We are beginning to see the early economic impact of the Coronavirus outbreak in the U.S. and globally. Beyond the human healthcare aspect, it is clear that the outbreak will disrupt the global supply of goods, making it harder for U.S. firms to fill orders. But as events get cancelled, schools and offices close, and social withdrawal becomes the norm, the demand for products and services will decrease, workers will lose jobs and some businesses may shut their doors forever.

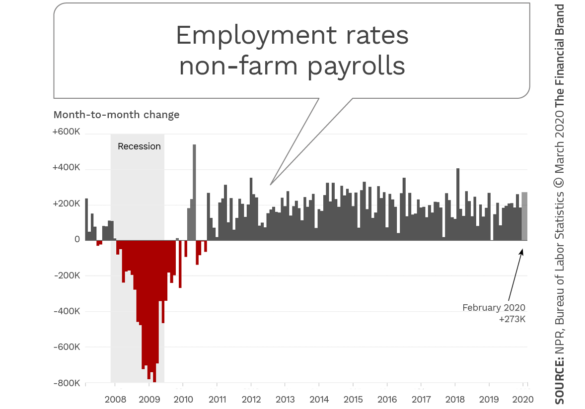

With the virus that causes COVID-19 spreading to significantly more communities around the country, it’s becoming clear that the epidemic is the biggest threat to the global economy since the financial crisis almost a dozen years ago. In a startlingly short period of time, spending and confidence that until recently underpinned the economy and supported a record-breaking job market for more than a decade appear to be coming to a screeching halt.

For consumers, the impact of being sent home because demand for their services are not needed at this time (or the need to stay home to care for a sick loved one or a child without a school to attend) differs depending on the specific circumstances. There is far less impact for a middle income worker telecommuting from home than one who is out of a job without unemployment benefits or a safety net of funds available for emergencies.

If the health crisis continues for an extended period, the impact on income and future employment becomes less certain and more at risk. The impact is even more uncertain when we consider the impact of global supply chains potentially drying up.

Eleven states and the District of Columbia require employers to offer workers paid leave, but none of these states guarantee paid leave to healthy workers if a virus outbreak requires everyone to stay home. Because of this gap, 14 Democratic senators wrote to leaders of the Business Roundtable, the Chamber of Commerce and the National Association of Manufacturers to urge their member companies not to penalize workers for going home during the outbreak, according to Politico.

It is clear that we are entering completely uncharted waters.

Read More:

- Beware: Customers May Cut Banks From The Digital Journey

- Just Because Banking Customers Don’t ‘Switch’ Doesn’t Mean They Love You

- Fintech for Good: Five Innovators Changing The Banking World

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

A Unique Opportunity for Financial Institutions

According to Alex Johnson, Director of Portfolio Marketing for FICO, “Most of the time, consumers don’t think about banking at all. They just expect it to work. The only times they really think about banking is when there is a financial need or when they’re facing a crisis. Johnson continues, “Delivering solutions, tailored to each individual customer, is what builds trust and brand loyalty in these moments.”

This need has not gone unnoticed by the regulators. A joint statement from the Federal Reserve, CFPB, FDIC, NCUA, OCC and Conference of State Bank Supervisors stated, “Regulators note that financial institutions should work constructively with borrowers and other customers in affected communities.” The statement continued, “Prudent efforts that are consistent with safe and sound lending practices should not be subject to examiner criticism.”

To stimulate the economy, the central bank also cut its benchmark short-term lending rate by half a percentage point, with the rate expected to go even lower soon. The President also indicated the potential for additional stimuli, including a possible direct payment to consumers, a cut in payroll taxes and other options.

Dozens of Ways to Help Consumers

“These are extraordinary times and they require extraordinary thinking and actions, states Bryan Clagett, Director of Strategic Initiatives for StrategyCorps. “From a tactical level, financial institutions can do a lot to reduce consumer and business stress. For years I’ve seen and heard bankers preach advocacy. It’s put up or shut up time.”

While some consumer relief strategies can be offered unilaterally (such as reductions in lending rates or elimination of penalty fees), now is a perfect time to leverage both personalized strategies as well as the use of advanced analytics to deliver contextual solutions.

Some examples that should be considered on a case-by-case basis include:

- The ability to defer mortgage and other loan repayments for extended periods of time.

- Access to cash from fixed-term savings accounts without early termination fees.

- Temporary increase in credit card borrowing limit.

- Elimination of cash advance fees.

- Simplified digital personal loan application process.

- Increase in cash withdrawal limits.

- Reimbursement of overdraft and NSF fees if funds are redeposited within one week.

One of the most impactful offerings may be the availability of short-term, small-dollar personal lines of credit that can provide relief for consumers needing funds until an upcoming employment or benefit check is received. Similar to the high-rate ‘payday loan’ offered by third party vendors, a much lower rate offering from a traditional or fintech organization can create tremendous positive impact on a consumer experiencing financial stress.

This type of small dollar personal loan offering should be offered on a pre-approved basis (and for varying amounts) directly on a bank’s or credit union’s mobile app. With instant access, and the ability to repay the borrowed funds automatically when a deposit is made, this service should take into account the longevity of the relationship, utility and rent bill payment history as well as other non-traditional credit criteria.

“To provide people with more financial instruments during Black Swan events like the Coronavirus outbreak, financial institutions should look for more ways to help their customers and members tap into their credit, their savings, and other sources of income to sustain them when they are unable to work, states Bradley Leimer, co-founder of Unconventional Ventures. “More innovation has to come from within banking and from our friends in fintech.”

According to best-selling author, speaker and founder of Moven, Brett King, “After years of continuous growth, banks and lenders should be seeking to alleviate some of the stress of Coronavirus with mortgage holidays and temporary rate reductions on credit lines for effected individuals. It’s time for banks to show their social and community commitment.”

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Are Banks and Credit Unions Prepared to Help?

Unfortunately, the challenge for many traditional financial institutions is a combination of a lack of simple digital product offerings as well as an inability to deliver highly personalized financial solutions seamlessly.

According to Ron Shevlin, Director of Research at Cornerstone Advisors and senior contributor to Forbes, “Nearly every financial institution I’ve surveyed or spoken to says that ‘personalization’ is important to their customer relationship building efforts. But when it comes to ‘personalizing’ a product – like offering flexible payment terms on mortgage payments, or allowing someone to ‘skip a payment’ – it’s ‘oh no, we can’t do that’.”

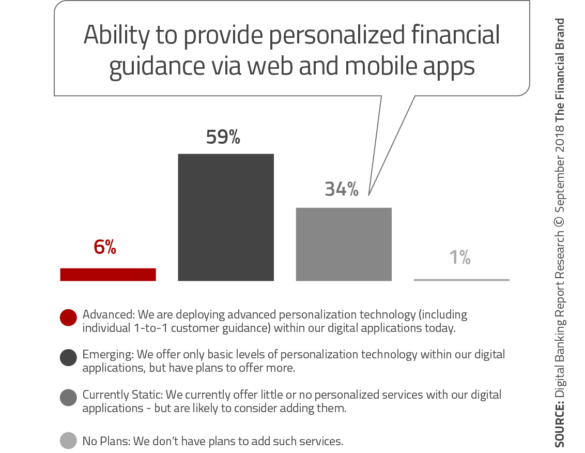

We found the same to be true in research conducted by the Digital Banking Report. As would be expected, the largest financial institutions had the highest self-assessment around the ability to provide real-time contextual guidance. That said, less than 20% of the large national and regional banks considered themselves “Advanced” in this capability.

While it was somewhat encouraging that almost 60% of financial organizations in all asset ranges considered themselves as “Emerging” (10% higher than in 2016), the overall percentage of institutions believing they were “Advanced” is dismal. Bottom line, 94% of financial institutions are still unable to deliver on the ‘personalization promise’.

Unfortunately, most responses to the Coronavirus outbreak have consisted of email messages to customers and members, discussing a ‘commitment to the community’ and ‘willingness to help’, with close to zero specifics beyond phone numbers to call. In the case of my primary business bank, they also offered links to digital bill payment solutions and their overdraft solutions page. (#epicfail)

Alternatives to Branch Support

Obviously, if the Coronavirus epidemic gets much worse, branch banks may be forced to limit operations or potentially close some branches if there are not adequate employees to support the office. In China many banks needed to close hundreds of offices during the height of the epidemic. Many banks and credit unions in the U.S. are developing contingency plans, but how does the consumer and small business get impacted if a local branch needs to close?

Government agencies understand that financial institutions may face staffing and other challenges. Regulators stated that they will expedite, as appropriate, any request to provide alternative availability of services in affected communities. In these situations, it becomes clear the importance of digital banking solutions across the organization, from opening accounts and applying for loans to disbursement of funds.

A Time to Come Together

Consumers, small businesses and bank employees are looking for relief during these unusual times. While some may be forced out of work or may simply just be emotionally impacted by the current inundation of stressful economic messages, everyone will be looking to their local financial institution for a calming influence and financial solutions that will help.

What is the culture of your organization? Can you deliver on your promise of delivering a positive customer experience? Can you illustrate your support for your employees?

One example of how an organization put their corporate culture to the test was WeLab in Shenzhen China. When the Chinese fintech reopened their offices, employees received Welcome Bank Packs that included hand sanitizer, anti-bacterial wipes, face masks and additional goodies. Most importantly, these Welcome Back Packs were assembled by the senior management team at WeLab.

“At times of crisis, how you treat your employees and your customers speak volumes about your values”, shared Theodora Lau, founder of Unconventional Ventures. “From allowing interest-only payments for mortgages, to suspending debt repayments, to extending relief loans for small businesses, we must ensure that the society’s most vulnerable citizens have access to a safety net. How our financial institutions choose to act will have a long lasting impact in the lives of their customers — and beyond. “