The banking industry is being attacked by a growing number of FinTech startups and digital companies who are working to capture market share from traditional players. To survive, traditional banking organizations need to evolve quickly, according to new research from digital innovation agency Adaptive Lab.

Based on this research, carried out for a new book called Bye Bye Banks?, written by James Haycock, and co-authored by technology reporter Shane Richmond, despite the fact that banks are spending billions of dollars on digital transformation and innovation activities, changing the entrenched culture within these organizations is very difficult. The extensive qualitative and quantitative research for the book stems from discussions with 110 senior managers, directors, C-Level executives, CEOs and Presidents within the retail banking sector.

“The financial services playing field has been changed irreversibly in recent years by a new generation of companies and leaders who have torn the rulebook to pieces, adopting new technology, introducing new working practices, and serving customers whose lives are increasingly orientated around their mobile phones”, says the research. Thanks to the expansiveness of the web and the accessibility of the smartphone, digital disruption is happening all around us, breaking dominant business models in retail, entertainment, travel and telecommunications.

Beyond well-known disruptors such as Amazon, Uber, PayPal, Skype, Spotify, WhatsApp, Netflix and Airbnb, there are even more smaller start-ups hoping to transform traditional transactions, companies and even industries.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Displaced, Diminished and Disintermediated

In the time it takes to develop an app, digital disruptors can change the way business is conducted and the revenue that can be generated. Leveraging simplified designs and big data, digital disruptors can provide new levels of personalization, contextuality, scalability and functionality at the tap of a finger.

There are an increasing number of new FinTech start-ups attacking the core functions of payments, lending, investing, money transfer, advising, etc. Services such as Lending Club, Funding Circle, Nutmeg, Transfer Wise and Venmo are only the largest (and most successful) of the new entrants.

The banking industry may be more at risk than other industries due to their large size, historically high profitability and tendency to move at a snail’s pace. Bankers are also hesitant to explore new business models that could cannibalize or compete with existing ones and find themselves hamstrung by legacy … legacy technology, legacy processes and, in most cases, legacy thinking.

Banking giants face a further challenge according to the research. With a very high cost of compliance, it is believed to be harder to deliver change at the rate of the new, agile entrants. Many in the industry believe that regulation protects them from the tech startups to a degree. That protective cushion might be slipping away, however, as governments act to promote competition by changing regulation to encourage new offerings.

“It’s plain to see that a perfect storm of competition, technology, shifts in customer behavior and regulation looks set to wreak havoc on the businesses we trust with our money. It’s a matter of when, not if, banking will be reinvented.” – James Haycock

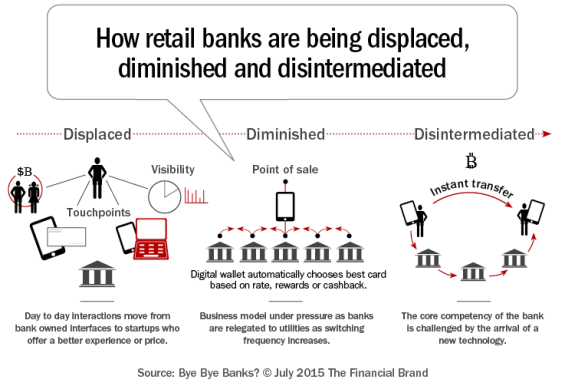

The research discussed in Bye Bye Banks? proposes that incumbent banking organizations are becoming displaced, diminished and disintermediated by new businesses and new technologies.

- Displaced – by a superior customer experience and price offered by new entrants, enabled partly by the luxury of being free of legacy technology and cost base, and developers closer to the needs of their target customers.

- Diminished – revenues are squeezed and legacy organizations are relegated to utilities in a market with higher switching frequency.

- Disintermediated – core competency of the incumbents, such as storing and transferring value, are challenged by the arrival of new technologies, such as the blockchain. In this phase, complete functionalities may be replaced by FinTech start-ups.

“The generation coming of age today might not see a need for a traditional bank at all, just as they don’t see any reason to have a landline, send letters or buy newspapers,” Haycock says, saying that the only reason people still have banks – which they no longer trust, in any case – is inertia. “With 2.5 billion unbanked people in the world, and a billion of those owning a mobile, a digital disruption is now realigning the entire banking industry.”

What is enlightening (and a bit frightening) are the comments interspersed throughout the book, where bankers share their views of the impact of the tech startups, the cost of compliance that the existing players are burdened with, and the contention that customers won’t trust a startup with their money. Some of these comments are encouraging, while some reinforce some of the challenges facing legacy organizations around people, culture and technology.

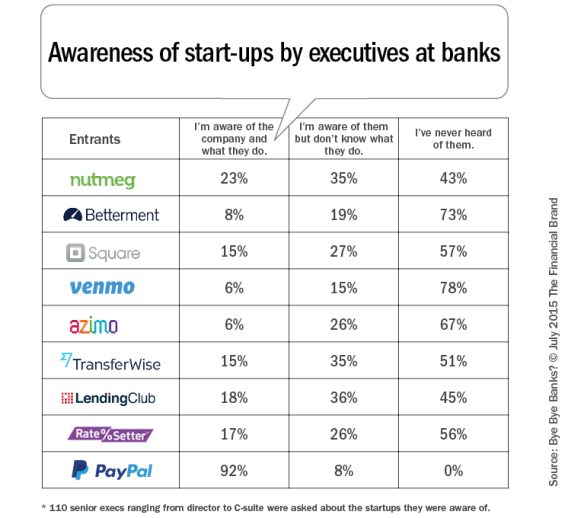

One of the most disconcerting findings of the research was that top-level managers lack an in-depth understanding of the digital world and its impact, as well as new competitors. While some of this lack of knowledge can be attributable to the age and level of executive interviewed (less apt to be a ‘digital native’), or that the survey was done in the U.K., knowing your ‘enemy’ may be an important first step.

Bold Response Needed – The Beta Bank

Traditional banks may be able to succeed in the digital age. They have benefits, such as large customer bases, access to rich transactional data and the ability to offer integrated financial services. But, they must find a way to leverage them.

To succeed, however, banks and credit unions need to concentrate on ridding themselves of legacy processes, technology, and possibly, even people. Organizations will need to develop a balanced multichannel delivery model, deepen their data analysis capabilities and play a larger role in their customers’ lives. Banking organizations will also need to continue down the path of digital transformation, service and product innovation, and partnering or investing with FinTech startups.

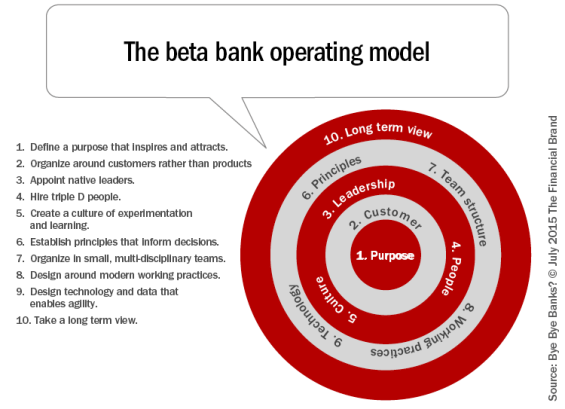

While the authors believe these changes can deliver results, they don’t believe they will have a great enough impact on the three critical components of people, culture and technology. With this in mind, they proposed the development of a ‘Beta Bank’.

A ‘Beta Bank’ is a standalone organization with a separate leadership and headquarters. Providing a fresh start and offering the opportunity to rethink from the ground up, the new organization would need to consider a new, ten point operating model.

“We believe this approach is the best opportunity for a bank to design a proposition, servicing model and, critically, an organization built for a future where the pace of change is only set to increase, not an adapted version of a business model that hasn’t changed in hundreds of years,” stated the authors. Detail of this new model is provided in the book.

Commenting on the importance of digital as part of the core team within retail banks, Anne Boden, CEO, Starling Bank, said, “Currently, having somebody whose job is digital, in a bank, says a lot about the organizations in that it is something bolted on, rather than something that is fundamental.”

Alessandro Hatami, Founder of Pacemakers and former Digital Payments and Innovation Director at Lloyds Bank stated, “The vast majority of the leadership of banks don’t understand exactly how digital works and are very worried about the digital bank. They have a subset of a subset of a subset of their employee base running large percentages of their business without the leadership knowing exactly what’s going on inside.”

“A concern that the banks have is the arrival of big ecosystems that will replace them, such as Google, Facebook, Apple, etc. These are customer-based organizations. The customers are already users of these environments. If they start pushing financial services to their own customer bases, these ecosystems can potentially take customers away from the banks.”

Finally, speaking at the World Economic Forum in 2015, the Bank of England Governor, Mark Carney, stated that the banking sector is vulnerable to an Uber-type incursion and that such a situation was imminent. He went on to say that the forces driving this change are undeniable.

According to Carney, it is a matter of when, not if, banking is reinvented.

About The Book Bye Bye Banks?

Bye Bye Banks?, written by James Haycock, MD of Adaptive Lab and former Telegraph Technology Editor, Shane Richmond, provides an analysis of the forces shaping the future of financial services. The book looks at the struggling business model of traditional banks, where despite billions of dollars of investment in digital technologies, they continue to struggle to keep pace with consumer expectations when it comes to digital experiences and wider market trends.

Bye Bye Banks?, written by James Haycock, MD of Adaptive Lab and former Telegraph Technology Editor, Shane Richmond, provides an analysis of the forces shaping the future of financial services. The book looks at the struggling business model of traditional banks, where despite billions of dollars of investment in digital technologies, they continue to struggle to keep pace with consumer expectations when it comes to digital experiences and wider market trends.

Free of legacy technology, processes and thinking, emerging disruptors are unbundling services offered by traditional banks and transforming them into a seamless digital service for tech savvy customers. These start-ups are impacting all areas of the banking ecosystem, including payments, lending, investing, money transfer, advising, etc.

The key themes and messages that come out of the book are based on extensive qualitative and quantitative research that was carried out with 110 senior managers, directors, C-Level executive, CEO’s and Presidents within the retail banking sector, and a survey with over 400 nationally representative UK consumers. The book also features commentary with senior experts including, Anne Boden, CEO, Starling Banks, Alessandro Hatami, former Digital Payments and Innovation Director at Lloyds Banking Group, Tom Hopkins, Product Innovation Director at Experian and James Barty, Head of European Equity Strategy, Bank of America Merrill Lynch.

Bye Bye Banks? is available to buy on Amazon and can be read in under 2 hours.