The report: KPMG 2023 Banking CEO Outlook [November 2023]

The report: KPMG 2023 Banking CEO Outlook [November 2023]

Source: KPMG

Why we picked it: The perspective and priorities of banking CEOs, as they pivot from the challenges of 2023 to the opportunities in 2024, will shape the industry’s near-term success and long-term evolution. The good news: Despite significant challenges, most executives remain optimistic.

Executive Summary

KMPG surveyed 142 banking CEOs in North and South America, Europe and Asia about their concerns, what they see as current risks and their approach to strategic planning and leadership.

Despite an uncertain global economic environment, and uniform concern over the impact of the rising cost of living on talent and borrowing demands, a majority of executives are confident in their three-year outlook and are focusing on resilience and pragmatic growth in the year ahead. Most also say that ESG is now fully embedded in their organization, although many cannot yet substantiate significant positive impacts.

Key Takeaways

- More than 70% of banking CEOs are confident in growth prospects for the industry over the next three years.

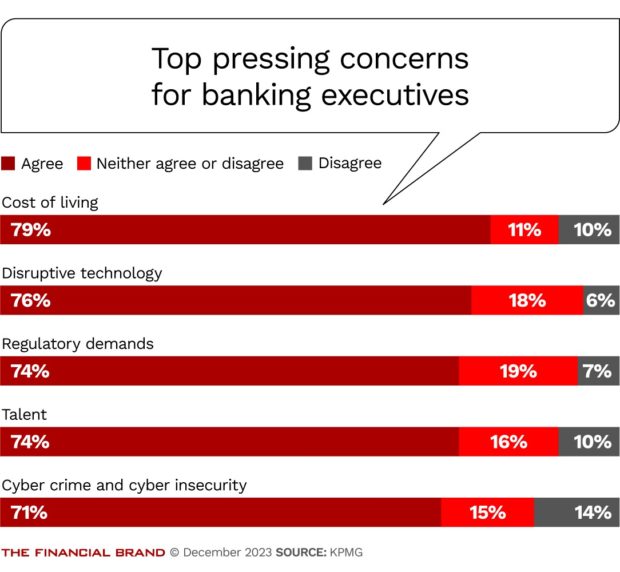

- Nearly 80% say the rising cost of living is their most pressing concern, as it impacts the cost of talent and stalls borrowing and investing volume.

- Most CEOs say they are all-in on ESG and diversity and inclusion. Nearly three-quarters said they would take on a politically or socially contentious issue or divest a profitable part of the business if it impacted the bank’s reputation.

- CEOs are evolving their leadership styles and will invest more in technology and talent in the coming years.

What we liked: The report’s global perspective, which included European and Asian banking leaders. There was one surprise: As noted above, “cost of living” ranked as the most pressing issue, higher than increased regulations or threats from cybercrime. The negative impact is potentially two-sided: surging costs for talent and suppressed borrowing demand.

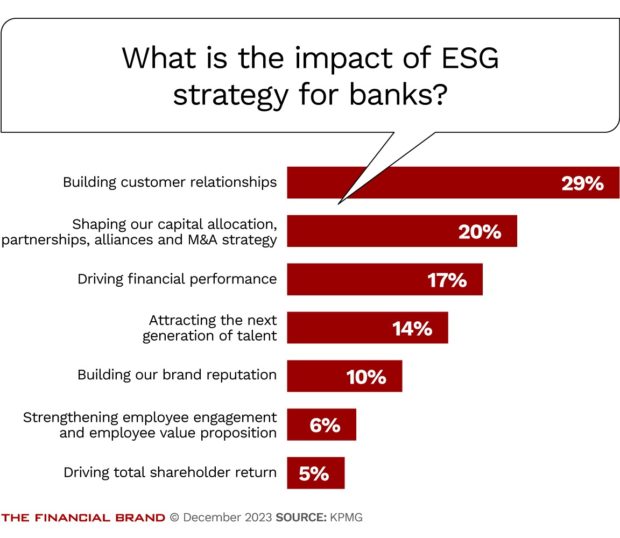

What we didn’t: The survey findings on ESG are ambiguous. Over half of CEOs say ESG strategy is “fully embedded” in their business and will offer a “significant” ROI in three to five years. At the same time, the specific impacts reported are diffuse: The most significant — building customer relationships — was reported by just 29% of respondents.

Only 17% said it would drive financial performance, and a mere 5% said ESG strategy would drive total shareholder return.

Things that made us go “Hmm”: KPMG doesn’t say so explicitly, but the survey results appear to indicate CEOs don’t actually expect significant positive impacts from ESG, suggesting many are primarily paying lip service to the social issue.

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Impact of Economic Uncertainty

While many CEOs retain confidence in growth, their convictions have slightly deteriorated since 2022. For example, confidence in the global economy ticked down from 72% to 70%, while confidence in their company’s growth fell from 82% to 76%.

Interest rates and monetary policy: Although 80% of CEOs believe rising interest rates and persistent inflationary policies could prolong a potential recession, nearly nine in ten forecast positive earnings (89%) and think they will expand their headcount (87%) in the coming years.

Top risks to growth: CEOs were unanimous on the top risks to growth: 79% said their workforces are dramatically impacted by the current economic conditions — which are driving wage inflation — while simultaneously stalling borrowing among customers. At the same time, political uncertainty and disruptive technologies moved up the list, what KPMG calls a shift in priorities. Conversely, as rate hikes have now stabilized and banks have adapted to the new market conditions, fewer CEOs view interest rates as a critical issue.

“The main sentiment among bank CEOs is cautious optimism. They feel quite able to navigate current uncertainty, thanks to the steps taken in recent years to strengthen governance and risk management. With solid management capability, capital, and liquidity in place, everyone is looking toward growth possibilities.”

— Francisco Uría, global head of Banking and Capital Markets, KPMG International

Defining a Bank’s ‘Trusted Purpose’

While CEOs have come to accept that ESG is here to stay, KPMG says many are now taking a more “outcomes-based approach” with a focus on return on investment. Two-thirds of CEOs say ESG is now fully embedded in their business as a source of value creation. More than half believe they will see a significant rate of return on their ESG investments in three to five years.

Almost a third believe their ESG strategy will have an impact on building customer relationships, and some say it is shaping capital allocations and partnerships. But only a small minority say their ESG programs are currently driving financial performance.

Setting an example and taking a stand: Many banking CEOs are also working to set an example on social responsibility. Nearly three-quarters said they would take on a politically or socially contentious issue, even if their board was concerned about it. A similar portion (73%, up from 63% in 2022) also said they would divest a profitable part of the business that was damaging the bank’s reputation.

Where the Chips Fall:

The percentage of executives that would get drop a profit line if it damaged the bank's reputation:73%

Diversity and inclusion: Banking executives also remain highly committed to diversity and inclusion (D&I). More than three-quarters (79%) said gender equity in the C-suite will help them meet their company’s growth commitments and that, as business leaders, they have a responsibility to drive greater social mobility.

Interestingly enough, two-thirds of executives also said that progress on D&I in the business world has moved too slowly.

Leadership Styles and Strategic Planning

Leadership style: CEOs acknowledge that today’s unique business environment requires a finessed leadership style. For example, nearly half said that “micro-level decision-making is required for success” so that a CEO can respond quickly and confidently in time-critical circumstances.

Three-quarters also agree that today’s leaders need a collaborative leadership style, with shared management and operational responsibility. As a whole, respondents indicated that more diverse inputs, constructive collaboration and challenged perspectives will lead to better decision-making for the bank.

The paths to growth: While CEOs are optimistic about growth, their enthusiasm for inorganic growth is tempered. Many say they must first see stable market conditions (28%) or more available financing (20%) before they prioritize inorganic opportunities. 54% said they are ready to make more capital investments to acquire new technologies, a dip from 58% last year.

Read more:

- Why U.S. Bank Invests in ‘Human Connections’ While Pursuing Digital Innovation

- Today’s Internet Is a Vulnerable Home for Our Money

Backing off on “back to the office”: While CEOs were uniformly trying to get people back in the office in 2022, their attitudes seem to be shifting in 2023 and into 2024. Only 59% now envision office-based corporate employee roles to be in office, down from 69% in 2022, while 34% expect those roles to be hybrid, up from 24%.

However, 86% of CEOs agreed they are more likely to reward those who try to come into the office with favorable assignments, raises or promotions.

Disruptive Technologies and Gen AI

Nearly three-quarters of banking CEOs agree that, despite economic uncertainties, generative AI is the most critical investment opportunity for their company. Many point to the promise of increased profitability, stronger fraud detection and new product and market opportunities.

Benefits and challenges of AI: The same number are expecting a return on investment in five years and a quarter expecting a return within three years. However, executives are also aware of the challenges of artificial intelligence;55% reported a high cost of implementation and complex ethical considerations.

Readiness for cyberattack: While banking CEOs remain confident in their cybersecurity preparedness, that confidence has declined notably from 66% in 2022 to 54% in 2023. Those who said they were unprepared or less prepared pointed to the increasing sophistication of attackers, shortage of skilled personnel and a lack of investment in cyber defenses.

Craig Guillot is a longtime contributor to The Financial Brand who specializes in technology. He often writes about IoT, cybersecurity and SaaS. His work has appeared in The Wall Street Journal, Entrepreneur and elsewhere.