Search for “bank bailout” on Google and you’ll find 43.9 million results. Media coverage — and the highly politicized nature of American discourse — have stoked the nation’s worst fears with simplistic soundbites that make liberal use of the B-word. So, naturally many consumers are wondering: Are we back to 2008 with the federal government again bailing out the banking industry?

That question will likely upset banking leaders, and I am entirely sympathetic. The public perception of the industry has been formed largely by a lack of understanding of how banking works. It was easy to pin 2008 on all banks, but the industry knows who the bad actors were before the Dodd-Frank Act came along. On the whole, all banks were punished for the sins of a few, in a crisis with extensive roots in nonbank lenders and investment banks.

But people don’t have any interest in understanding the nuances of banking. What they see is the second-largest and third-largest bank failures in U.S. history in just two days. They see that the Federal Reserve will ![]() ensure those two failed banks “have the ability to meet the needs of all their depositors.” And they see headlines on the “latest banking bailouts.” The industry must again deal with public relations, media coverage, customer questions, and potential future legislation, all spiced with loose use of that infamous word: “bailouts.”

ensure those two failed banks “have the ability to meet the needs of all their depositors.” And they see headlines on the “latest banking bailouts.” The industry must again deal with public relations, media coverage, customer questions, and potential future legislation, all spiced with loose use of that infamous word: “bailouts.”

Never mind that even the media is putting that word in quotes this time around.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Brand of Banking Itself Is At Risk — Again

Because of the political implications, there’s a lot of risk in commenting publicly on the topic of bank bailouts. Bankers also are de facto apolitical in their dealings with customers. But, they have an alternative means of affecting public opinion. The industry employs more than 2.2 million people, not including boards of directors or the vendor community. Together, banking must communicate at dinner tables, coffee shops, country clubs and local chambers of commerce to tell its story.

To accomplish that, though, the industry needs its narrative straight on today’s “bailouts.” The task is not just understanding how these banks failed, and how banking overall — at big and small institutions across the country — differs from these specific failed banks, but being able to communicate about it effectively with people who are confused and sometimes even angry.

This is the only hope for avoiding the same progression of events that unfolded in 2008, when the banking industry became so demonized that recruiting efforts tanked nationwide and many once-proud bankers kept their heads low to avoid vitriol.

Credit unions too should set their differences with banks aside here. They also have unrealized bond losses, and now have access to the new emergency liquidity program. If the country blames “banking” for a “bailout,” everyone will suffer together, come what may. To prevent that, everyone should be singing from the same hymnbook. We’ve seen before how these kinds of events play out; the industry brand again hangs in the balance.

So, what’s the song?

Here’s what the public needs to know:

First, the failed banks are not being bailed out — they no longer even exist.

Second, the coverage for uninsured deposits, which is funded by the banking industry, benefits many small tech startups along with some big venture capital firms. If it is a “bailout” at all, it is largely a venture capital bailout, not a bank bailout. And the banks are paying the price for it.

Third, Silicon Valley Bank and Signature Bank were unique aberrations of poor risk management.

And, finally, regulators should take full responsibility for two major issues at Silicon Valley Bank that contributed to the sharp deposit runoff there: its overconcentration in the technology sector and its poor risk management.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Long Shadow Cast by Bank Bailouts

Before setting the record straight on bailouts, let me say first: Bankers would be totally justified — after tech companies preached at them for years about “banking being broken” and how the industry is “too risk-averse” and lacks “an innovation mindset” — if they relished tech’s panic right now. Those preachers of progress didn’t manage risk in their deposit relationship, and the worst-case scenario happened. Ironically, their plight is not so different from that of banks in 2008.

The crisis of 15 years ago was caused by lending quality. To oversimplify, lenders — both in mortgage and commercial — made bad loans at such scale that losses threatened their solvency. The degree of damage escalated as property values cratered and foreclosures piled up. This perpetuating loop kept the credit issues spiraling to the point that they undermined the entire banking system. The government, infamously, saved some financial institutions and allowed others to fail.

But the bottom line is that it spun up the Troubled Assets Relief Program, or TARP, to prevent the collapse of the U.S. banking system and, in the end, this investment in the banking industry turned a profit. Even so, the whole mess gave rise to the “bailout” label that is still haunting the industry now.

Using TARP as the measuring stick, the Silicon Valley and Signature bank failures are just that — failures — and they’re being resolved. They are not being saved by taxpayer money. Those two banks no longer exist.

So Who Is Really Getting Bailed Out?

Let’s turn back to those tech companies that had millions of uninsured deposits at Silicon Valley Bank. In the banking relationship, bank and customer exchange capital. A loan is a bank extending its capital to borrowers. A deposit is an accountholder extending capital to the bank. One’s asset is the other’s liability and vice versa.

About 94% of Silicon Valley Bank depositors extended their capital to the bank without collateral and without insurance. If the money were going the other way, we’d call it an unsecured, no-collateral loan. If a bank made that loan and it ended in default, we’d say the bank earned every dollar in losses — it made a “bad” loan. This is, in fact, what created public outrage after 2008’s bank bailouts; bad actors deserve bad outcomes, and some of the worst offenders went largely unscathed.

If It Smells Like Smoke:

The fuse was lit for the Silicon Valley Bank fire long ago, and the flame should have attracted attention — and questions — from customers, investors and regulators.

The decision by regulators to cover depositors at the two failed banks is only necessary because so many of them concentrated their deposits in a single institution without properly assessing the risk of providing too much of their capital — in some cases, all of it — to that institution. The bank is the borrower in this case. The depositors, many of them tech startups, had raised millions of dollars from investors and parked that money in the bank. Silicon Valley Bank reportedly had 50% of all U.S. venture-backed tech startups as customers, a concentration so large that the loss of those uninsured deposits, if left unaddressed, would have been potentially destabilizing for the entire tech ecosystem.

Venture capitalists’ money also sat in Silicon Valley Bank accounts, and those same VC experts had seats on the tech company boards that were responsible for turning their investment capital into 300% returns.

So what’s happened is the banking industry is paying the bill for risks taken by other players in the financial services sector. As President Joe Biden said in his address to the nation on Monday, March 13, “All customers who had money in these banks will be protected and have access to their money today; the money will come from fees that banks pay into the deposit insurance fund.”

That’s an important point for bankers to be clear about when talking to people. So far, it’s a largely tech depositor bailout, not a bank bailout; the industry is holding the bucket.

Read More:

- SVB Post-Mortem: Communications Lessons Amid the Collapse

- Why Silence Isn’t Golden on SVB & Signature Bank Failures

- 3 Effective Tactics to Calm Customer Fears in a Banking Crisis

How the Failed Banks Were Managed Differently Than Others

Uninsured depositors took risks, but is it entirely their fault they were so open to losses? The bank’s failure is certainly management’s blunder. But the two sides made a merry pair.

Clearly, investors in the bank’s parent company feel deceived. A suit from them alleges that “SVB Financial Group and top executives failed to disclose to investors how rising interest rates would leave Silicon Valley Bank, the firm’s banking unit, ‘particularly susceptible to a bank run,'” Banking Dive reported on March 16. The plaintiffs accuse Greg Becker, the bank’s chief executive officer, and Daniel Beck, its chief financial officer, either of deceiving investors or “of acting with reckless disregard for the truth when they failed to ascertain and disclose the true facts in the statements made by them or other personnel of the company to members of the investing public.”

It’s not a stretch to say that depositors were unlikely to learn of the bank’s troubles directly from management. But, Silicon Valley Bank was an outlier based on even basic industry research. After its third-quarter results were released, depositors could have observed the powder keg just waiting for a spark. Only 5.65% of total deposits were insured at that point, according to data that is publicly available via the Federal Deposit Insurance Corp.; it screams risk of a bank run.

The bank’s fourth-quarter results show 94% uninsured deposits to domestic deposits, according to data reported by The CorePoint. The same ratio at Signature Bank was 90%. “The industry median is 34%,” says Neil Stanley, an asset-liability expert who is the founder and CEO at CorePoint.

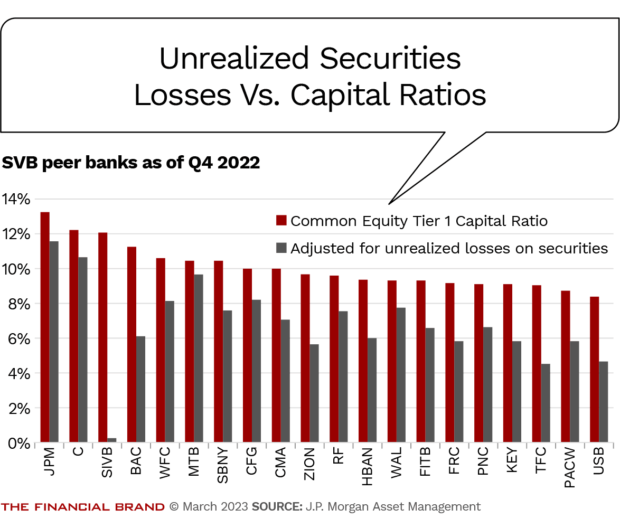

Silicon Valley Bank’s tax equivalent bond yield was 1.75% on total investments of $129 billion — which made up over 60% of its balance sheet. Over 25% of its loans and securities had more than a 15-year duration, well above its peer group. The median for banks over $100 billion was 13%. “They had a large, long, and low-yielding portfolio,” Stanley says.

Just as bankers must research carefully (known as the underwriting process) before they give their money to someone, the same applies to uninsured depositors.

In addition, banks also have options for vastly expanding deposit insurance. Wintrust’s MaxSafe program lets individuals or entities increase the maximum amount of FDIC insurance to $3.75 million, from the standard $250,000. Other options to increase deposit coverage — IntraFi, for example — also exist.

It does not speak well of venture capital firms that they overlooked such basics of money management.

If you are going to capitalize a bank with your deposits, taking all the same risks as an investor, demand accountability based on publicly reported data, or take your funds elsewhere. If depositors had applied that discipline, Silicon Valley Bank and Signature Bank may not have become infamous for poor risk management.

Regulators Should Have Seen the Trouble Brewing

So could depositors have taken their funds elsewhere? Technically, yes.

But Silicon Valley Bank attracted customers because of its specialization in services that catered to the unique needs of tech founders.

Speaking about the bank on a LinkedIn post, one founder said: “I don’t remember talking about fees or features. It was just included, with a sense that they could do whatever I needed without thinking about it. It started as a place to store money and move it in or out as needed, without fees, special exceptions, or hassles. I didn’t have to think about it, explain what was going on, worry, or pay much attention to it.”

It’s a lot of extra work to pay attention to banking stuff as the CEO of a startup that needs to grow by 30% every year. And conceivably, for some of those CEOs, it also could be outside their area of expertise.

But Silicon Valley Bank’s specialization allowed a kind of autopilot. That was a key part of its value proposition to the tech industry. End the relationship, lose that value.

When tech companies raise money, they do it in funding rounds. With each successful capital raise comes an infusion of cash that startups have to deposit somewhere, and because they need it to cover expenses, including rent and payroll, they need it to be relatively liquid. As a result, capital raises would translate into more deposits for Silicon Valley Bank, and the money would deposit in tens, and even hundreds, of millions of dollars. In some cases it also could go out in millions for payroll, depending on the size of the tech company.

The bank had several advantages that allowed it to attract such a whopping share of those deposits. But one of the biggest advantages, outside of its deep relationships in the tech industry that fueled enviable word-of-mouth referrals, was its second area of specialization: venture debt.

“Silicon Valley Bank’s deposit concentration came from serving a niche extraordinarily well.”

Silicon Valley Bank was a pioneer of venture debt. Even 10 years ago, “few would have predicted that venture debt would attract the world’s largest private equity firms and hedge funds,” reported PitchBook, a research platform that focuses on capital. “Back then, venture debt was a poorly understood product offered by only a few banks and a narrow group of specialized lenders.”

If you sought venture debt, you talked to Silicon Valley Bank. From there, loan officers would seek — and probably incentivize — a deposit relationship. All banks want to be their customers’ preferred financial institution. This bank’s deposit concentration came from serving a niche very well.

So who should have pumped the breaks? No one — not customers, not investors, not regulators — raised a red flag about the business model’s risks. And it is a long list of risks: Multimillion-dollar deposits too large for traditional FDIC insurance; startup expertise that spared customers’ leadership teams from the hassle of managing liquidity; a practice of lending millions of dollars to customers and then receiving those funds as deposits; customers from a homogeneous industry with many sharing the same venture capital firms and board members; and ownership stakes for the bank in cases where customers utilized venture debt, which, in turn, could provide the bank with greater influence in that customer’s operations than in the standard banking “customer” relationship.

Silicon Valley Bank may have passed muster on cookie-cutter, by-the-asset-size regulations, but regulators should have seen the potential of a bank run coming. It’s apparent to anyone who understands the business model that it had a massive propensity for the out-movement of deposits.

In fact, the simple fact that the free-flowing spigot of tech funding had dried up over the past year resulted in a growing drain on deposits for four consecutive quarters that, all by itself, should have been a red flag long ago.

Regulators should take full responsibility for the concentration and poor risk management that lead to the run on deposits at Silicon Valley Bank.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Narrative Is the Seed of Policy, So Beware the ‘Bailout’ Misnomer

Banks took TARP in late 2008 and 2009 — including many who did not need or want it, but did so under duress from regulators, their goal being to mask the banks that were struggling. Because of this checkered past, there’s an assumption that banking should take care of its own messes today. To some degree, the assumption is also that any mess at any bank is the industry’s collective mess. In this case, those assumptions are inconsistent with what’s actually transpired.

Banking needs to defend its brand boldly. After the federal government interceded to “save the banks” in the financial crisis of 2008, the public heaved a collective sigh of relief for a few months. Then came some vicious fallout — from the public and regulators.

Most bankers back then felt targeted unjustly by the outrage that had been well-earned by bad actors.

Unidentified demonstrators gather for an Occupy Wall Street-related protest in the wake of the financial crisis of 2008. Talk of bank bailouts remains a hair trigger. SHUTTERSTOCK IMAGES

Now is not the time to let history repeat itself. Make sure everyone — board members, employees, business partners, community — has the narrative straight on today’s “bailouts” and can speak to how banking writ large differs from the approach at Silicon Valley and Signature banks.

Prepare all of these people with a succinct and easy-to-understand response to, “What happened?”

The narrative of today will be the policy of tomorrow.