

With location data from a consumer’s mobile device, residence address information or possibly just an understanding of the local branch a consumer may use, financial institutions could easily promote local small businesses on mobile banking apps. Payment platforms could do the same.

Taking this concept a step further, forward-looking financial institutions could easily place local business links or special offers within their mobile banking platform. This effort may take significant development time for a financial institution, but the payoffs to the overall community could be massive.

Digital Development Support

Alipay unveiled a plan in March to work with 50,000 Independent Software Vendors (ISVs) who would support the digital transformation of 40 million service providers. Alipay also introduced several incentive programs to encourage some of their software vendors to leverage Alipay’s full suite of digital tool kits, such as digital cashier assistant and smart marketing, to develop sector-specific solutions for 5 million storefronts of multiple chain brands.

Every financial institution globally has relationships with hundreds or thousands of programing and digital support companies. By providing financial incentives to those small businesses and contractors who could improve the digital capabilities to other small businesses in local markets, the potential for survival of both the contractors and merchants increase.

Small Business Digital Training

Not only has the COVID-19 crisis exposed the flaws in the digital capabilities of banks and credit unions, but many small businesses were caught flat footed. While more progressive firms moved to a totally digital model, many other small businesses were unable to pivot. If this was possible, this alternative model may have provided some level of financial support.

Even before small businesses were able to open their physical doors, Alipay provided free training courses via its app to equip service and catering workers, such as cashier staff, storefront managers and small business owners, with the skills and knowledge they need to fully tap into the digital technologies offered by the Alipay platform. They also helped organizations to build websites, mobile platforms and e-commerce capabilities that will increase the potential for post coronavirus success.

Every small business could benefit from training on the way to improve their business model from a digital or basic business management perspective. Most financial institutions have relationships with firms that could provide this form of training or could conduct classes themselves. No investment could have a greater local impact than to use local resources to help local businesses.

“In every hardship, there lies an opportunity to envision and create a brighter future. We firmly believe that, after the COVID-19 outbreak, service providers who are able to tap into the power of digital technologies will come out the strongest,” said Simon Hu, Chief Executive Officer of Ant Financial. “We are committed to supporting SMEs and will continue to provide leading digital technology solutions to support the recovery of small businesses and help them prepare for the future.”