The Great Recession came about in some ways because of mistakes made by financial institutions. The resulting damage and ongoing recovery remade many aspects of the industry, created a huge cleanup and a concurrent compliance flood. And it also helped create an opportunity for fintechs to take root and bring fresh ideas to financial challenges while traditional institutions were otherwise occupied.

That recession was a catalyst, and now it’s happening again, for different reasons.

By contrast to the Great Recession, the COVID Recession and the pandemic and lockdowns that drove it, had almost nothing to do with financial institutions’ own previous actions. Quite the contrary. They helped keep financial services and parts of the economy on an even keel.

Nevertheless, traditional financial institutions have been looking at the beginnings of a major series of changes in the way they operate — potentially even their very existence, at least in familiar form.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Shape of Financial Things to Come?

These changes will hit traditional financial institutions in this country and worldwide in major ways, according to a report from PwC Financial Services.

PwC expects tectonic economic effects that will hit all the constituencies that banks and credit unions serve.

“Compared with all previous crises — including the global financial crisis, the oil-price shocks of the 1970s or even the Great Depression of the 1930s — COVID-19 will likely have the most substantial impact on the global economy, with a one-year reduction in worldwide Gross Domestic Product of more than 6%,” the firm’s report states. Hardly any sector will not be affected, as things play out.

For financial institution’s specifically, PwC’s report, predicts they will be slammed by “second-order effects.” That is, “deteriorating credit quality of customers, along with the continued low interest rate environment, as the pandemic and its aftereffects will be felt throughout the real economy over the next several years.”

PwC believes these effects will impact banks and credit unions in two broad ways.

• Of these, the first is economic effects that will be felt for years.

“We’ve come to the end of a positive credit environment that lasted more than a decade, and we will see increasing numbers of personal and business defaults,” the report states. Financial institutions have already been reflecting that outlook somewhat in their setting of loan loss reserves. Spread income, already under great pressure, will be squeezed further as the Federal Reserve and other central banks keep interest rates down.

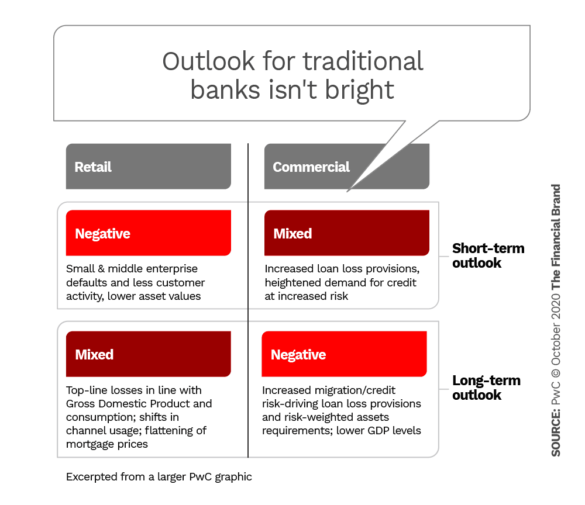

In a huge chart in the report (the one below about retail banking is only a small slice of the whole) PwC sketches out a picture that is at best neutral and more often mixed or negative for banking, payments, insurance, asset and wealth management, real estate firms and financial exchanges. However, as the chart below shows, the core businesses of American financial institutions — retail and commercial lending — face at best gray skies for the foreseeable future.

• The second major effect will be structural. PwC expects the economic impacts of COVID to intersect with other trends such that many traditional structures and relationships among traditional institutions, fintechs, private capital and more aspects of financial markets will be broken up and re-formed.

Both practical economic effects and regulatory measures in response to the new recession will play their parts. Continuing low interest rates, for example, will continue the erosion of classic financial institution business models. PwC expects nonbank credit providers to become more important as international capital rules implemented among national regulators come into play in the next few years for traditional bank lenders. These rules — “Basel IV” in industry technocrat language — will push many larger institutions to raise more capital even to maintain current activities, according to the report.

Overlaying that challenge, “Firms face unrelenting pressure to boost productivity through the digitization of the business and the workforce,” the report states.

At the same time, additional momentum will be added to a shift that’s already been taking place, the movement towards platforms and ecosystems.

The Financial Brand discussed the implications of the report with John Garvey, Global Financial Services Leader, PwC US.

One conclusion from the discussion: Banking leaders won’t have the luxury of solving the COVID slump’s challenges one by one. They’ll have to juggle cleaning up damage, managing current business and preparing for the future all at once.=

Repairing the Damage While Continuing to Compete

One of the keys to dealing with the quagmire of higher capital requirements and impaired credit will be handling troubled consumer and business loans in the most efficient and expeditious way.

“The boom times of the last decade didn’t encourage development of a new cadre of troubled credit specialists.”

But one major problem here is that much of the industry’s experience base for handling troubled credits, especially business loan workouts, is long retired at many institutions, Garvey acknowledges, and the boom times of the last decade didn’t encourage development of a new cadre of troubled credit specialists.

Garvey says consumer and business lending functions need not learn all the hard lessons of past recessions all over again. They still have a ready source of talent: the retirees who used to do those jobs and have the battle scars to prove it.

“You’re going to have a lot of people coming back who, at a minimum, will be mentoring young bankers and workout specialists who haven’t done this before,” says Garvey. “They’ll be consulting with lending institutions.”

Thinking out of the box like this will make handling massive credit issues more manageable. The report makes the point that financial institutions will also have to find ways to manage teams so they can be thrown at diverse challenges on short notice.

Credit and Funding Will Begin to Look Very Different as Recovery Continues

The COVID recession is putting pressure on approaches and processes that have made up the essential blueprints of many financial institutions. Where there were cracks, the firm’s report suggests, there will now be complete breaks. Old ways won’t make economic sense anymore.

One victim of this massive shift, says Garvey, will be the traditional combination of raising deposits and making loans with those deposits. That’s a stunning prediction considering the practice has been the bank business model back to Renaissance Italy. While deposits are dirt cheap in terms of rate and in abundance, those aren’t the only costs of deposit funding. Garvey believes the cost of regulatory capital and account rule of deposits will have more banks look into alternate ways of funding loans.

“One victim of this massive shift will be the traditional combination of raising deposits and making loans with those deposits.”

More loans may be funded through infusions of private capital going straight into lending, rather than into ownership of banking institutions, Garvey suggests — basically the nonbank lender model

On the other hand, a counter-trend may arise in regulatory responses to various forms of nonbank lending as their own losses begin to climb and funding dries up, as has been seen before.

“The spread between the price of regulated capital and nonregulated capital will continue to increase,” Garvey believes. He predicts that as Basel IV capital rules begin to come in in 2022, absent other developments, banking companies will begin rethinking their models in earnest.

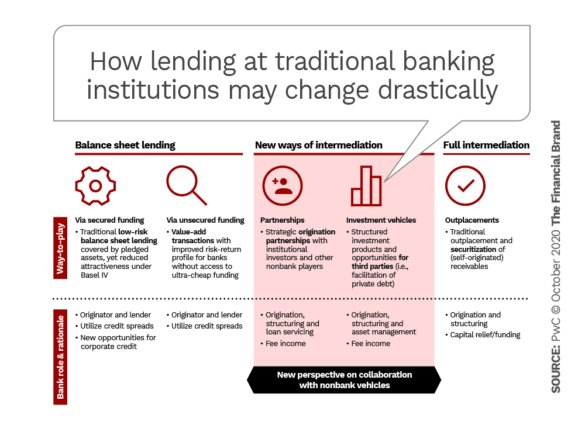

“They are going to be thinking, ‘We’d like to participate in this lending business. But we don’t actually have the capital. So what do we do? How do we originate the loans? Do we sell them? Or do we even originate them? Do we act as intermediary, take in loans from originators, sell them, get a fee and move on?’,” says Garvey. “Those are the kind of questions that people are facing right now.”

This graphic from the report gives a taste of the kinds of combinations that could result as the traditional forms of financial intermediation are uncoupled. Innovative approaches should have an unparalleled chance to prove themselves in this crunch. An earlier example of this trend: Much of what’s taken for granted about mortgages today — like self-amortizing loans — was invented as the U.S. recovered from the first parts of the Great Depression.

This uncoupling isn’t brand new, but it will accelerate and morph in the COVID recession. Garvey believes this will be a time for new types of cooperation and partnerships with various types of fintechs.

Platform Financial Services Could Flourish in COVID Slump

In the space of a few months it’s become old news that many digital banking holdouts had to try out new channels and found out they had their points, especially during lockdown.

But that acceleration of the gradual movement towards digital channels has had a major ripple effect that many traditional players may still not be seeing.

PwC believes that the shift to digital will in turn speed the movement towards platforms based on the services of multiple providers. Garvey explains that this structure will be much like Amazon’s offering many products and services of its own but also offering many products and services of other sellers in various combinations.

The digital shift, plus the capital issues and the decoupling described earlier, will favor platformication, according to Garvey.

“I’m not saying that one bank will have its own platform where everyone buys everything and its all ‘made’ by that bank,” says Garvey, “though that’s a structure some will offer.” He believes many more players will choose to join platforms along the lines of a Lending Tree, which serves as a marketplace for many competitive providers.

While Lending Tree is a credit market, there’s no reason a platform couldn’t offer the full range of services. Garvey points out that in other countries there are small business platforms that offer products even beyond what regulated banking companies are provide.

For a portion of the industry, the question will not be a matter of if but how.

“Banks must ask if they will be part of someone else’s platform or if they are strong enough to create their own platforms, and bring other parties into their own ecosystems,” says Garvey.

As platforms blend banking, fintech, big tech and more, the look and feel of financial services may change drastically. And if it works out well, it may be an optimistic consequence of the COVID-19 recession.