Banking institutions that want to stay relevant must quickly get an understanding of what a digital ecosystem is and how that will change the way consumers do their banking going forward. Getting ready for this will require traditional banks and credit unions to leverage modern technologies like artificial intelligence and create real-time personalized engagement with customers and members.

This premise and supporting research come from a new Economist Impact study that provides valuable insights into the future of banking at a time of increasing industry disruption.

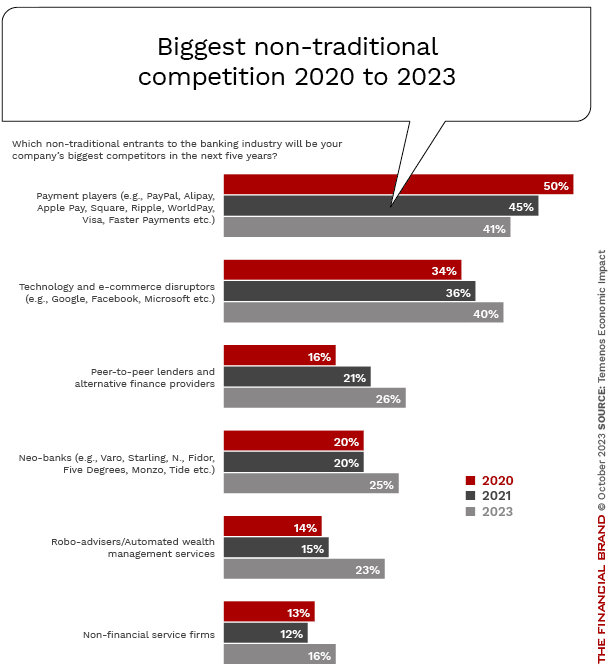

The study, commissioned by Temenos, emphasizes the increasing threat to traditional financial providers from fintechs and large technology companies like Apple, Amazon, Shopify and Uber. The challengers are integrating financial services into their interactions with consumers. This includes payments, lending and even deposit services, all of which are generally made possible through partners.

The risk banks and credit unions face is becoming merely financial utilities without direct consumer engagement. Almost four years ago, Michael Corbat, then the chief executive at Citigroup, warned of the risk banking faced of becoming “dumb pipes” — just a carrier used by nonbanking interlopers. The threat continues to be real.

The Economist Impact report is based on a global survey of 300 executives as well as expert interviews.

In fact, as shown in the second set of bars above, 40% of survey respondents considered ecommerce disruptors like Google, Amazon and Facebook as their biggest competitors over the next five years compared to only 34% in 2020. As has occurred with the integrated financial capabilities of firms like Apple, tech giants could eventually own the full customer journey.

Bankers must quickly understand the danger of becoming completely disintermediated from their current customers and members.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Banks Must Rapidly Evolve into True Digital Ecosystems

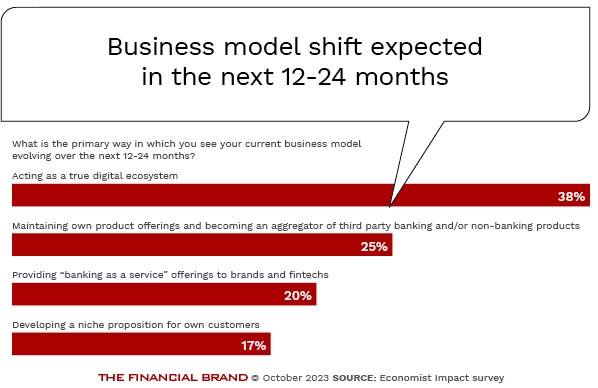

To counter this competitive threat, the Economist report suggests that banking institutions must rethink their existing business models and figure out how to take part in digital ecosystems. This means not just being a “bank,” but having a blend of banking and other functions that essentially overlap with each other for better functionality.

In this approach, banking institutions increasingly partner up with other types of companies to create and distribute products and services jointly. In the survey, 38% of executives said they foresee their organizations’ business models shifting to become a form of digital ecosystem within two years. Another 25% of executives believe their organizations will begin offering both owned and third-party financial and nonfinancial products in that same time period.

By becoming a centralized hub meeting an expanded array of customer needs, traditional financial institutions would be able to maintain direct relationships, collecting and using insights from customers to deliver hyper-personalized experiences. The objective would be to become embedded within the customer journey, regaining the primary account relationship as transactions occur, and reducing the disintermediation that is occurring today. Being an active player makes the difference and helps institutions avoid becoming “dumb pipes.”

The New Technologies Driving Change

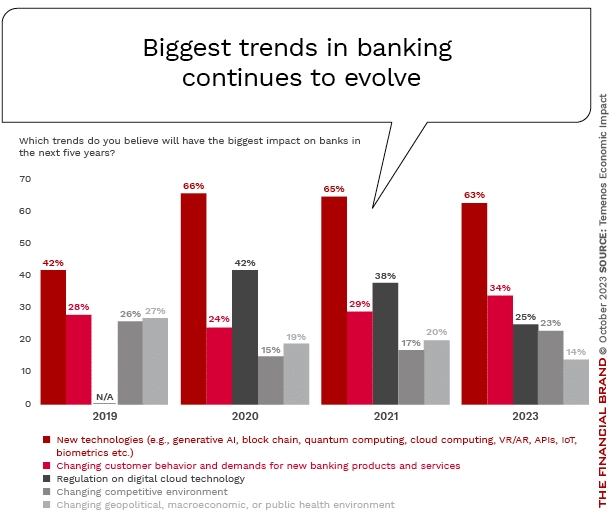

Emerging technologies are expected to remain at the forefront of change for banks in the future, according to 63% of survey respondents, surpassing changes in consumer behavior, regulations and even the competitive landscape. In particular, generative AI (such as ChatGPT) is expected to become a dominant force, with 75% of financial institution executives surveyed expecting it to significantly impact banking and financial services. Given that emerging technologies are expected to drive the industry’s future, failing to invest and build capabilities (even at an incremental level) could leave slower-moving banks and credit unions behind.

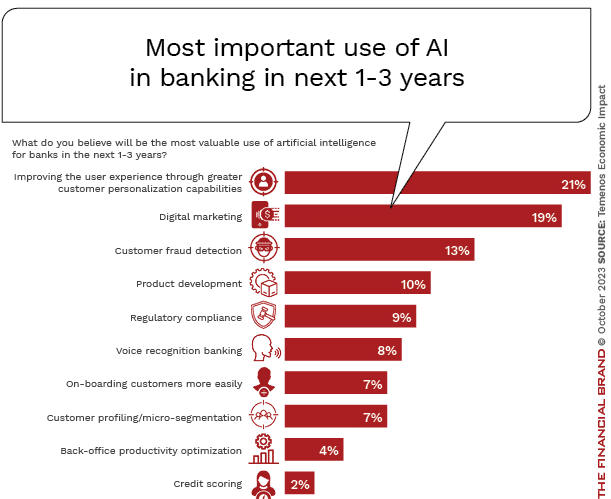

Areas such as personalization, digital marketing, customer service, fraud detection and other back-office optimization solutions are poised for major benefits from generative AI’s natural language capabilities. To capitalize on generative AI and other leading-edge technologies like blockchain and quantum computing, there will be increasing collaboration with fintech firms and third-party solution providers that support low-risk access to leading-edge technology expertise that can delivered at both speed and scale.

“44% of survey respondents believe that banks will acquire majority stakes in fintechs.”

— Economist Impact research

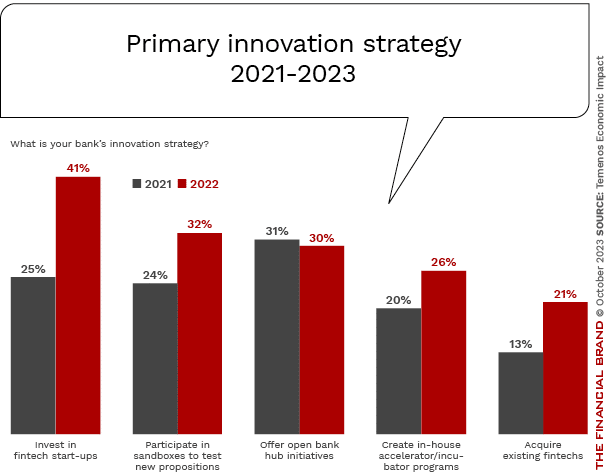

Since the last survey, conducted in 2021, deepening engagement with fintechs has become a much more important innovation strategy for banks. A much higher share of banking executives now cite investing in fintech start-ups and participating in sandboxes with fintechs and other technology providers to test new propositions as their top innovation strategy.

Read more:

- A Generative AI Decision-Making Guide for Banks & Credit Unions

- The Future of Value: Rethinking Banking in an Era Beyond Money

Movement to the Cloud

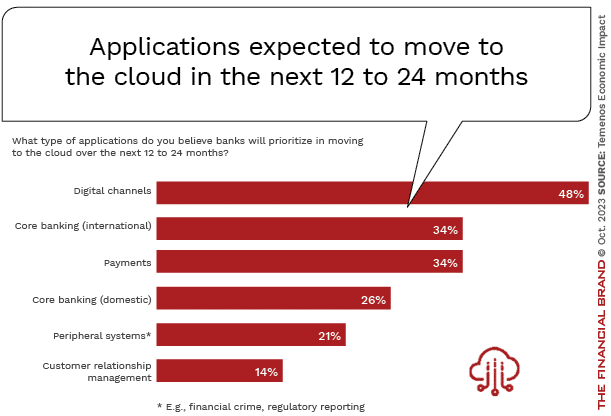

The Economist Impact survey found that the shift of banking workloads to public and hybrid cloud platforms is accelerating rapidly. Just over half — 51% of respondents — agreed that within five years, banks will no longer own any private data centers as public cloud comes to dominate.

Rather than relying on a single provider, banks are adopting strategies using two-three leading cloud platforms. This avoids getting locked into a single vendor, and localizes any potential service disruptions. Compliance, security and resiliency requirements make multi-cloud adoption essential.

The transition is being driven by several key factors:

- Growing data and analytics demands. As banks implement data-intensive technologies like AI and machine learning, they require the scalable storage and computing power of cloud providers. Public cloud offers on-demand flexibility.

- Faster innovation cycles. Cloud’s agile infrastructure allows banks to test and deploy new capabilities more quickly. They can also leverage cloud providers’ latest innovations.

- Enhanced sustainability. Public cloud’s energy efficiency, renewable power sourcing, and ability to optimize workloads substantially reduces banks’ carbon footprints. This aligns with rising ESG pressures.

- Lower costs. Cloud displaces expensive on-premises infrastructure, saving banks money long-term despite initial migration investments. Automation also streamlines operations.

To remain competitive amidst open banking and embedded finance disruption, incumbent banks must tap the agility, innovation, sustainability, and customer experience gains enabled by leading cloud providers. Migrating core systems and data capabilities to the cloud is becoming an imperative.

Read more:

- The Shift to Cloud Technology in Banking Accelerates

- Why AI Projects Often Flop in Banking and What to Do

Recommendations for Success

The Economist study provides a blueprint for how banks and credit unions can thrive at the center of digital ecosystems moving forward:

- Become a frictionless one-stop shop for financial and non-financial needs by allowing simple integration of third-party offerings alongside owned products. In addition, develop open architecture leveraging application programming interfaces (APIs).

- Improve data internal mastery to deliver hyper-personalized experiences and increased engagement by embedding within customers’ daily lives. Leverage AI-driven insights to understand users’ needs and deliver recommendations that reflect these needs.

- Create close collaborative relationships with fintechs and third-party solution providers to rapidly implement cutting-edge innovations within banking, including AI, cloud capabilities, blockchain and quantum computing.

- Commit to sustainability through customer offerings like green loans and operations like public cloud migration. Embed ESG into existing and new solutions as stakeholder pressures grow.

While substantial challenges exist, banks can retain and even build core relationship and trust-based loyalty despite digital disruption. By focusing on transitioning to platform models with an expansive ecosystem of integrated owned and third-party solutions, banks can once again become the primary hub serving consumers’ full range of financial and non-financial needs.

That said, banks and credit unions that hesitate to deploy highly personalized digital engagements, emerging technologies like the cloud and AI, as well as embedded finance capabilities will risk losing relationships and be forced to a business model that reflects a role as a commoditized utility — “dumb pipes.”