During the height of the pandemic, Americans may have felt like they had money to burn. Some typical expenses like commuting, rent and loan payments just disappeared for a while, even as government stimulus money pumped up savings accounts. But, while we may have ducked a pandemic collapse, there’s a sense that deferred pain may be coming due.

The banking, payments and savings habits of American consumers are shifting in an environment of continuing economic turmoil and some gaps in their financial knowledge — and reluctance to even discuss money with their spouses or families — could be making matters worse.

A selection of recent surveys explores how American consumers are handling financial stresses, along with their attitudes and habits related to money.

One finding shows that shoppers are making small splurge purchases — like lipstick — to make themselves feel better.

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

1. Will ‘Buy Now, Pay Later’ Become ‘Eat Now, Pay Later’?

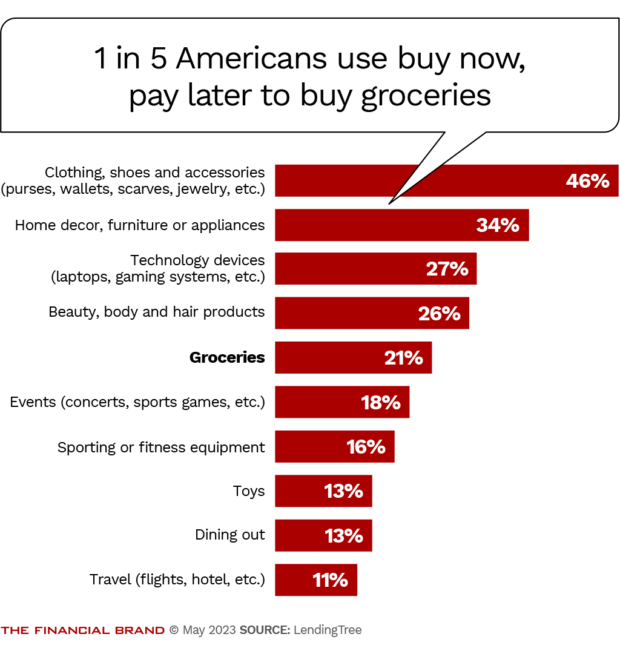

Buy now, pay later financing is often promoted as an interest-free alternative to credit cards that can be used to make purchases much like the classic layaway programs that allowed consumers to pay for purchases in installments. But research by LendingTree finds that 27% of BNPL users surveyed say that have used some form of buy now, pay later program as a bridge to their next payday. This comes during a period of high inflation and rising interest rates, and record credit card use.

BNPL plans are being used to purchase necessities, with 21% of LendingTree’s respondents saying that they have paid for food and basic supplies in installments.

“That’s eye-opening,” the report says. “Buying groceries differs greatly from buying designer purse, a refrigerator or a PlayStation 5.”

The use of BNPL to make it to the next payday occurred across all demographics. Men (32%) were much more likely to say they’d relied on BNPL for this purpose than women (23%).

Overall adoption of BNPL is up, though the growth rate has slowed. “It’s unclear whether that means BNPL growth is beginning to plateau or if rising inflation has had a cooling effect on demand, or if other things are at play, but it bears watching going forward,” the report says.

In the study, 46% of consumers said they’ve used BNPL, up from 43% in 2022 and 31% in 2021. Among younger generations BNPL usage is higher: 65% of Gen Z consumers use BNPL and 55% of Millennials do so.

On the other side of the “stretch” is late payments. Two out of five respondents who have used BNPL have been late. Among the groups most likely to be late on BNPL payments are parents of kids under 18, Gen Zers ages 18 to 26 and Millennials between 27 and 42.

In addition, the study found that nearly half — 45% — of BNPL users making $100,000 or more annually made late payments.

While BNPL plans “can be a great tool — they’re predictable, finite, often easier to get than other types of loans and often interest free — they’re not without warts,” the report states.

Indeed, it’s not unusual for companies offering merchant-supported BNPL programs to promote them to sellers as a factor that leads consumers to buy more than they would have if the installment plan hadn’t been available.

Read More:

- A Bright Future for BNPL Is in the (Bank) Cards

- Why Consumers Don’t Think BNPL Is ‘Debt’ (and Why It Matters)

2. Many Americans Know Celebrities’ Net Worths — But Not Their Own

Multiple studies are finding that consumers don’t know their net worth, and that they sometimes think that net worth is something that only the wealthy even have.

“Despite Americans’ fascination with other people’s net worth, it’s not a figure the average American knows about themselves,” says a research report that Qualtrics did for Credit Karma, which is part of Intuit.

The study found that more than half of respondents — 51% — don’t know how to calculate net worth.

A Financial Oops:

Among those Americans who can calculate their net worth, the news isn't always good. Nearly one in three people say their net worth comes in at $0 or a negative quantity. Among people nearing retirement age, 21% are at that low level.

Research by Civic Science has found that one out of 10 adults admit that they are “not at all financially literate,” while most people surveyed consider themselves “somewhat financially literate.”

Read More: To Capitalize on Home Equity Opportunity, Go Beyond Credit Scores

3. People Won’t Talk About Money with Family, Friends or Partners

Three out of five consumers in another survey said they don’t talk about money matters with others. Perhaps that’s not surprising in the case of co-workers and other acquaintances, but the study found the communication problem is much more pervasive.

The research, which Harris Poll conducted for Empower Annuity Insurance Company, found that 75% of those surveyed won’t discuss money with friends, 63% won’t talk about money within their family, and 46% won’t so much as touch on the subject with their spouse or significant other.

But younger generations generally are chattier than older ones when it comes to money matters. Millennials and Gen Z are twice as likely to be open about money with others than Boomers and Gen X consumers.

In lieu of talking about finances with those they know, many consumers — two thirds of those queried in the research — turn to the internet, perhaps trusting in the supposed anonymity of their interactions. Often, their questions are about basics such as how to save for retirement, the report says.

Some of the reticence to discuss finances may be learned behavior. More than half of those polled say their families never discussed financial matters when they were growing up. In fact, one out of four said they were raised to think it was impolite to discuss money.

“Money is the monster under the bed in many homes — and it’s time to turn on the lights.”

— report from Empower Annuity Insurance

Read More: Should Banks Add ‘Financial Therapists’ to Their Wellness Programs?

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

4. Weddings Can Spread the Financial ‘Joy’ Beyond the Happy Couple

One of the most stressful times not only for the principals but also the “supporting cast” are weddings. It’s also an expensive time, with many taking on debt to participate.

A LendingTree survey found that 40% of respondents have had to borrow to attend a wedding and 62% of people who were part of a bridal party went into debt for clothing and more.

Money also has been a reason that many could not participate: 31% of Americans have declined to attend a wedding due to costs, and 27% of those invited to be part of the bridal party have turned down the privilege, according to LendingTree.

“As 80% of Americans agree that weddings and wedding-related events are getting too expensive, some are setting financial boundaries,” the report says.

But there can be a non-monetary cost. The study found that 10% of those who were brides or grooms whose invitee declined to come say the turndown ruined that relationship.

Read More: Ally Campaign Pokes Fun at Couples’ Fears Over the ‘Money Talk’

5. Technology Pressures Tippers to Up Their Gratuities

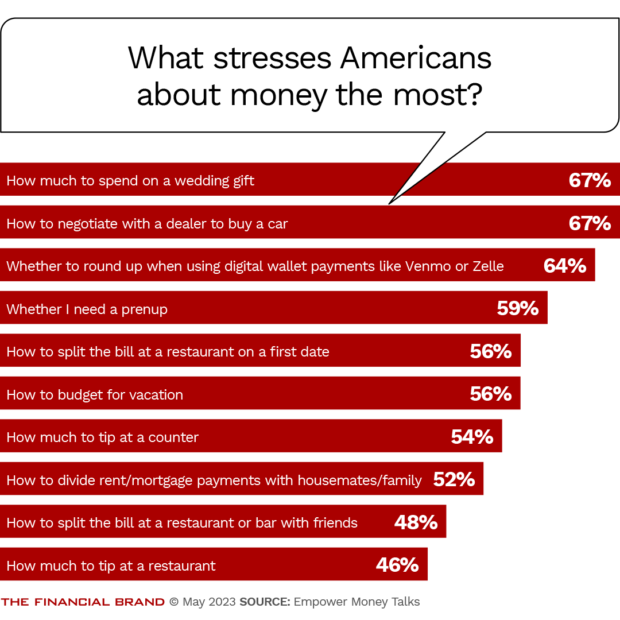

Anyone who’s ever given a tip knows how subtle clues often indicate when one is expected — a cleared throat, a brief hesitancy in making change from cash. The growing ubiquity of handhelds and tablets used for taking payments, often with suggested percentage tipping amounts, takes the subtlety out of it. Generally, a range of percentages appears on the screen, and opting out of those choices can feel awkward.

A LendingTree survey found that 24% of consumers always feel pressured to tip when the option is presented and that 42% sometimes feel such pressure.

This leads to what LendingTree calls “guilt tipping.” People frequently don’t want to be seen as cheapskates, so they will tip something even if they hadn’t intended to or didn’t expect it to even be an issue.

Nowadays a device will make tipping suggestions even at takeout counters, where the server’s activity amounts to handing over a bag.

“Technology has made it so easy for businesses to implement tipping,” the LendingTree report says. “Most businesses run on such tiny profit margins that the ability to add a new revenue stream by doing nothing more than adjusting some settings on a payment terminal is a pretty appealing thing.”

Read More:

- Digital Wallets Could Cost Banks Billions in Lost Payments Income

- How the ‘Paze’ Digital Wallet Aims to Win Over Merchants and Consumers

- What Bankers Need to Know About Higher Credit Card Spending & Consumer Debt

6. Nine Out of 10 Americans Keep Cash at Home

In a poll of American consumers, the Life and My Finances blog found that while nearly all had at least a savings account, just over 90% also keep some cash around their home. While 63.3% of respondents use some type of safe, the more atypical choices for cash storage include:

- Inside the refrigerator: 13.3%

- In a suitcase: 6.1%

- In a closet: 5%

- In a water tank: 4%

When a safe isn’t used, women tend to favor the fridge — 18.1% use the refrigerator versus 10.7% for men. On the other hand, men favor closets, 7.1% versus 1.2% for women.

The survey doesn’t indicate that anyone is keeping cash under their mattress anymore.

Read More: Costly Truth for Banks: Cash Payments Are Down But Not Out

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

7. Revisiting the Counter-Intuitive ‘Lipstick Index’

It almost seems perverse, but human reasoning can often be so. The so-called “lipstick index” holds that when economic times are tough, people treat themselves to make things feel better. Deloitte Insights reports that lipsticks and other personal grooming items have seen a rise in sales, partly due to this effect.

The firm conducted global research and found that this isn’t just an American thing, but a universal trait. In some countries the tendency to do this is much higher, but worldwide three out of four consumers told the firm that they had made some sort of splurge purchase. And the research found that men are just as likely as women to treat themselves.

But lipstick isn’t the prime indulgence.

“Globally, consumers are almost three times more likely — and four times more likely in the United States — to say their recent splurge purchase was food and beverage compared to personal care,” according to the study.

The report quips that “along with the lipstick index, we should all be talking about the bourbon barometer.”