The report: Learning by Bouncing: Overdraft Experience and Salience [April 2024]

Source: Federal Reserve Bank of New York

Despite new regulations and changes to overdraft rules in recent years, there remains debate and concern that consumers may not be fully aware of policies and fees. In January, CFPB proposed a rule that would close a loophole that exempts overdraft lending services from provisions of the Truth in Lending and other consumer financial protection laws. Under the proposal, large banks could extend overdraft loans if they disclose applicable interest rates.

Donald P. Morgan and Wilbert van der Klaauw, economic research advisors at the Federal Reserve Bank of New York’s Research and Statistics Group, recently authored a piece about overdraft experience and salience, whether account holders know how often they overdraft their accounts and how much it costs them.

To learn more, they asked participants in the New York Fed’s Survey of Consumer Expectations about their knowledge of and experience with their bank’s overdraft program. The study found that while the majority knew the fee they were charged, even those who regularly overdraft their accounts do not know the terms and practices — such as the maximum overdraft allowed or whether the bank processed larger transactions first.

Key Takeaways:

- In the past year, one in five consumers overdrafted and half of those overdrafts were for less than $50.

- Most consumers don’t use overdraft protection and many don’t care about policies or fees. Four in ten consumers said they were “indifferent” to their bank’s overdraft policies.

- 84% of consumers who had experienced an overdraft know their bank’s overdraft fees. However, less than a quarter of these consumers know the transaction processing order.

What we liked: With little available research into awareness of overdraft fees and policies, the Fed shines a light on what consumers do know.

What we didn’t: Since it initiated the effort, the Fed could have asked a few more questions and dug deeper into the issue.

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

A Problem of Overdrawing Accounts

The background on overdraft: Until the 1990s, overdraft was typically granted manually on a case-by-case basis for trusted customers. However, as ATMs and debit cards became more common, banks started to develop more automated programs that worked in real-time to determine if an overdraft should be allowed. Overdraft was initially called “bounce protection” after bounced checks and was marketed by industry consultants to banks as a benefit for both the bank and the customer.

The problem: Morgan and van der Klaauw didn’t dig into the problems with overdraft protection, but regulators have pushed for many changes in overdraft protection over the years. Overdraft fees are still a big source of revenue for banks, although they have steadily declined since 2019. Many banks have responded in recent years by lowering or eliminating fees, increasing the trigger value and reducing the daily maximum number of overdraft fees charged.

Lack of data: Because credit bureaus don’t track overdraft credit, most knowledge about overdrafts comes from focus groups and surveys. One CFPB study of 36 low- and moderate-income households found that many respondents were confused about overdraft coverage during and after opening their accounts. The Fed based its findings on a larger sample of U.S. households participating in the February 2022 SCE Credit Access Survey, which included roughly 1,000 heads of household.

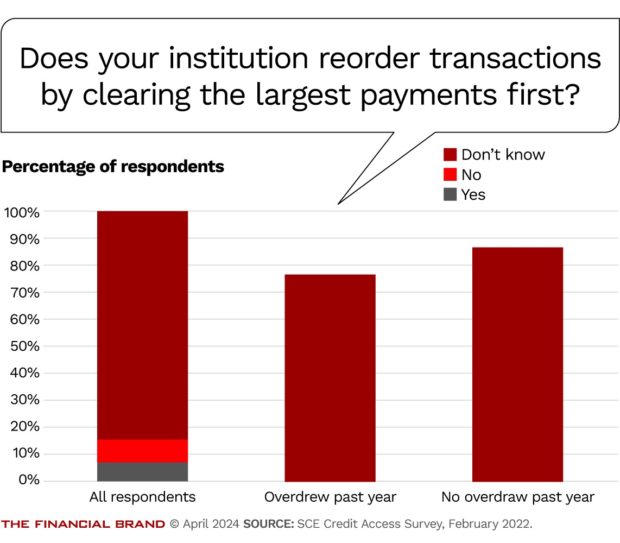

“In general, we find that people with recent overdraft experience are more attentive to their institutions’ overdraft policies. However, even experienced overdrafters are unlikely to know if their bank or credit union reorders checking account transactions.”

Overdrafts are uncommon and small: Most consumers never use or require overdraft services. Seventy-eight percent of respondents reported having no overdrafts in the previous year. Additionally, half of all reported overdrafts were for less than $50. Only 1.5% of respondents didn’t know if they had overdrawn their account in the past year, and only 11% didn’t know how much they had overdrawn, thus suggesting the event of overdrafting is salient.

Repeat and bigger offenders: However, those who overdraft more tend to do so in larger amounts. As overdraft fees are typically not related to the dollar amount of the overdraft, this implies that more frequent overdrafts receive more credit per fee.

Accidental and expected verdrafts: The Fed asked respondents who had overdrawn their account in the past year if they expected to do so and 58% said they didn’t. However, it was found that the fraction over overdrafts was positively correlated with overdraft frequency.

Dig deeper:

What Consumers Know About Fees and Policies

The Fed surveyed consumers about their knowledge of overdraft fees, limits, and the order in which the bank clears transactions.

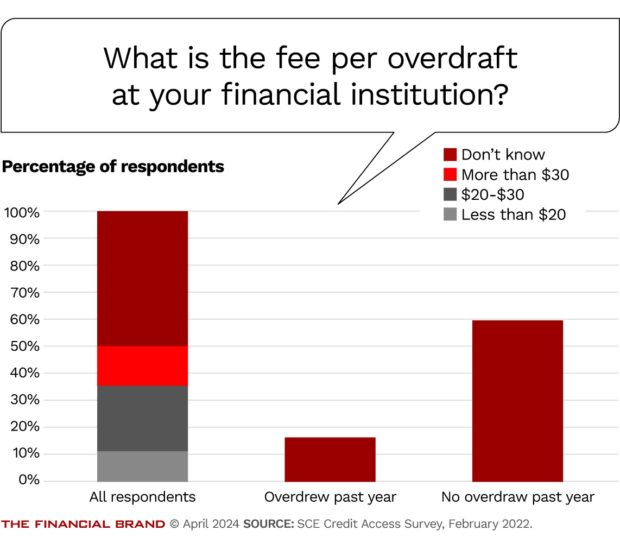

Overdraft salience: To learn more about consumers’ knowledge of overdraft terms at their banks, the Fed asked several questions. More than half of the respondents did not know their banks’ overdraft fees; however, of those who had experienced an overdraft, 84% knew the fee. The Fed notes this offers some assurance that those prone to overdrafts know what it will cost should they overdraft the account again. They also found a similar pattern with overdraft limits and the maximum protection the bank provides. While only 20% of respondents knew the limit, that number rose to 39% for those with overdraft experience.

Transaction clearing order: Banks clear transactions in different orders, some clearing the largest transactions first rather than in chronological order. While the banks claim it can help ensure customers’ mortgage payments or rents clear the account, it can also increase the likelihood and number of overdrafts. Less than a quarter (23%) of respondents with overdraft experience knew if their bank’s reordered transactions and that number fell to only 16% for all respondents.

Do consumers pay attention? The fact that most consumers will never need to use overdraft protection indicates why many may not know or care about overdraft policies. Approximately four in ten (41%) of respondents said the policies did not matter at all and that they were indifferent to overdraft policies. Meanwhile, only 10% of those with overdraft experiences said they were indifferent.