“How can I make a difference to my customers?”

If you are looking for a North Star in today’s unsettling times as a financial marketer, those nine words are worth putting on a sticky note, real or virtual.

They come from Laura Ziemer, Director of Insights at Comperemedia, a Mintel company.

The ongoing impact of the coronavirus pandemic requires some immediate steps as well as some reality and attitude checks, Ziemer said in an interview with The Financial Brand. There will be mistakes and misjudgments. But if marketers remember the question above when posting on social media, placing digital ads, making or breaking sponsorship deals and working out the direction of future marketing efforts, they will be ahead of the game, according to Ziemer and other experts.

One immediate task is to turn off or pause the “robots” that run many aspects of marketing today, from pre-loaded social media posting software to programmatic ads that pick up on bad cues to automated emails driven by website registrations or pre-scheduled software.

This is a time for human intervention and oversight. Who among us hasn’t seen an unfortunate faux pas or two on digital ads, such as one financial brand whose inventoried ad for vacation loans talked about “Maria’s dream trip to Italy” as a lead-in to a story about an Italian who counted the pages of obituaries in his newspapers pre and post the arrival of COVID-19.

It’s not a time for lockstep, business-as-usual marketing. “In a time of uncertainty, it is important that communications be proactive, simple, direct, honest and empathetic,” says Jeff MacDonald, First Vice-President, Marketing, at Marquette Bank. “Right now, brands are flooding consumers with coronavirus readiness messages. We should ensure that our communications are focused on the consumer, are relevant and add value by being helpful to the situation.”

“Brands and sales people should pause all automated outreach, both emails and social media posts.”

— Jeff MacDonald, Marquette Bank

All brands, not just financial institutions, need to reassess what is in the hopper, says MacDonald. “I have seen posts for upcoming events and I have received emails requesting meetings and demos. Brands and sales people should pause all automated outreach, both emails and social media posts.”

Brands have to see what adds value and what just adds noise. They also have to avoid promising what they may not be able to deliver. For community financial institutions, MacDonald suggests these marketing and communication priorities for the present:

- Reminding people of all the digital banking options available — online banking, online bill pay, mobile banking, mobile deposits, Zelle.

- Warning and educating consumers on financial scams and how criminals will use the situation to steal personal and sensitive information.

- Informing the public about steps to alter operations — cancellation of events or their transformation into virtual ones, closure of lobbies or entire branches, extended call center hours.

- Amplifying the reach of helpful information from credible sources.

“Right now is not the time to promote a checking account,” says MacDonald. Ziemer agrees, saying that this doesn’t mean that acquisition marketing is over, but that this isn’t the time for promotion for the sake of promotion. In any format or platform, what financial brands should be aiming for is to be helpful — such as relaying decisions about extended payment deadlines and passing on helpful information.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Consider Social Media as Part of a Bigger Picture

Something that can be reassuring to both consumers and businesses is a demonstration that “we’ve got your back.”

“I’ve seen posts from institutions that are switching to drive-up only service or increasing capacity for remote customer service — those are great examples of content that has immediate informational value for a customer,” says Doug Wilber, CEO of Gremlin Social, a social media management technology provider. “The worst thing for a financial institution to do right now would be to push sales-oriented social posts. Also, financial institutions should immediately check previously scheduled social content to be sure they’re not inadvertently posting something that today would be tone-deaf.”

“My suggestion is to channel Elizabeth Warren and ‘have a plan for that.’ Institutions might do well to showcase how much contingency planning they have done.”

— Davia Temin, Temin and Co.

“Banking institutions need to better communicate strength in uncertainty,” says Davia Temin, President and CEO of Temin and Company, a crisis management consultancy. “My suggestion is to channel Elizabeth Warren and ‘have a plan for that.’ Institutions might do well to showcase how much contingency planning they have done and how thorough it is. If the populace, the markets and the regulators believe them, life can be far less panic-driven.”

Merrie Spaeth, President of Spaeth Communications, a communications strategy firm, says the main error she has seen is the lack of a coherent message of long-term confidence. “One can be honest and still express confidence that we as a nation and banking as a business — which is the backbone and lifeblood of the economy — has survived for decades, even centuries.”

Spaeth suggests that banks and credit unions tap not just mass channels like email and social, but also personal connections that their employees — their brand ambassadors — have with consumers and businesses. “One-to-one contact is powerful, if an employee knows a customer personally,” says Spaeth. While an in-person visit might or might not be timely and appropriate, a personal email, text or phone call could be meaningful.

“Unfortunately, too many banks, particularly the great big ones, are relying on mass emails that begin, ‘Dear Valued Customer’,” says Spaeth. “That conveys to customers that they are anything but valued.”

In fact, some firms are unwittingly sending the message with their emails that they are completely out of touch. “I’m hearing about how every business that has ever had someone’s email address is now emailing them with details about how they’re handling the situation, whether it’s relevant to the email recipient or not,” says Penne VanderBush, Chief Strategy Officer at FI GROW Solutions.

“Too many banks, particularly the great big ones, are relying on mass emails that begin, ‘Dear Valued Customer’.”

— Marrie Spaeth, Spaeth Communications

By contrast, Spaeth adds, “I know of a number of community banks that truly do know their customers and have been working the phones, and those banks will end up with even more solid relationships. ”

VanderBush says such calls can be especially meaningful on the business side. Many smaller firms are very uncertain if they can stay in business.

“A phone call from their banking provider to discuss options in a time like this shows how much the institution cares and helps solidify their future together,” she explains.

Read More: Banking Without Branches a Matter of Life and Death

‘Set It and Forget It’ Marketing is a COVID-19 Casualty

Going forward, it’s important to realize that the current media environment is a major shift no marketer has navigated before, and is changing constantly.

Google noted in a mid-March 2020 blog that: “As market dynamics change rapidly, we’re constantly reassessing campaigns, creative, and even our guidelines. What we decided two weeks ago isn’t necessarily appropriate today.”

“Communications need to be incredibly clear, very empathetic and use a human, real voice in a time of crisis,” advises Ally Financial’s Andrea Brimmer, Chief Marketing and Public Relations Officer. “Consumers need to hear from brands consistently with relevant updates on how to navigate the crisis as it relates to your brand or category.”

Social Media’s Role in the Coronavirus Crisis

The run-up to today’s tense atmosphere has seen social media play all kinds of roles. At its best it has brought timely information to people, increasingly people who are shut in or getting ready to shelter in place. At its worst, it has brought out untimely politics at all levels and hate speech uttered by folks who feel powerless to stop what really scares them.

It’s not an overstatement that social’s appropriate role in society will tested in the days ahead.

“This is truly a crisis unlike any other,” says Gremlin’s Doug Wilber. “First, it’s not a singular moment in time — it’s ongoing and quickly evolving. And unlike in past crises, we live in an age of rapid social media communication. The channels are completely different and customer expectations are higher than ever.” Social media, done well, lends itself to combining speed with trust-building, according to Wilber.

Wilber thinks that as “social distancing” becomes a norm, social media will become more important than ever for financial institutions.

“Banks should be actively managing their profiles and keeping a close eye on customer conversations,” says Wilber. “Engagement is more important, as we increasingly isolate ourselves. Banks should be looking at social monitoring tools and practices.”

Indeed, the “snark factor” has picked up, with brands getting criticized as the drop of a tweet. If it’s not operationally threatening, be Disneyesque and “let it go.”

“It’s impossible to make everyone happy when we’re facing black swan chaos,” says Davia Temin. “We do need to be classy, authoritative and kind. But we all also need to cut one another some slack.”

“I have been exceptionally proud of the way the industry has responded and risen up to do right by the American consumer,” says Ally’s Brimmer. “I think everyone is moving as fast as they can trying to safeguard their associate base while supporting the customer on a parallel path. And the whole category has come together putting the customer at the center in a very fluid situation.”

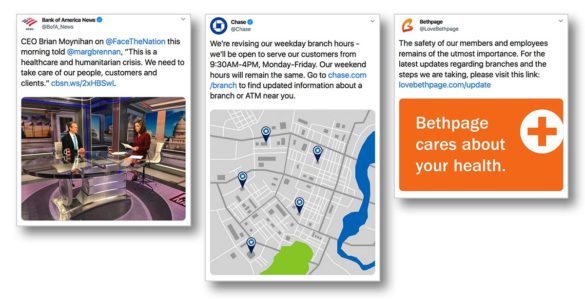

Reviewing financial institutions’ Twitter output in mid-March, the activity appears to fall into several categories:

- Those who started using social early in the COVID-19 crisis, advising about plans and updating things as the situation grew worse.

- Those who issued messages sporadically, with some suddenly dropping off the channel completely, perhaps reflecting uncertainty about what to say or not wishing to stoke worries.

- Other financial institutions that seemed determined to stick to their usual messages, not betraying a whisper of how things were changing. On occasion promotion of large member-only events or concert series were still appearing even when it was looking obvious that these were going to be shut down.

The most active bank and credit union social media users have been issuing advisories about drive-up service replacing lobby service, reminding consumers about digital options, and even offering tips about remote working for those who find themselves making a sudden transition.

A key question is, with the variety of social media platforms out there, where do messages belong?

“Each social media channel is unique,” says Jeff MacDonald. “Twitter should be used for breaking information, LinkedIn for business updates, Facebook for consumer updates, and YouTube for video updates.”

A Forrester paper suggests that setting up a central page on bank and credit union websites for all Coronavirus-related information is critical. Social media posts can point to this page. Forrester suggests that these pages contain a FAQ in addition to key contact information.

Beyond flagging service information and new policies, the firm suggests sites should also “tackle other subjects like travel insurance, inform on refunds (from travel, entertainment purchases, etc.), how to retrieve cash safely, and ways to help support family members or charities through digital tools.”

FI GROW’s Penne VanderBush urges some common sense to back up tweets and posts. Are you telling people to rely on mobile devices? Clear the way by waiving traditional waiting periods after signups. Are you shifting to drive-through only? Consider expanding the hours there so everyone can be served.

Read More: Work At Home Disruption Creates Once-In-A-Lifetime Opportunity

Resist the Urge to Be an Amateur Entertainer

A common reaction to COVID-19 grimness is to be funny. Think twice about that. It’s natural to want to cheer things up where you can. Social media isn’t the place for this for comedic beginners, experts say.

“We don’t recommend that anybody try to ‘lighten the mood’ with jokes or posts that otherwise ignore what’s happening,” says VanderBush. “Consumers follow plenty of other groups on social media for humor and comic relief. Financial institutions shouldn’t try to be who they’re not — especially during this time.”

Comperemedia’s Laura Ziemer has a slightly different take.

“Humor is dicey, but fun can be OK,” says Ziemer.

She gives an example. The Chipotle restaurant chain has been hosting “virtual lunches” where celebrities online hold forth while viewers chow down. This may be a glimmer of where sponsored events will be happening for a while, as institution-sponsored concerts, festivals and more get postponed or cancelled.

Podcasts on all kinds of subjects are ripe for sponsorship as well, Ziemer notes, especially with more people staying home. Streaming media may also be a good fit. She suggests that a popular approach may be announcing at the start of a half-hour block, “the next 30 minutes of entertainment is brought to you commercial-free by …”

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Beyond Social: Looking at Email

Ziemer notes that email, along with social media, is the channel that can be most quickly ramped up for timely communication with consumers and businesses, particularly when some length is needed.

“But think about relevancy,” she urges.

Forrester likewise endorses the use of email, but suggests that institutions not forget the basics when using it in this atmosphere. It’s best if there is a call to action of some kind, not just a generic message. The report cites a Keybank email that clearly showed contact information in the event of questions or problems.

In a related vein, Forrester suggests that financial brands take the time for design. While there’s a sense of urgency, remember that lots of messages are being shot to people right now, many of whom are now juggling personal and business communications on the same computer or mobile device all day long — messages from schools, brands, delivery updates and the surprising continuation of junk email. Forrester says clear headers like “What we are doing for customers” and “What you can do” can help guide recipients to key information in the emails.

Beyond Social: Thinking About Video

People of all ages increasingly use YouTube and other video sources and housebound citizens will gravitate towards images. Experts are suggesting that this is a good place to establish presence.

“This situation requires daily — or more frequent — updates, and an important component of an institution’s strategy should be video, or what I call ‘person-to-person/video-enabled’ communications,” says Merrie Spaeth.

Ideally, Spaeth adds, the financial institution’s representative is talking “through” the camera, not “at” it. Ordinarily this might involve training, but for now it may be necessary to pick someone with innate talent.

“The goal is to find an institutional voice from the top —preferably the voice of the executive who is most skilled at connecting with others,” says Spaeth.

“Having one voice is important at a time like this to ensure consistency in a way that is authentic,” says Andrea Brimmer. “Frankly, things are evolving so quickly that this also ensures were are responding to the latest information. There are many people working behind the scenes, of course. But it is important to be consistent and relevant with your messages.”

One last point about an old standby that some gave up on: Depending on how long we’re all shut in, Ziemer says direct mail may have a resurgence. Getting a physical message may be a change of pace to people who are emailed out, socialed out, texted out, phoned out. Under current circumstances, says Ziemer, “direct mail will have a longer tail.”