Many banking executives are concerned about deposits, but David Lamb isn’t one of them.

Lamb has been focused on funding since he arrived at Oxford Bank in 2015, back when deposits were plentiful and everyone got complacent.

“We’re in an enviable liquidity position now” — the bank’s loan-to-deposit ratio is 63% — “because when other people weren’t concentrating on deposits, we were always concentrated on deposits,” says Lamb, the chairman, president and chief executive at the $821.6 million-asset bank.

Oxford is a heavily commercial bank serving three counties in the Detroit metro area, and for most of Lamb’s time there, it has taken a relationship-banking approach, which, it tells borrowers, is a two-way street. Oxford would lend, but it expected businesses to bring their deposits to the bank.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Taking a Relationship-Banking Approach with Business Customers

Lamb was learning from experience.

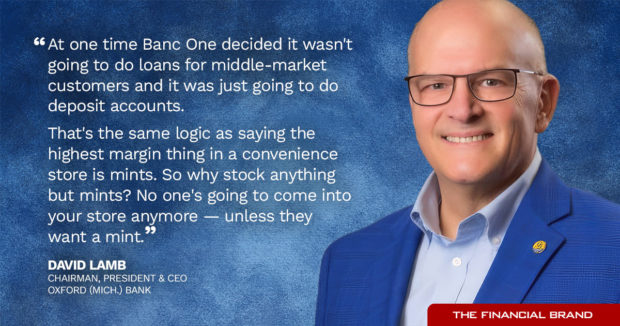

He had started out as a bank examiner and moved into banking, including more than a decade at the former Banc One Corp. in Chicago. A shift in philosophy while he was there taught him a lesson.

“At one time, Banc One decided it wasn’t going to do loans for middle-market customers and it was just going to do deposit accounts,” says Lamb. “That’s the same logic as saying the highest margin thing in a convenience store is mints. So why stock anything but mints? No one’s going to come into your store anymore — unless they want a mint.” (Banc One merged with JPMorgan Chase in 2004.)

But the flip side of insisting on that full relationship is providing a wide array of services for businesses — in other words, Oxford stocks its store with more than mints.

It offers robust treasury management services, providing rate protection during the rapid runup businesses and banks have been facing. It also expanded into commercial finance services through an acquisition. This gives Oxford an entrée with companies that may later graduate to traditional bank credit, and in the meantime provides some loan growth that tends to be countercyclical.

Maintaining a strong reputation and a role in the community — the bank’s roots go back over 100 years — also counts.

“During the turmoil with Silicon Valley, I called our top 10 large depositors,” says Lamb. “To a person, they laughed at me and said, ‘Why would we be worried about you?'” Several said they had money with a regional bank that they were going to move to Oxford.

Read More: How Data Can Supercharge Small Business Growth for Banks

Does a Community Bank Need Treasury Management?

Treasury management services began to gain broad traction back in the high inflation days of the late 1970s and early 1980s, when double-digit interest rates made it essential for businesses to squeeze every buck. With the Federal Reserve’s rate increases in 2022 and 2023, treasury services are having an extended déjà vu moment.

“Treasury management people are having a field day. They have a hook for why someone might want to have a conversation.”

— Mac Thompson, White Clay

That’s because using treasury management helps a company maximize return on their cash while maintaining the safety and liquidity of those funds, says Mac Thompson, founder and president of the consulting firm White Clay.

Just a few years ago, it was uncommon for a community bank to offer treasury management, adds Thompson. But this expertise is in higher demand now.

Oxford Bank was ahead of the curve. Lamb says the bank built its treasury function from within, using features in its Jack Henry core system to enable the services.

“We have customers who like our system better than that of Bank of America or Chase,” says Lamb. “And I’m not criticizing either of their systems, because they’re very good. But we didn’t have to spend $10 billion to develop ours.”

Providing treasury services is also seen as part of the relationship mix for this community bank. Lamb explains that larger banks tend to undercut institutions his size on loan rates, then make up for that by charging relatively higher prices for treasury management.

“We’re a little more balanced,” Lamb says. “We’re going to want a little bit more on the loan rate, but you’re going to get a better deal on treasury management. And you’re going to get better service overall.”

As a business-focused bank, Oxford still enjoys the advantage of having noninterest-bearing business checking accounts. This has tempered Oxford’s deposit pricing and marketing. The bank has run some specials on CDs — mainly just to let customers know what the rates are — but it doesn’t push them.

“We have to be fair with our customers,” says Lamb. “We can’t keep the rate at five basis points when you can buy a Treasury bill for over 500 basis points. But because we have liquidity, we’re not going to pay up for money because that will just mean more cash. We’re right in the middle of the market.”

Lamb says he wouldn’t mind if higher loan demand pushed his 63% loan-to-deposit ratio up. But he isn’t focusing on that measure right now because liquidity is paramount for him.

Read More: Storytelling With a Twist Powers Small-Business Connections for This Community Bank

Finding Loan Demand and Helping Business Customers Manage Rising Interest Rates

Oxford Bank’s business lending is heavy on commercial and industrial loans, with commercial real estate credit representing only a small portion of the overall portfolio. This sets it apart from the many other community banks that are CRE heavy. Lamb says at current rates, and in the current market, there’s not a lot of CRE activity anyway. But demand for C&I loans, while down, remains decent.

Oxford’s customer base includes a healthy portion of service businesses and franchises. But most of its business borrowers are manufacturers, with a significant portion of them being suppliers in the automotive sector. You can’t escape dependence on the auto industry in the Detroit area, Lamb says.

A growing trend called “insourcing” (also called “reshoring”) is providing additional credit business for the bank as well, according to Lamb. The term is a play on “outsourcing” (or “offshoring”), which refers to U.S. companies moving their manufacturing to countries with cheaper labor costs, notably China. Lamb notes that “light manufacturing” had come to be something of a euphemism for assembled overseas except for the on/off switch.

With worries rising about political tensions with China, manufacturing has been rebounding in the three counties Oxford serves. For example, dies — specialized machine tools for cutting and forming — are critical for certain manufacturing. Some companies, worried about not being able to get dies made if China trade got shut down, are reshoring this type of work.

All of this has led to loan demand.

Lamb is mindful that the higher rate environment can put pressure on borrowers. But he says that many manufacturers have been able to keep up with inflation, chiefly by raising their prices.

Rate risk is harder to address. So Oxford has been offering credit derivatives — transactions designed to lay off rate risk.

Over his long career Lamb had a stint selling derivatives for a big bank, so he is comfortable with the concept. “We do things like ‘knockout swaps,'” he says. These are designed to provide protection against rising rates on variable rate loans, but, within three years of the commitment, the bank will permit the borrower to cancel the contract without cost.

Lamb thinks of this more as a customer service than a profit center. The bank writes the contracts on behalf of an outside counterparty. The bank makes a small amount on the difference between what the customer pays for the rate protection and what the third party charges.

Read More:

- How Banks Can Avoid Losing Small-Business Loans to Fintechs

- How One Community Bank is Reinventing Itself for Future Relevance

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The Advantages of Expanding into Commercial Finance

Lamb has a mental “to do” list that for some time included getting Oxford Bank into the commercial finance business.

“If you’re a conventional bank, you want to be in the commercial finance business,” says Lamb, calling it a matter of diversification. “It’s countercyclical to the conventional bank business. They’re busier in bad times.”

Lamb also sees commercial finance as a way to capture relationships early in the life of a small business. Companies can join a bank’s “family” before they would typically be regarded as bankable. In the meantime, a bank can also begin to cultivate the company as a source of deposits, much as Oxford does with its commercial lending clients.

Lamb found his opportunity in spring 2022, and the bank’s holding company acquired FSW Funding, a commercial finance specialist with nationwide reach. Oxford picked up not only $25 million in high-yield factoring assets, but also Robyn Barrett, the firm’s owner and manager, and her experienced team.

At the time of the acquisition, Barrett noted that Oxford was bringing liquidity and capital to the table. This means muscle in commercial finance. (Lamb notes that there are some commercial finance players out there with little more than a financier in a basement with a laptop and some connections.)

Beyond the immediate toehold, Lamb discovered that the acquired business, now named Oxford Commercial Finance, became something of a magnet for talent and relationships. Crestmark Bank, a major player in commercial finance based in Troy, Mich., was acquired in 2018. Oxford was able to attract some Crestmark alumni, including Mick Goik, who had been president and CEO there. (Crestmark is part of Meta Financial, which rebranded as Pathward Financial. Meta is based in Sioux Falls, S.D.)

Having added to the staff, Oxford Commercial Finance also expanded its offerings. FSW was in the factoring business — making short-term loans on the basis of the borrowing firm’s accounts receivable. The division has added asset-based lending — borrowing based on a firm’s assets such as equipment or inventory — and commercial leasing. It also has added term loans for firms that don’t meet bank criteria.

An advantage of having the commercial finance division under the same roof means that business lenders don’t have to say “no” when prospects cannot make it past the bank’s credit filters — there are other options in-house.

“That helps us generate growth right now,” Lamb says. “It’s a better customer experience when you don’t kick people out.”