Like a case of long Covid, the impact of pandemic-period auto industry trends will be with lenders and borrowers for some time yet, thanks to a cascade of factors: increasing numbers of defaults on higher balance loans, an increase in repossessions in the wake of those defaults, and higher losses on those loans, due to the difference between COVID-level auto prices and today’s lower levels. Many loans are “underwater” in relation to current values.

Understanding the Auto Market’s Many Moving Parts

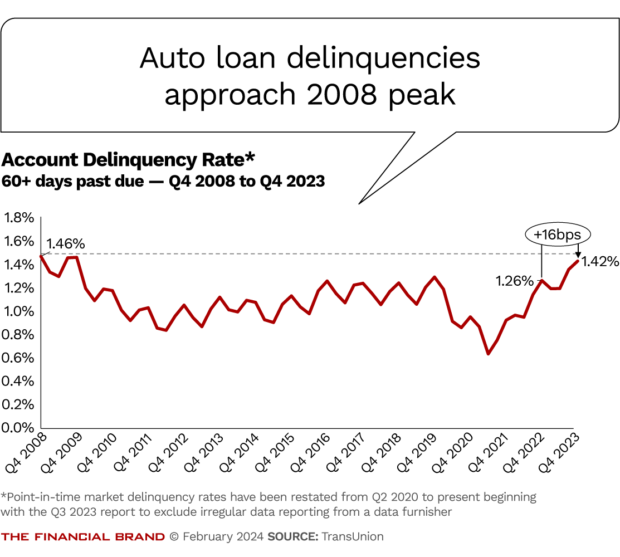

Delinquencies on auto credit have been rising. In the third quarter of 2023 the level of delinquencies on auto loans stood at 1.61%, up from 1.43% at the end of 2022 and from 1.10% at the end of 2020, according to TransUnion.

Loans originated in 2022 and 2023 are performing worse than other vintages, notes the New York Federal Reserve Bank’s Liberty Street Economics blog. The analysis suggests that “buyers during these years faced higher car prices and may have been pressed to borrow more, and at higher interest rates.”

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Many lenders have been tightening availability of auto credit, according to the Federal Reserve’s January 2024 edition of its Senior Lending Officer Survey.

At the same time, fewer consumers have been buying cars and borrowing to do so — originations fell 4% in the third quarter of 2023, compared to the year earlier, according to TransUnion. (Originations are reported one quarter in arrears.) The only demographic group to see an increase in auto lending in this period is super prime consumers.

Auto Buyers' Triple Whammy:

Even while prices have dropped and supply has increased, the combination of price, much higher interest rates, and lenders' shortening of loan maturities has resulted in higher monthly payments.

Experian reported late last year that the average monthly payment was $726 in the third quarter of 2023, compared to $701 in 2022 and $617 in 2021, both in the third quarter.

Meanwhile, multiple factors — including the end of the 2023 United Auto Workers strikes against Detroit’s big three automakers — have created growing inventories of new vehicles at dealers, lowering car prices further.

S&P Mobility analysts are projecting moderate growth in auto sales in 2024, perhaps a 3% rise. The firm predicts that dealers will begin trimming prices below the manufacturer’s suggested retail price (MSRP) levels, possibly offering incentives to move inventory off their lots.

Read more: Credit Card Watch: Balancing ‘Growth Math’ and Lending Risk

Repossessions Rise in 2023, and Will Maintain that Level in 2024

When you talk about “underwater” auto loans, it’s necessary to acknowledge that all automotive lending has this issue. The moment a car leaves the dealer lot, it begins depreciating. If there’s a loan on the vehicle it will probably be underwater, according to Mark Schirmer, director of industry insights and corporate communications at Cox Automotive. Cox is a conglomerate of firms that serve the auto industry, including Manheim, which is the leading wholesale vehicle solutions firm in the U.S.

The prices that new vehicles were commanding in 2020 and 2021 were considered “historic,” in Cox’s words.

“What the market is certainly feeling is the result of some serious price movement during and after the pandemic — with new vehicle prices reaching all-time highs and then retreating,” says Schirmer.

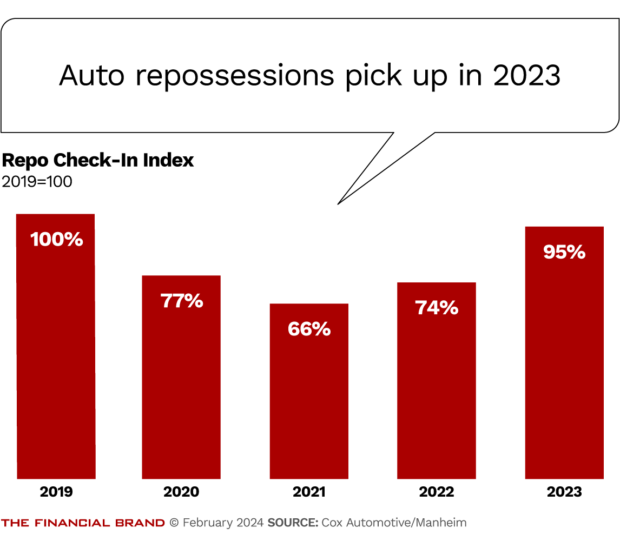

Manheim auto auctions took on 1.5 million repossessed vehicles in 2023, said Jeremy Robb, senior director, economic and industry insights, during a Cox webinar looking at auto industry trends. This was a 29% increase over repos for 2022, but actually 5% lower than 2019. Robb said that much higher delinquencies in 2023 drove increased defaults, leading to repossessions.

The company projects that repos will stay at that level in 2024.

“High interest rates have curtailed loan growth,” said Robb, “and that, coupled with low unemployment, should keep repos relatively flat.”

Car Conundrum By The Numbers:

In 2023 the Manheim Used Vehicle Value Index dropped 7% from 2022, about half of the decrease seen from 2021 to 2022. The firm reported that the index peaked in December 2021, and that yearend 2023 values fell almost 21% from that high.

While values may have fallen, Cox analysts also believe 2024 will be a period of normalization. In part this is because with the return of higher inventory levels, the industry will revert to normal value depreciation levels. At the same time, a combination of somewhat higher prices and higher interest rates has weighed on demand for used vehicles, according to Robb. Retail used car prices were down 4% from 2022 at yearend.

New vehicle prices are expected to fall moderately, according to Cox analysts, but rates and resulting monthly payments will likely keep retail new vehicle sales flat. Likewise, the company expects that used vehicle sales will be up only slightly — less than 1%, due to lower production in previous years.

Read more:

- Credit Card Trends Have Bank Issuers on Alert

- Credit Cards Now: Everything You Need to Know From the CFPB’s Latest Report

- Buy Now, Pay Later Needs to Pay Off in 2024

Spotlight on a Lender: How Ally Bank is Handling the Challenge

The degree to which individual lenders have been impacted by these trends depends on their business mix. Brian Ropp, managing director, financial institutions, at Kroll Bond Rating Agency, notes that credit unions took market share from banks in the 2020-2021 period as some banks exited the indirect auto lending business. Citizens Bank, which in mid-2023, announced that it was leaving the business to “optimize its balance sheet and emphasize relationship-based lending.”

Ropp believes the credit unions have been harder hit by the pricing trend than many banks have.

But it’s a challenge for all. During Ally Bank’s yearend 2023 earning briefing, an analyst asked how the bank was dealing with rising delinquencies. Ally is one of the nation’s largest indirect auto lenders, thanks to roots as General Motors Acceptance Corp. — “Gee-Mac” — then the automaker’s captive finance arm.

Russ Hutchinson, CFO, told analysts that Ally has been adjusting its collections process. Most specifically, the company has changed how it times repossessions.

“We have found we get better outcomes by delaying repossession,” said Hutchinson. “This gives our collectors additional time to work their credits and gives our borrowers a little additional time. This tends to work out in our favor and we’re getting better outcomes.”

Hutchinson added that a deep focus on vintages of loans, deeper than any data that is published, helps the bank manage performance. He pointed out that 2023 auto loans in its portfolio are beginning to show improvement over the 2022 vintage.