One area where many banks are getting lapped by fintechs is with small and midsize business customers. But the shortcoming that’s causing this dynamic is fixable.

Bankers — who often perceive the SMB segment as fee-averse — need to recognize that some of their business customers are already spending thousands for subscription services in accounting, payroll, marketing, and customer relationship management.

By integrating these types of services into their own platform, banks can enhance relationships with their business customers and tap a new source of noninterest income.

Some of the banks that have pursued this strategy, when asked by Q2 about their results, reported that the fintech apps they’ve integrated did help boost revenue. The fee income they earned from the businesses that used the apps more than doubled in 2022, compared with the previous year.

An Untapped Source of Fee Income Opportunities

Over the past decade, noninterest income, or NII, has become increasingly critical to revenue growth for financial institutions.

But banks can no longer rely on the volume of consumer-generated fees they once earned. Digitization and the commoditization of banking have made free checking table stakes, while competition and regulation have reduced fees for overdrafts and interchange.

As those traditional sources of fee-based revenue declined, banks turned to earning fee income through investment banking, wealth management, financial technology and, in some cases, cryptocurrency.

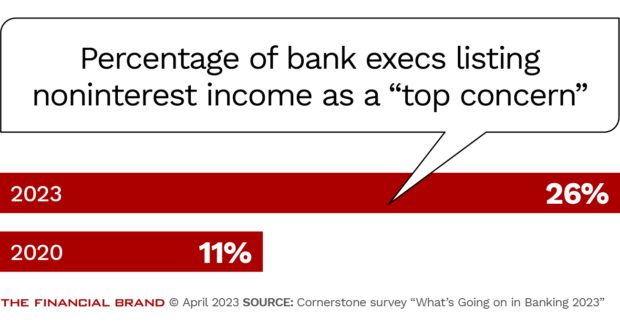

These options have helped offset some of the NII losses, but they are insufficient to fill the gap. A recent report by Cornerstone Advisors found that between 2020 and 2023, the number of banking executives who rank noninterest income among their top concerns more than doubled from 11% to 26%.

In the pursuit of fee income, many banks also have expanded services to their large commercial clients. That has included focusing on Automated Clearing House transactions, wire transfers, merchant services and fraud detection.

However, far fewer banks are capitalizing on the opportunity to provide these same services to the small businesses that often make up most of their clientele. This is generally because they are under the mistaken impression these business owners are unwilling to pay fees.

Among a sampling of banks pursuing the opportunity to offer such extra services to small businesses, Q2 found that their overall noninterest income from this segment in 2022 increased roughly 20% from the previous year.

What Services to Small Businesses Could Generate Fees?

The most common approach with small and midsize businesses has been to capture deposits, earn a little transaction revenue, and try to interest them in lending products. Fee income hasn’t been a big part of the strategy for banks serving this segment.

Yet today’s small businesses are strong adopters of technology and have some complex needs, which are prime opportunities for fee-based services. Many entrepreneurs are young, digitally engaged and already accustomed to paying for apps and cloud-based solutions.

In addition, digitization took off in the SMB segment during the pandemic, as business owners sought new solutions to manage their operations and finances more efficiently. Solo service providers, for example, now typically use mobile solutions for scheduling, invoicing and payments. Corner restaurants employ online ordering systems and mobile payments. And across all sectors, the use of cloud-based solutions for accounting, payroll, and marketing automation is popular.

Accordingly, business owners are starting to seek out financial institutions that can provide this type of help. A survey by Citizens Bank found 83% of business decision-makers expect their bank to leverage the latest technological tools to help their business compete.

A Suite of Services:

There is an opportunity to go beyond just traditional banking services, given that small business owners are looking to their primary financial institutions for more than that, including online ordering systems and payroll services.

In particular, some of the banking solutions they wanted most included real-time functionality and a secure mobile-optimized treasury management platform.

Another survey by Chase found 69% of business owners now consider it “critical” that financial institutions provide customer insights and business intelligence services.

The Fintech Threat: The Appeal for Small Businesses

Many business owners are already spending hundreds or thousands annually on subscription-based solutions from fintechs to support receivables automation, expense management, cash-flow forecasting, and seamless payment initiation processes.

These fintechs, especially large ones, are continually rolling out new solutions to customers, which — beware — can then be used as leverage to further expand into traditional banking. For example, Square initially started in payments and now offers commerce solutions, customer analytics, and marketing programs. In 2021, the company doubled down on the market with its Square Banking solution to put cash flow needs at the center.

PayPal also offers small business solutions, including payments, invoicing, marketing analytics, and banking. Meanwhile, fintech companies that provide accounting, expense management, and other solutions have begun expanding into lending.

It is a strategy that has allowed fintechs to siphon SMB customers away from traditional banks.

The danger to banks is greater than they realize. That’s because business owners are inclined to be receptive to overtures from fintechs. Nearly half of small businesses say their financial institution doesn’t understand their needs, and 60% have already partnered with a fintech for a capability their bank doesn’t offer, according to a 2021 survey by Aite-Novarica Group.

More Banks Plan to Offer Business Services

Despite the challenges, banks that dig deeper to discover what they don’t know may find significant opportunities to grow noninterest income with their small and midsize business customers. A survey of customers could pinpoint what would be the best types of services for a bank to pursue initially.

Findings from other surveys strongly suggest banks should act. An Aite survey in the third quarter of 2022 found that 66% of small businesses would give their payments business to a financial institution that offers nontraditional products. Nearly three-quarters also wish their primary financial institution would work more with fintechs.

A Reason to Switch:

The percentage of small businesses that would be willing to move their payments business to a financial institution with nontraditional products:66%

Many are at least getting closer to offering these types of services, with a dashboard for businesses as the starting point. In a survey by PYMNTS.com, nearly 80% of the banking executives who responded said their institutions were working to develop a single view of “real-time cash flow management” for business owners, which could serve as a foundation for financial forecasts.

The survey also showed that financial institutions are looking to integrate third-party platforms into their banking systems to offer invoicing, marketing automation, project management, accounting services, and risk management. All of these present the opportunity to provide business owners with needed help, while deepening their relationship with the bank and increasing fee income.

Bankers Must Think Differently When It Comes to Their Own Business

Clearly, putting small business customers on enhanced consumer platforms will no longer suffice. Banks sticking with that strategy will be ignoring revenue potential and stand to continually lose market share to competitors — not only fintechs, but forward-thinking financial institutions.

Bankers must evolve their own thinking, to see their financial institution as a business service provider, rather than as a place for just deposits and loans. To capitalize on this opportunity, they will need to have the vision to provide services outside the scope of traditional banking. Only then can they work out how to achieve that.

About the authors:

Debbie Smart and Jaime Dominguez are senior product marketers at Q2.